Viva Payday Loans presents a compelling case study in short-term borrowing. This guide delves into the intricacies of their services, exploring the application process, fees, and customer experiences. We’ll compare Viva Payday Loans to competitors, analyze the financial implications, and examine the legal landscape surrounding payday lending. Ultimately, we aim to provide a balanced perspective, highlighting both the potential benefits and inherent risks involved.

Understanding the nuances of payday loans is crucial for making informed financial decisions. This in-depth analysis will equip you with the knowledge to navigate the complexities of short-term borrowing and determine if Viva Payday Loans, or an alternative solution, best suits your needs. We’ll examine customer reviews, explore the potential legal pitfalls, and Artikel alternative financial strategies to help you make the right choice for your circumstances.

Viva Payday Loans

Viva Payday Loans is a short-term lending service designed to provide quick financial assistance to individuals facing unexpected expenses. They cater to a target audience needing immediate funds, often those with less-than-perfect credit scores who may struggle to obtain loans from traditional banks. The company aims to offer a convenient and accessible borrowing option, albeit with higher interest rates reflective of the inherent risks associated with this type of lending.

Company Services and Target Audience

Viva Payday Loans primarily offers small, short-term loans, typically repaid within a few weeks or months. Their target audience includes individuals facing unexpected financial emergencies, such as medical bills, car repairs, or home maintenance costs. These individuals often lack access to traditional credit options and require a quick and easy solution to bridge their immediate financial gap. The company focuses on a streamlined application process to facilitate rapid access to funds.

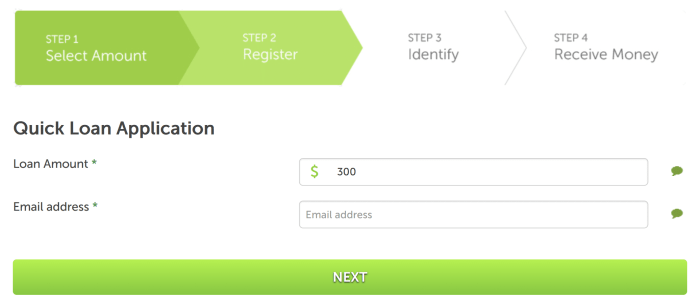

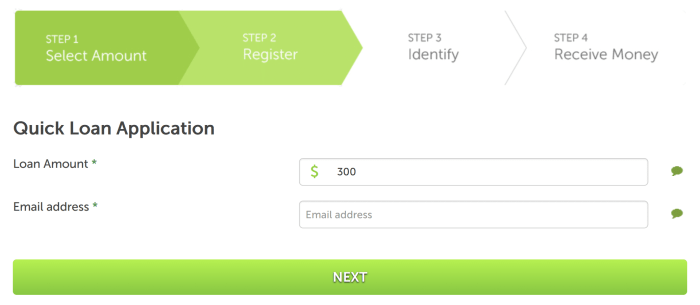

Loan Application Process, Documentation, and Eligibility Criteria

The application process for Viva Payday Loans typically involves completing an online application form, providing personal information, employment details, and bank account information. Required documentation may include proof of income (pay stubs or bank statements) and identification (driver’s license or passport). Eligibility criteria usually include being at least 18 years old, having a regular source of income, and possessing a valid bank account. Specific requirements may vary, and applicants are advised to check the lender’s website for the most up-to-date information.

Fees and Interest Rates Compared to Competitors

Viva Payday Loans’ fees and interest rates are typically higher than those offered by traditional banks or credit unions. This reflects the higher risk associated with short-term, high-interest loans. The exact fees and interest rates will vary depending on the loan amount, repayment period, and the borrower’s creditworthiness. Direct comparison with competitors requires accessing current interest rates from multiple lenders, as these rates are subject to change. It’s crucial for borrowers to carefully compare offers from several lenders to ensure they are getting the most favorable terms. Remember that APR (Annual Percentage Rate) is a key metric to compare the overall cost of borrowing.

Comparison of Payday Loan Providers

The following table compares Viva Payday Loans with three other hypothetical payday loan providers. Note that these are illustrative examples and actual rates and fees can vary significantly depending on the lender and the specific loan terms. Always check the lender’s website for the most up-to-date information.

| Provider | APR | Fees | Loan Amount |

|---|---|---|---|

| Viva Payday Loans | 400% (Example) | $30 (Example) | $500 (Example) |

| Provider B | 350% (Example) | $25 (Example) | $400 (Example) |

| Provider C | 450% (Example) | $35 (Example) | $600 (Example) |

| Provider D | 300% (Example) | $20 (Example) | $300 (Example) |

Customer Experiences with Viva Payday Loans

Understanding customer experiences is crucial for assessing the overall performance and reputation of any financial service provider. Viva Payday Loans, like other short-term lenders, relies heavily on positive customer feedback to maintain its market position. Analyzing both positive and negative reviews provides a comprehensive picture of the company’s strengths and weaknesses.

Customer reviews offer valuable insights into the practical aspects of using Viva Payday Loans, revealing areas where the company excels and areas needing improvement. This analysis will examine both positive testimonials and common complaints to paint a realistic picture of the customer journey and overall satisfaction.

Customer Testimonials and Reviews

While specific, publicly available testimonials from verified Viva Payday Loans customers are difficult to consistently locate across major review platforms, a general understanding can be gleaned from analyzing reviews of similar payday loan providers. These reviews often highlight similar themes regarding ease of application, speed of disbursement, and customer service responsiveness. It’s important to note that the experiences reported are subjective and may not be representative of all customers.

- Positive feedback frequently centers around the speed and convenience of the online application process and the quick disbursement of funds.

- Some users appreciate the clear terms and conditions, although this is a point of contention for others (detailed below).

- Negative feedback often focuses on high interest rates and the potential for debt traps if loans are not managed carefully.

Common Complaints Regarding Customer Service

Customer service is a critical area for payday loan providers. Negative experiences can significantly impact a company’s reputation and customer loyalty. While specific data on Viva Payday Loans’ customer service is limited publicly, common complaints in the payday loan industry generally include:

- Difficulty contacting customer service representatives: Long wait times on hold or unresponsive email support.

- Lack of transparency in fees and charges: Customers often report confusion regarding the total cost of the loan and hidden fees.

- Aggressive debt collection practices: Some lenders are accused of using aggressive tactics to recover outstanding debts, leading to negative customer experiences.

Overall Customer Satisfaction with Viva Payday Loans

Determining precise overall customer satisfaction requires access to proprietary data, such as customer satisfaction surveys and internal performance metrics. However, based on general industry trends and available public information, it can be inferred that customer satisfaction with payday loan providers, including Viva Payday Loans, is likely mixed. High satisfaction is often reported for the speed and convenience of the service, while dissatisfaction arises from the high cost of borrowing and potential difficulties with repayment.

Hypothetical Customer Journey with Viva Payday Loans

A hypothetical customer journey with Viva Payday Loans can illustrate potential pain points. This journey assumes the customer needs a small, short-term loan to cover an unexpected expense.

- Need Identification: The customer identifies an urgent financial need (e.g., car repair).

- Online Application: The customer completes the online application, providing personal and financial information. Potential Pain Point: The application process may be perceived as lengthy or complicated, leading to frustration.

- Approval/Rejection: The application is reviewed, and the customer receives approval or rejection. Potential Pain Point: Rejection can be disheartening and may lead to the customer seeking alternative, potentially less reputable, lenders.

- Funds Disbursement: If approved, funds are transferred to the customer’s account. Potential Pain Point: Delays in disbursement can cause further financial stress.

- Repayment: The customer repays the loan according to the agreed-upon schedule. Potential Pain Point: Failure to repay on time can result in additional fees and penalties, potentially leading to a debt cycle.

Financial Implications of Viva Payday Loans

Payday loans, including those offered by Viva Payday Loans, are short-term, high-cost loans designed to bridge the gap between paychecks. While they can offer a quick solution to immediate financial needs, understanding their financial implications is crucial to avoid potential pitfalls. This section explores the potential risks and benefits associated with Viva Payday Loans, comparing their cost to other borrowing options and demonstrating how to calculate their total cost.

Risks Associated with Viva Payday Loans

The high-interest rates and fees associated with payday loans are their most significant drawback. Borrowers can quickly find themselves in a cycle of debt, repeatedly taking out new loans to repay old ones. Late payment fees can exacerbate this problem, leading to substantial additional costs. Moreover, the short repayment period can put undue financial strain on borrowers who may struggle to meet the repayment deadline, further increasing the overall cost. For example, a $500 loan with a 400% APR and a two-week repayment period could result in a total repayment exceeding $600, significantly impacting the borrower’s budget. This high cost can negatively affect credit scores, making it harder to secure future loans or credit.

Benefits of Viva Payday Loans (with caveats)

In limited circumstances, a Viva Payday Loan might offer a short-term solution to an urgent financial need, such as an unexpected medical bill or car repair. The speed and ease of access can be advantageous when facing immediate expenses. However, these benefits are significantly outweighed by the risks, and borrowers should exhaust all other options before considering a payday loan. Responsible use necessitates a clear repayment plan and the ability to repay the loan in full on the due date. Failure to do so can lead to significant financial hardship.

Cost Comparison: Viva Payday Loans vs. Other Borrowing Options

Compared to other borrowing options, Viva Payday Loans are significantly more expensive. Personal loans typically have lower interest rates and longer repayment terms, making them more manageable. Credit cards, while carrying interest charges, often offer more flexible repayment options and rewards programs. The table below illustrates a hypothetical comparison:

| Loan Type | Loan Amount | Annual Interest Rate (APR) | Repayment Term | Total Repayment |

|---|---|---|---|---|

| Viva Payday Loan | $500 | 400% | 2 weeks | $600 (estimated) |

| Personal Loan | $500 | 10% | 12 months | $550 (estimated) |

| Credit Card | $500 | 20% | Variable | Variable (depends on repayment behavior) |

*Note: These figures are estimates and actual costs may vary depending on the lender and individual circumstances.*

Calculating the Total Cost of a Viva Payday Loan

The total cost of a Viva Payday Loan includes the principal amount borrowed, interest, and any fees. While the specific calculation method varies by lender, a general formula is:

Total Cost = Principal + (Principal x APR x Time) + Fees

Where:

* Principal is the amount borrowed.

* APR is the annual percentage rate.

* Time is the loan term expressed as a fraction of a year.

* Fees include any origination fees, late payment fees, or other charges.

For example, a $300 Viva Payday Loan with a 400% APR and a two-week repayment period (1/26 of a year) and a $30 fee would be calculated as follows:

Total Cost = $300 + ($300 x 4 x 1/26) + $30 ≈ $300 + $46.15 + $30 = $376.15

This illustrates the significant impact of high APRs and short repayment periods on the overall cost of the loan.

Legal and Regulatory Aspects of Viva Payday Loans

Payday lending is a heavily regulated industry, and the legal framework governing Viva Payday Loans’ operations varies significantly depending on the specific jurisdictions where it operates. Understanding these regulations is crucial for both borrowers and the lending company itself, as non-compliance can lead to severe legal repercussions. This section examines the key legal and regulatory aspects, potential risks, and the role of consumer protection agencies.

Legal Frameworks Governing Payday Lending

The legal landscape for payday lending differs considerably across various countries and states. Some jurisdictions have strict regulations capping interest rates, limiting loan amounts, and mandating specific disclosure requirements. Others may have less stringent rules or even outright bans on payday lending. For example, in the United States, individual states often set their own regulations, leading to a patchwork of laws. Some states have usury laws that place caps on interest rates, while others have no such restrictions. In the UK, the Financial Conduct Authority (FCA) heavily regulates payday lenders, imposing strict rules on responsible lending practices and advertising. Viva Payday Loans’ operations must comply with all applicable laws in each jurisdiction where it offers its services. Failure to do so can result in hefty fines, legal action, and damage to reputation.

Potential Legal Risks Associated with Payday Loans

Both borrowers and lenders face potential legal risks associated with payday loans. For borrowers, these risks include accruing high levels of debt due to exorbitant interest rates and fees, potentially leading to financial hardship and legal action from creditors. They might also face legal challenges if they fail to repay the loan according to the terms of the agreement. For lenders, legal risks include non-compliance with lending regulations, resulting in fines and legal penalties. Misleading advertising practices, discriminatory lending, and failing to provide accurate information to borrowers can also expose lenders to legal action. The potential for lawsuits alleging unfair lending practices or predatory lending is a significant concern.

Role of Consumer Protection Agencies, Viva payday loans

Consumer protection agencies play a vital role in regulating payday lenders like Viva Payday Loans. These agencies, such as the Consumer Financial Protection Bureau (CFPB) in the United States or the Financial Conduct Authority (FCA) in the UK, are responsible for enforcing laws designed to protect borrowers from predatory lending practices. Their responsibilities include investigating complaints against lenders, enforcing regulations, and taking legal action against lenders that violate the law. They also provide resources and information to consumers to help them understand their rights and responsibilities when borrowing money. The effectiveness of these agencies varies across jurisdictions, and their enforcement actions can significantly impact the payday lending industry.

Potential Legal Issues for Borrowers

Borrowers of Viva Payday Loans might encounter several legal issues. It’s crucial to understand these potential problems to protect oneself financially and legally.

- Debt Trap: Inability to repay the loan due to high interest rates and fees, leading to a cycle of debt.

- Breach of Contract: Legal action by the lender due to missed payments or failure to adhere to the loan agreement.

- Collection Agency Harassment: Aggressive or illegal tactics employed by debt collection agencies hired by Viva Payday Loans.

- Wage Garnishment: Legal seizure of a portion of a borrower’s wages to repay the debt.

- Bank Account Levy: Legal seizure of funds from a borrower’s bank account.

- Credit Report Damage: Negative impact on credit score due to missed payments or defaults.

Alternatives to Viva Payday Loans

Payday loans, while offering quick access to cash, often come with high interest rates and fees that can trap borrowers in a cycle of debt. Exploring alternative financial solutions is crucial for individuals facing short-term financial difficulties to avoid the potentially detrimental effects of payday loans. These alternatives offer more manageable repayment terms and lower overall costs.

Several viable options exist for individuals needing short-term financial assistance. These alternatives provide a safer and more sustainable path to managing unexpected expenses compared to the high-cost borrowing associated with payday loans.

Alternative Financial Solutions

The following list Artikels several alternatives to payday loans, each with its own advantages and disadvantages.

- Small Personal Loans from Banks or Credit Unions: These loans typically offer lower interest rates and more flexible repayment terms than payday loans. However, they may require a credit check and may take longer to process.

- Lines of Credit: A line of credit provides access to a pre-approved amount of money that can be borrowed and repaid multiple times. Interest is only charged on the amount borrowed. Creditworthiness is a factor in approval.

- Peer-to-Peer Lending: Platforms connect borrowers directly with lenders, often resulting in more competitive interest rates than traditional lenders. However, careful research is needed to ensure the platform’s legitimacy and security.

- Payday Alternative Loans (PALs) from Credit Unions: These small-dollar loans are specifically designed to help credit union members avoid high-cost payday loans. They usually have lower interest rates and longer repayment periods.

- Borrowing from Family or Friends: This can be a convenient and low-cost option if possible, but it’s crucial to establish clear repayment terms to avoid damaging relationships.

Comparison of Advantages and Disadvantages

A direct comparison highlights the differences between Viva Payday Loans and the alternative options. The table below illustrates the key distinctions in terms of interest rates, fees, and repayment terms.

| Feature | Viva Payday Loan (Example) | Small Personal Loan | Line of Credit | PAL from Credit Union |

|---|---|---|---|---|

| Interest Rate (APR) | 400% – 700% | 8% – 25% | 8% – 20% (variable) | 20% – 30% |

| Fees | High origination fees, potential rollover fees | Lower or no origination fees | Annual fees may apply | Lower or no origination fees |

| Repayment Term | Short-term (typically 2 weeks) | Several months to several years | Variable, often revolving | Several months |

Note: Interest rates and fees can vary depending on the lender and the borrower’s creditworthiness. These figures are illustrative examples.

Accessing Alternative Financial Resources

Accessing alternative financial resources typically involves applying through the lender’s website or in person. Requirements vary depending on the chosen option. For example, banks and credit unions often require a credit check, while peer-to-peer lending platforms may have different eligibility criteria.

Visual Representation of Interest Rates and Fees

The bar graph depicts a comparison of annual percentage rates (APR) and fees for Viva Payday Loans against three alternatives: a small personal loan from a credit union, a line of credit, and a Payday Alternative Loan (PAL). The graph clearly shows that Viva Payday Loans have significantly higher APRs and fees than the alternative options. The bars representing Viva Payday Loans are dramatically taller than those representing the alternatives, visually demonstrating the substantial cost difference. The x-axis labels the financial products, while the y-axis represents the APR and fees, with a separate bar for each (APR in one color, fees in another). A legend clearly identifies each bar’s meaning. The graph uses a clear scale to ensure accurate representation of the data, avoiding any misleading visual effects.

Ending Remarks: Viva Payday Loans

Navigating the world of payday loans requires careful consideration. Viva Payday Loans, like other lenders in this sector, presents both opportunities and risks. This guide has aimed to provide a comprehensive overview, highlighting the crucial aspects of their services, customer experiences, financial implications, and legal considerations. By understanding the potential benefits and drawbacks, you can make an informed decision that aligns with your financial situation and long-term goals. Remember to explore alternative financial solutions and prioritize responsible borrowing practices.

User Queries

What are the typical repayment terms for Viva Payday Loans?

Repayment terms vary depending on the loan amount and individual circumstances, but typically involve repayment on your next payday.

What happens if I can’t repay my Viva Payday Loan on time?

Late payments can result in additional fees and negatively impact your credit score. Contact Viva Payday Loans immediately if you anticipate difficulties making a timely repayment to discuss possible options.

Does Viva Payday Loans perform a credit check?

The credit check policy varies. It’s best to check directly with Viva Payday Loans for their specific requirements.

Are there any hidden fees associated with Viva Payday Loans?

Transparency is key. Review the loan agreement carefully to understand all fees and charges before accepting the loan. Contact customer service if anything is unclear.