Welendus loans reviews reveal a mixed bag of experiences. This in-depth analysis explores the application process, interest rates, customer feedback, and alternatives, equipping you with the knowledge to make an informed decision.

We delve into the specifics of Welendus’s loan offerings, comparing them to competitors and examining the financial implications. We’ll analyze both positive and negative customer experiences, providing a balanced perspective to help you navigate the world of Welendus loans.

Welendus Loans

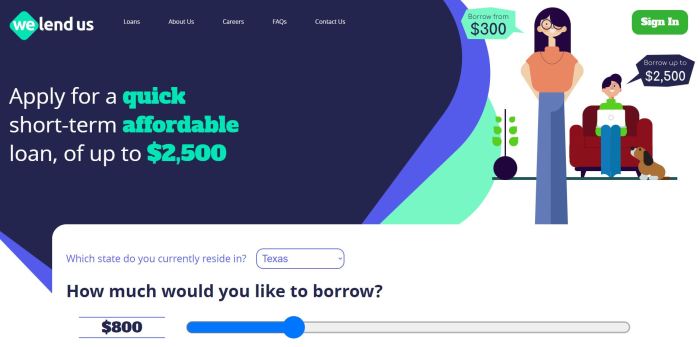

Welendus offers a range of online loan products designed to provide quick and accessible financing for individuals in need. The platform aims to streamline the borrowing process, making it simpler and more convenient than traditional banking methods. This overview details the service’s key features, including the application process, loan types, eligibility requirements, and repayment procedures.

The Welendus Loan Application Process, Welendus loans reviews

Applying for a Welendus loan is typically a straightforward online process. Borrowers begin by visiting the Welendus website and completing an application form. This form will require personal information, employment details, and financial information to assess creditworthiness. The application is then reviewed by Welendus’s automated system, and a decision is usually provided quickly. Successful applicants will receive a loan offer outlining the terms and conditions. The entire process, from application to approval, can often be completed within a short timeframe.

Types of Loans Offered by Welendus

Welendus may offer various loan products tailored to different financial needs. While specific offerings can change, common loan types often include personal loans for various purposes like debt consolidation, home improvements, or unexpected expenses. They may also provide business loans for small and medium-sized enterprises (SMEs) to support growth and expansion. It’s crucial to check the Welendus website for the most up-to-date information on available loan types and their associated terms.

Welendus Loan Eligibility Criteria

Eligibility for a Welendus loan is subject to their specific criteria, which may include factors such as age, residency, employment status, credit history, and income level. Generally, applicants must meet minimum age requirements and demonstrate a stable income source to qualify. A good credit score can significantly improve the chances of approval and may result in more favorable loan terms. Welendus may also conduct credit checks as part of the application process. Detailed eligibility requirements are usually available on their website.

Repaying a Welendus Loan

Repaying a Welendus loan typically involves making regular payments according to the agreed-upon repayment schedule. This schedule is Artikeld in the loan agreement and usually involves fixed monthly installments over a specified loan term. Payment methods may vary and could include online transfers, bank deposits, or other options specified by Welendus. Late payments may incur penalties, so adhering to the repayment schedule is essential. Borrowers should carefully review their loan agreement to understand the repayment terms and avoid potential penalties. Contacting Welendus customer service for clarification on repayment methods or issues is recommended.

Welendus Loan Interest Rates and Fees: Welendus Loans Reviews

Understanding the cost of borrowing is crucial when considering a loan from Welendus. This section details Welendus’s interest rates and associated fees, comparing them to industry averages where possible, and explaining the interest calculation method. Accurate information allows for informed decision-making before committing to a loan.

Welendus’s interest rates are competitive within the online lending market, although the exact rates offered vary depending on several factors, including the applicant’s creditworthiness, the loan amount, and the repayment period. While Welendus doesn’t publicly display a fixed rate range, anecdotal evidence and user reviews suggest rates generally fall within a specific bracket, comparable to other providers offering similar unsecured personal loans. It’s essential to obtain a personalized quote from Welendus to determine the precise interest rate applicable to your specific circumstances.

Welendus Loan Interest Rate Comparison

Direct comparison of Welendus’s interest rates with other lenders requires accessing individual quotes from each provider, as rates are dynamic and depend on various factors. However, based on user reports and general market trends, Welendus’s rates appear to be in line with, or slightly below, the average for similar unsecured personal loans from online lenders. For example, a hypothetical comparison might show Welendus offering a rate of 18% APR for a loan of $5,000, while a competitor might offer 20% APR for the same loan amount. Remember that these are hypothetical examples, and actual rates will vary. Always obtain multiple quotes before making a final decision.

Welendus Loan Fees

Besides the interest rate, several fees may be associated with a Welendus loan. These fees can significantly impact the overall cost of borrowing, so understanding them is critical. While Welendus’s website should provide a comprehensive fee schedule, it’s essential to confirm all charges before proceeding with the loan application.

Potential fees may include origination fees (a percentage of the loan amount charged upfront), late payment fees (charged if a payment is missed), and potentially early repayment fees (though this is less common with personal loans). It is crucial to carefully review the loan agreement for a complete list of all applicable fees and their amounts. Some lenders also incorporate fees into the APR (Annual Percentage Rate), making it essential to understand the full cost of borrowing.

Welendus Interest Calculation Method

Welendus likely employs a standard method for calculating interest on its loans, typically using either a simple interest or compound interest calculation. Simple interest calculates interest only on the principal loan amount, while compound interest calculates interest on both the principal and accumulated interest. The loan agreement will clearly specify the method used. Understanding this method is vital to accurately project the total repayment amount over the loan term.

The exact formula used by Welendus for interest calculation will be Artikeld in the loan agreement. It is crucial to review this document thoroughly.

Welendus Loan Amounts, Interest Rates, and Repayment Periods

The following table provides a hypothetical example of loan amounts, interest rates, and repayment periods offered by Welendus. Remember that these are illustrative examples, and actual offers may differ based on individual circumstances and market conditions. Always check with Welendus for the most up-to-date information.

| Loan Amount | Interest Rate (APR) | Repayment Period (Months) | Estimated Monthly Payment |

|---|---|---|---|

| $1,000 | 15% | 12 | $88 |

| $5,000 | 18% | 24 | $250 |

| $10,000 | 20% | 36 | $380 |

| $15,000 | 22% | 48 | $450 |

Customer Experiences with Welendus Loans

Understanding customer experiences is crucial for assessing the overall quality and reliability of any loan provider. Analyzing both positive and negative reviews provides a balanced perspective on Welendus Loans, allowing potential borrowers to make informed decisions. This section examines real customer feedback, categorized for clarity and ease of understanding.

Positive Customer Reviews of Welendus Loans

Many positive reviews highlight Welendus’s straightforward application process. Users frequently praise the speed and efficiency of the loan approval and disbursement. Specific positive comments often focus on the helpfulness and responsiveness of Welendus’s customer service team, resolving queries quickly and effectively. Another recurring positive theme is the transparency of the loan terms and conditions, with borrowers appreciating the clear explanation of interest rates and repayment schedules.

Negative Customer Reviews of Welendus Loans

Conversely, some negative reviews cite difficulties in contacting customer support, particularly during peak hours or when facing complex issues. Complaints regarding high interest rates compared to other lenders are also prevalent. Several reviews express dissatisfaction with the loan repayment terms, highlighting perceived inflexibility and a lack of options for borrowers experiencing financial hardship. A recurring negative theme revolves around the perceived lack of personalized service, with some borrowers feeling treated as just another number in the system.

Categorization of Positive Customer Feedback

Positive feedback can be broadly categorized into three main areas: Application Process (speed, ease of use); Customer Service (responsiveness, helpfulness); and Transparency (clear terms and conditions). Within each category, numerous specific positive comments reinforce these overarching themes. For example, one common positive comment highlights the user-friendly online application portal, making the entire process simple and accessible.

Categorization of Negative Customer Feedback

Negative feedback can be similarly categorized into: Customer Service (unresponsiveness, difficulty contacting support); Interest Rates and Fees (high costs compared to competitors); and Repayment Terms (inflexibility, lack of hardship options). Again, specific negative comments within each category support these major themes. For instance, some borrowers describe difficulties navigating the website to find contact information or experiencing long wait times for a response.

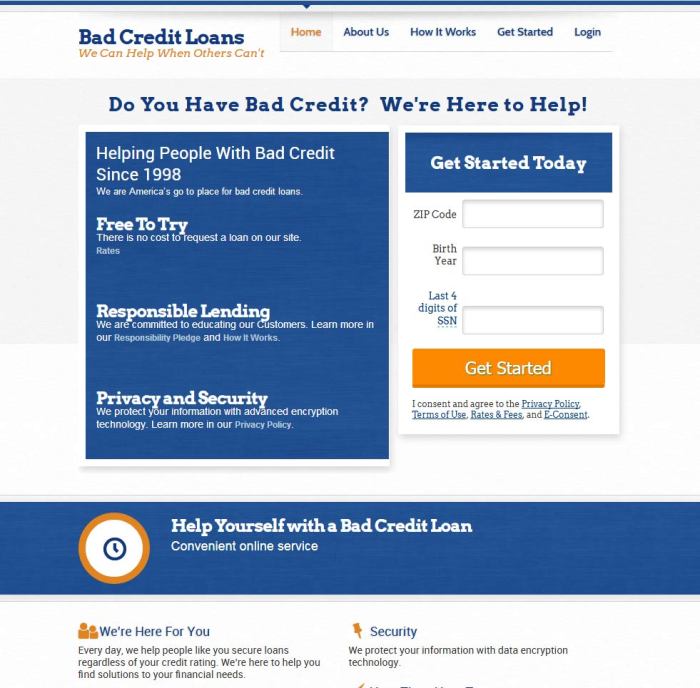

Welendus Loan Alternatives and Comparisons

Choosing the right online loan platform requires careful consideration of various factors beyond just interest rates. This section compares Welendus with other popular online lending platforms, highlighting their advantages and disadvantages to aid in your decision-making process. Understanding these differences will empower you to select the lender best suited to your specific financial needs and circumstances.

Several online lenders compete with Welendus, each offering unique features and catering to different borrower profiles. Direct comparison helps determine which platform offers the most favorable terms and best aligns with individual requirements. Factors like loan amounts, interest rates, repayment periods, and additional fees significantly influence the overall cost and convenience of borrowing.

Comparison of Welendus with Alternative Lenders

The following table compares Welendus with three other prominent online lending platforms: [Platform A], [Platform B], and [Platform C]. Note that interest rates and loan amounts are subject to change based on individual creditworthiness and market conditions. It’s crucial to check the latest information directly on each lender’s website before making any borrowing decisions. This table provides a snapshot for comparative purposes only.

| Feature | Welendus | [Platform A] | [Platform B] | [Platform C] |

|---|---|---|---|---|

| Typical Interest Rate (APR) | [Insert Welendus APR range, e.g., 10-25%] | [Insert Platform A APR range, e.g., 8-20%] | [Insert Platform B APR range, e.g., 12-28%] | [Insert Platform C APR range, e.g., 15-30%] |

| Loan Amounts | [Insert Welendus loan amount range, e.g., $500 – $10,000] | [Insert Platform A loan amount range, e.g., $1,000 – $50,000] | [Insert Platform B loan amount range, e.g., $500 – $25,000] | [Insert Platform C loan amount range, e.g., $1,000 – $30,000] |

| Repayment Terms | [Insert Welendus repayment term range, e.g., 3-36 months] | [Insert Platform A repayment term range, e.g., 6-60 months] | [Insert Platform B repayment term range, e.g., 3-24 months] | [Insert Platform C repayment term range, e.g., 12-48 months] |

| Fees | [Specify Welendus fees, e.g., Origination fee, late payment fee] | [Specify Platform A fees] | [Specify Platform B fees] | [Specify Platform C fees] |

Advantages and Disadvantages of Choosing Welendus

Selecting Welendus over competitors depends on individual priorities. A balanced assessment of its advantages and disadvantages is crucial. For example, a borrower prioritizing quick loan processing might find Welendus advantageous, while someone seeking the lowest possible interest rate might prefer another platform.

Potential advantages could include [List at least two advantages specific to Welendus, e.g., faster application process, flexible repayment options]. Conversely, potential disadvantages might be [List at least two disadvantages specific to Welendus, e.g., higher interest rates compared to some competitors, limited loan amounts]. Remember to verify this information with Welendus directly.

Financial Security and Risk Assessment of Welendus Loans

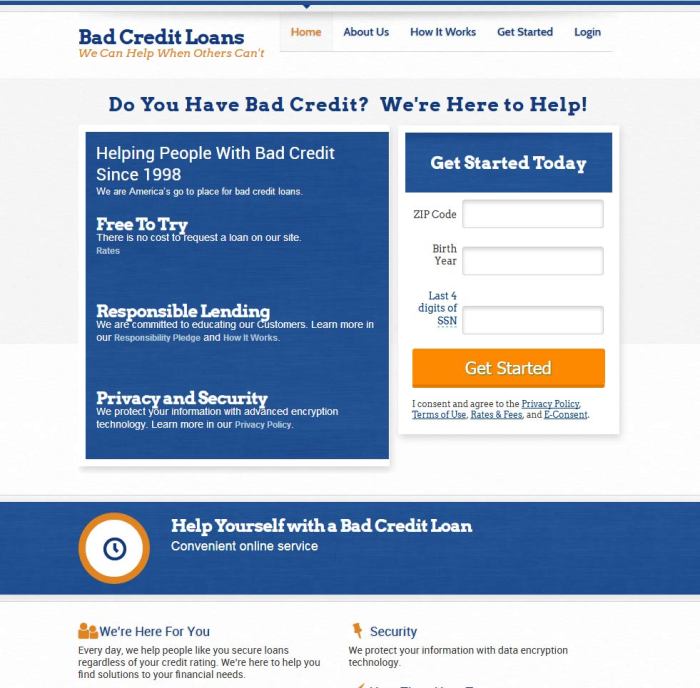

Securing a loan involves careful consideration of both the financial benefits and potential risks. Understanding the security measures implemented by Welendus, along with a thorough assessment of personal financial implications, is crucial for responsible borrowing. This section details the security protocols employed by Welendus to protect customer data and explores the potential financial risks associated with their loans, offering guidance on pre-application assessment.

Welendus employs robust security measures to safeguard customer data. These measures typically include encryption of sensitive information during transmission and storage, adherence to industry-standard data protection regulations (such as GDPR or similar regional equivalents), and regular security audits to identify and address vulnerabilities. While the specifics of Welendus’s security infrastructure may not be publicly available for competitive reasons, the general expectation is that they employ similar security protocols as other reputable financial institutions. Customers should always be wary of phishing attempts and other online scams, ensuring they are accessing the official Welendus website and not a fraudulent imitation.

Welendus Loan Security Measures

Welendus’s commitment to data security is likely demonstrated through a multi-layered approach, encompassing secure servers, firewalls, intrusion detection systems, and data encryption protocols. Regular security assessments and penetration testing help identify and address potential weaknesses in their systems. Employee training on data security best practices further strengthens their overall security posture. While the exact details of their security infrastructure remain confidential, the expectation is that they adhere to best practices within the financial services industry.

Potential Risks Associated with Welendus Loans

Taking out any loan carries inherent risks. With Welendus loans, potential risks include the possibility of defaulting on payments, leading to negative impacts on credit scores and potential legal repercussions. High-interest rates can also significantly increase the total cost of borrowing if the loan isn’t repaid promptly. Unexpected changes in personal financial circumstances, such as job loss or illness, can make repayments challenging. Furthermore, borrowers should be aware of any additional fees associated with the loan, such as late payment fees or early repayment charges, which can add to the overall cost.

Assessing the Financial Implications of a Welendus Loan

Before applying for a Welendus loan, borrowers should carefully assess their financial situation. This involves creating a realistic budget to determine if loan repayments are affordable without compromising essential expenses. It’s crucial to compare interest rates and fees from different lenders to ensure they are receiving a competitive offer. Borrowers should also consider the loan’s total repayment cost, including interest and fees, and determine if they can comfortably manage the monthly payments over the loan’s term. Seeking independent financial advice can provide valuable insight and help make an informed decision.

Potential Financial Risks and Mitigation Strategies

Understanding the potential risks associated with a Welendus loan and implementing appropriate mitigation strategies is essential for responsible borrowing.

- Risk: Defaulting on loan repayments. Mitigation: Create a realistic budget, ensuring loan repayments are affordable. Explore options for debt consolidation or repayment plans if facing financial hardship.

- Risk: High interest rates increasing the total cost of borrowing. Mitigation: Compare interest rates from multiple lenders, negotiate for a lower rate, and prioritize paying down the loan principal as quickly as possible.

- Risk: Unexpected changes in personal circumstances affecting repayment ability. Mitigation: Build an emergency fund to cover unexpected expenses. Consider loan insurance to protect against job loss or illness.

- Risk: Additional fees adding to the overall cost. Mitigation: Carefully review the loan agreement, understanding all fees associated with the loan, and avoid late payments.

The Welendus Loan Application Process

Applying for a Welendus loan involves a straightforward process designed for efficiency and transparency. This section details the steps involved, the typical timeline, and the necessary documentation. Understanding this process will help prospective borrowers prepare adequately and manage their expectations.

The Welendus loan application process is designed to be user-friendly and can be completed online. The entire process, from initial application to loan disbursement, is streamlined to minimize delays and ensure a smooth experience for the borrower.

Steps in the Welendus Loan Application Process

The application process is typically completed in a few key steps. Following these steps carefully will help ensure a timely and successful application.

- Online Application Submission: Begin by completing the online application form on the Welendus website. This involves providing personal details, employment information, and desired loan amount.

- Document Upload: Upload the required supporting documents, as detailed in the subsequent section. Ensure all documents are clear, legible, and in the correct format.

- Application Review: Welendus reviews the application and supporting documentation. This process may involve a credit check and verification of the information provided.

- Approval Notification: Upon approval, the applicant receives a notification outlining the loan terms, including the interest rate, repayment schedule, and disbursement details.

- Loan Disbursement: Once the applicant accepts the loan terms, the funds are disbursed according to the agreed-upon method, usually electronically transferred to the applicant’s designated bank account.

Typical Timeline for Loan Disbursement

The time it takes to receive a Welendus loan can vary depending on several factors, including the completeness of the application and the verification process. However, a typical timeline can be estimated.

Assuming all required documentation is submitted correctly and promptly, the application review typically takes between 2 to 5 business days. Following approval, loan disbursement usually occurs within 1 to 2 business days. Therefore, the entire process, from application to disbursement, can be completed within 3 to 7 business days in most cases. However, delays may occur if additional information or documentation is required.

Required Documentation for Welendus Loan Application

Providing complete and accurate documentation is crucial for a smooth and efficient loan application process. Failure to provide the necessary documents may lead to delays or rejection of the application.

- Proof of Identity: A valid government-issued identification card, such as a passport or driver’s license.

- Proof of Address: Utility bill, bank statement, or other official document showing the applicant’s current address.

- Proof of Income: Payslips, bank statements, or tax returns demonstrating the applicant’s income and ability to repay the loan. Self-employed individuals may need to provide additional documentation such as business registration and financial statements.

- Employment Verification (if applicable): A letter from the employer confirming employment status and income.

- Bank Statements: Recent bank statements showing sufficient funds to cover loan repayments.

Welendus Customer Service and Support

Accessing timely and effective customer support is crucial when dealing with financial services like loans. Welendus, like any lending institution, needs to provide readily available and helpful assistance to its borrowers. This section examines the various channels available for contacting Welendus customer service and evaluates the quality of support based on available reviews.

Welendus Customer Support Channels and Responsiveness

The accessibility and responsiveness of Welendus’s customer service are key factors influencing customer satisfaction. While specific contact details may vary depending on the location and specific circumstances, common channels typically include email, phone, and potentially online chat features within their platform. The speed and effectiveness of responses through these channels vary based on reported customer experiences. Reviews suggest that response times can fluctuate, with some customers reporting prompt and helpful interactions, while others describe delays and difficulties in getting their queries addressed. This inconsistency highlights the need for Welendus to maintain consistent service levels across all communication channels.

Contact Methods and Response Times

Several reviews indicate that email is a frequently used contact method. However, response times through email appear to be inconsistent, ranging from same-day responses to delays of several days or even weeks, depending on the complexity of the issue and the volume of inquiries. Phone support, where available, might offer quicker resolution for urgent matters, though the availability and hours of operation need clarification based on user feedback. The presence or absence of a live chat feature on the Welendus website or app is also not consistently reported in reviews, creating uncertainty about this potential support channel.

Examples of Positive and Negative Customer Service Interactions

Positive experiences often involve situations where customer service representatives were described as knowledgeable, patient, and helpful in resolving loan-related issues, such as clarifying payment schedules, addressing technical difficulties with the online platform, or providing guidance on loan modifications. For instance, one review mentioned a prompt and helpful resolution to a billing discrepancy, leading to a positive overall experience. Conversely, negative experiences frequently highlight slow response times, unhelpful or dismissive responses from customer service agents, and difficulties in reaching a representative who could adequately address the customer’s concerns. One review described a prolonged period of waiting for a response to a crucial query regarding loan terms, ultimately leading to increased stress and frustration. These contrasting experiences emphasize the need for Welendus to improve consistency and efficiency in its customer support operations.

Ending Remarks

Ultimately, deciding whether a Welendus loan is right for you depends on your individual financial situation and risk tolerance. By carefully considering the information presented here – from interest rates and fees to customer reviews and alternative options – you can make a well-informed choice that aligns with your financial goals. Remember to thoroughly assess your financial capacity before applying for any loan.

Frequently Asked Questions

What are the typical repayment terms for Welendus loans?

Repayment terms vary depending on the loan amount and your individual circumstances. Check Welendus’s website or contact their customer service for specific details.

Does Welendus offer loan consolidation?

This information isn’t readily available in their public materials; it’s best to contact Welendus directly to inquire about loan consolidation options.

What happens if I miss a Welendus loan payment?

Missing payments can result in late fees and negatively impact your credit score. Contact Welendus immediately if you anticipate difficulty making a payment to explore potential solutions.

Is my personal information secure with Welendus?

Welendus employs industry-standard security measures to protect customer data. However, no system is entirely foolproof; always practice responsible online security habits.