USDA Loans Rochester NY: Securing your dream home in the vibrant city of Rochester might seem daunting, but with the right knowledge and guidance, the process can be surprisingly straightforward. Understanding USDA loans, their eligibility requirements, and the local real estate market is key to navigating this exciting journey. This comprehensive guide breaks down everything you need to know about accessing USDA loan programs in Rochester, NY, empowering you to make informed decisions every step of the way.

From identifying reputable lenders and understanding the application process to navigating the nuances of the Rochester housing market and budgeting for associated costs, we aim to equip you with the tools you need for a successful home-buying experience. We’ll explore the various loan types, interest rates, and potential challenges, providing clear, concise information to help you confidently pursue your homeownership goals in Rochester.

Understanding USDA Loans in Rochester, NY

USDA loans offer a pathway to homeownership for eligible individuals and families in rural areas, including parts of Rochester, NY. These government-backed loans are designed to make homebuying more accessible by offering lower down payments and potentially more favorable interest rates than conventional mortgages. Understanding the specifics of USDA loans in Rochester is crucial for prospective homebuyers to determine if this financing option is right for them.

USDA Loan Definition

USDA loans are mortgages insured or guaranteed by the United States Department of Agriculture (USDA). They are specifically designed to assist low-to-moderate-income homebuyers in purchasing homes in eligible rural areas. This program aims to strengthen rural communities by supporting homeownership and economic development.

Eligibility Requirements for USDA Loans in Rochester, NY

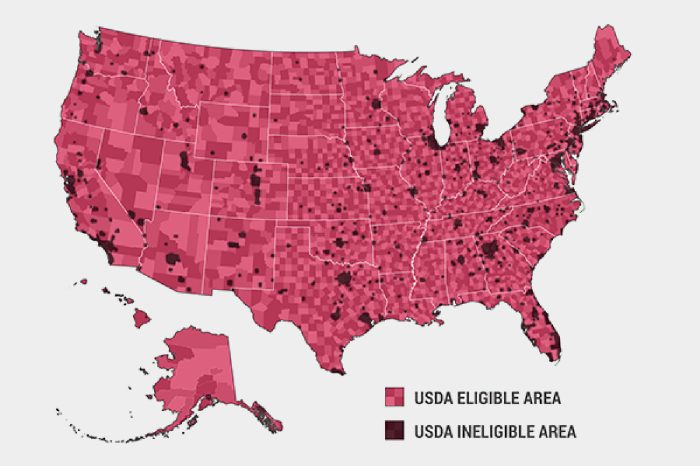

Eligibility for a USDA loan in Rochester, NY, hinges on several factors. First, the property must be located within a designated USDA-eligible rural area. The USDA maintains a map of eligible areas, which should be consulted to verify property location. Secondly, the borrower’s income must fall below the USDA’s income limits for the area. These limits vary based on household size and are adjusted periodically. Finally, the borrower must meet standard credit and debt-to-income ratio requirements. A strong credit history and manageable debt are essential for loan approval. Specific credit score requirements vary depending on the lender.

Types of USDA Loans

There are two main types of USDA loans: USDA-guaranteed loans and USDA direct loans. USDA-guaranteed loans are the most common. In this scenario, a private lender provides the loan, and the USDA guarantees a portion of the loan, reducing the lender’s risk. USDA direct loans, less frequently available, are loans made directly by the USDA to the borrower. The eligibility criteria and terms may differ slightly between these two types.

Interest Rates and Loan Terms for USDA Loans in Rochester, NY

Interest rates for USDA loans are generally competitive with conventional mortgages, often reflecting prevailing market rates. However, it is important to note that rates can fluctuate. The actual interest rate offered will depend on factors such as the borrower’s credit score, the loan amount, and the prevailing market conditions. Loan terms typically range from 15 to 30 years, allowing borrowers to choose a repayment schedule that suits their budget. It is crucial to shop around and compare rates from multiple lenders to secure the best possible terms. It’s recommended to consult with a mortgage professional for the most up-to-date interest rate information specific to Rochester, NY.

Finding USDA Loan Lenders in Rochester, NY

Securing a USDA loan in Rochester, NY, requires identifying a reputable lender experienced in handling these specific government-backed mortgages. Several lenders operate in the area, each offering varying services and levels of expertise. Choosing the right lender can significantly impact your loan application process and overall experience.

Reputable USDA Loan Lenders in Rochester, NY

Finding the right lender is crucial for a smooth USDA loan process. The following table lists some lenders that operate in or near Rochester, NY, and are known to work with USDA loans. Note that lender availability and specialization can change, so it’s always recommended to verify directly with the lender before proceeding. This information is for general guidance only and does not constitute an endorsement.

| Lender Name | Contact Information | Website | Specializations |

|---|---|---|---|

| [Lender Name 1 – Replace with Actual Lender Name] | [Phone Number], [Email Address], [Address] | [Website Address] | [e.g., First-time homebuyers, rural properties] |

| [Lender Name 2 – Replace with Actual Lender Name] | [Phone Number], [Email Address], [Address] | [Website Address] | [e.g., Refinancing, Construction loans] |

| [Lender Name 3 – Replace with Actual Lender Name] | [Phone Number], [Email Address], [Address] | [Website Address] | [e.g., Low-income borrowers, multi-family properties] |

Comparison of Lender Services

Let’s compare three hypothetical lenders (replace with actual lenders from your research): Lender A, Lender B, and Lender C. Lender A might specialize in first-time homebuyers and offer extensive educational resources, while Lender B may focus on refinancing and offer competitive interest rates. Lender C could prioritize customer service and provide personalized assistance throughout the entire loan process. Each lender’s strengths and weaknesses will vary depending on individual needs and preferences. For example, Lender A’s focus on first-time homebuyers might be advantageous for a new homebuyer, but Lender B’s competitive rates might be more attractive to someone refinancing. Thorough research is crucial to identify the best fit.

Advantages and Disadvantages of Using a Particular Lender

Choosing a lender involves weighing potential advantages and disadvantages. For instance, a large national lender might offer a streamlined online application process (advantage), but lack the personalized service of a smaller, local lender (disadvantage). Conversely, a local lender may provide more personalized attention (advantage), but potentially have less flexible loan options (disadvantage). The optimal choice depends on individual circumstances and priorities. Consider factors such as fees, interest rates, customer service responsiveness, and the lender’s experience with USDA loans.

USDA Loan Pre-qualification Process

The pre-qualification process for a USDA loan generally involves providing the lender with basic financial information, including income, debts, and credit history. This allows the lender to assess your eligibility for a USDA loan before you begin the full application process. The lender will review your credit score, debt-to-income ratio, and employment history to determine your borrowing capacity. A pre-qualification is not a guarantee of loan approval, but it provides a clearer picture of your chances and helps you set realistic expectations. This step helps avoid wasting time on a full application if your financial profile doesn’t meet the USDA loan requirements.

The Rochester, NY Real Estate Market and USDA Loans

The Rochester, NY real estate market, like many others, experiences fluctuations. Understanding the current market conditions is crucial for prospective homebuyers considering a USDA loan, as these loans often target properties in rural or less densely populated areas. The eligibility criteria for USDA loans, focusing on location and property type, significantly impacts the available housing options within the Rochester area.

Current State of the Rochester Housing Market and USDA Loan Eligibility, Usda loans rochester ny

Rochester’s housing market displays a mix of characteristics. While some areas experience higher demand and prices, others offer more affordable options that often align with USDA loan eligibility criteria. Properties eligible for USDA loans in Rochester are typically found in suburban and rural areas surrounding the city, often featuring slightly older homes or those located in areas with a lower population density. These areas generally exhibit a slower pace of appreciation compared to the more central, high-demand neighborhoods. It’s important to consult up-to-date market data from reliable sources such as the Greater Rochester Association of REALTORS® to gain a comprehensive understanding of current trends and pricing in specific areas.

Hypothetical USDA Loan Scenario in Rochester, NY

Let’s consider a hypothetical scenario: A family is looking to purchase a three-bedroom, two-bathroom single-family home in a USDA-eligible area outside of Rochester city limits. They find a suitable property listed at $250,000. With a USDA loan, they may be able to secure financing with a 0% down payment, assuming they meet all eligibility requirements. Their estimated monthly principal and interest payment, factoring in a current interest rate of approximately 6%, could be around $1,500. This figure doesn’t include property taxes, homeowner’s insurance, or potential private mortgage insurance (PMI), which would increase the total monthly housing cost. The actual monthly payment will depend on the specific loan terms and individual circumstances.

Examples of Suitable Properties for USDA Loans in Rochester, NY

The following examples illustrate property types and price ranges that might qualify for a USDA loan in Rochester, NY. It’s crucial to remember that USDA eligibility is determined by location and property type, not solely by price. A property appraisal is always required to confirm eligibility.

These examples are illustrative and should not be considered a definitive representation of the current market. Actual prices and availability will vary.

- Single-Family Homes: Many single-family homes in the suburbs surrounding Rochester, in towns like Greece, Gates, or Spencerport, often fall within the price range of $200,000 to $300,000 and are frequently eligible for USDA loans. These homes typically offer ample living space and yards, making them appealing to families.

- Townhouses: Townhouses in certain developments outside the city center may also qualify. Price ranges for eligible townhouses can vary, but they might be found in the $180,000 to $250,000 range. These properties provide a balance between affordability and convenience, often with access to shared amenities.

The Application Process for USDA Loans in Rochester, NY: Usda Loans Rochester Ny

Securing a USDA loan in Rochester, NY, involves a multi-step process requiring careful preparation and attention to detail. Understanding the requirements and potential challenges beforehand can significantly increase your chances of a successful application. This section Artikels the steps involved, necessary documentation, potential hurdles, and a step-by-step guide to navigate the application.

Necessary Documentation for a USDA Loan Application

Gathering the correct documentation is crucial for a smooth and efficient application process. Incomplete or inaccurate documentation can lead to delays or rejection. Lenders typically require a comprehensive package demonstrating your financial stability and eligibility for the program. Missing even a single document can significantly delay the process.

- Proof of Income: This usually includes W-2s, pay stubs, tax returns (for self-employed individuals), and bank statements showing consistent income.

- Credit Report: A detailed credit report from a major credit bureau is essential to assess your creditworthiness. A higher credit score generally improves your chances of approval.

- Proof of Assets: Documentation demonstrating your liquid assets, such as savings and checking account statements, investment accounts, and retirement accounts, is necessary.

- Property Information: Information about the property you intend to purchase, including the address, appraisal, and any relevant property surveys.

- Personal Identification: Valid government-issued photo identification, such as a driver’s license or passport.

- Debt Information: Documentation outlining all your existing debts, including loans, credit cards, and other financial obligations.

Potential Challenges During the USDA Loan Application Process

While the USDA loan program aims to make homeownership accessible, applicants may encounter several challenges. Proactive preparation and communication with your lender can help mitigate these potential obstacles.

- Credit Score Requirements: Meeting the minimum credit score requirements is a significant hurdle for some applicants. Improving your credit score before applying can significantly increase your chances of approval.

- Income Limitations: USDA loans have income limits based on household size and location. Applicants exceeding these limits may not qualify.

- Property Eligibility: The property you intend to purchase must meet USDA eligibility criteria, including location within a designated rural area. This may require careful property selection.

- Appraisal Process: The appraisal process can sometimes be lengthy and may reveal issues impacting the loan approval. Addressing any appraisal concerns promptly is crucial.

- Documentation Delays: Gathering and submitting all necessary documentation can be time-consuming. Organizing your documents in advance can streamline the process.

Step-by-Step Guide to Completing the USDA Loan Application

The application process involves several sequential steps. Following these steps methodically can help ensure a smooth and efficient application.

- Pre-qualification: Contact a USDA-approved lender to pre-qualify for a loan. This involves providing basic financial information to determine your eligibility.

- Property Search: Begin searching for a suitable property within a designated USDA eligible area. Work with a real estate agent familiar with USDA loans.

- Loan Application Submission: Complete and submit the formal loan application along with all required documentation to your chosen lender.

- Credit and Background Checks: The lender will conduct a thorough credit and background check to verify your financial information.

- Property Appraisal: An independent appraiser will assess the property’s value to ensure it meets the loan requirements.

- Underwriting Review: The lender will review your application and supporting documentation to determine loan approval.

- Closing: Upon approval, you will proceed with the closing process, signing all necessary documents and finalizing the purchase of your property.

Additional Considerations for USDA Loans in Rochester, NY

Securing a USDA loan in Rochester, NY, involves more than just the interest rate and principal amount. Understanding the ancillary costs and potential support programs is crucial for a realistic budget and a smooth closing process. This section details important factors beyond the loan’s core components.

Property Taxes and Insurance Costs Impact on Monthly Payments

Property taxes and homeowner’s insurance are significant components of your total monthly mortgage payment. In Rochester, NY, property taxes vary depending on the assessed value of your home and the local tax rate. Homeowner’s insurance premiums are influenced by factors like the property’s location, age, and coverage level. These costs, added to your principal and interest payments, create your total monthly housing expense. For example, a home valued at $250,000 might incur annual property taxes of $5,000 and annual insurance premiums of $1,500, resulting in approximately $500 and $125 added to the monthly mortgage payment, respectively. It’s essential to obtain accurate estimates for these costs from local assessors and insurance providers before finalizing your loan application.

Closing Costs Associated with USDA Loans in Rochester, NY

Closing costs represent upfront expenses associated with finalizing your loan. These fees can vary but typically include appraisal fees, lender fees, title insurance, recording fees, and potentially other charges specific to the lender or the property. While USDA loans don’t typically have upfront mortgage insurance premiums, other closing costs can still add up to a significant sum, often 2-5% of the loan amount. For a $200,000 loan, this could mean closing costs ranging from $4,000 to $10,000. It’s vital to obtain a detailed Loan Estimate from your lender well in advance of closing to understand all anticipated costs.

Government Programs and Initiatives Supplementing USDA Loans

Several government programs and initiatives may complement USDA loans, potentially reducing costs or providing additional support. For instance, some state or local programs offer down payment assistance or closing cost assistance to eligible homebuyers. Additionally, energy efficiency programs might provide rebates or incentives for upgrading a home’s energy performance, lowering utility bills over time. It’s advisable to research and explore these possibilities through your local government agencies and housing authorities to determine your eligibility and potential benefits.

Visual Representation of Total Loan Costs

Imagine a pie chart illustrating the distribution of total loan costs. The largest slice would represent the principal and interest payments, forming the bulk of your monthly mortgage. A smaller slice would depict property taxes, followed by another for homeowner’s insurance. A final, relatively small slice would represent closing costs. The exact proportions of each slice would vary based on the specific loan terms, property location, and insurance rates. This visual representation helps emphasize that the monthly mortgage payment encompasses more than just the principal and interest. The overall size of the pie would reflect the total monthly housing cost.

Conclusion

Purchasing a home in Rochester, NY, using a USDA loan can be a rewarding experience. By understanding the eligibility criteria, exploring available lenders, and meticulously navigating the application process, you can successfully secure financing and achieve your homeownership dreams. Remember to carefully consider all associated costs, including taxes, insurance, and closing fees, and don’t hesitate to seek professional advice when needed. With diligent preparation and the right resources, owning a home in Rochester through a USDA loan is well within reach.

FAQ Section

What credit score is generally required for a USDA loan in Rochester, NY?

While specific requirements can vary by lender, a credit score of at least 640 is often preferred for USDA loans. However, some lenders may consider applicants with slightly lower scores.

Are there income limits for USDA loans in Rochester, NY?

Yes, USDA loans have income limits based on household size and the area’s median income. These limits ensure the program benefits those who need it most. You can find the specific income limits for Rochester, NY on the USDA Rural Development website.

What are the typical closing costs associated with a USDA loan?

Closing costs vary depending on the loan amount and lender, but generally range from 2% to 5% of the loan amount. These costs can include appraisal fees, title insurance, and other administrative charges.

Can I use a USDA loan to buy a multi-family home in Rochester, NY?

Yes, USDA loans can be used to purchase multi-family homes, provided they meet the program’s eligibility requirements, including location and intended use.