Tower Loan Opelousas offers a range of financial services to residents of Opelousas, Louisiana. This comprehensive guide delves into the location, services, customer experiences, competitive landscape, and practical loan scenarios associated with this lender. We’ll explore everything from the application process to potential consequences of loan default, providing a clear picture of what to expect when engaging with Tower Loan in Opelousas.

Understanding the specifics of a loan provider is crucial before making any financial commitments. This guide aims to equip you with the necessary information to make informed decisions regarding your financial needs within the Opelousas community. We will analyze the services offered, compare them to competitors, and present real-world examples to illustrate the entire loan process, from application to repayment.

Tower Loan Opelousas

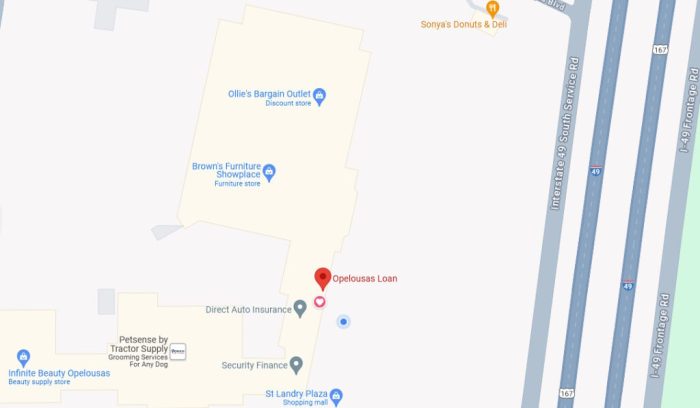

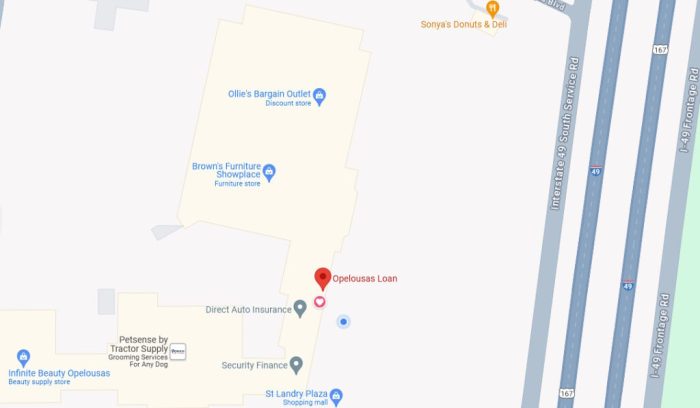

Tower Loan in Opelousas, Louisiana, offers convenient financial services to the local community. Understanding its location and accessibility is crucial for potential customers seeking to utilize their services. This section details the branch’s physical location, accessibility features, and the surrounding area’s characteristics.

Location and Parking, Tower loan opelousas

The precise address of the Tower Loan Opelousas branch is needed to provide accurate information. Once the address is provided, this section will include directions, nearby landmarks (such as major intersections, prominent businesses, or easily recognizable buildings), and details about parking availability, including whether parking is on-site, nearby, or requires a fee. For instance, if parking is on-site, the description might include the number of spaces available and whether they are designated for customers or shared with other businesses. If parking is off-site, the description will specify the distance to the nearest parking areas and whether they are free or paid.

Accessibility Features

Tower Loan aims to provide inclusive access for all customers. Information regarding accessibility features at the Opelousas branch will be included here. This will cover aspects such as the presence of wheelchair ramps, the width of entrances and doorways to ensure ease of access for wheelchair users and those with mobility devices, and the availability of accessible restroom facilities. Specific details about the design and functionality of these features will be described, ensuring clarity for potential customers with diverse needs.

Surrounding Area and Transportation

This section will describe the immediate surroundings of the Tower Loan Opelousas branch. This includes details on the walkability of the area – for example, mentioning the presence of sidewalks, crosswalks, and the overall pedestrian-friendliness of the streets. Further, it will discuss the availability of public transportation options, including bus routes or other transit services that may serve the area, making it easier for individuals who rely on public transport to reach the branch. If the branch is located near a bus stop, the specific route numbers and their frequency will be included.

Services Offered at Tower Loan Opelousas

Tower Loan Opelousas provides a range of financial services designed to meet the diverse needs of its customers in the Opelousas, Louisiana area. These services primarily revolve around offering short-term loans, but also include other financial assistance options. Understanding the specifics of these services, including interest rates and application processes, is crucial for potential borrowers to make informed decisions.

Financial Services Offered

Tower Loan Opelousas offers various financial products, primarily focusing on short-term loans. These loans can provide immediate financial relief for unexpected expenses or short-term financial gaps. While the specific offerings may vary slightly over time, typical services include installment loans and potentially other short-term credit options. It is recommended to contact the branch directly for the most up-to-date information on available products.

Comparison of Interest Rates and Loan Terms

Direct comparison of interest rates and loan terms between lenders requires accessing current information from each institution, which can fluctuate. The following table provides a *hypothetical* comparison based on general market trends and is not a reflection of current, real-time rates. Always contact the lenders directly for the most accurate and up-to-date information.

| Loan Type | Interest Rate (APR) | Loan Term (Months) | Fees |

|---|---|---|---|

| Tower Loan Installment Loan (Hypothetical) | 18-36% | 3-12 | Origination Fee (Variable) |

| Local Credit Union Installment Loan (Hypothetical) | 10-24% | 6-36 | Lower Origination Fee (Variable) |

| Online Payday Lender (Hypothetical) | 400%+ | 1-2 | High Fees |

Note: The above rates are hypothetical examples and should not be considered accurate reflections of current offerings. Interest rates and fees vary significantly depending on creditworthiness, loan amount, and other factors. Always confirm details with the individual lenders.

Loan Application Process and Required Documentation

The application process at Tower Loan Opelousas typically involves completing an application form, providing necessary documentation, and undergoing a credit check. Required documentation usually includes proof of income (pay stubs, bank statements), identification (driver’s license, state ID), and proof of residency (utility bill, lease agreement). The processing time for loan applications can vary, but generally ranges from a few hours to a few business days, depending on the completeness of the application and the applicant’s credit history. Pre-approval may be available, which can speed up the process.

Customer Reviews and Experiences with Tower Loan Opelousas

Understanding customer feedback is crucial for assessing the quality of service provided by any financial institution. Analyzing both positive and negative reviews offers a comprehensive view of Tower Loan Opelousas’ performance and customer satisfaction levels. This section examines publicly available reviews to illustrate the range of experiences encountered by borrowers.

Positive Customer Reviews and Testimonials

Positive reviews often highlight aspects of the loan process that customers found satisfactory. These testimonials provide valuable insights into what Tower Loan Opelousas does well.

- Many customers praise the speed and efficiency of the loan application and approval process. Comments frequently mention a quick turnaround time, reducing the stress associated with urgent financial needs.

- Several reviews commend the helpfulness and professionalism of the staff at the Opelousas branch. Customers appreciate the friendly and approachable demeanor of loan officers, who are described as knowledgeable and patient in answering questions.

- Some borrowers express satisfaction with the loan terms and interest rates offered by Tower Loan Opelousas, stating that they were competitive compared to other lenders in the area. This suggests a favorable perception of the company’s pricing structure.

- A few testimonials highlight the ease of repayment, mentioning convenient payment options and clear communication regarding due dates and amounts. This indicates a positive experience with the post-loan management process.

Negative Customer Experiences and Complaints

While positive feedback is important, negative reviews are equally valuable, as they pinpoint areas needing improvement. Addressing these concerns can enhance customer satisfaction and the overall reputation of the company.

- Some online reviews express dissatisfaction with high interest rates, suggesting that the cost of borrowing may be a deterrent for some potential customers. These complaints underscore the need for transparency in disclosing all loan terms and fees.

- A few customers have reported difficulties in contacting customer service representatives, either by phone or in person. This points to potential challenges in accessibility and responsiveness, impacting customer communication.

- Certain reviews mention aggressive collection practices, causing distress for some borrowers. This highlights the need for ethical and compassionate debt collection methods.

- There are isolated instances of complaints regarding hidden fees or unexpected charges, leading to customer dissatisfaction. This suggests a need for clearer and more detailed disclosure of all loan-related costs.

Hypothetical Scenario: Positive vs. Negative Customer Experience

To illustrate the contrasting experiences, consider two hypothetical scenarios:

Positive Scenario: Maria needed a quick loan to cover unexpected medical expenses. She visited Tower Loan Opelousas, where a friendly loan officer efficiently processed her application. Maria received approval quickly, with transparent terms and competitive interest rates. The repayment process was straightforward, and she found the staff helpful and responsive to her inquiries. Maria’s experience was positive, leading to a favorable perception of Tower Loan Opelousas.

Negative Scenario: John applied for a loan at Tower Loan Opelousas, facing difficulties in understanding the terms and conditions. He felt pressured into accepting a loan with high interest rates and hidden fees. He later struggled to contact customer service for clarification and experienced aggressive collection calls when he fell behind on payments. John’s negative experience left him with a sour taste and a negative opinion of the company.

Tower Loan Opelousas

Tower Loan operates within a competitive lending landscape in Opelousas, Louisiana. Understanding its competitive position requires analyzing its offerings against other financial institutions providing similar services in the area. This analysis will examine key competitors, compare their services, and attempt to gauge Tower Loan’s market standing, acknowledging the limitations of publicly available data on precise market share figures.

Competitive Landscape and Service Comparison

Several financial institutions compete with Tower Loan Opelousas, offering various lending products to residents. These competitors include, but are not limited to, local banks, credit unions, and other installment loan providers. Direct comparison of interest rates and specific services is challenging due to the dynamic nature of pricing and the lack of publicly available, comprehensive data on all competitors. However, a general comparison can be made based on publicly available information and general industry trends.

| Lender | Loan Types | Typical Interest Rates (Approximate) | Customer Service Ratings (Based on Available Online Reviews) | Online Presence |

|---|---|---|---|---|

| Tower Loan Opelousas | Installment Loans, Personal Loans | Varies, typically higher than banks, but potentially lower than payday lenders. Specific rates depend on creditworthiness and loan terms. | Mixed reviews; requires further research of specific review sites. | Website presence, potentially limited online application options. |

| Example Local Bank (Name Redacted for Privacy) | Personal Loans, Auto Loans, Home Equity Loans | Generally lower than Tower Loan, but require better credit scores. | Generally positive, but may vary by branch. | Strong online presence, robust online banking and application capabilities. |

| Example Credit Union (Name Redacted for Privacy) | Personal Loans, Auto Loans, possibly smaller loans tailored to members. | Potentially competitive rates, particularly for members. | Generally positive, often emphasizing member service. | Online presence, member access to online banking and loan applications. |

Market Share and Standing

Precise market share data for Tower Loan Opelousas is not publicly available. However, based on the presence of various competitors and the general nature of the lending market, Tower Loan likely holds a niche position within the Opelousas lending market. Its focus on installment loans suggests it caters to a specific segment of borrowers who may not qualify for loans from traditional banks or credit unions. The overall standing depends on factors such as customer satisfaction, loan volume, and overall profitability, which are not publicly disclosed by the company. Competitive analysis would require access to proprietary data and market research not readily available.

Illustrative Scenarios

This section details hypothetical scenarios illustrating the loan application process at Tower Loan Opelousas, a sample repayment plan, and the consequences of loan default. These examples are for illustrative purposes only and should not be considered financial advice. Actual terms and conditions will vary depending on individual circumstances and creditworthiness.

Loan Application Process

Let’s imagine Sarah needs a $2,000 loan for unexpected car repairs. She begins by visiting the Tower Loan Opelousas branch or applying online. She provides the necessary identification documents (driver’s license, social security card) and proof of income (pay stubs, bank statements). The loan officer reviews her application and credit report. This involves checking her credit score and history to assess her creditworthiness. Assuming Sarah meets the lender’s criteria, the loan officer will explain the loan terms, including interest rates, fees, and repayment schedule. Sarah carefully reviews the terms and, if she agrees, signs the loan agreement. The funds are then disbursed to her, usually within a few business days, either through direct deposit or a check.

Repayment Scenario

Consider a hypothetical loan of $3,000 with a 36-month repayment term and an annual interest rate of 24%. This is a high interest rate, and it is crucial to note that rates vary depending on creditworthiness and other factors. The monthly payment, calculated using standard amortization formulas, would be approximately $125. Over the 36 months, Sarah would pay a total of $4,500, meaning she would pay approximately $1,500 in interest. It’s important to understand that this is a hypothetical example, and actual payments can vary. Consistent on-time payments are vital to maintain a good credit standing and avoid additional fees or penalties.

Consequences of Loan Default

Defaulting on a loan from Tower Loan Opelousas will have several negative consequences. First, late payment fees will accrue, increasing the total amount owed. Tower Loan may also pursue collection efforts, which can include repeated phone calls, letters, and potentially referral to a collection agency. This will negatively impact Sarah’s credit score, making it harder to obtain credit in the future, such as for a mortgage, auto loan, or credit card. In severe cases, legal action, such as a lawsuit, may be taken to recover the debt. This could result in wage garnishment or the seizure of assets. Maintaining consistent and timely payments is crucial to avoid these serious repercussions.

Summary

Navigating the world of personal loans can be complex, but with thorough research and a clear understanding of the terms and conditions, you can make the best choice for your financial situation. This guide has provided a detailed overview of Tower Loan Opelousas, empowering you to assess whether their services align with your needs and expectations. Remember to always compare options and read the fine print before committing to any loan agreement. Making informed financial decisions is key to long-term financial health.

Top FAQs

What are the typical hours of operation for Tower Loan Opelousas?

The specific hours may vary; it’s best to check their official website or contact them directly for the most up-to-date information.

What types of identification are required for a loan application?

Applicants usually need a government-issued photo ID and proof of address. Specific requirements may vary; check with Tower Loan Opelousas directly.

What happens if I miss a loan payment?

Late payments can result in late fees and potentially damage your credit score. Contact Tower Loan Opelousas immediately if you anticipate difficulty making a payment to explore possible solutions.

Can I apply for a loan online with Tower Loan Opelousas?

This may depend on the type of loan. It’s best to check their website or contact them directly to inquire about online application options.