USDA Loan Map New Jersey unlocks access to rural development loans in the Garden State. This guide navigates the intricacies of USDA loan eligibility, from understanding income limitations and property location requirements to mastering the USDA loan map itself. We’ll delve into the application process, explore various property types and loan amounts, and connect you with crucial resources and support services. Understanding the map’s visual representation is key to identifying suitable properties, and we’ll provide clear examples to illustrate the process. Let’s explore how you can utilize this valuable tool to find your dream home.

This comprehensive guide will equip you with the knowledge and resources to confidently navigate the USDA loan process in New Jersey. From deciphering the map’s visual cues to understanding eligibility criteria and assembling your application, we aim to make the process as straightforward as possible. We’ll compare USDA loans to conventional options, address common misconceptions, and provide contact information for key support services. By the end, you’ll be well-prepared to embark on your homeownership journey.

Understanding USDA Loan Eligibility in New Jersey

Securing a USDA loan in New Jersey can provide a pathway to homeownership for eligible individuals and families. Understanding the specific eligibility requirements is crucial for a successful application. This section details the income limitations, property location stipulations, verification process, and a comparison with conventional loans.

Income Limitations for USDA Loans in New Jersey

USDA loan income limits in New Jersey vary by county and household size. These limits are established annually by the USDA and are based on the median income for the area. Applicants must demonstrate that their household income does not exceed the established limit for their county and family size. Exceeding this limit will automatically disqualify an applicant. For example, a family of four in a high-cost county might have a significantly higher income limit than a single individual in a lower-cost area. It’s essential to check the USDA’s official website for the most up-to-date income limits specific to your county and family size before applying.

Property Location Requirements for USDA Loans in New Jersey

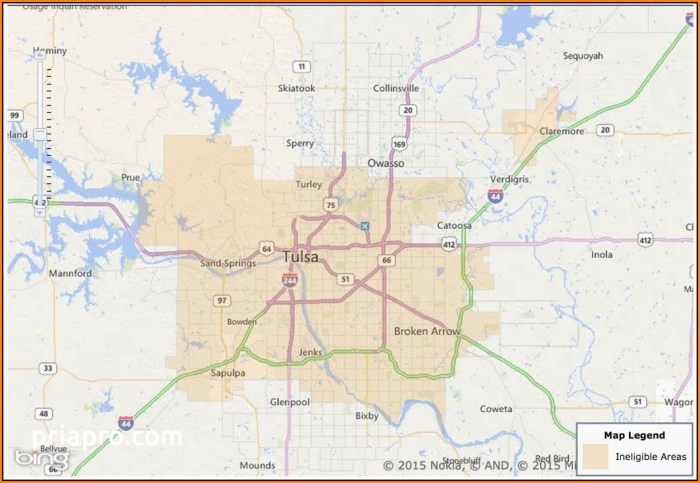

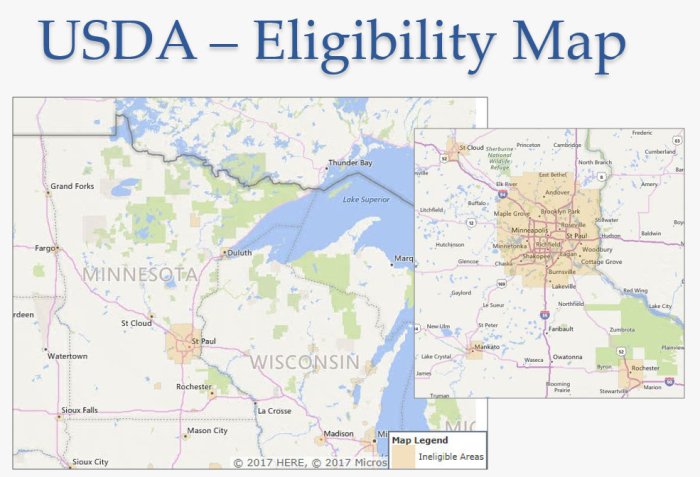

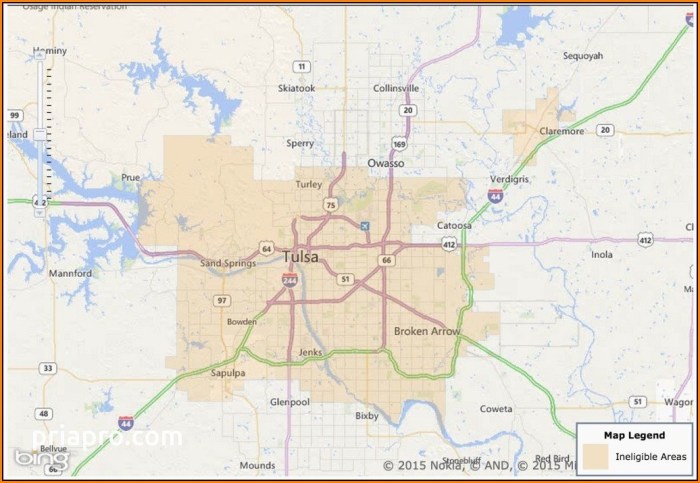

USDA loans are not available for properties located in all areas of New Jersey. The property must be located within a designated rural area, as defined by the USDA. These areas are typically outside of densely populated urban centers and suburbs. The USDA provides maps and tools to help determine if a specific property is eligible. Properties within incorporated towns or cities often do not qualify, even if they appear to be in a rural setting. Therefore, verifying the property’s location within an eligible USDA rural area is a critical step in the eligibility process.

Verifying Eligibility for a USDA Loan in New Jersey

The process of verifying eligibility begins with pre-qualification. This involves providing basic financial information, including income, credit score, and debt-to-income ratio, to a lender approved by the USDA. The lender will then use this information to assess your preliminary eligibility. Further verification will involve providing documentation such as pay stubs, tax returns, and bank statements to support your financial information. The lender will also verify the property’s location to ensure it is within a designated USDA eligible area. Finally, a complete credit report and appraisal will be necessary to finalize the eligibility determination. It’s crucial to work closely with a USDA-approved lender throughout this process.

Comparison of USDA Loan Requirements Versus Conventional Loans in New Jersey

USDA loans and conventional loans differ significantly in their requirements. USDA loans generally have lower credit score requirements and often allow for 100% financing, eliminating the need for a down payment. However, USDA loans usually involve annual mortgage insurance premiums. Conventional loans, on the other hand, typically require higher credit scores and a down payment, but may offer lower overall interest rates depending on market conditions and the borrower’s financial profile. Additionally, conventional loans often have stricter debt-to-income ratio requirements. The best option for a borrower depends on their individual financial circumstances and risk tolerance.

Navigating the USDA Loan Map for New Jersey: Usda Loan Map New Jersey

The USDA Rural Development website provides an interactive map tool to determine eligibility for USDA loans in New Jersey. Understanding how to use this map is crucial for prospective homebuyers seeking to utilize this valuable financing option. This section will guide you through the process of using the USDA loan map and interpreting its data, highlighting both its strengths and limitations.

Step-by-Step Guide to Using the USDA Loan Map

Using the USDA loan map involves a straightforward process. First, navigate to the USDA Rural Development website and locate their interactive map tool. Next, zoom in on the New Jersey area. The map will visually represent areas eligible for USDA loans. Eligible areas will typically be shaded or highlighted in a specific color. Clicking on a specific area often provides further details regarding eligibility criteria and program specifics for that location. Finally, examine the information presented to confirm eligibility. Remember that visual representation on the map is not always a definitive confirmation of eligibility; further verification through official channels is recommended.

New Jersey Counties and USDA Loan Availability

The availability of USDA loans varies across New Jersey counties. While some rural areas have widespread eligibility, others may have limited or no access to USDA financing. The following table provides a simplified representation. Note that this is a generalized overview and individual property eligibility must be verified separately.

| County | USDA Loan Availability | Notes | Example Area |

|---|---|---|---|

| Sussex | High | Significant portions of the county are eligible. | Rural towns near the Delaware Water Gap |

| Warren | Moderate | Eligibility varies; some areas are eligible, others are not. | Areas outside of Phillipsburg and Washington |

| Salem | Moderate | Similar to Warren County, eligibility is patchy. | Towns further from larger population centers |

| Bergen | Low | Limited areas may qualify, mostly in very rural sections. | Highly unlikely to find eligible areas. |

Interpreting USDA Loan Map Data, Usda loan map new jersey

The USDA loan map utilizes color-coding or other visual cues to indicate areas eligible for USDA loans. Green might indicate high eligibility, while yellow might suggest moderate eligibility, and grey might represent ineligible areas. However, it’s crucial to understand that this is a general representation. The map provides a preliminary assessment, but a formal application process is necessary to determine final eligibility. For example, a property might appear eligible on the map, but factors like property type or income limitations could ultimately disqualify the applicant.

Limitations and Potential Inaccuracies of USDA Loan Map Data

The USDA loan map is a helpful tool, but it’s not without limitations. The data might not be completely up-to-date, leading to potential inaccuracies. Additionally, the map’s visual representation can be somewhat simplistic, failing to account for nuanced eligibility criteria. For instance, a property located within a generally eligible area might still be ineligible due to factors not readily apparent on the map. Therefore, reliance solely on the map for determining eligibility is strongly discouraged. Always conduct thorough research and consult with a USDA loan specialist for accurate and up-to-date information.

Property Types and Loan Amounts in New Jersey

USDA loans in New Jersey offer financing options for a range of property types, with loan amounts varying based on factors like location, property value, and borrower income. Understanding these variables is crucial for prospective homebuyers. This section details eligible property types, typical loan amounts, potential closing costs, and interest rate variations across the state.

The USDA guarantees loans made by approved lenders, mitigating risk for the lender and allowing for more favorable terms for borrowers. Eligibility depends not only on the property itself but also on the borrower’s income and creditworthiness, and the location of the property within a designated rural area.

Eligible Property Types in New Jersey

USDA loans in New Jersey typically support the purchase of single-family homes, including those located in rural areas and smaller towns. While multi-family dwellings are sometimes eligible, the criteria are stricter, usually requiring the borrower to occupy one of the units. Existing homes, new constructions, and even some fixer-uppers can qualify, provided they meet the USDA’s property standards.

Loan Amounts in New Jersey

Loan amounts for USDA loans in New Jersey vary considerably depending on factors such as location and property value. There isn’t a fixed maximum loan amount, but it’s typically capped at a certain percentage of the property’s appraised value. Borrowers should consult with a lender to determine the maximum loan amount they qualify for in their specific area. For example, a property appraised at $300,000 might qualify for a USDA loan of up to $270,000 (90% of the appraised value), while a property valued at $200,000 might see a maximum loan of $180,000. The actual loan amount will also depend on the borrower’s debt-to-income ratio and credit score.

Closing Costs for USDA Loans in New Jersey

Closing costs for USDA loans in New Jersey are similar to those for other loan types, but the specific amounts can fluctuate based on various factors. These costs can include appraisal fees (typically ranging from $300 to $500), lender fees (varying depending on the lender), title insurance, recording fees, and other administrative costs. A reasonable estimate for closing costs might range from 2% to 5% of the loan amount. For a $200,000 loan, this could mean closing costs between $4,000 and $10,000. It’s vital for borrowers to receive a detailed Loan Estimate from their lender to understand the precise costs involved.

Interest Rate Variations Across New Jersey

Interest rates for USDA loans are not fixed across New Jersey; they fluctuate based on prevailing market conditions and the borrower’s credit profile. Generally, borrowers with higher credit scores tend to secure lower interest rates. While precise figures are not consistently available for specific New Jersey regions, comparing rates from multiple lenders is essential to obtain the most competitive offer. For example, a borrower in a rural area of South Jersey might find slightly higher rates than a borrower in a more populated area of North Jersey, but this difference can be minimal depending on the lender and prevailing market conditions. It is strongly recommended to obtain multiple quotes from lenders to compare interest rates.

The USDA Loan Application Process in New Jersey

Securing a USDA loan in New Jersey involves a multi-step process requiring meticulous attention to detail and thorough documentation. Understanding the requirements and timeline is crucial for a smooth application and approval. This section Artikels the necessary steps, documentation, and potential appeals process.

Required Documentation for a USDA Loan Application in New Jersey

The USDA requires extensive documentation to verify applicant eligibility and the property’s suitability. Failure to provide complete and accurate documentation will delay the process significantly. Missing documents are a common reason for application delays.

- Proof of Income: This typically includes W-2s, tax returns (for the past two years), pay stubs, and bank statements demonstrating consistent income sufficient to meet the loan’s monthly payments.

- Credit Report: A thorough credit report is essential to assess creditworthiness. Applicants should review their reports for accuracy before submission.

- Proof of Identity: Valid government-issued identification, such as a driver’s license or passport, is required.

- Property Appraisal: An independent appraisal is needed to determine the property’s fair market value and ensure it meets USDA guidelines. The appraisal will detail the property’s condition and features.

- Asset Documentation: Proof of assets, including bank accounts, investment accounts, and retirement funds, demonstrates financial stability and ability to manage the loan.

- Debt-to-Income Ratio Calculation: Applicants need to provide documentation to calculate their debt-to-income ratio, showing their ability to manage monthly payments.

Steps Involved in Submitting a Complete USDA Loan Application in New Jersey

The application process is sequential and requires careful adherence to each step. Each step is critical, and omissions can cause significant delays.

- Pre-qualification: This initial step involves assessing eligibility based on income, credit score, and debt-to-income ratio. It helps determine loan amounts and potential terms.

- Property Search: Once pre-qualified, applicants can begin searching for suitable properties within USDA-eligible areas in New Jersey.

- Loan Application Submission: A complete application, including all required documentation, must be submitted to the lender.

- Underwriting Review: The lender reviews the application and supporting documents to verify information and assess risk. This is a thorough process.

- Appraisal and Inspection: An appraisal is conducted to determine the property’s value, and an inspection may be required to assess its condition.

- Loan Closing: Once approved, the loan is finalized, and the borrower receives the funds to purchase the property.

USDA Loan Application Processing Timeline in New Jersey

The processing time for a USDA loan varies, influenced by several factors, including the completeness of the application, the complexity of the property, and the lender’s workload. While a timeframe cannot be guaranteed, applicants should anticipate a processing time ranging from several weeks to several months.

Processing times can vary considerably. While some applications may be processed within 30-60 days, others may take significantly longer.

Appealing a Denied USDA Loan Application in New Jersey

If a USDA loan application is denied, the applicant has the right to appeal the decision. The appeal process requires careful documentation of the reasons for the denial and the evidence supporting the appeal. The applicant should review the denial letter carefully, identify the specific reasons for denial, and address those issues in their appeal. This may involve providing additional documentation or addressing concerns raised by the underwriter.

Resources and Support for USDA Loans in New Jersey

Securing a USDA loan in New Jersey requires navigating various resources and support systems. Understanding where to find reliable lenders, relevant government agencies, and first-time homebuyer assistance is crucial for a successful application process. This section details key resources to help you through each step.

Reputable USDA Loan Lenders in New Jersey

Finding a lender experienced with USDA loans is essential. Many mortgage lenders operate throughout New Jersey, but not all are equally knowledgeable about the specifics of USDA financing. Choosing a lender with a proven track record in USDA loans can significantly streamline the process and increase your chances of approval. It’s recommended to compare rates and services from several lenders before making a decision.

Contact Information for USDA Offices and Support Services in New Jersey

Direct contact with USDA offices can provide valuable assistance throughout the loan process. While specific contact details may change, the USDA Rural Development website is the primary resource for locating the appropriate regional office and support staff in New Jersey. This website typically provides phone numbers, email addresses, and physical addresses for relevant personnel. Additionally, searching for “USDA Rural Development New Jersey” online will yield further contact information.

Resources for First-Time Homebuyers Seeking USDA Loans in New Jersey

New Jersey offers various resources specifically designed to assist first-time homebuyers navigating the USDA loan process. These resources often include workshops, seminars, and one-on-one counseling sessions that provide guidance on credit repair, budgeting, and the overall home-buying process. Many non-profit organizations and government agencies in New Jersey offer such services, and contacting your local housing authority or a community development corporation is a good starting point. The New Jersey Housing and Mortgage Finance Agency (NJHMFA) website is also a valuable resource for first-time homebuyers.

Common Misconceptions Surrounding USDA Loans in New Jersey

Several misconceptions surround USDA loans, potentially deterring eligible borrowers. Clarifying these misunderstandings is vital for prospective homebuyers.

- Misconception: USDA loans are only for rural areas. Reality: While USDA loans prioritize rural and suburban areas, many eligible properties exist in less densely populated parts of New Jersey.

- Misconception: You need to be a farmer to qualify. Reality: USDA loans are available to a wide range of individuals, not just farmers. The primary requirement is that the property is located in an eligible rural area.

- Misconception: USDA loans require a large down payment. Reality: USDA loans often require zero down payment, although closing costs still apply.

- Misconception: The application process is excessively complex. Reality: While the process involves several steps, using a knowledgeable lender can significantly simplify it.

- Misconception: Credit score requirements are extremely stringent. Reality: While a good credit score is helpful, USDA loan requirements are often more lenient than conventional loans.

Visual Representation of USDA Loan Availability

The USDA Rural Development website provides an interactive map displaying areas eligible for USDA loans in New Jersey. This visual tool is crucial for prospective borrowers, allowing them to quickly determine if their desired property location qualifies for the program. The map employs a clear and intuitive design to convey complex eligibility information effectively.

The map uses color-coding to delineate eligible and ineligible areas. Eligible areas are typically highlighted with a distinct color, such as green or blue, while ineligible areas remain uncolored or are shaded in a different color, like gray or beige. This immediate visual distinction allows users to easily identify potential property locations. The intensity of the color might also indicate variations in eligibility criteria, such as loan limits or property type restrictions. For example, a darker shade of green might represent areas with higher loan limits. The map’s legend clearly explains the meaning of each color and shading.

Map Elements and Eligibility Criteria

Different visual elements on the map directly correspond to specific USDA loan eligibility criteria. The primary element is the color-coding already mentioned, representing the basic eligibility status. However, the map might also incorporate other visual cues. For instance, icons or symbols overlaid on the map could indicate specific property types eligible within a given area. A house icon might signify eligibility for single-family homes, while a barn icon might denote eligibility for rural properties with agricultural potential. Additionally, the map might use pop-up windows or tooltips that appear when hovering over a specific location. These interactive features provide more detailed information about loan limits, eligible property types, and other relevant criteria for that particular area.

Information Provided for Eligible Areas

When a user clicks on or hovers over an eligible area, the map provides detailed information relevant to USDA loan eligibility within that specific region. This information typically includes: the maximum loan amount available in that area, the types of properties eligible for financing (e.g., single-family homes, multi-family dwellings, farms), and any special considerations or limitations that apply. For example, an area might have a higher loan limit for single-family homes but a lower limit for multi-family dwellings. The information provided ensures users have a complete understanding of the USDA loan program’s parameters before proceeding with a property search.

Interpreting Map Data: A Hypothetical Scenario

Imagine a family searching for a single-family home in rural New Jersey using the USDA loan map. They are pre-approved for a loan up to $300,000. Using the map, they first identify areas shaded in green, indicating USDA loan eligibility. They then hover their cursor over a specific green area and see a pop-up window displaying the following information: “Maximum Loan Amount: $350,000; Eligible Property Types: Single-family homes, eligible for the Section 502 Guaranteed Loan Program.” Since their pre-approved loan amount falls below the maximum loan amount shown on the map for this area and the property type matches their needs, they conclude that properties within this green-shaded area are suitable for them to explore further. They would then begin searching for homes within that area, confident that their loan application would likely be considered under the USDA program. If they explored another area shaded a lighter green and saw a maximum loan amount of $250,000, they might eliminate that area from their search since it would restrict their home-buying options.

Last Point

Securing a USDA loan in New Jersey requires careful planning and a thorough understanding of the eligibility criteria and application process. This guide has provided a roadmap to navigate the complexities of the USDA loan map and related requirements. Remember to leverage the provided resources, carefully review your eligibility, and seek assistance from reputable lenders to increase your chances of success. With diligent preparation and a clear understanding of the process, achieving your homeownership dreams through a USDA loan is within reach.

FAQ Guide

What is the maximum loan amount for a USDA loan in New Jersey?

The maximum loan amount varies depending on the county and property type. Consult the USDA loan map and speak with a lender for specific details.

Can I use a USDA loan to buy a multi-family property in New Jersey?

Yes, under certain circumstances. Eligibility depends on factors like property location and intended occupancy.

What credit score is typically required for a USDA loan?

While there’s no strict minimum, a higher credit score significantly improves your chances of approval. Aim for a score above 620.

How long does the USDA loan application process take in New Jersey?

Processing times vary, but expect the process to take several weeks or even months.