Upstart apply for second loan? Securing a second loan from Upstart isn’t just a repeat of the first; it involves navigating a nuanced landscape of eligibility requirements, interest rates, and repayment history. This guide unravels the complexities, offering a step-by-step walkthrough of the application process, comparing it to the first-time experience. We’ll delve into the crucial factors influencing approval, explore alternative lending options, and weigh the potential risks and rewards before you take the plunge.

From understanding how your previous Upstart loan performance impacts your chances to optimizing your application for maximum success, we’ll equip you with the knowledge to make an informed decision. Whether you’re looking to consolidate debt, fund a new project, or simply need additional financial flexibility, this comprehensive resource will illuminate the path towards securing your second Upstart loan.

Upstart’s Second Loan Application Process

Applying for a second loan with Upstart generally follows a similar process to your first application, but there are key differences. While Upstart leverages your credit history and financial data from your first loan, the review process might be slightly faster or slower depending on various factors including your repayment history on the initial loan and any changes in your financial situation. This guide will Artikel the steps involved, comparing the second loan application with the initial application process.

Upstart Second Loan Application Steps Compared to the First

Applying for a second Upstart loan is streamlined compared to the first, assuming a positive repayment history on your initial loan. The platform will likely pre-populate some of your information, reducing the amount of data entry required. However, you will still need to provide updated financial information and undergo a credit check. The primary difference lies in the reduced paperwork and potentially faster processing times, contingent upon your financial standing. A less-than-stellar repayment history on your first loan could result in a more thorough and potentially longer review.

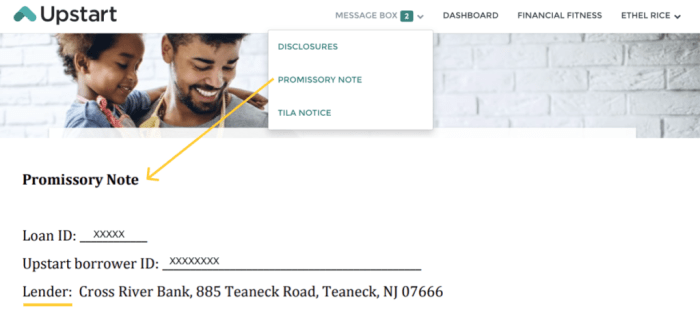

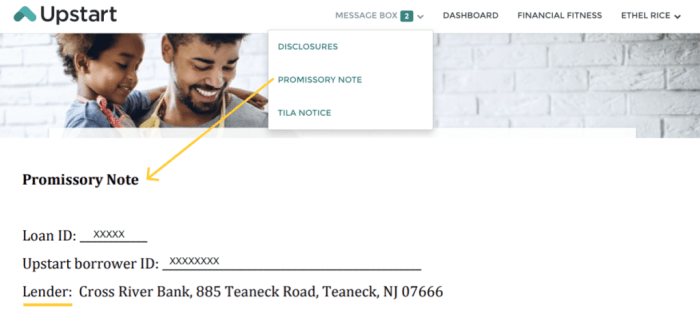

Step-by-Step Guide to Applying for a Second Upstart Loan

The following table provides a structured overview of the application process for a second Upstart loan. Remember, the actual experience may vary based on individual circumstances.

| Step Number | Action | Required Documents | Potential Delays |

|---|---|---|---|

| 1 | Visit the Upstart Website and Initiate the Application | None initially, but you’ll be prompted to log in with your Upstart account. | Minimal; login issues may cause slight delays. |

| 2 | Review Loan Offers | None. Upstart will present loan offers based on your financial profile. | Upstart’s internal processing time for generating offers; typically within minutes but can vary. |

| 3 | Provide Updated Financial Information | Income verification (pay stubs, tax returns, bank statements), employment details. | Delayed verification of income sources, inaccuracies in provided data. |

| 4 | Consent to Credit Check | None; Upstart will conduct a soft and then a hard credit pull. | Credit reporting agency delays, inaccuracies in credit reports. |

| 5 | Review and Accept Loan Terms | None; simply review and accept or reject the terms presented. | Potential delays are minimal; if terms are not suitable, the process will end here. |

| 6 | E-Signature and Loan Disbursement | Digital signature. | Potential delays are minimal; disbursement times depend on Upstart’s internal processes. |

Eligibility Requirements for a Second Upstart Loan

Securing a second loan from Upstart involves navigating a set of eligibility criteria that, while similar to those for a first loan, may present unique challenges. Understanding these requirements is crucial for borrowers aiming to access additional funding. The process considers various financial factors to assess the applicant’s ability to repay the loan responsibly.

Upstart’s eligibility assessment for second loans centers around a holistic review of the borrower’s financial profile. This differs from a simple credit score check; it incorporates income verification, debt-to-income ratio (DTI), and a review of the borrower’s repayment history with their first Upstart loan (and other credit accounts). The goal is to determine the applicant’s capacity to manage the additional debt responsibly.

Credit Score’s Influence on Second Loan Eligibility

A strong credit score significantly improves the chances of approval for a second Upstart loan. While Upstart doesn’t publicly disclose a minimum credit score requirement, a higher score generally indicates a lower risk to the lender. A higher score reflects responsible credit management in the past, making lenders more confident in the borrower’s ability to repay the second loan. Conversely, a low credit score may lead to loan denial or a higher interest rate to compensate for the increased risk. For example, an applicant with a credit score above 700 might receive favorable terms, while an applicant with a score below 600 might face stricter requirements or rejection.

Income and Debt-to-Income Ratio’s Role in Eligibility

Income verification is a critical aspect of the eligibility process. Upstart needs to ensure the borrower has sufficient income to cover both their existing debt obligations and the new loan payments. The debt-to-income ratio (DTI), calculated by dividing total monthly debt payments by gross monthly income, is a key indicator of financial health. A lower DTI suggests a greater capacity to manage additional debt. For instance, an applicant with a high income and a low DTI will likely be viewed as a lower-risk borrower compared to an applicant with a lower income and a high DTI. A high DTI might result in loan denial or a smaller loan amount.

Differences in Eligibility Requirements Between First and Second Loans

While the core principles of creditworthiness remain consistent, there are key differences between the eligibility requirements for first and second Upstart loans. The most significant difference lies in the assessment of repayment history. For a second loan application, Upstart will scrutinize the borrower’s performance on their previous loan(s). Late payments or defaults on the first loan can significantly impact the approval chances for a second loan, potentially leading to rejection or less favorable terms. Furthermore, the length of time since the first loan’s disbursement might also influence eligibility. A shorter timeframe between loans may be viewed with more scrutiny.

Examples of Eligibility Scenarios

Scenario 1: A borrower with a 750 credit score, a stable income, and a low DTI who successfully repaid their first Upstart loan is highly likely to be approved for a second loan with favorable terms.

Scenario 2: A borrower with a 600 credit score, a fluctuating income, and a high DTI who experienced late payments on their first Upstart loan is less likely to be approved for a second loan. They might be offered a loan with a higher interest rate or a smaller loan amount, or they might be denied altogether.

Scenario 3: A borrower with a 680 credit score and a stable income, but with a high DTI due to several outstanding loans, may still be eligible for a second loan but with a smaller loan amount to keep their DTI within acceptable parameters. This demonstrates Upstart’s nuanced approach to evaluating financial responsibility.

Interest Rates and Loan Terms for Second Upstart Loans

Securing a second loan with Upstart involves understanding the associated interest rates and loan terms. These factors can significantly influence the overall cost and repayment schedule of your loan. While Upstart doesn’t publicly disclose exact rate ranges for second loans separately from first loans, we can analyze typical interest rates and compare them to those offered for initial loans to provide a clearer picture.

Upstart’s interest rates are highly personalized and depend on several factors, including your credit score, income, debt-to-income ratio, and the loan amount. Generally, borrowers with higher credit scores and lower debt-to-income ratios qualify for lower interest rates. The interest rates for second loans are likely to be similar to or slightly higher than those for first loans, reflecting the increased risk associated with lending to a borrower who has already taken out a loan. Loan terms, typically ranging from 36 to 60 months, remain consistent across both first and second loan applications, although the specific term offered depends on individual circumstances.

Interest Rate Comparison for First and Second Upstart Loans

Understanding the differences between interest rates for first and second Upstart loans is crucial for financial planning. While precise figures aren’t publicly available, a comparison can be made based on general lending practices and publicly available data on average interest rates for personal loans. Borrowers should expect slightly higher rates for second loans due to increased risk assessment. The difference, however, is usually marginal, especially for borrowers with excellent credit histories. For instance, a borrower with a 750 credit score might receive a 7% APR for their first loan and potentially an 8% APR for their second. This difference is not a fixed rule and can vary significantly based on the applicant’s financial profile.

Sample Interest Rates for Second Upstart Loans, Upstart apply for second loan

The following table illustrates hypothetical interest rates for second Upstart loans, based on varying loan amounts and credit scores. Remember that these are examples and your actual rate will depend on your individual circumstances. It’s essential to check your personalized rate offer from Upstart before proceeding.

| Loan Amount | Credit Score 660-699 | Credit Score 700-759 | Credit Score 760+ |

|---|---|---|---|

| $5,000 | 14-18% | 10-14% | 8-12% |

| $10,000 | 12-16% | 9-13% | 7-11% |

| $15,000 | 11-15% | 8-12% | 6-10% |

Impact of a First Loan on a Second Loan Application

Your repayment history on your first Upstart loan significantly influences your chances of approval for a second loan. Upstart, like other lenders, uses this data to assess your creditworthiness and risk profile. A strong repayment history demonstrates your ability to manage debt responsibly, increasing your likelihood of securing another loan with favorable terms. Conversely, a poor repayment history can negatively impact your application.

Your repayment performance on your first Upstart loan is a key factor in determining your eligibility for a second loan. Upstart’s algorithms analyze various aspects of your repayment behavior, including on-time payments, missed payments, and the overall loan repayment duration. This data helps Upstart assess your reliability and predict your future repayment behavior. A consistent track record of on-time payments strengthens your application, while late or missed payments can significantly reduce your chances of approval or result in less favorable loan terms for your second loan.

Early Loan Payoff’s Influence on Future Loan Applications

Paying off your first Upstart loan early demonstrates financial responsibility and can positively impact your application for a second loan. This proactive approach signals to Upstart that you are a low-risk borrower capable of managing debt effectively. The positive impact extends beyond simply demonstrating on-time payments; it showcases your commitment to minimizing debt and improving your financial standing. This can lead to higher approval odds and potentially more favorable interest rates on your next loan.

Examples of Repayment Behavior and Subsequent Loan Applications

Let’s consider two hypothetical borrowers:

Borrower A consistently made on-time payments on their first Upstart loan and paid it off early. This excellent repayment history significantly improved their chances of approval for a second loan. Upstart likely viewed Borrower A as a low-risk borrower, potentially offering them a lower interest rate and a higher loan amount compared to Borrower B.

Borrower B, on the other hand, experienced several late payments on their first Upstart loan. This negative repayment history significantly reduced their chances of approval for a second loan. Even if approved, Borrower B would likely receive a higher interest rate and a lower loan amount reflecting the increased risk associated with their repayment history. In a worst-case scenario, their application could be denied altogether. The contrast between these two borrowers illustrates the crucial role repayment history plays in Upstart’s lending decisions.

Alternatives to a Second Upstart Loan: Upstart Apply For Second Loan

Securing a second personal loan can be beneficial for various financial needs, but Upstart isn’t the only option available. Exploring alternative lenders and loan types is crucial for finding the best fit for your individual circumstances and financial profile. Comparing interest rates, fees, and application processes will help you make an informed decision.

Considering alternatives to a second Upstart loan allows borrowers to potentially access better terms or find a lender more suited to their specific financial situation. Factors like credit score, debt-to-income ratio, and the purpose of the loan significantly influence the eligibility and terms offered by different lenders.

Peer-to-Peer Lending Platforms

Peer-to-peer (P2P) lending platforms connect borrowers directly with individual investors. These platforms often have less stringent requirements than traditional banks and can offer competitive interest rates, particularly for borrowers with good credit. However, the application process may involve more scrutiny of your financial details.

- Interest Rates and Fees: P2P interest rates are variable and depend on your creditworthiness and the loan’s terms. Fees can include origination fees and late payment penalties. These are generally comparable to Upstart, sometimes slightly lower or higher depending on the platform and individual investor assessment.

- Application Process: The application process typically involves submitting a detailed financial profile, including income verification and credit history. This is similar in complexity to Upstart’s application.

Banks and Credit Unions

Traditional banks and credit unions offer personal loans, often with fixed interest rates and established repayment schedules. While they may have stricter eligibility criteria than Upstart or P2P lenders, they often provide a higher level of customer service and established loan structures.

- Interest Rates and Fees: Interest rates from banks and credit unions vary based on credit score and loan amount. They might offer lower interest rates to borrowers with excellent credit, but fees can be comparable to Upstart or slightly higher depending on the institution and loan type.

- Application Process: The application process is usually straightforward, but may require more documentation than Upstart. Credit checks are standard, and approval times can vary.

Online Lenders

Numerous online lenders offer personal loans, often specializing in specific niches, such as loans for debt consolidation or home improvements. They can provide convenient online application processes and quick funding, but it’s crucial to carefully review their terms and fees.

- Interest Rates and Fees: Interest rates and fees from online lenders are highly variable, ranging widely depending on the lender’s policies and the borrower’s credit profile. Some may offer lower rates than Upstart, while others may charge higher rates for higher-risk borrowers.

- Application Process: Application processes are typically fast and convenient, often fully online. However, the speed can sometimes come at the cost of more rigorous credit checks and potentially higher fees.

Potential Risks and Benefits of Taking Out a Second Upstart Loan

Considering a second Upstart loan requires careful evaluation of both the potential advantages and disadvantages. Taking on additional debt can significantly impact your financial health, and it’s crucial to understand the full implications before proceeding. A thorough assessment of your current financial situation and future goals is paramount to making an informed decision.

Debt Burden and Default Risk

Taking out multiple loans increases your overall debt burden. This means higher monthly payments and a greater risk of default if your income decreases or unexpected expenses arise. For example, if you already have a significant amount of credit card debt and then take out a second Upstart loan, your monthly payments could become unmanageable, leading to potential delinquency and damage to your credit score. The consequences of default can be severe, including negative impacts on your credit report, collection agency involvement, and potential legal action. Careful budgeting and realistic assessment of your repayment capacity are crucial before applying for a second loan.

Benefits of a Second Upstart Loan

While the risks are significant, a second Upstart loan can offer certain benefits under the right circumstances. One key advantage is debt consolidation. If you have several high-interest debts, consolidating them into a single, lower-interest Upstart loan can simplify your payments and potentially save you money on interest over time. Another benefit is financing a specific purchase, such as home improvements or a necessary vehicle repair. This allows you to spread the cost over time rather than paying upfront, making larger expenses more manageable. However, it’s crucial to ensure the purchase is truly necessary and that the loan amount is affordable given your existing financial commitments.

Pros and Cons of a Second Upstart Loan

| Pros | Cons |

|---|---|

| Debt consolidation, potentially leading to lower monthly payments and interest savings. | Increased debt burden, potentially leading to financial strain and difficulty making payments. |

| Ability to finance large purchases, making them more manageable. | Higher risk of default and negative impact on credit score if payments are missed. |

| Simplified payment process with a single loan provider. | Potential for accumulating significant interest charges over the loan term. |

| Potential for improved credit score if managed responsibly. | Increased financial stress and potential for long-term financial difficulties. |

Improving Chances of Approval for a Second Upstart Loan

Securing a second Upstart loan hinges on demonstrating improved financial health and responsible borrowing habits since your first loan. Lenders assess applicants based on a variety of factors, and proactive steps can significantly increase your chances of approval. By focusing on credit score improvement, debt management, and providing comprehensive financial documentation, you can present a compelling case for loan approval.

Improving your credit score is paramount. A higher credit score significantly reduces the perceived risk to the lender, leading to better loan terms and a higher likelihood of approval. This is because a higher credit score indicates a lower probability of default. Similarly, effectively managing your existing debt shows responsible financial behavior. Upstart will scrutinize your debt-to-income ratio (DTI), comparing your monthly debt payments to your monthly income. A lower DTI demonstrates greater capacity to repay a new loan. Finally, providing thorough and accurate financial documentation strengthens your application. This includes accurate income verification, employment history, and detailed information on existing debts.

Credit Score Improvement Strategies

Improving your credit score takes time and consistent effort. Strategies include paying all bills on time, reducing credit utilization (keeping your credit card balances low relative to your credit limits), and monitoring your credit report for errors. Regularly checking your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) is crucial to identify and dispute any inaccuracies that could negatively impact your score. Consider using credit monitoring services or apps to track your progress and receive alerts about potential issues. Aiming for a substantial credit score increase before applying for a second loan will significantly improve your chances of approval. For example, improving your score from 650 to 700 could drastically change the lender’s risk assessment.

Debt Management Techniques

Effective debt management is crucial for demonstrating financial responsibility. This involves creating a realistic budget to track income and expenses, prioritizing high-interest debt payments, and exploring options like debt consolidation or balance transfers to potentially lower interest rates. Reducing your overall debt load directly lowers your DTI, making you a less risky borrower. For instance, if you successfully pay off a significant credit card balance, your DTI will decrease, improving your loan application. Maintaining a consistent and responsible payment history on all existing loans and credit accounts is essential for showing a pattern of reliable repayment.

Providing Comprehensive Financial Documentation

Submitting complete and accurate financial documentation strengthens your application. This includes providing verifiable proof of income (pay stubs, tax returns, W-2s), employment history (verification from your employer), and a detailed list of all existing debts (loan amounts, interest rates, monthly payments). Accuracy is critical; any inconsistencies or omissions can raise red flags and lead to application rejection. Organizing these documents neatly and ensuring they are readily accessible for Upstart will streamline the application process and present a professional image. This thoroughness demonstrates your commitment to transparency and responsible borrowing, increasing your credibility as a borrower.

Last Word

Successfully navigating the Upstart second loan application process hinges on understanding your financial standing, your repayment history, and the specific requirements Upstart sets. By carefully considering your eligibility, comparing interest rates and terms to alternatives, and proactively addressing any potential risks, you can significantly improve your chances of approval. Remember, responsible borrowing is key to leveraging the benefits of a second loan while avoiding potential pitfalls. This guide provides the foundation; your diligent preparation ensures a successful outcome.

FAQs

What if my first Upstart loan is still outstanding?

Upstart considers your repayment history on your first loan. Consistent on-time payments significantly increase your chances of approval for a second loan.

Can I apply for a second loan if I defaulted on a previous loan with another lender?

A previous default can negatively impact your approval odds. Upstart will assess your credit report, and a history of defaults might make approval less likely. Improving your credit score before applying is advisable.

How long do I have to wait between Upstart loans?

There’s no fixed waiting period. Upstart assesses each application individually, considering your repayment history and current financial situation. A shorter time between loans might be viewed less favorably than a longer period with consistent on-time payments.

What documents will I need to provide for a second Upstart loan application?

Similar to the first application, you’ll likely need proof of income, employment verification, and potentially bank statements. Upstart’s application portal will guide you through the required documentation.