Truliant home equity loan rates can significantly impact your borrowing costs. Understanding these rates, along with associated fees and terms, is crucial before taking the plunge. This guide delves into the specifics of Truliant’s offerings, comparing them to industry standards and helping you determine the best loan type for your financial situation. We’ll explore different loan options, repayment schedules, and factors influencing interest rates, empowering you to make informed decisions.

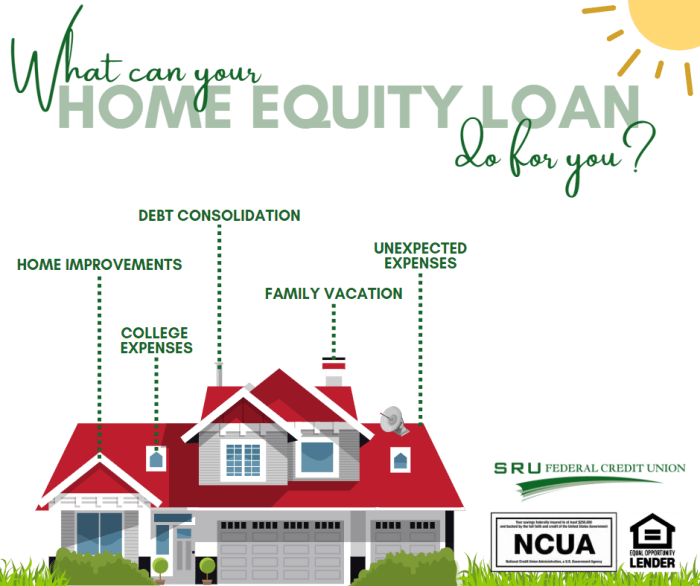

From eligibility requirements and the application process to comparing home equity loans with HELOCs, we aim to provide a comprehensive overview. We’ll examine real-world scenarios illustrating how a Truliant home equity loan can benefit various financial goals, such as home improvements or debt consolidation. By the end, you’ll have a clear understanding of whether a Truliant home equity loan is the right choice for you.

Truliant Home Equity Loan Overview

Truliant Federal Credit Union offers home equity loans, providing borrowers access to funds using their home’s equity as collateral. These loans can be a valuable financial tool for various purposes, from home improvements to debt consolidation. Understanding the different loan types, eligibility criteria, and the application process is crucial for making an informed decision.

Truliant Home Equity Loan Types

Truliant likely offers several types of home equity loans, although the precise offerings may vary. Common types include home equity lines of credit (HELOCs) and fixed-rate home equity loans. A HELOC functions like a credit card, allowing you to borrow against your available equity up to a certain limit. A fixed-rate home equity loan provides a lump sum of money with a fixed interest rate and repayment schedule. It’s advisable to contact Truliant directly to confirm their current offerings and details.

Truliant Home Equity Loan Eligibility Requirements

Eligibility for a Truliant home equity loan depends on several factors. Generally, borrowers need to be a member of Truliant Federal Credit Union, possess sufficient equity in their home, have a good credit history, and meet certain income requirements. The minimum credit score, loan-to-value ratio (LTV), and debt-to-income ratio (DTI) requirements will be specified by Truliant. Meeting these criteria increases the likelihood of loan approval.

Truliant Home Equity Loan Application Process

The application process typically involves submitting an application, providing supporting documentation (such as proof of income, tax returns, and home appraisal), and undergoing a credit check. Truliant will assess your financial situation to determine your eligibility and the loan terms. Once approved, you’ll receive loan documents to review and sign. The entire process may take several weeks. Contacting Truliant directly will provide the most up-to-date information on their application procedures.

Calculating Potential Monthly Payments for a Truliant Home Equity Loan

Calculating potential monthly payments involves understanding the loan amount, interest rate, and loan term. A simple formula, although not perfectly accurate without accounting for fees and other charges, is:

Monthly Payment = [P x (r(1+r)^n)] / [(1+r)^n – 1]

Where:

* P = Principal loan amount

* r = Monthly interest rate (Annual interest rate divided by 12)

* n = Number of months in the loan term

For example, a $50,000 loan at a 6% annual interest rate (0.06/12 = 0.005 monthly rate) over 10 years (120 months) would yield an approximate monthly payment. However, it’s crucial to use a loan calculator provided by Truliant or a reputable financial website for a precise calculation that incorporates all applicable fees and charges. This ensures an accurate representation of the total cost of borrowing.

Understanding Truliant’s Loan Terms

Truliant offers home equity loans with varying terms, allowing borrowers to tailor their repayment schedules to their financial capabilities. Choosing the right loan term involves a careful consideration of monthly payments and the total interest paid over the life of the loan. Shorter terms mean higher monthly payments but significantly less interest paid overall, while longer terms offer lower monthly payments but result in substantially higher total interest costs.

Understanding the implications of different loan terms is crucial for making an informed decision. This section details the loan terms available and illustrates the impact of term length on repayment schedules.

Loan Term Lengths and Their Implications

Truliant’s home equity loan terms typically range from 10 to 15 years, although specific offerings may vary. A shorter-term loan, such as a 10-year loan, will require larger monthly payments but will lead to a much lower total interest paid over the life of the loan. Conversely, a longer-term loan, like a 15-year loan, will have smaller monthly payments but will accumulate significantly more interest. The optimal choice depends on an individual’s financial situation and comfort level with monthly payment amounts. Borrowers should carefully weigh the benefits of lower monthly payments against the increased overall cost of borrowing.

Examples of Repayment Schedules

The following examples illustrate how repayment schedules differ based on loan amount and term length. These are hypothetical examples and actual rates and payments may vary depending on individual creditworthiness and market conditions. Always consult with a Truliant representative for personalized information.

- Scenario 1: $25,000 Loan at 6% Interest

- 10-year term: Approximately $275 monthly payment; Total interest paid approximately $6,000.

- 15-year term: Approximately $200 monthly payment; Total interest paid approximately $10,000.

- Scenario 2: $75,000 Loan at 6% Interest

- 10-year term: Approximately $825 monthly payment; Total interest paid approximately $18,000.

- 15-year term: Approximately $600 monthly payment; Total interest paid approximately $30,000.

Hypothetical Repayment Schedule: $50,000 Loan at 6% Interest Over 15 Years

This example demonstrates a possible repayment schedule. Actual payments may vary slightly due to rounding and other factors. It is crucial to remember that this is a simplified example and does not include potential fees or changes in interest rates. Contact Truliant for precise figures.

| Year | Beginning Balance | Annual Payment | Interest Paid | Principal Paid | Ending Balance |

|---|---|---|---|---|---|

| 1 | $50,000.00 | $4,486.65 | $2,962.78 | $1,523.87 | $48,476.13 |

| 2 | $48,476.13 | $4,486.65 | $2,780.24 | $1,706.41 | $46,769.72 |

| 3 | $46,769.72 | $4,486.65 | $2,592.20 | $1,894.45 | $44,875.27 |

| … | … | … | … | … | … |

| 15 | $3,168.64 | $4,486.65 | $182.10 | $4,304.55 | $0.00 |

Note: This table shows a simplified amortization schedule. The actual schedule provided by Truliant may differ slightly.

Comparing Truliant Home Equity Loan Options

Choosing between a Truliant home equity loan and a home equity line of credit (HELOC) depends significantly on your individual financial goals and circumstances. Both options utilize your home’s equity as collateral, but they differ substantially in how you access and repay the funds. Understanding these differences is crucial for making an informed decision.

Home Equity Loan versus Home Equity Line of Credit

A Truliant home equity loan provides a lump-sum payment upfront. You receive a fixed amount of money at closing, and then repay it over a fixed term with regular, scheduled payments, similar to a traditional mortgage. In contrast, a Truliant HELOC functions more like a credit card. It offers a line of credit you can borrow against repeatedly up to a pre-approved limit during a specified draw period. Repayment typically begins after the draw period concludes, and interest rates may be variable.

Advantages and Disadvantages of Home Equity Loans

Home equity loans offer the advantage of predictable monthly payments and a fixed interest rate, protecting you from fluctuating interest costs. This stability can make budgeting easier. However, a significant disadvantage is the limited access to funds; you receive only the initial loan amount. Additionally, accessing the full equity in your home might require a larger loan with higher payments, potentially impacting your budget.

Advantages and Disadvantages of Home Equity Lines of Credit

HELOCs provide flexibility, allowing you to borrow funds as needed during the draw period. This can be beneficial for unexpected expenses or ongoing projects. The variable interest rate, however, presents a risk: your monthly payments can fluctuate, making budgeting more challenging. Furthermore, while you have access to funds as needed, you’ll only have access to the pre-approved credit limit, and you must repay the balance after the draw period ends.

Comparison of Key Features, Truliant home equity loan rates

The following table summarizes the key differences between Truliant’s home equity loan and HELOC options. Note that specific rates and terms are subject to change and depend on individual creditworthiness and market conditions. Always contact Truliant directly for the most up-to-date information.

| Feature | Home Equity Loan | HELOC |

|---|---|---|

| Interest Rate | Typically Fixed | Typically Variable |

| Credit Limit | Fixed Loan Amount | Pre-approved Line of Credit |

| Draw Period | One-time disbursement | Specified period (e.g., 10 years) |

| Repayment Period | Fixed term (e.g., 15-30 years) | Begins after draw period, typically 10-20 years |

Determining the Best Loan Type for Different Financial Situations

A home equity loan is ideal for borrowers who need a lump sum for a specific purpose, such as home renovations or debt consolidation, and prefer the predictability of fixed monthly payments. A HELOC is better suited for individuals who anticipate needing access to funds over time for various expenses or projects, understanding the potential for fluctuating interest rates and the need for repayment after the draw period. For example, a homeowner planning extensive renovations would benefit from a home equity loan, while someone facing unpredictable home repair costs might prefer a HELOC.

Illustrating Truliant Home Equity Loan Scenarios

Truliant home equity loans offer a flexible financing option for various needs. Understanding how these loans can be applied in different situations is crucial for making informed financial decisions. The following scenarios illustrate the potential benefits and applications of Truliant home equity loans.

Home Improvement Loan Scenario

Let’s imagine Sarah and John need to renovate their kitchen. Their home is valued at $400,000, and they have a mortgage balance of $200,000, leaving $200,000 in equity. They decide to take out a $30,000 Truliant home equity loan at a fixed interest rate of 7% for a 10-year term. This translates to a monthly payment of approximately $360. The renovation significantly increases their home’s value and enjoyment. This scenario showcases how a home equity loan can fund home improvements while leveraging existing home equity.

Debt Consolidation Loan Scenario

Consider David, who has high-interest credit card debt totaling $25,000 with an average APR of 18%. He decides to consolidate this debt with a $25,000 Truliant home equity loan at a fixed interest rate of 7% for a 5-year term. His monthly payment would be approximately $480. By consolidating his debt, David reduces his monthly payments from approximately $800 (assuming a $25,000 debt at 18% APR) to $480, saving him approximately $320 per month. Over the five-year loan term, he saves approximately $19,200 in interest. This demonstrates the potential cost savings of using a home equity loan for debt consolidation. Note: These calculations are simplified and do not include any potential fees.

Truliant Home Equity Loan vs. Other Financing Options

Suppose Mark needs to purchase a new car costing $30,000. He has three options: a personal loan, an auto loan, or a Truliant home equity loan. A personal loan might offer a higher interest rate (e.g., 12%), resulting in higher monthly payments. An auto loan may have a lower interest rate (e.g., 5%), but it’s secured against the car, not his home. A Truliant home equity loan, with a potentially lower rate than the personal loan (e.g., 7%), uses his home equity as collateral. The choice depends on his risk tolerance, interest rate offered for each option, and overall financial goals. The comparison highlights that home equity loans are not always the best option for every purchase. Individual circumstances and the terms offered by each lender must be carefully evaluated.

Impact of Interest Rates on Total Loan Cost

Imagine two scenarios with a $20,000 Truliant home equity loan, one at 6% interest and the other at 8% interest, both over a 10-year term. The lower interest rate scenario would result in a lower total interest paid over the life of the loan compared to the higher interest rate scenario. A visual representation would show two upward-sloping lines, representing the cumulative interest paid over time. The line representing the 8% interest rate would be steeper and higher than the line representing the 6% interest rate, clearly illustrating how even small differences in interest rates significantly impact the total cost of the loan over time. The difference in total interest paid would be substantial, highlighting the importance of securing the lowest possible interest rate.

Conclusive Thoughts

Securing a home equity loan can be a significant financial decision. By carefully considering Truliant’s home equity loan rates, fees, and loan terms, alongside your individual financial circumstances, you can make a well-informed choice. Remember to compare options, explore different repayment schedules, and factor in all associated costs before committing to a loan. This guide provides a strong foundation for your research, empowering you to navigate the process confidently.

Questions and Answers: Truliant Home Equity Loan Rates

What credit score is needed for a Truliant home equity loan?

Truliant’s minimum credit score requirements vary depending on the loan amount and type. It’s best to contact Truliant directly for the most up-to-date information on their specific requirements.

How long does the Truliant home equity loan application process take?

The application process timeline depends on several factors, including the completeness of your application and the appraisal process. While Truliant aims for efficiency, it’s advisable to allow several weeks for the entire process.

Can I prepay my Truliant home equity loan?

Truliant’s loan agreements typically allow for prepayment without penalty. However, it’s crucial to review your loan documents to confirm the specific terms regarding prepayment.

What happens if I miss a payment on my Truliant home equity loan?

Missing payments can negatively impact your credit score and may lead to late fees. Contact Truliant immediately if you anticipate difficulties making a payment to explore possible solutions.