Volunteer mortgage loan servicing online payment represents a crucial intersection of community support and technological advancement. This system allows volunteers to manage and process mortgage payments digitally, streamlining the process for both borrowers and the organizations assisting them. This exploration delves into the intricacies of establishing and maintaining a secure and user-friendly online payment system for volunteer-run mortgage servicing programs, addressing critical aspects like security, legal compliance, and user experience.

We’ll examine the various online payment platforms available, comparing their security features and ease of integration with existing volunteer management software. Furthermore, we’ll discuss the critical importance of data security, risk mitigation strategies, and compliance with relevant regulations to protect sensitive financial information. Finally, we’ll consider the user experience, focusing on creating a simple and accessible interface for both volunteers and borrowers, and the ethical considerations inherent in handling financial data within a volunteer context.

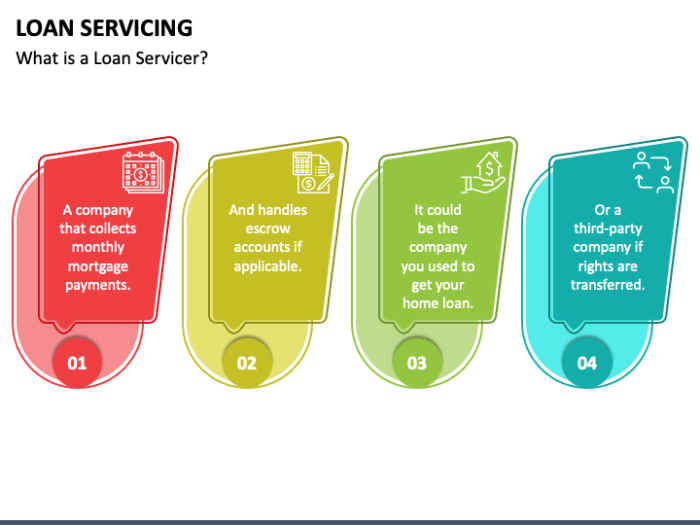

Understanding Volunteer Mortgage Loan Servicing

Volunteer mortgage loan servicing represents a unique approach to assisting homeowners facing financial hardship. It involves individuals donating their time and expertise to help borrowers navigate the complexities of their mortgages, often focusing on preventing foreclosure. This contrasts with traditional mortgage servicing, which is a for-profit industry. Understanding the nuances of this volunteer-based system is crucial for both potential volunteers and homeowners seeking assistance.

Volunteer Mortgage Loan Servicing Programs

Several types of volunteer programs contribute to mortgage loan servicing. Some organizations offer comprehensive assistance, guiding borrowers through the entire process from initial financial counseling to negotiating with lenders. Others might specialize in specific areas, such as loan modification applications or foreclosure prevention strategies. A significant portion of volunteer efforts also involve educating homeowners about their rights and options, empowering them to advocate for themselves effectively. These programs often rely heavily on partnerships with non-profit housing organizations and legal aid societies.

Examples of Organizations Offering Volunteer Mortgage Loan Servicing

Numerous organizations across the country offer volunteer-based mortgage assistance. While specific programs and their availability vary by location, examples include local chapters of Habitat for Humanity, non-profit housing counseling agencies affiliated with the U.S. Department of Housing and Urban Development (HUD), and faith-based organizations that provide financial literacy and debt management workshops. Many of these organizations recruit and train volunteers with backgrounds in finance, law, or social work. The level of involvement can range from providing one-time assistance to ongoing support over several months.

Benefits and Drawbacks of Volunteer-Based Mortgage Servicing

Volunteer-based mortgage servicing offers several advantages. It provides much-needed support to homeowners who might not otherwise be able to afford professional assistance, often leading to improved financial stability and reduced foreclosure rates. The personalized attention and empathy offered by volunteers can significantly improve the borrower experience, creating a more supportive and less adversarial environment. However, limitations exist. Volunteers may lack the same legal expertise or negotiating power as professional mortgage servicers, potentially limiting their effectiveness in certain situations. The availability of volunteer services can also be inconsistent, depending on factors like volunteer recruitment and program funding. Furthermore, the time commitment required for effective volunteer assistance can be substantial.

Comparison of Professional and Volunteer Mortgage Servicing

| Feature | Professional Mortgage Servicing | Volunteer Mortgage Servicing | Notes |

|---|---|---|---|

| Cost | Typically involves fees | Usually free or low-cost | Professional services can be expensive, while volunteer services rely on donations. |

| Expertise | Highly trained professionals | Volunteers with varying levels of expertise | Professionals possess specialized knowledge and legal expertise, while volunteers may require additional training. |

| Availability | Widely available | Availability varies by location and program | Professional services are readily accessible, while volunteer services depend on program resources and volunteer capacity. |

| Personalization | Often standardized processes | More personalized attention | Volunteer programs offer more individualized support, while professional services tend to follow established procedures. |

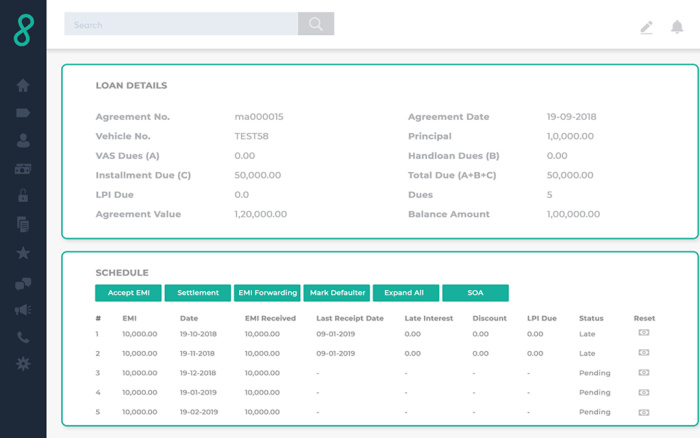

Online Payment Systems for Volunteer Mortgage Loan Servicing

Efficient and secure online payment processing is crucial for volunteer organizations managing mortgage loan servicing. Streamlining this process improves transparency, reduces administrative burden, and enhances the overall donor experience. Choosing the right payment platform is vital for achieving these goals.

Suitable Online Payment Platforms

Several online payment platforms cater to the needs of non-profit organizations, offering varying levels of functionality and fees. Popular options include PayPal, Stripe, Square, and Authorize.Net. PayPal is widely recognized and user-friendly, offering a simple integration process. Stripe provides robust features, including customizable payment pages and advanced fraud prevention tools. Square is known for its ease of use and point-of-sale integration, while Authorize.Net offers a comprehensive suite of payment processing solutions tailored to larger organizations. The optimal choice depends on the organization’s specific needs, volume of transactions, and technical capabilities.

Comparison of Security Features

Security is paramount when handling financial transactions. Each platform employs different security measures. PayPal utilizes encryption and fraud detection systems to protect against unauthorized access and fraudulent activities. Stripe offers similar features, along with advanced machine learning algorithms for real-time risk assessment. Square’s security protocols include PCI DSS compliance and robust encryption. Authorize.Net provides a range of security features, including address verification and fraud screening services. While all platforms prioritize security, it’s essential to review their specific security features and compliance certifications before selecting a provider.

Integration with Volunteer Management Software

Integrating online payment systems with existing volunteer management software streamlines workflows and improves data management. Many platforms offer APIs or plugins that enable seamless integration with popular volunteer management systems. This integration allows for automated payment recording, reconciliation, and reporting, reducing manual data entry and minimizing errors. For example, a volunteer organization using a CRM like Salesforce could integrate Stripe’s API to automatically record payments within the CRM, maintaining a unified view of donor activity and financial data.

Challenges in Implementing Secure Online Payments

Implementing secure online payments for volunteers presents several challenges. Maintaining PCI DSS compliance requires careful adherence to data security standards. Educating volunteers on secure payment practices is crucial to minimize the risk of phishing and other online threats. Furthermore, managing potential technical issues, such as payment gateway downtime or integration complexities, requires proactive planning and technical support. Finally, addressing potential accessibility concerns for volunteers with varying levels of technological proficiency is essential for inclusive payment processing.

Step-by-Step Guide for Secure Online Payment Processing

Before initiating any online payment, it is crucial to ensure the security of the platform and the process. Here’s a step-by-step guide:

- Verify the Website’s Security: Check for a secure HTTPS connection (indicated by a padlock icon in the browser’s address bar) before entering any sensitive information.

- Use a Strong Password: Create a unique and strong password for your online payment account, avoiding easily guessable information.

- Update Software: Ensure your browser and operating system are updated to the latest versions with security patches applied.

- Review Payment Details: Carefully verify the payment amount and recipient information before confirming the transaction.

- Use a Secure Network: Avoid making payments on public Wi-Fi networks, as these are more vulnerable to security breaches.

- Monitor Account Activity: Regularly check your online payment account statements for any unauthorized transactions.

- Report Suspicious Activity: Report any suspicious activity to the payment platform provider and relevant authorities immediately.

Security and Risk Management in Online Volunteer Mortgage Payments

Online volunteer mortgage loan servicing, while offering convenience, introduces significant security and risk management challenges. Protecting sensitive financial data and maintaining the integrity of the payment process is paramount to ensure the trust and confidence of both volunteers and borrowers. Failure to implement robust security measures can lead to financial losses, reputational damage, and legal repercussions.

Potential Risks Associated with Online Payments

Online payment systems for volunteer mortgage servicing are susceptible to various risks, including data breaches, unauthorized access, fraud, and system failures. Data breaches can expose borrowers’ personal information, such as Social Security numbers, addresses, and bank account details, leading to identity theft and financial fraud. Unauthorized access to the payment system could allow malicious actors to alter transaction details, redirect payments, or steal funds. Fraudulent activities, such as phishing scams or malware attacks, can compromise user credentials and facilitate unauthorized transactions. System failures, due to technical glitches or cyberattacks, can disrupt the payment process and cause significant inconvenience to users. The consequences of these risks can be severe, impacting the financial well-being of borrowers and damaging the reputation of the organization involved.

Security Measures to Protect Sensitive Financial Data

Protecting sensitive financial data requires a multi-layered approach encompassing technological, procedural, and administrative controls. Strong authentication mechanisms, such as multi-factor authentication (MFA), are crucial to verify user identities and prevent unauthorized access. Data encryption, both in transit and at rest, is essential to safeguard sensitive information from unauthorized disclosure. Regular security audits and penetration testing help identify vulnerabilities and improve the overall security posture of the system. Employee training programs on security awareness and best practices are vital to prevent human error from becoming a security weakness. Furthermore, robust access control measures restrict access to sensitive data based on the principle of least privilege. Finally, incident response plans are necessary to effectively handle security incidents and minimize their impact.

Best Practices for Data Encryption and Storage

Data encryption is a critical component of securing sensitive financial data. Data should be encrypted both during transmission (using protocols like HTTPS) and at rest (using strong encryption algorithms like AES-256). Encryption keys should be securely managed and protected from unauthorized access. Data should be stored in secure, encrypted databases, ideally in a cloud environment with robust security features. Regular backups of the data should be performed and stored securely in a separate location to ensure business continuity in case of a data loss event. Data minimization principles should be applied, storing only the necessary data for the intended purpose and discarding unnecessary information. Compliance with relevant data privacy regulations, such as GDPR or CCPA, is crucial.

Strategies for Preventing Fraud and Unauthorized Access

Preventing fraud and unauthorized access requires a proactive approach encompassing various security measures. Implementing robust fraud detection systems can identify suspicious transactions and alert administrators to potential fraudulent activities. Regular monitoring of system logs and security alerts can help detect unauthorized access attempts. User education programs can help users identify and avoid phishing scams and other social engineering attacks. Employing strong password policies, including password complexity requirements and regular password changes, helps prevent unauthorized access. Implementing regular security updates and patching of software vulnerabilities reduces the risk of exploitation by malicious actors. Utilizing intrusion detection and prevention systems can help detect and block malicious traffic. Finally, maintaining comprehensive audit trails of all transactions and user activities allows for forensic analysis in case of a security incident.

Compliance Regulations Relevant to Online Financial Transactions

Several compliance regulations govern online financial transactions, ensuring the security and privacy of sensitive data. Adherence to these regulations is crucial to avoid legal penalties and maintain public trust.

- Gramm-Leach-Bliley Act (GLBA): This US law requires financial institutions to protect the confidentiality and security of customer data.

- Payment Card Industry Data Security Standard (PCI DSS): This standard mandates security requirements for organizations that process, store, or transmit credit card information.

- General Data Protection Regulation (GDPR): This EU regulation protects the personal data of individuals within the European Union.

- California Consumer Privacy Act (CCPA): This California law grants consumers rights regarding their personal data.

- State-Specific Data Breach Notification Laws: Many US states have laws requiring notification of individuals in the event of a data breach.

The User Experience of Online Payment for Volunteers and Borrowers: Volunteer Mortgage Loan Servicing Online Payment

A positive user experience is paramount for successful online mortgage payment systems, ensuring both volunteers and borrowers find the process efficient, secure, and straightforward. A well-designed interface, coupled with clear communication and accessible features, fosters trust and encourages consistent use. This section details the key elements contributing to a superior user experience.

Interface Design for Online Mortgage Payments

The ideal interface should prioritize simplicity and intuitiveness. Navigation should be clear and logical, guiding users through the payment process with minimal clicks. A clean, uncluttered layout, using a consistent color scheme and typography, enhances readability and reduces cognitive load. Prominent placement of key elements, such as the payment amount field and submit button, minimizes user frustration. The design should be responsive, adapting seamlessly to various screen sizes and devices (desktops, tablets, smartphones). Progress indicators can provide visual cues to users, showing them where they are in the payment process and what steps remain. Error messages should be clear, concise, and actionable, guiding users towards resolution. For example, if a payment fails due to insufficient funds, the error message should clearly state this and suggest next steps, like contacting the bank or updating payment information. The use of visual cues, such as icons representing different payment methods or progress bars indicating payment status, further enhances usability.

Clear and Concise Instructions for Online Payments

Instructions for making online payments must be unambiguous and easy to understand, regardless of the user’s technical proficiency. Short, concise sentences, avoiding jargon and technical terms, are crucial. Step-by-step guidance, using numbered lists or visual cues, is highly recommended. For example, instructions might include: “1. Log in using your username and password. 2. Enter the payment amount. 3. Select your preferred payment method. 4. Review the payment details. 5. Submit your payment.” Visual aids, such as screenshots or videos, can supplement written instructions, clarifying complex steps or processes. The use of plain language and simple sentence structure is key to ensuring accessibility for all users. Furthermore, a FAQ section addressing common questions about the online payment system can preemptively address user concerns and reduce the need for support.

Effective Communication Strategies to Enhance User Understanding

Proactive communication is essential to building user trust and confidence. Regular email updates, informing users about payment due dates and processing statuses, can prevent late payments and reduce anxiety. Automated email confirmations, sent immediately after a successful payment, provide reassurance and serve as a valuable record. The use of a consistent brand voice and tone across all communication channels (email, website, in-app notifications) reinforces brand identity and fosters a sense of familiarity. For instance, using a friendly and approachable tone in emails, rather than a formal or impersonal one, can create a more positive user experience. Clear and concise language, avoiding technical jargon, should be consistently employed across all communication materials.

Improving Accessibility for Users with Disabilities, Volunteer mortgage loan servicing online payment

Adherence to accessibility guidelines, such as WCAG (Web Content Accessibility Guidelines), is critical. This includes providing alternative text for images, ensuring sufficient color contrast, and supporting keyboard navigation. The system should be compatible with screen readers and other assistive technologies, allowing users with visual or motor impairments to access and use the online payment system effectively. For example, the use of ARIA attributes in the code can significantly enhance accessibility for screen reader users. Providing options for different input methods (e.g., keyboard shortcuts, voice input) further expands accessibility. Regular accessibility audits can identify and address any barriers to access.

Feedback Mechanisms for Continuous Improvement

Implementing robust feedback mechanisms is vital for continuous improvement. User surveys, feedback forms, and online chat support provide valuable insights into user experiences and pain points. Analyzing this feedback allows for iterative improvements to the system’s design, functionality, and communication strategies. For instance, a survey could ask users to rate their satisfaction with different aspects of the online payment system, such as ease of use, clarity of instructions, and overall experience. Regular review of user feedback allows for the identification of areas requiring improvement and the implementation of changes to enhance the overall user experience. This iterative approach ensures the online payment system remains user-friendly, efficient, and accessible for all.

Legal and Ethical Considerations for Volunteer Mortgage Loan Servicing

Volunteer organizations offering mortgage loan servicing face significant legal and ethical responsibilities. Handling sensitive financial data necessitates strict adherence to relevant laws and ethical guidelines to protect both the organization and the individuals involved. Failure to do so can lead to serious legal repercussions and reputational damage.

Relevant Legal Frameworks

Volunteer organizations handling financial transactions must comply with a range of federal and state laws. These regulations vary depending on location and the specific services offered, but generally include laws related to data privacy (like HIPAA if dealing with medical information related to borrowers’ financial situations), consumer protection (such as the Fair Debt Collection Practices Act if collection activities are involved), and money laundering prevention (following the Bank Secrecy Act). State-specific regulations concerning charitable organizations and non-profit operations also apply. Understanding and complying with these regulations is paramount to avoid legal liabilities.

Data Privacy and Confidentiality

Protecting the privacy and confidentiality of borrower data is a critical ethical and legal obligation. This involves implementing robust security measures to prevent unauthorized access, use, or disclosure of sensitive information, such as social security numbers, bank account details, and mortgage agreements. This also includes adhering to data minimization principles – collecting only the data necessary for the service provided and securely disposing of data when it’s no longer needed. Ethical considerations extend to transparency; borrowers should be informed about how their data is collected, used, and protected.

Responsibilities of Volunteers Handling Sensitive Financial Information

Volunteers handling financial information must be properly trained and supervised. This training should cover data security protocols, ethical conduct, and relevant legal frameworks. Volunteers should understand the importance of maintaining confidentiality, adhering to data privacy regulations, and reporting any suspicious activity. They must also understand the potential consequences of non-compliance, both for themselves and the organization. Clear roles and responsibilities, coupled with appropriate oversight, are crucial to mitigate risks.

Potential Legal Liabilities and Mitigation Strategies

Potential legal liabilities include data breaches leading to identity theft, violations of consumer protection laws resulting in fines or lawsuits, and non-compliance with anti-money laundering regulations, which can lead to criminal charges. Mitigation strategies involve implementing robust security systems (including encryption and access controls), conducting regular security audits, providing comprehensive volunteer training, maintaining accurate records, and establishing clear protocols for handling sensitive information. Furthermore, having adequate insurance coverage can help protect the organization from financial losses resulting from legal action.

Volunteer Compliance Checklist

Prior to handling any financial information, volunteers should confirm the following:

- I have received and understand all relevant training materials on data privacy, security, and legal compliance.

- I understand the organization’s policies and procedures regarding the handling of sensitive financial information.

- I will only access and process information necessary for my assigned tasks.

- I will report any suspicious activity or security breaches immediately to the appropriate supervisor.

- I will maintain the confidentiality of all borrower information.

- I will follow all data security protocols, including password management and secure data storage.

- I understand the potential legal and ethical consequences of non-compliance.

Future Trends in Volunteer Mortgage Loan Servicing and Online Payments

The convergence of technology and volunteer-based mortgage servicing is poised for significant transformation. Emerging technologies offer the potential to streamline processes, enhance security, and broaden accessibility for both volunteers and borrowers. This section explores the anticipated future of this sector, focusing on the impact of technological advancements and opportunities for innovation.

The integration of innovative technologies will dramatically reshape the landscape of volunteer mortgage loan servicing. Automation, improved data analytics, and enhanced security protocols will be key drivers of this evolution. This will lead to more efficient workflows, reduced operational costs, and a significantly improved borrower experience.

The Impact of Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) will play a pivotal role in automating various aspects of volunteer mortgage loan servicing. AI-powered chatbots can handle routine inquiries, freeing up volunteer time for more complex tasks. ML algorithms can analyze vast datasets to identify potential risks, predict delinquency, and optimize resource allocation. For example, a system could predict which borrowers might be at risk of default based on historical data, allowing proactive intervention by volunteers. This proactive approach can significantly reduce defaults and improve overall portfolio performance.

Enhanced Security through Blockchain Technology

Blockchain technology offers a secure and transparent platform for managing mortgage data. Its decentralized nature reduces the risk of data breaches and ensures data integrity. By recording all transactions on an immutable ledger, blockchain can improve the auditability of the process and build greater trust among stakeholders. This is particularly important in volunteer settings, where maintaining transparency and accountability is crucial. Imagine a system where every transaction related to a mortgage is recorded on a blockchain, providing an auditable trail for both volunteers and borrowers.

Improved Accessibility with Mobile-First Applications

The increasing adoption of mobile devices necessitates the development of user-friendly mobile applications for volunteer mortgage loan servicing. These applications can facilitate online payments, provide real-time updates on loan status, and allow borrowers to easily communicate with volunteers. A well-designed mobile app can significantly improve accessibility for borrowers in remote areas or those with limited internet access. For example, an app could offer multiple language support and simplified interfaces, catering to a diverse borrower base.

Streamlined Online Payment Systems

Future online payment systems will integrate seamlessly with existing platforms, offering a variety of payment options, including mobile wallets and direct bank transfers. Advanced security measures, such as biometric authentication and fraud detection systems, will further enhance security. The goal is to create a frictionless payment experience for both borrowers and volunteers, reducing the time and effort required for processing payments. A system that automatically reconciles payments and updates loan balances in real-time would greatly enhance efficiency.

The Role of Cloud Computing in Enhancing Scalability and Efficiency

Cloud computing offers a scalable and cost-effective solution for managing large volumes of mortgage data. Cloud-based platforms provide the flexibility to adapt to changing needs and ensure data accessibility from anywhere with an internet connection. This is particularly beneficial for volunteer organizations with geographically dispersed teams. The use of cloud storage eliminates the need for expensive on-site servers and reduces the risk of data loss due to hardware failures.

Last Word

Successfully implementing a volunteer mortgage loan servicing online payment system requires careful planning and execution. By prioritizing robust security measures, user-friendly design, and strict adherence to legal and ethical guidelines, organizations can create a system that effectively serves both borrowers and volunteers. The future of this area likely involves further technological integration, enhancing efficiency and accessibility while continuing to ensure the utmost security and transparency in all financial transactions.

FAQ Compilation

What are the potential costs associated with implementing an online payment system for volunteer mortgage loan servicing?

Costs can vary depending on the chosen platform, including transaction fees, setup fees, and potential integration costs with existing software. Some platforms offer free or low-cost options for non-profits.

How can volunteers ensure the privacy and security of borrower data?

Implementing strong password policies, utilizing multi-factor authentication, encrypting data both in transit and at rest, and adhering to relevant data privacy regulations (like GDPR or CCPA) are crucial.

What happens if a borrower experiences technical difficulties making an online payment?

The system should include clear instructions and contact information for technical support. Alternative payment methods, such as mailing a check, should also be available as a backup.

Are there specific legal requirements for non-profit organizations accepting online payments?

Yes, non-profits must comply with all applicable federal and state laws regarding financial transactions, data privacy, and tax regulations. Consulting with legal counsel is recommended.