Syndicated loan jobs offer a dynamic and lucrative career path within the financial services industry. This sector provides opportunities for professionals with strong analytical, communication, and negotiation skills. The demand for skilled individuals in syndicated lending varies by region and role, with compensation packages reflecting experience and expertise. This guide explores the job market, required skills, and career progression within this exciting field.

From entry-level analyst roles to senior management positions, a career in syndicated loans presents a diverse range of challenges and rewards. Understanding the nuances of financial modeling, credit analysis, and legal documentation is crucial. However, equally important are the softer skills of teamwork, negotiation, and effective communication, which are essential for building strong relationships with clients and colleagues.

Required Skills and Qualifications: Syndicated Loan Jobs

Success in syndicated loan jobs hinges on a potent blend of technical expertise and interpersonal abilities. These roles demand individuals who can not only analyze complex financial data but also effectively communicate and collaborate within a team environment. The specific skill set, however, varies considerably depending on the seniority level of the position.

A thorough understanding of financial modeling, credit analysis, and loan documentation is paramount. Furthermore, strong communication, negotiation, and teamwork skills are crucial for navigating the intricacies of syndicated loan transactions, which often involve multiple parties and complex legal frameworks. This section details the essential skills and qualifications for both entry-level and senior-level syndicated loan officer positions.

Hard Skills in Syndicated Loan Jobs

Proficiency in financial modeling is fundamental. Candidates should be adept at building and interpreting financial models to assess the creditworthiness of borrowers and project the financial performance of loan portfolios. This includes understanding key financial ratios, cash flow projections, and sensitivity analysis. Credit analysis skills are equally important, encompassing the ability to evaluate a borrower’s credit risk, identify potential red flags, and structure loans to mitigate risk. A strong grasp of loan documentation, including legal agreements and regulatory compliance, is also essential. Finally, proficiency in relevant software, such as Bloomberg Terminal and Excel, is a practical necessity.

Soft Skills in Syndicated Loan Jobs

Effective communication is vital, as syndicated loan professionals frequently interact with clients, colleagues, and legal counsel. This includes the ability to articulate complex financial information clearly and concisely, both verbally and in writing. Negotiation skills are also critical, as loan terms are often negotiated with multiple parties. Strong interpersonal skills and the ability to build rapport with clients and colleagues are essential for fostering positive relationships and facilitating successful transactions. Teamwork is paramount, given the collaborative nature of syndicated loan deals. The ability to work effectively within a team, share information, and contribute to a shared goal is crucial.

Skill Requirements: Entry-Level vs. Senior-Level

Entry-level positions emphasize foundational skills in financial modeling and credit analysis. While experience is limited, a strong academic background and a demonstrated aptitude for learning are highly valued. Soft skills are still important, but the emphasis is on developing these capabilities through on-the-job training and mentorship. Senior-level roles demand a higher level of expertise in all areas. Senior syndicated loan officers are expected to possess deep knowledge of financial markets, credit risk management, and loan structuring. They are also responsible for leading teams, mentoring junior staff, and managing complex transactions. Strong leadership, strategic thinking, and extensive experience in negotiating and closing deals are critical at this level.

Essential Qualifications: Junior Syndicated Loan Officer

The following are essential qualifications for a junior syndicated loan officer position:

- Bachelor’s degree in finance, accounting, economics, or a related field.

- Strong analytical and problem-solving skills.

- Proficiency in financial modeling and credit analysis techniques.

- Excellent communication and interpersonal skills.

- Proficiency in Microsoft Excel and other relevant software.

Essential Qualifications: Senior Syndicated Loan Officer

Senior syndicated loan officers require a more extensive skill set and experience:

- Master’s degree in finance or a related field (MBA preferred).

- 5+ years of experience in syndicated lending or a related field.

- Extensive knowledge of financial markets and credit risk management.

- Proven ability to lead and mentor teams.

- Strong negotiation and closing skills.

- Deep understanding of loan documentation and regulatory compliance.

Career Paths and Progression

A career in syndicated loans offers a dynamic and rewarding path for ambitious finance professionals. The field provides ample opportunities for growth, specialization, and significant earning potential, driven by the ever-evolving global financial landscape and the continuous need for sophisticated debt financing solutions. Progression often depends on a combination of experience, performance, and the development of specialized skills.

Individuals entering the syndicated loan market typically begin in junior roles, gradually gaining experience and responsibility before advancing to senior positions. The path is not linear; individuals may specialize in specific areas, leading to diverse career trajectories. Networking and building strong relationships are also crucial for career advancement within this competitive yet collaborative industry.

Typical Career Progression in Syndicated Loans, Syndicated loan jobs

A common entry point is as an Analyst or Associate, focusing on tasks such as financial modeling, credit analysis, and document preparation. With experience, individuals may progress to roles such as Senior Analyst, Associate Vice President (AVP), Vice President (VP), Senior Vice President (SVP), Managing Director, and ultimately, to Partner or Head of Department. The time taken for each step varies depending on individual performance and market conditions. For example, an exceptionally high-performing individual might move from Analyst to VP in 5-7 years, while a more typical progression might take 8-10 years.

Specialization Opportunities in Syndicated Lending

Within syndicated lending, professionals can specialize in various areas, including:

The choice of specialization often reflects individual interests and strengths. For instance, someone with a strong analytical mind might gravitate towards credit analysis, while a highly communicative individual might excel in relationship management.

- Credit Analysis: In-depth assessment of borrowers’ financial health and risk profiles.

- Syndication: Marketing and placing loan deals with various lenders.

- Legal and Documentation: Ensuring compliance and drafting loan agreements.

- Relationship Management: Building and maintaining strong relationships with borrowers and lenders.

- Portfolio Management: Monitoring and managing a portfolio of syndicated loans.

- Structured Finance: Designing and implementing complex financing solutions.

Examples of Successful Career Trajectories

A successful career trajectory might involve starting as an Analyst, specializing in credit analysis, progressing to Senior Analyst, then AVP focusing on a specific industry sector (e.g., energy or technology). Further advancement could lead to VP roles with increasing responsibility, eventually culminating in a Managing Director position overseeing a team or specific product line. Another path might involve specializing in syndication, moving from Associate to VP in syndication, then to a leadership position managing a syndication team.

Career Progression Flowchart

The following flowchart illustrates a possible career path within a syndicated loan department. Note that this is a simplified representation, and actual progression can vary considerably.

Flowchart Description: The flowchart would visually represent the progression from Analyst to Associate to Senior Analyst, then branching into specialized roles like Credit Analyst, Syndication Manager, or Portfolio Manager. Each specialized role would then have a path to AVP, VP, SVP, and Managing Director. Horizontal arrows would show potential lateral moves between specialized roles at similar seniority levels. The overall structure would emphasize the various routes to senior management positions within the department.

End of Discussion

Securing a syndicated loan job requires a blend of technical expertise and interpersonal skills. While the financial modeling and credit analysis are paramount, the ability to build trust and effectively communicate complex financial information is equally crucial for success. The career trajectory within syndicated lending offers diverse paths, from specializing in a particular industry sector to moving into senior management roles. With diligent effort and continuous professional development, a rewarding and fulfilling career in syndicated loan jobs is achievable.

Answers to Common Questions

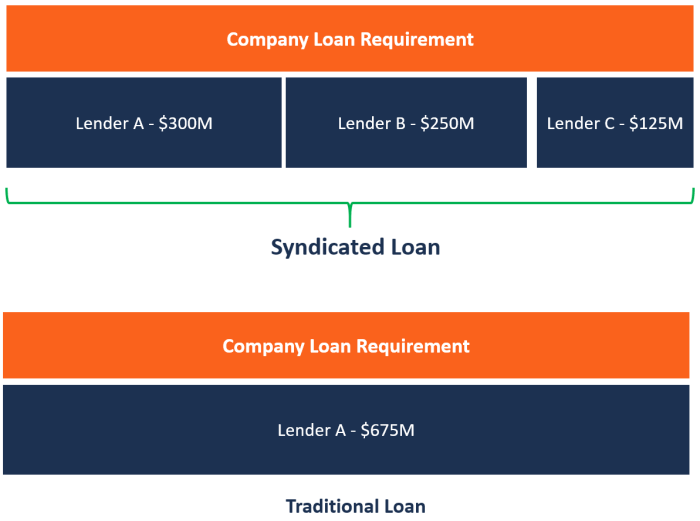

What is a syndicated loan?

A syndicated loan is a large loan provided by a group of lenders, rather than a single institution, to reduce risk and increase lending capacity.

What are the typical entry-level positions in syndicated lending?

Entry-level roles often include Analyst or Associate positions, focusing on financial modeling, credit analysis, and deal execution support.

How much can I expect to earn in a syndicated loan job?

Salaries vary widely based on experience, location, and specific role. Entry-level positions may offer $60,000-$80,000 annually, while senior roles can reach significantly higher levels.

What certifications are helpful for a career in syndicated loans?

While not always required, certifications like the CFA (Chartered Financial Analyst) or CAIA (Chartered Alternative Investment Analyst) can enhance career prospects.