USDA home loans Florence SC offer a unique pathway to homeownership, particularly for eligible rural residents. This comprehensive guide navigates the complexities of securing a USDA loan in Florence, South Carolina, covering eligibility requirements, lender selection, property considerations, and the overall home buying process. We’ll delve into crucial financial aspects, including credit scores and budgeting, and provide valuable resources to support your journey.

Understanding the nuances of USDA loans is key to a successful application. This guide aims to demystify the process, providing clear explanations and practical advice to help you confidently navigate each step, from initial eligibility checks to closing day. We’ll examine the benefits of working with local experts, compare various lenders, and highlight resources designed to empower you throughout your home buying experience in Florence, SC.

Understanding USDA Home Loans in Florence, SC

USDA home loans, also known as Rural Development loans, offer a pathway to homeownership for eligible individuals in rural areas and certain suburban areas. In Florence, SC, these loans can be a valuable tool for those who may struggle to qualify for traditional mortgages. Understanding the eligibility criteria, income limits, and application process is crucial for potential borrowers.

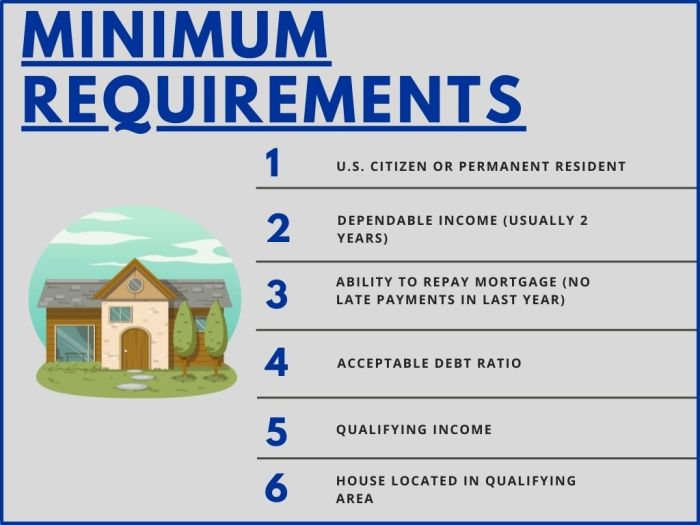

Eligibility Requirements for USDA Home Loans in Florence, SC

To qualify for a USDA home loan in Florence, SC, applicants must meet specific criteria. The property must be located in a USDA-designated eligible area, which can be verified through the USDA Rural Development website. The applicant must also be a U.S. citizen or eligible non-citizen, and have a credit score that meets the lender’s requirements. Importantly, the applicant’s income must fall within the established income limits for the area, and they must intend to occupy the property as their primary residence. The property itself must meet specific health and safety standards. Finally, the applicant must demonstrate the ability to repay the loan, often shown through stable employment and a responsible financial history.

Income Limits for USDA Home Loans in Florence, SC

Income limits for USDA home loans vary depending on household size and location within Florence, SC. These limits are adjusted periodically by the USDA. To determine the specific income limits applicable to a particular applicant, it is essential to consult the USDA Rural Development website or contact a local USDA-approved lender. Exceeding these limits will disqualify an applicant from receiving a USDA loan. The income limits are designed to target the loan program towards those who may have difficulty securing financing through conventional means.

Step-by-Step Guide on the Application Process for USDA Home Loans in Florence, SC

The application process for a USDA home loan in Florence, SC typically involves several key steps. First, the applicant should pre-qualify with a USDA-approved lender to determine their eligibility and loan amount. This involves providing financial documentation, such as pay stubs, tax returns, and bank statements. Next, the applicant will need to find a suitable property located in a USDA-eligible area. After identifying a property, the applicant will submit a formal loan application to their lender. This application will include extensive details about the property and the applicant’s finances. The lender will then order an appraisal to determine the property’s value and complete an underwriting review of the applicant’s financial situation. Once approved, the loan will close, and the applicant will become a homeowner.

Comparison of USDA Home Loans to Other Loan Types Available in Florence, SC

USDA home loans differ from other loan types available in Florence, SC, primarily in their eligibility requirements and down payment needs. Unlike conventional loans, USDA loans often require no down payment, making them more accessible to first-time homebuyers or those with limited savings. Compared to FHA loans, USDA loans generally have stricter eligibility requirements regarding location (rural areas) but may offer more lenient credit score requirements in some cases. Conventional loans typically require a larger down payment and a higher credit score, making them less accessible for many borrowers. The interest rates for each loan type will fluctuate based on market conditions, so comparing rates from multiple lenders is crucial before making a decision.

Properties Eligible for USDA Home Loans in Florence, SC

USDA home loans in Florence, South Carolina, offer a pathway to homeownership for eligible individuals and families. Understanding the types of properties that qualify is crucial for prospective borrowers. This section details the property eligibility criteria and provides examples of suitable locations within Florence.

The USDA Rural Development program, which administers these loans, has specific requirements for eligible properties. Generally, the property must be located in a designated rural area, meet certain size and condition standards, and be intended for use as a primary residence. Furthermore, the property must be modest in size and value, aligning with the program’s goal of providing affordable housing options. There are limits on the property’s appraised value, and exceeding this limit would disqualify the property. It’s important to consult with a USDA-approved lender to determine if a specific property meets the program’s requirements.

Property Types Eligible for USDA Loans in Florence, SC

Eligible properties typically include single-family homes, including detached houses, townhouses, and condominiums (subject to specific restrictions). Manufactured homes are also sometimes eligible, provided they meet the USDA’s standards for construction and permanency. The property must be habitable and in good enough condition to meet safety and health standards. Major repairs may be required before the loan is approved. Multi-family dwellings, such as duplexes or triplexes, are generally not eligible unless they meet very specific criteria and are intended to house the borrower as a primary residence.

Property Location Restrictions for USDA Home Loans in Florence, SC, Usda home loans florence sc

The USDA defines “rural” areas based on population density and proximity to urban centers. Florence, SC, while a city, contains areas that are considered rural and therefore eligible for USDA loans. These areas are typically located outside the city’s immediate core and may include smaller towns and unincorporated communities surrounding Florence. The precise boundaries of eligible areas can be found on the USDA Rural Development website’s eligibility map tool. Properties located within densely populated urban areas of Florence generally do not qualify. This is a key factor prospective borrowers need to consider when searching for properties.

Examples of Florence, SC Neighborhoods Commonly Using USDA Home Loans

Determining which neighborhoods specifically utilize USDA loans frequently requires accessing local real estate data and lender records, which is not publicly compiled in a single, easily accessible format. However, based on general knowledge of USDA loan usage patterns, properties in areas surrounding Florence, in less densely populated sections, are more likely to utilize this program. These areas often feature a mix of established homes and newer constructions, generally characterized by more affordable housing options. Pinpointing specific neighborhood names publicly is difficult due to privacy concerns related to individual loan applications. However, working with a local USDA-approved lender can provide a more precise understanding of eligible areas within Florence.

The Home Buying Process with USDA Loans in Florence, SC

Purchasing a home with a USDA loan in Florence, South Carolina, involves a series of steps, each requiring careful attention to detail and adherence to specific timelines. Understanding this process is crucial for a smooth and successful home buying experience. This section Artikels the key stages, from initial application to closing.

USDA Loan Timeline in Florence, SC

A typical USDA home loan process in Florence, SC, can take anywhere from 30 to 60 days, though unforeseen circumstances may extend this timeframe. This timeline provides a general overview; individual experiences may vary.

- Pre-Approval (1-2 weeks): This initial step involves gathering your financial documents and applying for pre-approval. This demonstrates your financial readiness to lenders and allows you to shop for homes within your approved budget. Lenders will review credit scores, income verification, and debt-to-income ratios.

- Home Search and Offer (2-4 weeks): Once pre-approved, you can begin your home search. Finding the right property may take time. After selecting a property, you’ll make an offer, which the seller may accept, counter, or reject.

- Loan Application and Appraisal (2-4 weeks): After your offer is accepted, you’ll formally apply for your USDA loan. The lender will order an appraisal to determine the market value of the property. This ensures the property meets USDA guidelines and the loan amount aligns with its worth.

- Underwriting (1-3 weeks): The lender’s underwriters review your application, appraisal, and all supporting documentation to assess your creditworthiness and the loan’s risk. This is a crucial step, and any missing information or discrepancies can cause delays.

- Closing (1-2 weeks): Once underwriting is complete and all conditions are met, the closing process begins. This involves signing all loan documents, paying closing costs, and transferring ownership of the property to you.

Obtaining a USDA Appraisal in Florence, SC

A USDA appraisal is a critical component of the loan process. It determines the market value of the property and ensures it meets USDA eligibility requirements. The lender selects a USDA-approved appraiser, who will conduct a thorough inspection of the property, considering factors like location, condition, and comparable sales. The appraiser’s report will detail the property’s value, condition, and any necessary repairs. This report is then submitted to the lender and reviewed as part of the underwriting process. Any issues identified in the appraisal may necessitate repairs or adjustments to the loan amount.

The USDA Loan Closing Process in Florence, SC

The closing process involves finalizing the loan and transferring ownership of the property. This typically takes place at a title company or attorney’s office. You’ll review and sign all loan documents, including the mortgage note, deed of trust, and closing disclosure. Closing costs, including fees for appraisal, title insurance, and other expenses, will be paid at this time. Once all documents are signed and funds are disbursed, the property title will officially transfer to you, completing the home buying process. It’s crucial to thoroughly review all documents before signing and to clarify any questions with your lender or closing agent.

Financial Considerations for USDA Home Loans in Florence, SC

Securing a USDA home loan in Florence, South Carolina, requires careful consideration of your financial standing. Lenders assess several key factors to determine your eligibility, primarily focusing on your creditworthiness and debt-to-income ratio. Understanding these aspects is crucial for a successful application.

Credit Score and Debt-to-Income Ratio

A strong credit score is paramount for USDA loan approval. Lenders generally prefer scores above 620, though some may consider applicants with lower scores depending on other factors. A higher credit score demonstrates responsible financial management, reducing the lender’s perceived risk. Your debt-to-income ratio (DTI), which compares your monthly debt payments to your gross monthly income, is equally important. A lower DTI indicates a greater capacity to manage additional debt, such as a mortgage. Lenders typically prefer a DTI below 43%, although this can vary. Improving these metrics significantly enhances your chances of loan approval. For example, an applicant with a 680 credit score and a 38% DTI is significantly more likely to be approved than one with a 550 credit score and a 55% DTI.

Sample Budget for a USDA Homebuyer in Florence, SC

Creating a realistic budget is essential before applying for a USDA loan. This budget example assumes a monthly mortgage payment of $1,500, but this will vary greatly depending on the loan amount, interest rate, and loan term. Property taxes and insurance costs are location-specific and should be obtained from local authorities or your real estate agent.

| Expense Category | Monthly Amount | Annual Amount | Percentage of Income |

|---|---|---|---|

| Mortgage Payment | $1,500 | $18,000 | 30% |

| Property Taxes (Estimate) | $200 | $2,400 | 4% |

| Homeowners Insurance (Estimate) | $100 | $1,200 | 2% |

| Utilities (Estimate) | $300 | $3,600 | 6% |

| Groceries (Estimate) | $500 | $6,000 | 10% |

| Transportation (Estimate) | $200 | $2,400 | 4% |

| Other Expenses (Estimate) | $200 | $2,400 | 4% |

| Total Monthly Expenses | $3,000 | $36,000 | 60% |

This budget illustrates a scenario where 60% of the monthly income is allocated to expenses. Remember to adjust these figures based on your individual circumstances. It’s crucial to have a clear understanding of your monthly income and expenses to ensure you can comfortably afford a home and meet your financial obligations.

Tips for Improving Creditworthiness

Several strategies can improve your credit score and DTI. Paying down existing debts, especially high-interest debts, is crucial. This reduces your DTI and demonstrates responsible financial behavior. Consistent on-time payments on all accounts are vital for building a positive credit history. Checking your credit report regularly for errors and disputing any inaccuracies can also significantly impact your score. Avoid opening multiple new credit accounts simultaneously, as this can negatively affect your credit score. Finally, consider seeking credit counseling if you’re struggling to manage your debt. By implementing these strategies, you can significantly increase your chances of securing a USDA loan in Florence, SC.

Resources and Support for USDA Homebuyers in Florence, SC

Securing a USDA home loan in Florence, SC, is a significant step toward homeownership, but navigating the process can be challenging. Fortunately, several resources and support systems are available to assist prospective buyers throughout their journey. Understanding these options can significantly improve the chances of a successful and stress-free home buying experience.

Finding the right resources is crucial for a smooth USDA home loan process. Local agencies and online tools provide invaluable information and assistance, while working with a knowledgeable real estate agent can streamline the entire process.

Local Government Agencies and Non-Profit Organizations

Several organizations in Florence, SC, offer assistance to first-time homebuyers, particularly those utilizing USDA loans. These resources can provide crucial guidance on navigating the application process, understanding financial requirements, and finding suitable properties. Accessing these services can significantly ease the burden of home buying.

- Florence County Housing Authority: This agency often offers housing counseling and assistance programs, potentially including information and referrals specific to USDA loans. They may provide guidance on credit counseling, budgeting, and financial literacy, vital components of a successful home loan application.

- Local Habitat for Humanity Affiliate: While not directly affiliated with USDA loans, Habitat for Humanity often works with families to secure affordable housing. They may have partnerships or knowledge of programs that complement USDA loan applications and assist with down payment assistance or other related costs.

- SC Housing Finance and Development Authority (SCFHA): Although not located in Florence, SCFHA offers statewide programs and resources that can benefit homebuyers across South Carolina, including those using USDA loans. They often provide information on down payment assistance programs and other financial aid options.

Online Resources for USDA Home Loan Information

The internet provides a wealth of information on USDA home loans, allowing prospective buyers to educate themselves and efficiently manage the application process. These online resources provide valuable tools and information to aid in decision-making and avoid potential pitfalls.

- USDA Rural Development Website: The official USDA Rural Development website offers comprehensive information on eligibility requirements, loan programs, and the application process. This is the primary source for accurate and up-to-date information on USDA loans.

- The U.S. Department of Agriculture (USDA) e-Handbook: This online resource offers detailed information and guidance on USDA home loan programs, including FAQs, application forms, and other essential documents.

- Mortgage Lender Websites: Many mortgage lenders specializing in USDA loans maintain informative websites with details on their loan programs, application processes, and contact information. Reviewing several lenders’ websites allows for comparison shopping and selection of the most suitable lender.

Benefits of Utilizing a Real Estate Agent Familiar with USDA Loans

Partnering with a real estate agent experienced in USDA loans offers numerous advantages throughout the home-buying journey. Their expertise can significantly simplify the process and increase the likelihood of a successful application.

A real estate agent familiar with USDA loans in Florence, SC, possesses specialized knowledge of eligible properties, the application process, and relevant local regulations. They can help identify suitable properties, navigate the complexities of the USDA loan program, and assist with negotiations and closing procedures. Their experience ensures a smoother and more efficient home-buying process, minimizing stress and maximizing the chances of a successful outcome.

Epilogue: Usda Home Loans Florence Sc

Securing a USDA home loan in Florence, SC, can be a rewarding experience, opening doors to homeownership for many. By carefully reviewing your eligibility, researching lenders, and understanding the financial implications, you can increase your chances of a successful application. Remember to leverage the resources available, connect with experienced professionals, and thoroughly plan your budget. With diligent preparation and informed decision-making, you can achieve your dream of homeownership in Florence, SC, through a USDA loan.

Common Queries

What is the typical processing time for a USDA loan in Florence, SC?

Processing times vary, but generally range from 30 to 60 days, depending on the lender and the complexity of the application.

Are there any pre-payment penalties for USDA loans?

No, USDA loans typically do not have pre-payment penalties.

Can I use a USDA loan to purchase a multi-family home in Florence, SC?

Yes, USDA loans can be used for multi-family homes, provided they meet specific eligibility criteria regarding occupancy and property location.

What is the role of an appraisal in the USDA loan process?

An appraisal determines the market value of the property, ensuring it’s sufficient collateral for the loan. A USDA-approved appraiser must conduct the appraisal.