UFCU refinance auto loan offers a compelling path to lower monthly payments and potentially significant savings. This comprehensive guide navigates the process of refinancing your auto loan through UFCU, detailing eligibility, rates, application procedures, and crucial comparisons with other lenders. We’ll explore the advantages and disadvantages, providing you with the information needed to make an informed decision about whether refinancing is right for you.

From understanding the intricacies of UFCU’s refinancing rates and terms to navigating the application and approval process, we’ll cover everything you need to know. We’ll also delve into practical scenarios, illustrating both the potential benefits and potential drawbacks of refinancing your auto loan with UFCU. By the end, you’ll be equipped to confidently assess whether UFCU auto loan refinancing aligns with your financial goals.

Understanding UFCU Auto Loan Refinancing

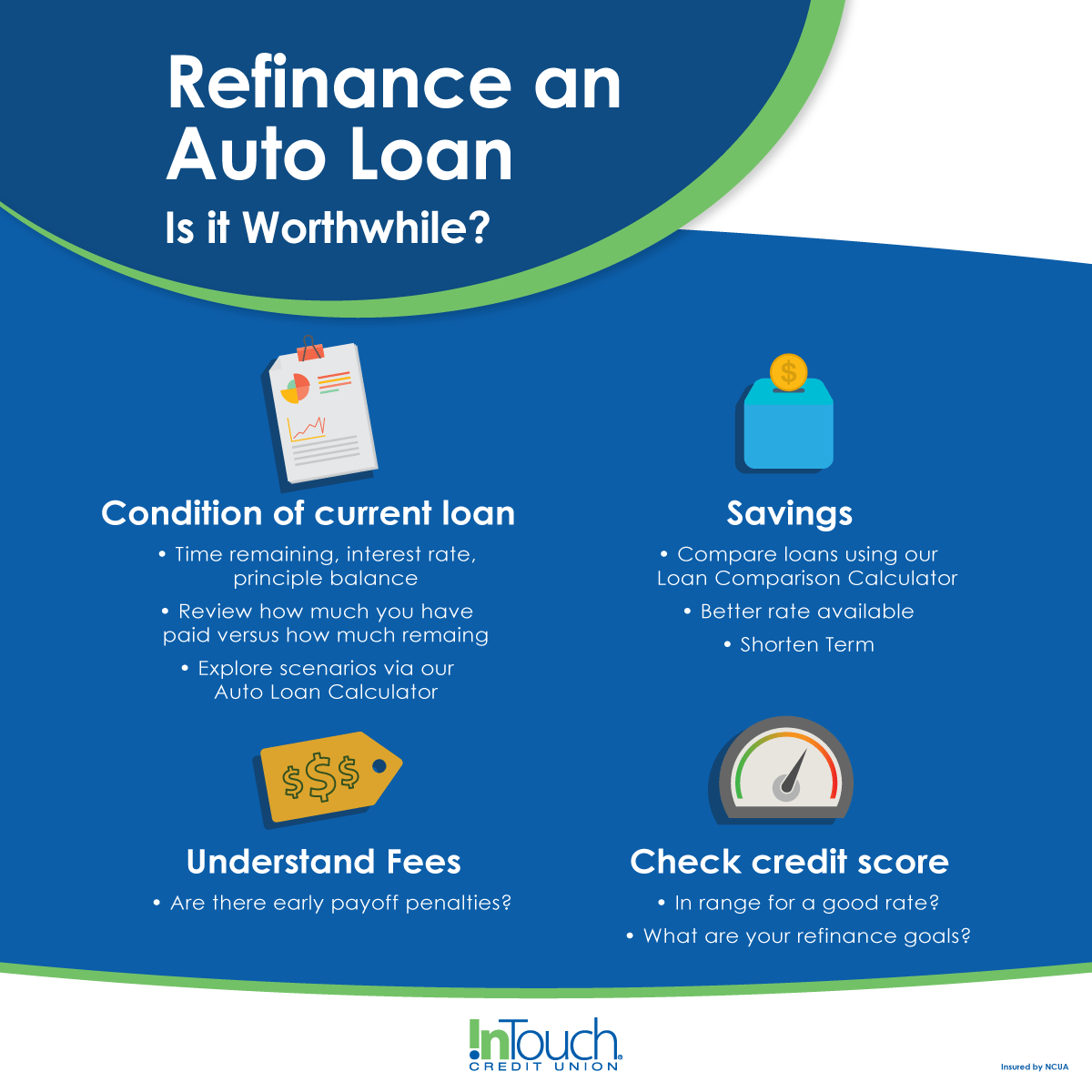

Refinancing your auto loan with UFCU can offer significant financial advantages, potentially lowering your monthly payments, reducing your overall interest paid, and freeing up cash flow. This process involves replacing your existing auto loan with a new one from UFCU, often at a more favorable interest rate. Understanding the benefits, eligibility criteria, and application process is crucial for making an informed decision.

UFCU Auto Loan Refinancing Benefits

Refinancing your auto loan with UFCU can offer several key benefits. Lower interest rates are a primary attraction, resulting in reduced monthly payments and less interest paid over the life of the loan. This can significantly impact your budget, allowing you to allocate funds elsewhere. Additionally, UFCU may offer flexible repayment terms, allowing you to choose a loan term that best suits your financial situation. Consolidating multiple auto loans into a single UFCU loan simplifies your finances and streamlines your monthly payments.

UFCU Auto Loan Refinancing Eligibility Requirements

To be eligible for UFCU auto loan refinancing, you must meet specific criteria. These typically include being a UFCU member in good standing, possessing a vehicle that qualifies for refinancing (generally, the vehicle’s value should be sufficient to secure the loan), and having a satisfactory credit history. Specific requirements regarding credit score minimums, loan-to-value ratios, and vehicle age may vary. It’s recommended to contact UFCU directly or review their website for the most up-to-date eligibility requirements.

UFCU Auto Loan Refinancing Application Process

The application process for UFCU auto loan refinancing is generally straightforward. First, you’ll need to gather necessary documentation, including your current loan details, vehicle information, and proof of income. Next, you’ll submit your application, either online through UFCU’s website or in person at a branch. UFCU will then review your application and assess your eligibility. Upon approval, you’ll receive a loan offer outlining the terms and conditions. Finally, you’ll need to sign the loan documents to finalize the refinancing process. The entire process may take several business days or weeks, depending on the volume of applications and the complexity of your situation.

Comparison of UFCU Auto Loan Refinancing Rates with Other Lenders

UFCU’s auto loan refinancing rates are competitive with other lenders, but the actual rate you qualify for will depend on several factors, including your credit score, the loan amount, and the vehicle’s value. To obtain an accurate comparison, you should obtain rate quotes from multiple lenders, including UFCU and other financial institutions. It is advisable to compare not only the interest rate but also the fees, terms, and other conditions associated with each loan offer before making a decision. Consider factors like prepayment penalties and any additional fees charged by the lender. For example, a lender may offer a slightly lower interest rate but charge higher fees, negating the initial savings. Careful comparison shopping is crucial to secure the best possible deal.

UFCU Refinancing Rates and Terms

Understanding UFCU’s auto loan refinancing rates and terms is crucial for making an informed decision. The rates offered are competitive, but vary based on several factors, allowing for personalized loan options. This section details the rates, terms, influencing factors, and potential fees associated with refinancing your auto loan through UFCU.

Sample Refinancing Rates and Monthly Payments

UFCU’s auto loan refinancing rates are dynamic and depend on several factors, including credit score and loan amount. The following table provides example rates and monthly payments. It’s important to note that these are illustrative examples only, and your actual rate and payment will vary based on your individual circumstances. Contact UFCU directly for a personalized rate quote.

| Credit Score | Loan Amount | Interest Rate (APR) | Monthly Payment (Example) |

|---|---|---|---|

| 680-719 | $20,000 | 6.5% | $380 |

| 720-759 | $20,000 | 5.5% | $365 |

| 760+ | $20,000 | 4.5% | $350 |

| 680-719 | $30,000 | 7.0% | $570 |

| 720-759 | $30,000 | 6.0% | $545 |

| 760+ | $30,000 | 5.0% | $525 |

Loan Terms Offered by UFCU

UFCU typically offers a range of loan terms for auto loan refinancing, commonly ranging from 24 to 72 months. The specific terms available will depend on the borrower’s creditworthiness and the value of the vehicle. Longer loan terms generally result in lower monthly payments but lead to higher overall interest paid. Shorter terms result in higher monthly payments but lower total interest paid. Choosing the right term involves balancing affordability with the total cost of the loan.

Factors Influencing UFCU Auto Loan Refinancing Rates

Several factors influence the interest rate UFCU offers for auto loan refinancing. These include the borrower’s credit score, the loan-to-value ratio (LTV) of the vehicle, the vehicle’s year and make/model, and prevailing market interest rates. A higher credit score generally qualifies for a lower interest rate. A lower LTV (meaning a larger down payment) also typically leads to a better rate. The age and type of vehicle can also influence the rate, with newer vehicles often commanding better rates. Finally, market interest rates play a significant role; when rates are low, refinancing rates tend to be lower.

Potential Fees Associated with UFCU Auto Loan Refinancing

While UFCU strives for transparency, it’s important to be aware of potential fees associated with auto loan refinancing. These may include an application fee, appraisal fee (if required), and possibly a prepayment penalty if you refinance before the end of your existing loan term. It’s crucial to inquire about all potential fees upfront to accurately assess the total cost of refinancing. These fees should be clearly Artikeld in the loan documents before you finalize the refinancing process.

Comparing UFCU Refinancing to Other Options

Refinancing your auto loan can significantly impact your monthly payments and overall loan cost. Choosing between UFCU and other financial institutions requires careful consideration of various factors, including interest rates, fees, and the overall loan terms. This section compares UFCU’s auto loan refinancing options with those offered by other lenders to help you make an informed decision.

A key aspect of comparing refinancing options lies in understanding the nuances of each lender’s offerings. While UFCU may offer competitive rates and member benefits, other institutions might provide different incentives or cater to specific credit profiles. A thorough comparison is essential to identify the most advantageous option for your individual financial situation.

UFCU Refinancing Compared to Other Lenders

The following points highlight the key differences between refinancing with UFCU and other financial institutions. These comparisons are generalized and actual rates and terms will vary depending on individual creditworthiness and market conditions.

- Interest Rates: UFCU often offers competitive interest rates, particularly for its members. However, other banks, credit unions, and online lenders may also provide attractive rates, especially during promotional periods. It’s crucial to obtain quotes from multiple lenders to compare.

- Fees: UFCU may have lower or more transparent fees compared to some other lenders. Some lenders charge origination fees, application fees, or prepayment penalties. Carefully review all fees associated with each loan offer.

- Loan Terms: UFCU offers a range of loan terms, allowing borrowers flexibility in choosing a repayment schedule that suits their budget. Similarly, other lenders offer varying terms, but the available options might differ. Comparing loan terms is vital for determining the total interest paid over the life of the loan.

- Member Benefits (UFCU): As a credit union, UFCU provides member benefits that may not be available from other lenders. These could include lower interest rates, access to financial education resources, or other perks. These benefits should be considered alongside the interest rate and fees.

- Customer Service: Both UFCU and other lenders offer varying levels of customer service. Consider the ease of communication, responsiveness, and overall experience when making your decision. Reading online reviews can provide valuable insights.

Hypothetical Refinancing Scenario

Let’s consider a hypothetical scenario to illustrate the potential savings of refinancing with UFCU. Suppose you have an existing auto loan with a principal balance of $20,000, an interest rate of 8%, and a remaining term of 36 months. Your current monthly payment is approximately $616.

If you refinance with UFCU and secure a new loan with a 6% interest rate and a 48-month term, your monthly payment would decrease to approximately $470. This represents a monthly savings of $146. Over the life of the loan, you would save approximately $2,784 in interest. However, extending the loan term increases the total interest paid compared to maintaining the original 36-month loan. This trade-off between lower monthly payments and increased total interest needs careful consideration.

Conversely, if you keep your existing loan, your monthly payments remain at $616, and you’ll continue paying interest at the 8% rate for the remaining 36 months. No additional fees are incurred, but you miss the opportunity to potentially lower your monthly payment and reduce the total interest paid.

Potential Savings or Costs

The potential savings or costs associated with refinancing depend on several factors, including the difference between your current interest rate and the rate offered by UFCU or another lender, the length of the new loan term, and any associated fees. A significant interest rate reduction can lead to substantial savings over the life of the loan, but extending the loan term can increase the total interest paid. It’s crucial to carefully weigh these factors to determine the most financially advantageous option.

For instance, a lower interest rate might offset the increased total interest from a longer loan term, leading to overall savings. Conversely, a small interest rate reduction coupled with a significantly longer loan term may result in higher total interest paid, negating any potential savings from lower monthly payments. A detailed comparison using a loan amortization calculator can help visualize the financial implications of each option.

The UFCU Application and Approval Process

Applying for a UFCU auto loan refinance involves several steps, from gathering necessary documents to understanding the factors influencing approval. A smooth and efficient process hinges on preparation and clear communication with UFCU. This section details the application procedure, required documentation, and key factors determining loan approval.

The UFCU auto loan refinance application process is designed to be straightforward and efficient. Applicants should expect clear communication throughout the process, with updates provided on the status of their application. Timelines vary depending on individual circumstances and the volume of applications being processed, but generally, applicants can expect a decision within a few business days to a couple of weeks.

Required Documents for UFCU Auto Loan Refinancing Application

Having all necessary documents readily available significantly streamlines the application process. A complete application minimizes delays and increases the chances of a timely approval. The following documents are typically required:

- Completed UFCU auto loan refinance application form.

- Valid driver’s license or government-issued photo ID.

- Vehicle identification number (VIN).

- Proof of vehicle insurance.

- Proof of income (pay stubs, tax returns, or bank statements).

- Current auto loan payoff information.

The UFCU Auto Loan Refinancing Application Process

The application process itself is generally straightforward and can be completed online, by phone, or in person at a UFCU branch. Applicants should anticipate providing detailed information about their vehicle, current loan, and financial situation. UFCU representatives will guide applicants through the process and answer any questions they may have.

After submitting the application, UFCU will review the provided information and supporting documents. Applicants should expect regular communication regarding the status of their application. This may include requests for additional documentation or clarification. Once the review is complete, UFCU will notify the applicant of their approval or denial, along with the terms of the loan if approved.

Factors Influencing UFCU Auto Loan Refinancing Approval or Denial, Ufcu refinance auto loan

Several factors play a significant role in UFCU’s decision to approve or deny an auto loan refinance application. A strong application demonstrates financial responsibility and reduces the risk for the lender. Understanding these factors can help applicants improve their chances of approval.

- Credit score: A higher credit score generally indicates a lower risk to the lender, increasing the likelihood of approval and potentially resulting in a more favorable interest rate.

- Debt-to-income ratio (DTI): A lower DTI shows that you have sufficient income to comfortably manage your existing debts and the new loan. A high DTI might lead to denial.

- Vehicle value: The value of the vehicle being refinanced is crucial. The loan amount cannot exceed the vehicle’s worth, preventing the lender from significant losses in case of default.

- Loan-to-value ratio (LTV): This ratio compares the loan amount to the vehicle’s value. A lower LTV is generally preferred by lenders.

- Employment history and income stability: Consistent employment and stable income demonstrate the ability to make timely loan payments.

Managing Your UFCU Refinance Loan

Successfully refinancing your auto loan with UFCU is only half the battle; effectively managing your new loan is crucial for long-term financial health. This section Artikels key strategies for managing your UFCU refinance loan, ensuring smooth payments and maintaining a positive credit standing.

Efficient loan management involves understanding your payment schedule, exploring various payment methods, and proactively maintaining a strong credit profile. By following these guidelines, you can leverage your refinance to improve your financial situation and build a solid credit history.

Sample Monthly Budget Incorporating an UFCU Auto Loan Refinance Payment

Creating a realistic monthly budget is essential for successful loan management. This involves listing all your monthly income and expenses, including your new, lower UFCU auto loan payment. By visualizing your complete financial picture, you can identify areas for potential savings and ensure your loan payment remains manageable.

For example, consider a monthly income of $4,000. After deducting essential expenses like rent ($1,200), groceries ($500), utilities ($200), and other regular bills ($300), you have $1,800 remaining. If your UFCU auto loan refinance payment is $350, you still have $1,450 left for discretionary spending, savings, and debt repayment. This demonstrates the importance of budgeting and prioritizing expenses to ensure loan payments are consistently met.

Making Payments on an UFCU Auto Loan Refinance

UFCU offers various convenient payment options for your refinanced auto loan. These include online bill pay through your UFCU account, automatic payments from your checking or savings account, mobile app payments, and in-person payments at a UFCU branch. Choosing a method that aligns with your personal preferences and financial habits is key to ensuring timely payments.

For instance, setting up automatic payments ensures you never miss a payment, minimizing late fees and potential damage to your credit score. The convenience of online and mobile payment options also allows for quick and easy payments from anywhere, at any time.

Tips for Maintaining a Good Credit Score After Refinancing

Refinancing your auto loan can positively impact your credit score, particularly if you secure a lower interest rate and shorter loan term. However, maintaining a good credit score requires ongoing diligence. This includes making timely payments, keeping your credit utilization low, and avoiding unnecessary credit applications.

Specifically, consistently paying your UFCU auto loan on time is crucial. Furthermore, limiting your overall credit utilization (the amount of credit you use compared to your total available credit) to below 30% is recommended. Finally, avoid opening numerous new credit accounts within a short period, as this can negatively affect your credit score.

Contacting UFCU Customer Service Regarding Your Auto Loan Refinance

UFCU provides multiple avenues for contacting customer service regarding your refinanced auto loan. These include calling their customer service hotline, using their online chat feature, emailing them through their website, or visiting a local branch. Selecting the method most convenient for you ensures prompt resolution of any queries or issues.

For example, if you have a question about your payment due date, you can quickly access this information through your online UFCU account or by calling their customer service number. If you experience a problem with your payment, contacting them immediately allows for proactive resolution and avoids potential late payment penalties.

Illustrative Scenarios of UFCU Auto Loan Refinancing

Refinancing your auto loan can significantly impact your monthly budget and overall loan cost. Understanding different scenarios helps determine if refinancing with UFCU is the right choice for your financial situation. The following examples illustrate situations where refinancing offers substantial benefits and situations where it may not be advantageous.

Significant Savings Through UFCU Refinancing

Let’s consider Sarah, who originally took out a $25,000 auto loan with a 7.5% APR over 60 months. Her monthly payment is approximately $490. After two years, she has a remaining balance of $16,000 and finds that UFCU offers a refinance rate of 4.5% APR. By refinancing with UFCU, Sarah can reduce her monthly payment to approximately $300 and save a substantial amount over the life of the loan. The total interest paid on the original loan would have been approximately $5,400. With the UFCU refinance, her total interest paid would be approximately $2,700, resulting in savings of $2,700. This example demonstrates how a lower interest rate from UFCU, combined with a shorter loan term (potentially), can lead to significant savings.

Scenarios Where Refinancing May Not Be Beneficial

Consider John, who took out a $15,000 auto loan at a 3% APR for 48 months. He has excellent credit and is already paying a low interest rate. Even if UFCU offered a slightly lower rate, the savings might be minimal and not worth the effort of refinancing. The administrative fees and time involved in refinancing may outweigh any small reduction in monthly payments or total interest paid. Furthermore, if John is close to paying off his loan, refinancing might not be financially prudent, as the total interest saved might be negligible compared to the cost of refinancing.

Visual Representation of Monthly Payment Differences

A bar graph would effectively illustrate the difference in monthly payments. The horizontal axis would represent the loan period (months), and the vertical axis would represent the monthly payment amount. Two bars would be displayed for each month: one representing the original loan’s monthly payment (higher bar), and another representing the refinanced loan’s monthly payment with UFCU (lower bar). The difference in height between the bars would visually demonstrate the monthly savings achieved through refinancing. The graph would clearly show a consistent reduction in monthly payments over the loan term, highlighting the cumulative savings achieved by refinancing with UFCU. For example, if the original monthly payment was $500 and the refinanced payment was $400, the bar graph would visually show a $100 difference each month. The cumulative savings would be clearly visible as the difference between the total area under the two bars.

Final Review

Refinancing your auto loan with UFCU can be a strategic move to reduce your monthly expenses and potentially save thousands of dollars over the life of your loan. However, careful consideration of your financial situation, credit score, and comparison with other lenders is crucial. This guide provides a roadmap to help you navigate the process effectively. Remember to meticulously review your options and make a decision that best suits your individual financial circumstances. By understanding the nuances of UFCU’s offerings and comparing them to alternatives, you can confidently embark on this financial journey.

General Inquiries: Ufcu Refinance Auto Loan

What credit score is needed for UFCU auto loan refinancing?

While UFCU doesn’t publicly state a minimum credit score, a higher score generally leads to better interest rates. It’s best to check your credit report and score before applying.

Can I refinance a car loan from another lender with UFCU?

Yes, UFCU typically allows refinancing of auto loans from other financial institutions.

What documents are needed for a UFCU auto refinance application?

Typically, you’ll need your vehicle’s title, proof of income, and your current loan details. UFCU will provide a complete list during the application process.

How long does the UFCU auto loan refinance application process take?

The timeframe varies, but expect the process to take several days to a few weeks, depending on the completeness of your application and verification of information.