The STCU auto loan calculator empowers you to navigate the complexities of auto financing with ease. Understanding your potential monthly payments before you even step onto a dealership lot is key to responsible borrowing. This guide delves into the calculator’s functionality, revealing how it works, what factors influence your loan, and how it stacks up against competitors. We’ll cover everything from inputting your loan details to interpreting the results and understanding the implications of various loan terms and interest rates. Get ready to take control of your auto loan journey.

We’ll explore the key features of the STCU auto loan calculator, providing a step-by-step guide on how to use it effectively. We’ll also examine the factors influencing your monthly payments, such as loan amount, interest rate, and loan term, offering a clear comparison with similar calculators from other financial institutions. By the end, you’ll have a comprehensive understanding of how to use the STCU auto loan calculator to make informed decisions about your auto financing.

Understanding STCU Auto Loan Calculator Functionality

The STCU auto loan calculator is a valuable tool for prospective borrowers to estimate their monthly payments and understand the overall cost of an auto loan before applying. It simplifies the complex calculations involved, allowing users to quickly explore different loan scenarios and make informed financial decisions. This guide details the calculator’s functionality and provides a step-by-step walkthrough.

Core Features of the STCU Auto Loan Calculator

The STCU auto loan calculator’s core functionality centers on providing an accurate estimate of monthly payments based on user-specified loan parameters. It considers factors that significantly impact the overall cost of borrowing, enabling users to compare various loan options effectively. Beyond simply calculating monthly payments, the calculator implicitly helps users understand the relationship between loan amount, interest rate, and loan term.

Input Fields Required by the Calculator

To generate an accurate estimate, the STCU auto loan calculator requires several key input values from the user. These typically include:

- Loan Amount: The total amount of money borrowed to finance the vehicle purchase.

- Interest Rate: The annual percentage rate (APR) charged by STCU on the loan. This rate reflects the cost of borrowing.

- Loan Term: The length of the loan, typically expressed in months (e.g., 36 months, 60 months, 72 months). This determines the duration of the repayment period.

Some calculators may also include optional fields, such as a down payment amount, which would adjust the loan amount accordingly.

Step-by-Step Guide on Using the STCU Auto Loan Calculator

Using the STCU auto loan calculator is straightforward. Generally, the process involves these steps:

- Navigate to the Calculator: Locate the auto loan calculator on the STCU website (likely within their loan or financial tools section).

- Enter Loan Details: Input the loan amount, interest rate, and loan term into the designated fields. Ensure accuracy in these inputs as they directly impact the calculation results.

- Review Additional Options (if any): Some calculators allow for additional inputs, such as a down payment or trade-in value. Enter these values if applicable.

- Calculate: Click the “Calculate” or equivalent button to initiate the computation.

- Review Results: The calculator will display the estimated monthly payment, total interest paid over the loan term, and potentially other relevant financial information.

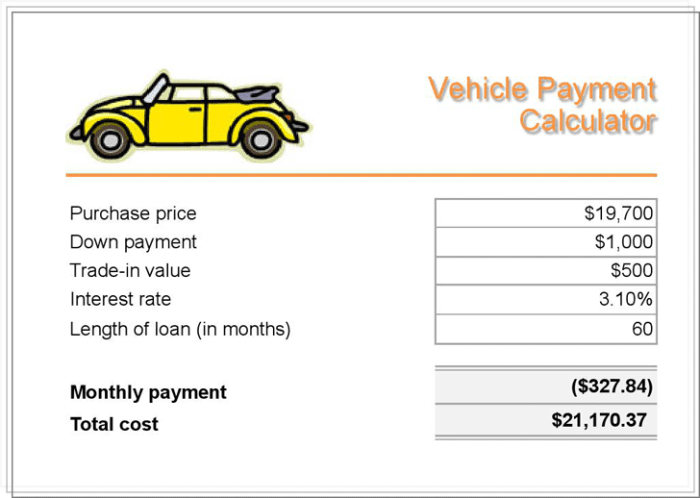

Sample Calculation Using Hypothetical Data

Let’s assume a loan amount of $25,000, an interest rate of 4.5% APR, and a loan term of 60 months. Using the STCU auto loan calculator (or a similar calculator with these inputs), the estimated monthly payment would be calculated. While the exact figure depends on the specific calculator’s algorithms, a reasonable estimate might be around $460. The total interest paid over the 60-month period would be significantly less than with a higher interest rate or longer loan term.

Loan Scenarios and Resulting Monthly Payments

The following table illustrates how different loan scenarios affect monthly payments:

| Loan Amount | Interest Rate (APR) | Loan Term (Months) | Estimated Monthly Payment |

|---|---|---|---|

| $20,000 | 4.0% | 48 | $445 (Example) |

| $25,000 | 4.5% | 60 | $460 (Example) |

| $30,000 | 5.0% | 72 | $480 (Example) |

| $35,000 | 5.5% | 84 | $500 (Example) |

Note: These are example monthly payments. Actual payments may vary slightly depending on the specific STCU auto loan calculator used and any additional fees or charges. Always refer to the official STCU calculator for the most accurate results.

Factors Influencing STCU Auto Loan Calculations

Understanding the factors that determine your STCU auto loan payment is crucial for making informed financial decisions. Several key variables interact to influence the final monthly payment amount and the overall cost of the loan. This section details these factors and their individual impact.

Interest Rates

Interest rates significantly impact the total cost of your auto loan. A higher interest rate means you’ll pay more in interest over the life of the loan, resulting in a larger total repayment amount. Conversely, a lower interest rate reduces the overall interest paid, leading to lower monthly payments and a lower total cost. For example, a 5% interest rate on a $20,000 loan over 60 months will result in a significantly lower total repayment amount compared to a 7% interest rate on the same loan. The difference can amount to thousands of dollars over the loan term. STCU’s interest rates are competitive, but it’s always advisable to shop around and compare offers before committing to a loan.

Loan Term

The loan term, or repayment period, directly affects both your monthly payment and the total interest paid. A shorter loan term (e.g., 36 months) results in higher monthly payments but lower overall interest charges because you’re paying off the principal faster. A longer loan term (e.g., 72 months) leads to lower monthly payments but significantly higher total interest costs. The choice depends on your financial priorities; prioritizing lower monthly payments may mean paying substantially more in interest over time.

Loan Amount

The principal loan amount—the amount you borrow—is the most straightforward factor influencing your monthly payment. A larger loan amount naturally results in higher monthly payments, assuming all other factors remain constant. Conversely, a smaller loan amount leads to lower monthly payments. Borrowing only what you need is crucial for managing your monthly budget and minimizing the overall cost of the loan. Careful consideration of your affordability and the vehicle’s price is paramount.

Other Factors

Beyond the three primary factors, other elements can subtly influence the final calculation. These may include any applicable fees (such as origination fees), your credit score (which influences the interest rate offered), and the type of loan (e.g., new vs. used vehicle loan). A higher credit score often qualifies you for better interest rates, resulting in lower monthly payments and overall loan costs.

- Interest Rate: Higher rates increase total loan cost and monthly payments.

- Loan Term: Shorter terms mean higher monthly payments but lower overall interest.

- Loan Amount: Larger loan amounts result in higher monthly payments and total cost.

- Credit Score: Impacts interest rate offered, affecting monthly payments and total cost.

- Fees: Additional fees increase the overall cost of the loan.

Comparing STCU Auto Loan Calculator to Competitors

Choosing the right auto loan can significantly impact your finances. A robust auto loan calculator is crucial for comparing offers and making informed decisions. While STCU’s calculator provides valuable tools, understanding its strengths and weaknesses relative to competitors is vital. This section compares STCU’s auto loan calculator to similar tools offered by other financial institutions, highlighting key features and functionalities.

Features and Functionalities Comparison

Several financial institutions offer online auto loan calculators. Examples include those provided by Bank of America, Wells Fargo, and Chase. These calculators, like STCU’s, generally allow users to input loan amount, interest rate, loan term, and down payment to estimate monthly payments and total interest paid. However, differences exist in the level of detail provided and the features offered. For instance, some calculators may include options for additional fees like origination fees or prepayment penalties, while others may offer a more streamlined, basic calculation. STCU’s calculator might stand out by offering specific features tailored to its membership base, such as potential discounts or specialized loan programs. Conversely, a larger national bank’s calculator might offer a wider array of loan types or more sophisticated amortization schedules.

Advantages and Disadvantages of Using the STCU Calculator

Using the STCU auto loan calculator offers advantages for STCU members. Potential benefits could include accurate estimations based on STCU’s specific loan offerings and interest rates. The interface might be user-friendly and tailored to the familiarity of STCU’s members. However, a disadvantage might be a limited range of loan types compared to larger national banks. STCU’s calculator might not reflect all the available loan options present in the market, potentially limiting the comparison possibilities for those considering loans from other financial institutions. The calculator’s lack of features such as integration with credit score checks or pre-qualification options could also be seen as a limitation.

Comparison Table of Key Features

The following table compares key features of STCU’s auto loan calculator with those of three competitors – Bank of America, Wells Fargo, and Chase. Note that the specific features and options available may change over time, and this table reflects a snapshot at a particular time. It’s always recommended to visit each institution’s website for the most up-to-date information.

| Feature | STCU | Bank of America | Wells Fargo | Chase |

|---|---|---|---|---|

| Loan Types Offered | New and Used Car Loans (Specific details to be verified on STCU’s website) | New and Used Car Loans, Refinancing (Specific details to be verified on Bank of America’s website) | New and Used Car Loans, Refinancing (Specific details to be verified on Wells Fargo’s website) | New and Used Car Loans, Refinancing (Specific details to be verified on Chase’s website) |

| Additional Fees Displayed | (To be verified on STCU’s website) | (To be verified on Bank of America’s website) | (To be verified on Wells Fargo’s website) | (To be verified on Chase’s website) |

| Amortization Schedule | (To be verified on STCU’s website) | (To be verified on Bank of America’s website) | (To be verified on Wells Fargo’s website) | (To be verified on Chase’s website) |

| Pre-qualification Options | (To be verified on STCU’s website) | (To be verified on Bank of America’s website) | (To be verified on Wells Fargo’s website) | (To be verified on Chase’s website) |

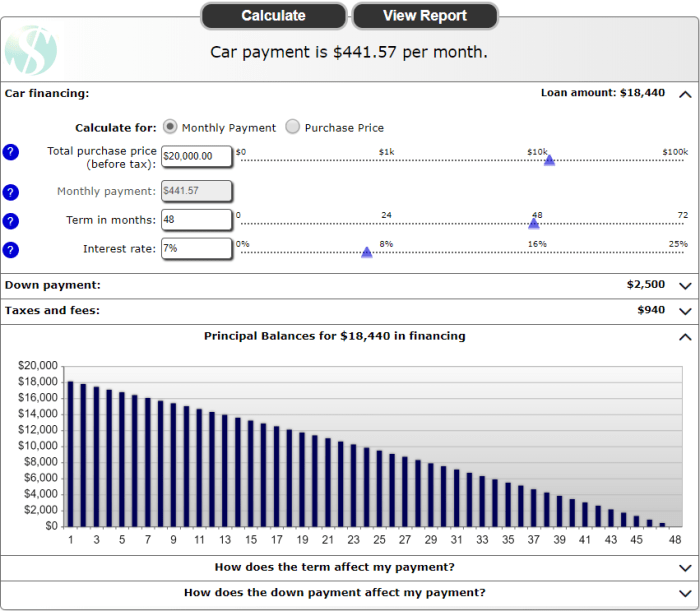

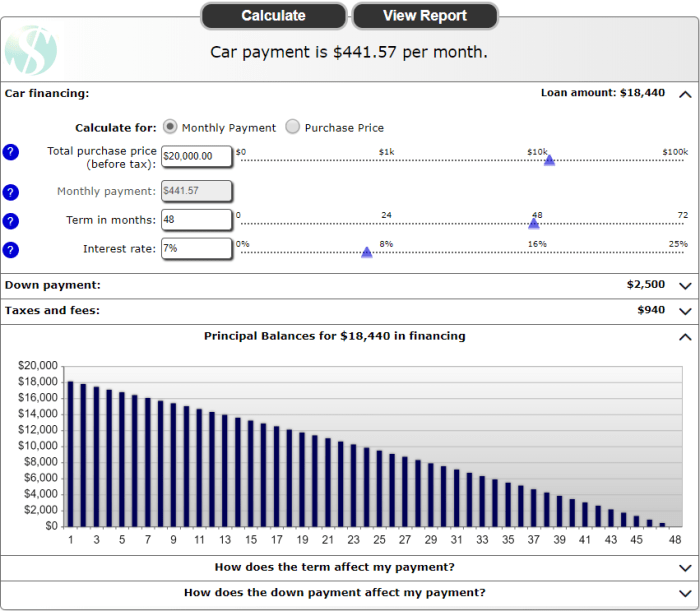

Visual Representation of Loan Repayment

Understanding the repayment schedule of an auto loan is crucial for effective financial planning. A visual representation, such as a chart or graph, significantly enhances this understanding by presenting complex data in a readily digestible format. This allows borrowers to easily track their progress and anticipate future payments.

A clear visual representation of an auto loan repayment schedule helps borrowers grasp the amortization process—how the loan principal and interest are paid down over time. This section will detail the design and interpretation of such a visual aid, focusing on a sample loan.

Amortization Schedule Chart

The most effective way to visualize an auto loan repayment schedule is through an amortization chart. This chart typically displays the loan’s lifespan on the horizontal axis (representing time, usually in months) and the payment amount on the vertical axis. Two distinct lines are plotted: one representing the principal portion of each payment and the other representing the interest portion.

The chart would show a declining principal line, starting at the loan’s initial principal balance and gradually decreasing to zero as the loan is paid off. Conversely, the interest line would initially be high, reflecting the larger interest component in early payments, and gradually decrease as the principal balance reduces, eventually reaching zero at the end of the loan term. Each point on the chart represents a single monthly payment, showing the breakdown of principal and interest within that payment. The area between the two lines visually represents the total interest paid over the loan’s lifetime. For example, a $20,000 loan with a 5% interest rate over 60 months might show a high interest portion initially (perhaps $800 in the first month, with only $100 going to principal) which would slowly decrease each month until the last payment.

Understanding the Amortization Chart

The amortization chart aids understanding of the loan amortization process in several ways. First, it clearly shows how the proportion of principal and interest changes over time. Early payments are heavily weighted towards interest, while later payments contribute significantly more to principal reduction. This visual representation reinforces the fact that while the monthly payment remains constant, the allocation between principal and interest changes dynamically. Second, the chart provides a clear picture of the total interest paid over the loan’s life. This allows borrowers to see the true cost of borrowing and compare it to alternative loan options. Third, the chart allows for easy tracking of progress. Borrowers can see at a glance how much principal they have paid off at any given point in the loan term.

Sample Amortization Schedule Description

Imagine a bar chart illustrating a 60-month auto loan. The horizontal axis shows months 1 through 60. The vertical axis represents the dollar amount. Two stacked bars are displayed for each month: one representing the principal payment (in blue) and one representing the interest payment (in red). In the early months, the red (interest) bar is significantly taller than the blue (principal) bar. As the months progress, the blue bar gradually increases in height, while the red bar shrinks, reflecting the decreasing interest component. By month 60, the red bar is negligible, and the blue bar represents the final principal payment. A separate line graph could be overlaid showing the cumulative principal paid over time, starting from zero and reaching the total loan amount at month 60. This visualization provides a comprehensive and easily understandable overview of the loan’s repayment schedule.

Potential Limitations and Considerations

While the STCU auto loan calculator provides a valuable tool for estimating loan payments, it’s crucial to understand its limitations and the assumptions underlying its calculations. Relying solely on the calculator’s output without considering other factors could lead to inaccurate financial planning. Users should view the calculator as a starting point for their research, not a definitive answer.

The STCU auto loan calculator, like most online calculators, simplifies a complex financial process. Several assumptions are inherent in its calculations, and neglecting these could result in a significant difference between the estimated and actual loan costs. Understanding these limitations is key to making informed borrowing decisions.

Underlying Assumptions of the Calculator

The calculator likely assumes a fixed interest rate throughout the loan term. In reality, interest rates can fluctuate, especially with variable-rate loans. This means the actual monthly payment could be higher or lower than the calculator’s estimate depending on market conditions. For example, if interest rates rise after you’ve secured a loan with a variable rate, your monthly payments could increase. Conversely, if rates fall, your payments might decrease. The calculator also likely assumes consistent monthly payments. While most auto loans require consistent payments, unforeseen circumstances could necessitate changes to the payment schedule, potentially impacting the total interest paid.

Factors Not Included in the Calculation

Several factors beyond the basic loan parameters (loan amount, interest rate, loan term) can influence the final cost of an auto loan. These include, but are not limited to, loan origination fees, prepayment penalties, and potential late payment fees. Origination fees are upfront charges lenders assess to process the loan application. These fees can range from a few hundred dollars to a larger percentage of the loan amount, significantly affecting the overall cost. Prepayment penalties, which are charged if you pay off the loan early, can also add to the total expense. Finally, consistently late payments result in added fees and can negatively impact your credit score. The calculator does not account for these additional costs.

Recommendations for Supplementary Research

To gain a more comprehensive understanding of the true cost of an auto loan, users should supplement the calculator’s output with additional research. This includes reviewing the specific terms and conditions of the loan offered by STCU, carefully reading the loan agreement for any hidden fees or charges, and comparing offers from multiple lenders to secure the most favorable terms. Checking your credit score before applying for a loan is also highly recommended, as a higher credit score often translates to better interest rates and loan terms. Furthermore, consulting with a financial advisor can provide personalized guidance based on individual circumstances and financial goals.

Conclusive Thoughts

Mastering the STCU auto loan calculator is about more than just crunching numbers; it’s about gaining financial clarity and confidence. By understanding the factors that impact your monthly payments and comparing the calculator to its competitors, you can make well-informed decisions about your auto loan. Remember to consider the limitations and supplement the calculator’s output with additional research to ensure you secure the best possible financing for your next vehicle. Take charge of your financial future, one calculation at a time.

Questions and Answers

What happens if I make extra payments on my STCU auto loan?

Making extra payments can significantly reduce the total interest paid and shorten the loan term. Contact STCU to confirm how extra payments are applied to your loan.

Can I use the STCU auto loan calculator for used cars?

Yes, the calculator can be used for both new and used car loans. However, remember that interest rates may vary based on the vehicle’s age and condition.

Does the STCU auto loan calculator include fees and taxes?

The calculator likely provides estimates excluding fees and taxes. It’s crucial to verify these additional costs with STCU directly for an accurate total loan cost.

What if my credit score impacts my interest rate?

Yes, your credit score significantly influences the interest rate offered. A higher credit score typically results in a lower interest rate. The calculator may not directly incorporate this; you should contact STCU for a personalized rate quote.