Suncoast Car Loan Interest Rates

Securing a car loan can be a significant financial decision, and understanding the interest rates is crucial for making an informed choice. Suncoast Credit Union, like other lenders, offers a range of car loan interest rates, influenced by several key factors. This analysis will delve into the specifics of Suncoast’s rates, providing clarity and helping you navigate the process.

Suncoast Car Loan Interest Rates Across Loan Terms

Suncoast’s interest rates vary depending on the loan term. Generally, shorter loan terms (like 36 months) result in higher monthly payments but lower overall interest paid, while longer terms (60 or 72 months) lead to lower monthly payments but higher total interest. The exact rates offered are dynamic and depend on prevailing market conditions and your individual creditworthiness. For instance, a 36-month loan might have a rate between 6% and 10%, while a 72-month loan could range from 7% to 12%. These are illustrative ranges and should not be considered definitive offers. Always check the current rates directly with Suncoast.

Factors Influencing Suncoast’s Interest Rate Calculations

Several factors influence the interest rate Suncoast applies to your car loan. These include your credit score, the loan amount, the loan term, the type of vehicle being financed (new or used), and the prevailing market interest rates. A higher credit score typically qualifies you for a lower interest rate, reflecting a lower perceived risk to the lender. Similarly, a larger loan amount might come with a slightly higher rate due to increased risk. The prevailing economic climate also plays a significant role; higher interest rates in the broader market will generally lead to higher car loan rates.

Interest Rate Scenarios for Various Credit Scores and Loan Amounts

Let’s consider some hypothetical scenarios to illustrate how these factors interact. Assume a new car purchase. A borrower with an excellent credit score (750+) applying for a $25,000 loan might receive a rate around 4.5% for a 60-month term, while a borrower with a fair credit score (650-699) might receive a rate closer to 8% for the same loan. Increasing the loan amount to $35,000 could potentially add another percentage point or more to the interest rate for both credit score groups, depending on other factors. These are estimates; actual rates may vary.

Comparison of Suncoast Interest Rates with Competing Lenders

Direct comparison of interest rates across lenders requires accessing real-time data from each institution. However, we can present a hypothetical comparison to illustrate the potential differences.

| Lender | 36-Month Rate (Estimate) | 60-Month Rate (Estimate) | 72-Month Rate (Estimate) |

|---|---|---|---|

| Suncoast Credit Union | 6.5% – 9.5% | 7.5% – 10.5% | 8.5% – 11.5% |

| Competitor A | 7% – 10% | 8% – 11% | 9% – 12% |

| Competitor B | 6% – 9% | 7% – 10% | 8% – 11% |

Note: These rates are hypothetical examples and may not reflect current offerings. Always check with the respective lenders for the most up-to-date information. The ranges provided reflect the variability based on individual creditworthiness and other factors.

Suncoast Car Loan Application Process

Securing a car loan can feel overwhelming, but understanding the process can significantly ease the anxiety. Suncoast Credit Union offers a relatively straightforward application process, designed to make financing your next vehicle as smooth as possible. This guide will break down the steps, required documentation, and online application procedure, allowing you to navigate the process with confidence.

The Suncoast car loan application process is designed for efficiency and transparency. Understanding the steps involved beforehand will significantly reduce stress and ensure a smoother experience. Whether you’re applying online or in person, being prepared with the necessary documentation is key to a quick approval.

Required Documentation for a Suncoast Car Loan Application

Before you begin the application, gather the necessary documents. This will streamline the process and prevent delays. Having these readily available will save you time and ensure a more efficient application. Incomplete applications often lead to processing delays.

Typically, you’ll need to provide proof of income, identification, and details about the vehicle you intend to purchase. The specific documents may vary slightly depending on your individual circumstances, so it’s always best to check directly with Suncoast for the most up-to-date requirements.

- Proof of Income (pay stubs, tax returns, etc.)

- Valid Government-Issued Photo Identification (driver’s license, passport, etc.)

- Vehicle Information (VIN number, make, model, year, etc.)

- Proof of Residence (utility bill, lease agreement, etc.)

- Social Security Number

Step-by-Step Guide to Completing the Online Application

Suncoast offers a convenient online application process. This allows you to apply from the comfort of your home, at your own pace. Following these steps will guide you through the online application process efficiently and accurately. Remember to double-check all information before submitting your application.

The online application is designed to be user-friendly and intuitive. However, preparing your documents beforehand will significantly expedite the process. Each step requires accurate information, so take your time and ensure accuracy.

- Visit the Suncoast Credit Union website and locate the car loan application section.

- Begin the application by providing your personal information, such as your name, address, and contact details.

- Input your employment information, including your employer’s name, your position, and your income details.

- Provide details about the vehicle you wish to finance, including the make, model, year, VIN number, and purchase price.

- Upload the required supporting documents, such as proof of income, identification, and proof of residence.

- Review your application carefully for accuracy before submitting it.

- Suncoast will review your application and contact you regarding the next steps in the process.

Suncoast Car Loan Repayment Options

Choosing the right repayment plan for your Suncoast car loan is crucial for effective financial management. Understanding the various options available and their implications will help you optimize your repayment strategy and avoid unnecessary fees or interest charges. Let’s explore the different repayment methods offered by Suncoast and their associated advantages and disadvantages.

Automatic Payments

Suncoast likely offers automatic payments, where your monthly payment is automatically deducted from your linked bank account or credit card on the due date. This method eliminates the risk of missed payments, a significant factor impacting your credit score. Setting up automatic payments streamlines the repayment process, saving you time and effort.

| Feature | Advantage | Disadvantage |

|---|---|---|

| Automated Deduction | Convenience, prevents late payments, improves credit score. | Requires sufficient funds in your account, potential for overdraft fees if insufficient funds. |

| Payment Tracking | Easy monitoring of payment history. | Requires online access to account statements. |

| Potential Discounts | Some lenders offer small discounts for automatic payments. Check with Suncoast for details. | No significant disadvantage. |

Early Payoff Options

Paying off your Suncoast car loan early can save you significant money on interest. Suncoast likely provides a clear process for making early payments, either in full or in part. However, it’s crucial to review your loan agreement for any potential prepayment penalties before making an early payoff.

| Feature | Advantage | Disadvantage |

|---|---|---|

| Reduced Interest Paid | Substantial savings on total interest over the loan term. | Requires a larger upfront capital outlay. |

| Faster Loan Completion | You’ll own your car outright sooner. | May impact short-term cash flow. |

| Potential Penalties | Some loans may have prepayment penalties; check your loan agreement. | Potential for unexpected fees. |

Calculating Monthly Payments

The calculation of your monthly payment depends on several factors: the loan principal (the amount borrowed), the annual interest rate, and the loan term (the length of the loan in months or years). While Suncoast provides this calculation as part of the loan application process, understanding the underlying formula can be beneficial.

The most common formula for calculating monthly payments is: M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1], where: M = Monthly Payment, P = Loan Principal, i = Monthly Interest Rate (Annual Interest Rate / 12), and n = Number of Months.

For example, let’s say you borrow $20,000 at an annual interest rate of 5% for 60 months (5 years). Your monthly interest rate (i) would be 0.05/12 = 0.004167. Plugging these values into the formula, you would calculate your approximate monthly payment. Note: This is a simplified example; actual calculations may involve additional fees or charges. Always consult Suncoast for precise figures.

Suncoast Car Loan Eligibility Requirements

Securing a Suncoast car loan hinges on meeting specific eligibility criteria. Understanding these requirements upfront can significantly streamline the application process and increase your chances of approval. Failing to meet these criteria could lead to delays or rejection, so careful review is essential.

Minimum Credit Score Requirements

Suncoast, like most lenders, uses credit scores as a key indicator of your creditworthiness. While they don’t publicly state a hard minimum credit score, a higher credit score generally translates to better loan terms, including lower interest rates and potentially higher loan amounts. Applicants with scores below the average range may find it more challenging to qualify or may receive less favorable loan offers. Improving your credit score before applying can significantly improve your chances of securing a loan with attractive terms. Consider reviewing your credit report for errors and paying down outstanding debts to boost your score.

Income and Employment Verification

Suncoast requires verification of your income and employment stability to assess your ability to repay the loan. This typically involves providing pay stubs, tax returns, or bank statements demonstrating a consistent income stream. The length of your employment history is also a factor; a longer, stable employment history generally strengthens your application. Self-employed individuals may need to provide additional documentation, such as business tax returns and profit and loss statements, to demonstrate their income stability. Accurate and complete documentation is crucial in this process.

Required Documents Checklist

To successfully apply for a Suncoast car loan, you’ll need to gather several essential documents. Having these readily available will expedite the application process. Missing documentation can cause delays. Ensure all documents are accurate and up-to-date.

- Valid Government-Issued Photo Identification (Driver’s License or Passport)

- Proof of Income (Pay stubs, W-2 forms, tax returns, or bank statements)

- Proof of Residence (Utility bill, lease agreement, or mortgage statement)

- Social Security Number

- Vehicle Information (VIN number, make, model, year)

- Details of Down Payment (if applicable)

Suncoast Car Loan Customer Reviews and Experiences

Understanding customer sentiment is crucial for any financial institution. Suncoast Credit Union’s car loan offerings are no exception. Analyzing customer reviews provides valuable insights into their overall satisfaction and identifies areas for potential improvement. This section summarizes publicly available feedback, categorized for clarity and providing representative examples.

Positive Customer Reviews

Many positive reviews highlight Suncoast’s competitive interest rates, efficient application process, and helpful customer service. Customers frequently praise the ease of online application and the transparent communication throughout the loan process. The speed of approval and funding is another frequently mentioned positive aspect.

“The entire process was smooth and straightforward. I got approved quickly and the interest rate was excellent. I would definitely recommend Suncoast to others.”

“The customer service representatives were incredibly helpful and answered all my questions patiently. They made the whole experience stress-free.”

Negative Customer Reviews

While predominantly positive, some negative reviews cite issues with communication delays, particularly in resolving specific problems or addressing inquiries. A few customers reported difficulties navigating the online portal or experienced challenges with the repayment process. These issues, though less frequent, highlight areas where Suncoast could enhance the customer experience.

“I had a problem with my payment and it took several calls to get it resolved. The communication could have been much better.”

“The online portal was a bit confusing to use. It wasn’t very user-friendly.”

Neutral Customer Reviews

A smaller number of reviews fall into a neutral category, reflecting average experiences. These reviews often lack significant positive or negative details, simply stating that the experience was “okay” or “as expected.” These reviews generally indicate a satisfactory, but not exceptional, experience with Suncoast’s car loan services.

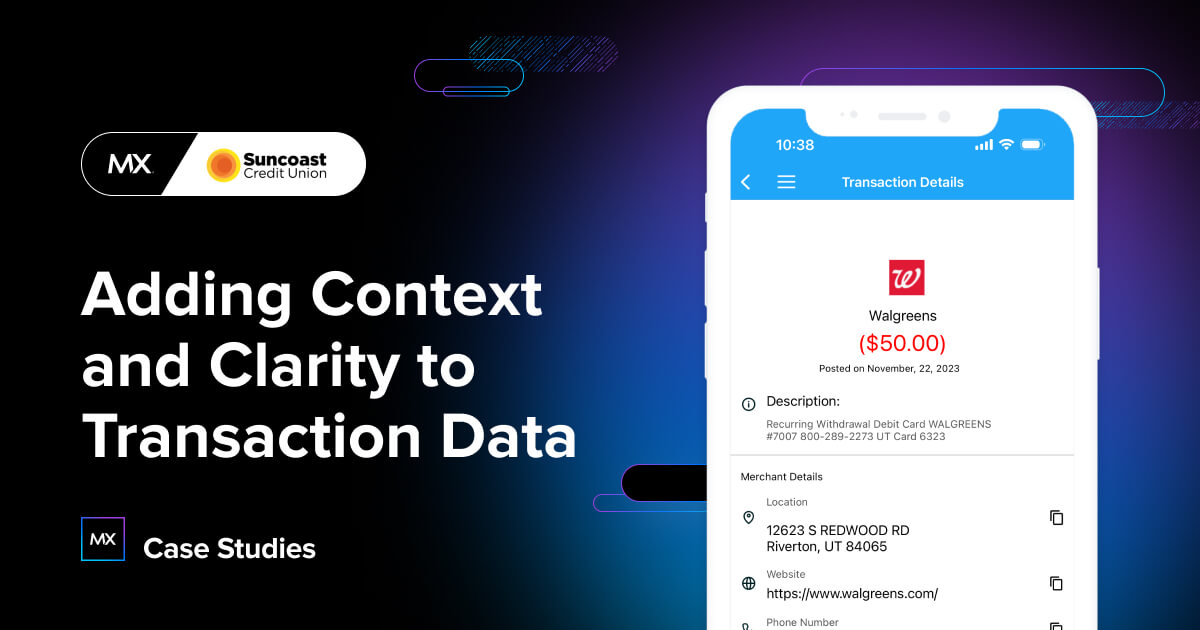

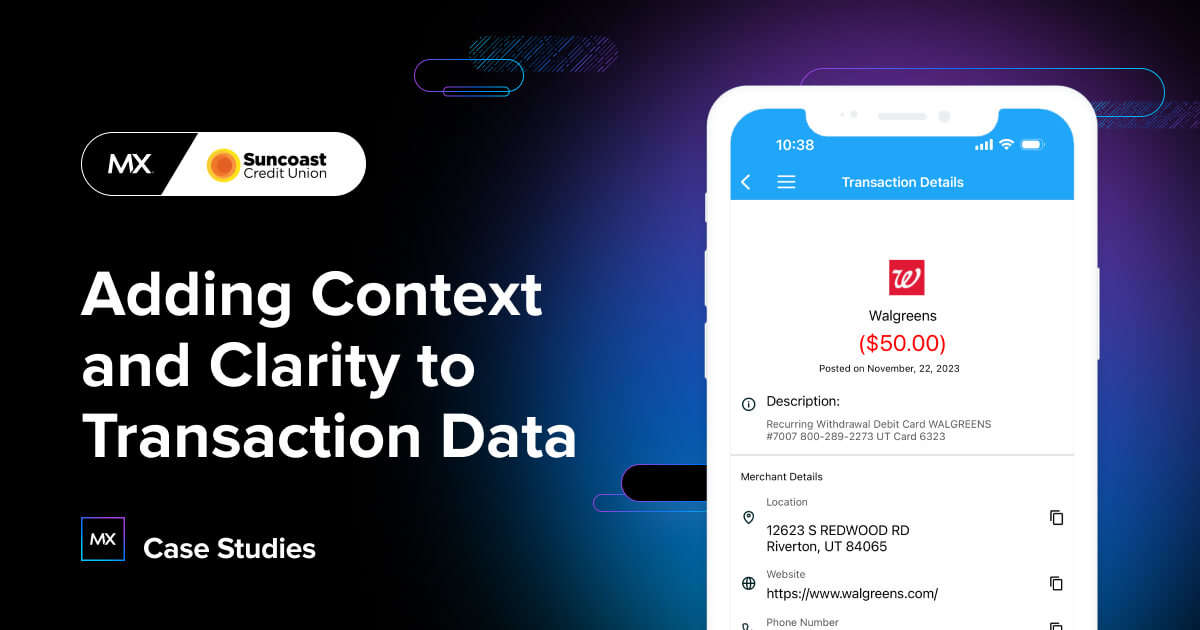

Visual Representation of Customer Reviews

Imagine a bar chart. The horizontal axis represents review sentiment, ranging from “Very Negative” to “Very Positive,” with gradations in between (e.g., Negative, Neutral, Positive). The vertical axis represents the percentage of reviews falling into each category. The bar representing “Positive” reviews would be significantly taller than the “Negative” bar, indicating a preponderance of positive feedback. The “Neutral” bar would be shorter than the “Positive” bar but taller than the “Negative” bar, reflecting the smaller number of neutral reviews. The overall visual impression would be one of largely positive customer sentiment, with a small portion expressing negative experiences. The chart clearly illustrates the distribution of positive and negative reviews, offering a quick visual summary of overall customer satisfaction.

Suncoast Car Loan Pre-Approval Process

Securing a car loan can feel overwhelming, but understanding the pre-approval process can significantly simplify the journey. Pre-approval from Suncoast Credit Union offers several advantages, streamlining the process and potentially securing you a better interest rate. This section details the pre-approval process, highlighting its benefits and comparing it to a full application.

Suncoast Car Loan Pre-Approval Benefits

Pre-approval provides several key advantages. Knowing your borrowing power beforehand allows you to shop for vehicles within your budget, avoiding the disappointment of falling in love with a car you can’t afford. It also strengthens your negotiating position with dealerships, as you present yourself as a serious buyer with financing already in place. Furthermore, a pre-approved loan often translates to a faster and smoother final loan approval process, reducing the overall time commitment. Finally, a pre-approval can give you a clear picture of your potential interest rate, enabling you to compare offers and potentially secure a better deal.

Suncoast Car Loan Pre-Approval Process Compared to Full Application

The pre-approval process is a simplified version of the full application. While a full application requires extensive documentation and a thorough credit check before loan disbursement, pre-approval focuses on a preliminary assessment of your creditworthiness. It involves providing basic financial information to determine your potential loan amount and interest rate. This preliminary assessment allows you to explore car buying options without committing to a full application until you’ve found the right vehicle. The full application, in contrast, is completed only after you have selected a car and requires the submission of extensive documentation including proof of income, employment history, and vehicle information.

Step-by-Step Guide to Obtaining Suncoast Car Loan Pre-Approval

Obtaining pre-approval is straightforward. First, gather necessary documents such as your driver’s license, proof of income (pay stubs or tax returns), and information about your existing debts. Next, visit the Suncoast Credit Union website or a local branch. You can usually initiate the pre-approval process online through their secure application portal. The online application will request basic personal and financial information, including your desired loan amount, credit score (if known), and employment details. After submitting your application, Suncoast will conduct a soft credit check, which won’t impact your credit score. Finally, you’ll receive a pre-approval notification within a short timeframe, outlining your potential loan amount, interest rate, and other loan terms. This pre-approval letter can then be used when you’re ready to purchase a vehicle.

Suncoast Car Loan Fees and Charges

Understanding the complete cost of a car loan is crucial before committing. While Suncoast Credit Union offers competitive interest rates, it’s essential to be aware of all associated fees and charges to accurately budget for your new vehicle. This section details the various fees you might encounter when financing a car through Suncoast.

Suncoast’s fee structure, like many financial institutions, can vary depending on the specific loan terms, your creditworthiness, and the type of vehicle being financed. Transparency in these matters is paramount, so let’s break down the potential costs.

Application Fees

Suncoast Credit Union generally does not charge an application fee for car loans. However, it’s always best to confirm this directly with a loan officer before submitting your application. Some lenders charge application fees ranging from $25 to $100, so the absence of this fee with Suncoast represents a potential cost saving.

Origination Fees, Suncoast car loan

Origination fees are charges lenders impose to cover the administrative costs associated with processing your loan application. These fees can vary significantly depending on the lender and the loan amount. While Suncoast may not explicitly advertise an origination fee, it’s important to inquire about any such charges during the loan application process. Some lenders charge a percentage of the loan amount (e.g., 1%), while others charge a flat fee.

Late Payment Fees

Late payments on your Suncoast car loan will likely incur penalties. These penalties typically consist of a late fee, which can range from $25 to $50 or more, depending on the loan agreement. Repeated late payments could also negatively impact your credit score, making it more difficult to secure loans in the future and potentially leading to higher interest rates on subsequent loans. Suncoast’s specific late payment policy should be clearly Artikeld in your loan agreement.

Other Potential Fees

While less common, other fees might apply depending on your specific circumstances. These could include fees for early loan payoff, document preparation fees, or other miscellaneous charges. Always thoroughly review the loan documents before signing to ensure you understand all associated costs.

Comparison with Other Lenders

Comparing Suncoast’s fees to those of other lenders requires researching the fees charged by competing institutions. Some lenders may advertise low interest rates but have higher origination fees or late payment penalties, ultimately making them less cost-effective. Consider using online loan comparison tools to assess different lenders’ total costs before making a decision. Remember to factor in all fees – not just the interest rate – when comparing loan offers.

Suncoast Car Loan Fee Summary

| Fee Type | Description | Amount | Notes |

|---|---|---|---|

| Application Fee | Fee for processing the loan application. | Generally $0 | Confirm with Suncoast. |

| Origination Fee | Covers administrative costs of loan processing. | Varies; often included in APR | Inquire directly with Suncoast. |

| Late Payment Fee | Penalty for late payments. | $25-$50+ (estimate) | Check your loan agreement. |

| Other Fees | Early payoff, document preparation, etc. | Varies | Review loan documents carefully. |