Legal Authority and Scope of Power of Attorney

In the context of USAA, the legal authority for power of attorney is derived from state laws and regulations. USAA, as a financial institution, adheres to these legal frameworks to ensure the validity and enforceability of powers of attorney.

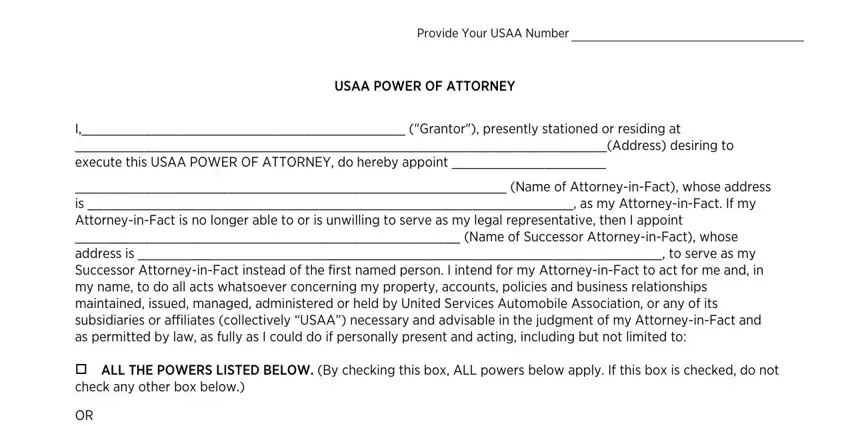

A USAA power of attorney grants an individual (the “agent”) the authority to act on behalf of another individual (the “principal”) in financial and legal matters. The scope and limitations of a USAA power of attorney are defined by the specific language used in the document and the applicable state laws.

Scope of Power

The scope of a USAA power of attorney can vary depending on the principal’s needs and intentions. Common powers granted in a USAA power of attorney include:

- Managing financial accounts, including checking, savings, and investment accounts

- Paying bills and expenses

- Filing taxes

- Making investment decisions

li>Handling real estate transactions

Limitations of Power

While a power of attorney grants significant authority, it is important to note that there are certain limitations to its scope. These limitations may vary by state, but generally include:

- The agent cannot act against the principal’s best interests

- The agent cannot make decisions related to the principal’s personal care or medical treatment

- The agent cannot enter into contracts that would bind the principal to personal liability

Types of Power of Attorney

USAA offers various types of power of attorney to suit different needs and preferences. Each type is designed to provide a specific level of authority and control over the principal’s affairs.

The main types of power of attorney offered by USAA include:

General Power of Attorney

A general power of attorney grants the agent broad authority to act on the principal’s behalf in a wide range of matters, including financial, legal, and personal affairs. This type of power of attorney is typically used when the principal needs someone to handle their affairs while they are away or incapacitated.

Limited Power of Attorney

A limited power of attorney grants the agent authority to act on the principal’s behalf only in specific matters. This type of power of attorney is often used when the principal wants to give someone limited authority to handle a particular task, such as selling a property or managing investments.

Durable Power of Attorney

A durable power of attorney remains in effect even if the principal becomes incapacitated. This type of power of attorney is often used when the principal is concerned about their ability to manage their own affairs in the future due to illness or disability.

Springing Power of Attorney

A springing power of attorney only becomes effective upon the occurrence of a specific event, such as the principal’s incapacity. This type of power of attorney is often used when the principal wants to ensure that someone will be able to manage their affairs if they become unable to do so themselves.

Establishing a Power of Attorney

Establishing a power of attorney with USAA is a straightforward process that can provide peace of mind knowing that your financial and legal affairs will be handled according to your wishes in the event of your incapacity.

To establish a power of attorney with USAA, you will need to:

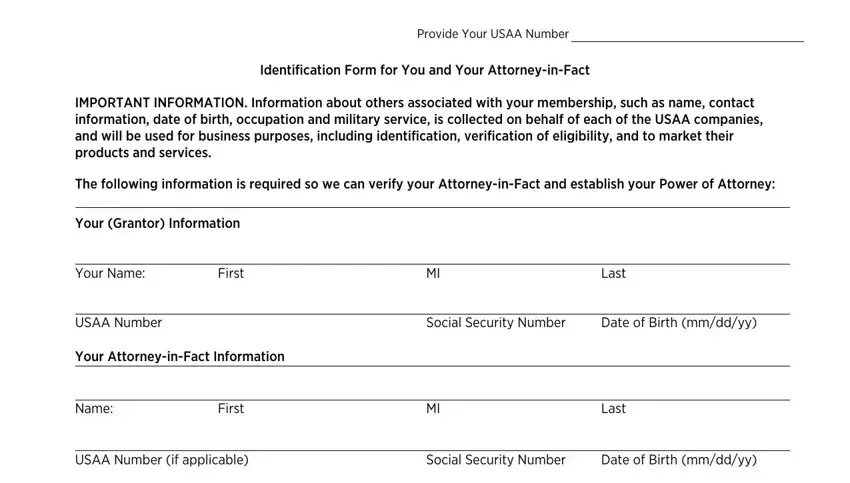

Requirements and Documentation

- Be a USAA member in good standing.

- Be at least 18 years old and of sound mind.

- Have a designated agent (also known as an attorney-in-fact) who is at least 18 years old and understands the responsibilities of being an agent.

- Complete a power of attorney form.

- Have the form notarized by a notary public.

- Submit the completed and notarized form to USAA.

Once your power of attorney is established, it will be effective immediately unless you specify a later date. You can revoke your power of attorney at any time by submitting a written notice to USAA.

Responsibilities of the Agent

The agent under a USAA power of attorney has a significant responsibility to act in the best interests of the principal. Their duties and responsibilities include:

- Managing the principal’s financial affairs, including paying bills, collecting debts, and making investments.

- Making decisions regarding the principal’s health care, including consenting to medical treatment and managing end-of-life care.

- Handling the principal’s legal affairs, such as signing contracts, filing lawsuits, and representing the principal in court.

- Maintaining regular communication with the principal and keeping them informed about all decisions made on their behalf.

Fiduciary Obligations

The agent under a USAA power of attorney has a fiduciary duty to act in the best interests of the principal. This means that they must:

- Act in good faith and with due care.

- Avoid conflicts of interest.

- Keep the principal’s property separate from their own.

- Account for all transactions made on behalf of the principal.

Potential Liabilities

The agent under a USAA power of attorney can be held liable for any breach of their fiduciary duties. This liability can include:

- Reimbursing the principal for any losses caused by the agent’s negligence or misconduct.

- Being removed as the agent.

- Facing criminal charges in cases of fraud or theft.

It is important for the principal to carefully consider who they appoint as their agent under a USAA power of attorney. The agent should be someone they trust and who they believe will act in their best interests.

Revocation and Termination

A power of attorney can be revoked or terminated at any time by the principal, unless the power is irrevocable. An irrevocable power of attorney can only be terminated under specific circumstances, such as if the principal becomes incapacitated or if the agent breaches their fiduciary duty.

To revoke a power of attorney, the principal must notify the agent in writing. The notice should state that the power of attorney is revoked and should be signed by the principal. The principal can also revoke a power of attorney by destroying the original document.

Once a power of attorney is revoked, the agent no longer has any authority to act on behalf of the principal. The principal is responsible for notifying any third parties who have been dealing with the agent under the power of attorney.

Circumstances and Legal Implications of Revocation

There are a number of circumstances that may lead to the revocation of a power of attorney. These include:

- The principal becomes incapacitated.

- The agent breaches their fiduciary duty.

- The principal changes their mind about giving the agent power of attorney.

- The power of attorney expires.

The legal implications of revoking a power of attorney can vary depending on the circumstances. If the power of attorney is revoked because the principal has become incapacitated, the agent may be required to account for their actions to the court.

If the power of attorney is revoked because the agent has breached their fiduciary duty, the principal may be able to sue the agent for damages.