What documents prove ownership of a business? This crucial question underpins the legal and financial stability of any enterprise. Understanding which documents definitively establish ownership—be it a sole proprietorship, partnership, LLC, or corporation—is paramount for securing loans, attracting investors, and protecting your business interests. This guide delves into the diverse range of documentation required to unequivocally demonstrate ownership, from incorporation certificates to financial records and legal agreements.

From the foundational registration documents to the intricate details of financial statements and legal contracts, we’ll explore the multifaceted landscape of business ownership verification. We’ll examine how different business structures necessitate specific documentation and how these documents interact to provide a comprehensive picture of ownership. This guide provides clarity and ensures you’re well-equipped to navigate the complexities of proving your business ownership.

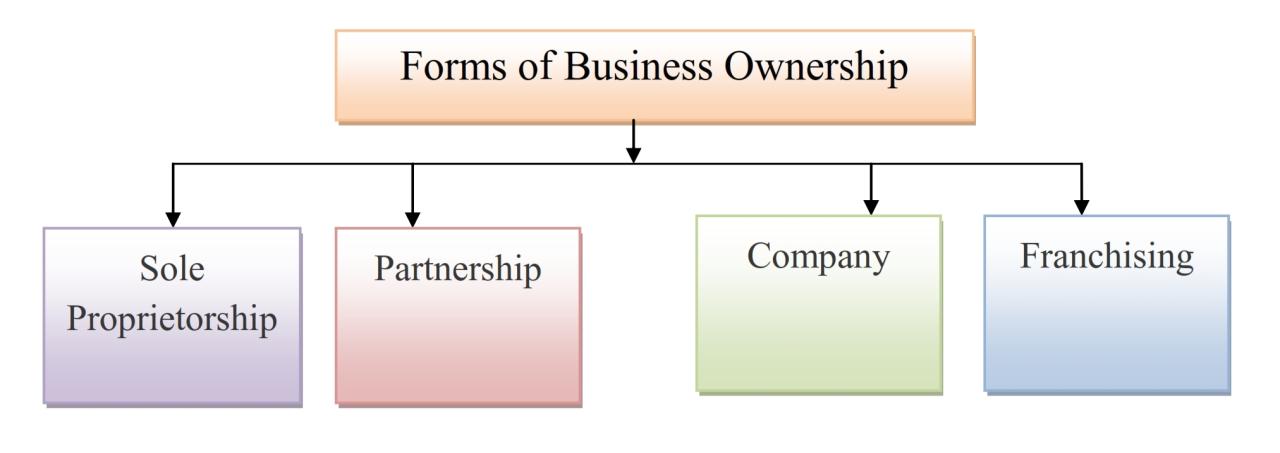

Types of Business Ownership and Associated Documentation

Understanding the legal structure of a business is crucial for establishing ownership and managing liabilities. Different structures necessitate different documentation to prove ownership and compliance with legal requirements. This section details the key documents associated with common business structures.

Choosing the right business structure significantly impacts legal and financial responsibilities. Factors such as liability protection, taxation, and administrative burden should guide this decision. Each structure offers unique advantages and disadvantages, making careful consideration essential.

Sole Proprietorship Documentation

A sole proprietorship is the simplest business structure, where the business is owned and run by one person. There is no legal distinction between the owner and the business. This simplicity translates to straightforward documentation requirements.

The primary document proving ownership is often the business license or registration certificate issued by the relevant local authority. Additional supporting documentation may include tax returns showing business income and expenses, bank statements reflecting business transactions, and contracts or invoices demonstrating business activities.

Partnership Documentation

A partnership involves two or more individuals who agree to share in the profits or losses of a business. A critical document establishing ownership is the partnership agreement. This legally binding contract Artikels the responsibilities, contributions, and profit-sharing arrangements of each partner.

Supporting documentation for partnerships might include tax returns filed under the partnership’s tax identification number, bank statements reflecting joint business accounts, and contracts demonstrating joint business activities. The partnership agreement should clearly define the ownership percentages of each partner.

Limited Liability Company (LLC) Documentation

An LLC combines the benefits of a sole proprietorship/partnership and a corporation. Owners, known as members, enjoy limited liability, meaning their personal assets are generally protected from business debts. The primary document proving ownership is the LLC’s Articles of Organization (or equivalent document filed with the state). This document formally establishes the LLC and lists the members and their ownership interests.

Secondary documentation includes the LLC’s operating agreement (detailing the management structure, member responsibilities, and profit-sharing), tax returns filed under the LLC’s tax identification number, and bank statements for the LLC’s accounts. The operating agreement often specifies the ownership percentages of each member.

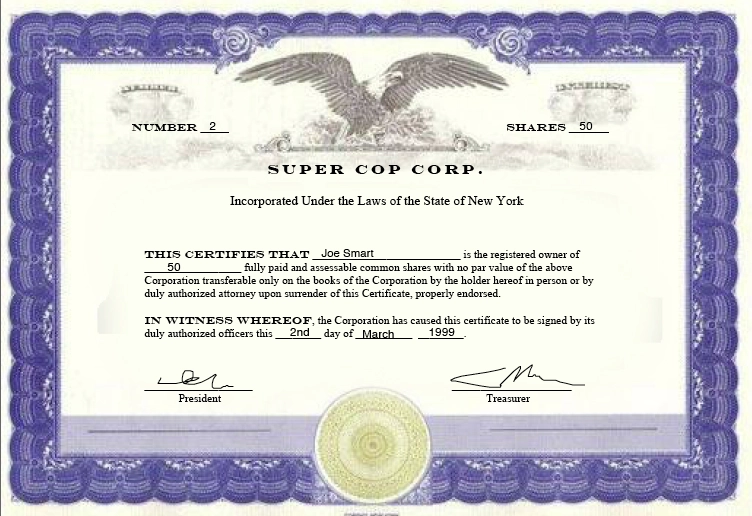

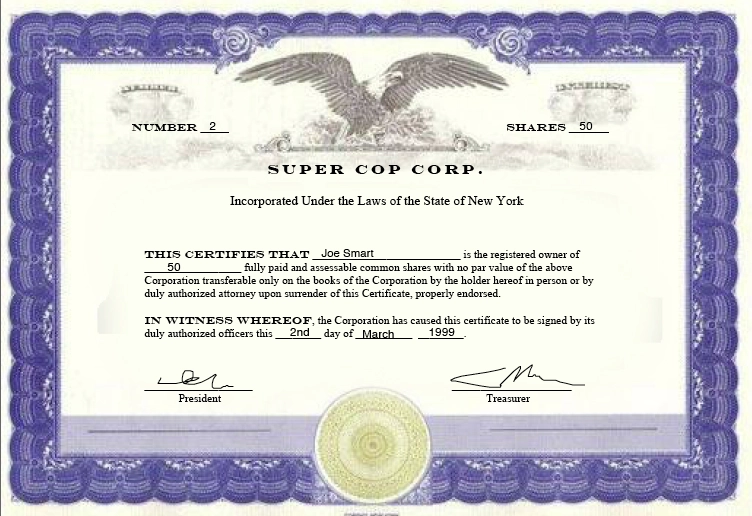

Corporation Documentation

Corporations are more complex structures, legally separate from their owners (shareholders). This separation provides significant liability protection. The primary document proving ownership is the corporation’s Articles of Incorporation (or Certificate of Incorporation), filed with the state. This document establishes the corporation and details its authorized shares. Share certificates then evidence ownership of specific shares.

Supporting documentation includes corporate bylaws (governing the corporation’s internal operations), shareholder agreements (defining the rights and responsibilities of shareholders), minutes of board meetings, tax returns filed under the corporation’s tax identification number, and bank statements for the corporation’s accounts. The share certificates and shareholder registry demonstrate the ownership distribution among shareholders.

Summary Table of Business Ownership Documentation

| Business Structure | Primary Ownership Document | Secondary Supporting Documents | Description |

|---|---|---|---|

| Sole Proprietorship | Business License/Registration | Tax returns, bank statements, contracts | Simple structure; ownership is directly tied to the individual. |

| Partnership | Partnership Agreement | Tax returns, bank statements, contracts | Agreement Artikels ownership percentages and responsibilities of partners. |

| LLC | Articles of Organization/Equivalent | Operating agreement, tax returns, bank statements | Combines limited liability with flexible management structures. |

| Corporation | Articles of Incorporation/Certificate of Incorporation, Share Certificates | Bylaws, shareholder agreements, meeting minutes, tax returns, bank statements | Legally separate entity offering strong liability protection. |

Registration and Incorporation Documents

Registering a business with the appropriate government agencies is a crucial step in establishing its legal existence and protecting the owner’s interests. This process formalizes the business entity, allowing it to operate legally and access various benefits, such as opening bank accounts and entering into contracts. The specific requirements vary depending on the type of business, its location, and the governing legal framework.

The registration process typically involves submitting an application along with necessary documentation, paying relevant fees, and potentially meeting certain compliance standards. Successful registration results in the issuance of official documents that serve as irrefutable proof of the business’s legal existence and, in many cases, ownership. These documents hold significant legal weight and are essential for various business transactions and legal proceedings.

Certificate of Incorporation

A Certificate of Incorporation, issued upon successful registration of a corporation (e.g., C-corp, S-corp, LLC), is a legal document confirming the corporation’s existence as a separate legal entity from its owners. This certificate contains vital information such as the corporation’s name, registered address, date of incorporation, and the names of its incorporators or registered agents. The certificate acts as primary evidence of the corporation’s legal standing and serves as proof of ownership for shareholders, as it confirms their stake in the company. Its legal significance is paramount in establishing the corporation’s right to operate, enter into contracts, and own assets. Disputes regarding ownership can often be resolved by referencing the information contained within this certificate. For example, in a shareholder dispute, the Certificate of Incorporation can definitively clarify the ownership percentages and voting rights of each shareholder.

Articles of Organization

For other business structures like Limited Liability Companies (LLCs) or partnerships, the equivalent document is typically called the Articles of Organization. This document Artikels the fundamental details of the LLC, including its name, registered agent, purpose, and management structure. Similar to a Certificate of Incorporation, the Articles of Organization serves as legal proof of the LLC’s existence and is crucial for establishing its legal rights and obligations. It’s a foundational document that defines the company’s structure and the rights and responsibilities of its members. A discrepancy between the Articles of Organization and the actual operational structure of the LLC could lead to legal complications. For instance, if the Articles state a member-managed structure, but the LLC operates under manager-managed structure, this inconsistency could be challenged in court.

Registration Documents for Sole Proprietorships and Partnerships

While sole proprietorships and general partnerships do not require formal incorporation, they still need to register with relevant government agencies, typically at the state or local level. These registrations might involve obtaining business licenses and permits, registering the business name (if different from the owner’s name), and potentially complying with tax registration requirements. The documentation issued upon successful registration—such as business licenses and tax registration certificates—serves as proof of the business’s legal operation and the owner’s right to conduct business under that name. These documents are crucial for opening bank accounts, securing loans, and complying with legal and tax obligations. For example, a business license provides legal permission to operate a specific type of business in a particular jurisdiction. Lack of such documentation can result in penalties and legal repercussions.

Financial Records as Ownership Evidence

Financial statements play a crucial role in substantiating business ownership claims, providing concrete evidence of control and investment. They offer a verifiable record of the business’s financial health and activity, which can be invaluable in various situations, including securing loans, attracting investors, or resolving disputes regarding ownership. The consistent presentation of financial data over time strengthens the claim of ongoing involvement and management.

Financial statements, specifically balance sheets, income statements, and cash flow statements, offer a multifaceted view of a business’s financial position. These documents demonstrate the owner’s investment, the business’s profitability, and the flow of funds within the enterprise. This comprehensive picture is essential for validating ownership claims, especially when dealing with external stakeholders. The information contained within these statements provides irrefutable evidence of the owner’s stake in the business’s success or failure.

Balance Sheets as Proof of Ownership

A balance sheet provides a snapshot of a business’s assets, liabilities, and equity at a specific point in time. The equity section, in particular, is crucial for demonstrating ownership. This section shows the owner’s investment in the business, including initial contributions, retained earnings, and any subsequent capital injections. A higher equity stake directly correlates to a greater degree of ownership. For example, a balance sheet showing a significant equity contribution from a specific individual strongly supports that individual’s claim of majority ownership. Discrepancies between claimed ownership and the equity shown on the balance sheet could raise serious questions. Furthermore, a consistent pattern of equity increases over time, reflected in a series of balance sheets, further strengthens the ownership claim.

Income Statements and Ownership Validation

Income statements, also known as profit and loss statements, illustrate a business’s revenue, expenses, and net income or loss over a specific period. While not directly demonstrating ownership in the same way as a balance sheet, income statements indirectly support ownership claims by showcasing the owner’s involvement in the business’s financial performance. Consistent profitability, coupled with a demonstrated history of management and decision-making reflected in the financial records, can be used to strengthen an ownership claim. For instance, an income statement showing a steady increase in revenue under a specific individual’s management strengthens their claim to ownership and successful operation of the business. Conversely, a consistent pattern of losses could raise questions about the management’s competency, though not necessarily their ownership.

Cash Flow Statements and Ownership Demonstrations

Cash flow statements track the movement of cash into and out of a business. These statements can provide evidence of an owner’s financial contributions and withdrawals. Significant cash inflows from an individual, corresponding to investments or loans, support their ownership claim. Similarly, consistent cash outflows reflecting the owner’s draw of profits further strengthens the claim. A cash flow statement illustrating a clear pattern of capital contributions and subsequent profit distributions to a specific individual directly supports that individual’s claim of ownership and management. This is especially useful in situations where other forms of documentation may be less clear.

Hypothetical Scenario Illustrating Ownership via Financial Records

Imagine Sarah is claiming ownership of “GreenThumb Gardens,” a landscaping business. She provides three years’ worth of financial statements: balance sheets showing a steady increase in her equity stake from 60% to 80%, income statements demonstrating consistent profitability under her management, and cash flow statements reflecting her initial investment and subsequent profit withdrawals. This comprehensive financial documentation powerfully supports Sarah’s claim of majority ownership and successful management of GreenThumb Gardens, especially when presented to a lender considering a loan application or potential investors assessing the viability of an investment. The consistency and completeness of these records significantly increase the credibility of her claim.

Legal Agreements and Contracts

Legal agreements and contracts serve as crucial evidence of business ownership, providing a legally binding record of ownership transfer, rights, and responsibilities. These documents offer a detailed and verifiable account of the ownership structure, often surpassing the information found in registration documents alone. Understanding the different types of agreements and their specific clauses is vital for establishing clear ownership.

Various legal agreements explicitly define ownership and operational aspects within a business. The specific agreement used depends heavily on the business structure and the transaction involved. These agreements often contain clauses that Artikel the distribution of profits, decision-making processes, and dispute resolution mechanisms, all of which contribute to a complete picture of ownership.

Purchase Agreements

Purchase agreements are legally binding contracts used when one entity acquires ownership of a business from another. These agreements detail the terms of the sale, including the purchase price, assets being transferred, and any liabilities assumed by the buyer. Crucially, they explicitly state the transfer of ownership from the seller to the buyer. A typical clause might state: “Upon receipt of the full purchase price, Seller hereby irrevocably transfers all right, title, and interest in the Business to Buyer.” The agreement would also typically include provisions regarding warranties and representations by the seller, ensuring the business is sold as described. Failure to comply with the terms Artikeld in the purchase agreement can lead to legal action.

Shareholder Agreements

Incorporations, particularly those structured as corporations or limited liability companies (LLCs), utilize shareholder agreements to define the rights and responsibilities of each shareholder. These agreements often Artikel voting rights, dividend distribution, and procedures for transferring shares. A key clause might detail the process for selling shares, stating: “No shareholder shall transfer their shares without first offering them to the other shareholders at a predetermined price.” This protects existing shareholders and maintains control within the company. Shareholder agreements provide a clear legal framework for ownership and operational decisions, particularly in situations with multiple owners. Disputes among shareholders are often resolved by referencing the terms detailed within this agreement.

Operating Agreements

Operating agreements are particularly relevant for LLCs. They Artikel the internal management structure, profit and loss distribution, and member responsibilities. Similar to shareholder agreements, these agreements establish the framework for ownership and operational control. A crucial clause might define member contributions and their corresponding ownership percentages: “Member A contributes $50,000 and holds a 50% ownership interest; Member B contributes $50,000 and holds a 50% ownership interest.” This clarifies the proportional ownership based on initial investment. The operating agreement also frequently includes provisions for the admission and withdrawal of members, outlining the process and implications for ownership.

Comparative Legal Weight

The legal weight of these agreements varies depending on their specificity, adherence to legal requirements, and the jurisdiction in which the business operates. Generally, contracts that are meticulously drafted, witnessed, and properly executed carry more legal weight. A well-drafted purchase agreement, for instance, providing detailed descriptions of assets and liabilities, will be stronger evidence of ownership than a less formal agreement. However, even seemingly less formal agreements can still hold significant legal weight, especially if they are supported by other evidence of ownership. Courts will consider the totality of the circumstances when determining the validity and legal weight of any ownership claim.

Intellectual Property Rights

Intellectual property (IP) rights represent a crucial aspect of business ownership, particularly for companies reliant on innovation and creativity. These intangible assets, unlike physical property, require specific documentation to establish and protect ownership. Patents, trademarks, and copyrights are the primary legal instruments used to demonstrate ownership and control over these valuable business assets.

Protecting and proving ownership of intellectual property is critical for several reasons. It safeguards against infringement, allowing businesses to exploit the commercial value of their creations. Furthermore, well-documented IP rights can enhance a company’s valuation and attractiveness to investors. This section explores how patents, trademarks, and copyrights serve as evidence of ownership and the legal ramifications of inadequate IP protection.

Patents as Proof of Ownership

A patent grants the inventor exclusive rights to use, sell, and manufacture their invention for a specific period. This exclusive right is a powerful form of ownership, legally protecting the invention from unauthorized use. For example, a pharmaceutical company holding a patent on a novel drug can prevent competitors from manufacturing and selling a generic version for the duration of the patent’s term. The patent document itself, along with any associated filings and legal decisions, serves as definitive proof of ownership and the scope of that ownership. Failure to obtain a patent leaves the invention vulnerable to copying and exploitation by others, potentially leading to significant financial losses.

Trademarks as Indicators of Brand Ownership

Trademarks protect brand names, logos, and other identifying features associated with a business. Registration of a trademark with the relevant authority establishes legal ownership and provides the exclusive right to use the mark in connection with specific goods or services. For instance, the iconic Apple logo is a registered trademark, protecting Apple Inc.’s brand identity and preventing others from using a confusingly similar logo. The trademark registration certificate acts as official proof of ownership, enabling the brand owner to take legal action against infringers. Without proper trademark registration, a business risks losing control of its brand identity, potentially leading to customer confusion and brand dilution.

Copyrights and the Protection of Creative Works

Copyrights protect original works of authorship, including literary, dramatic, musical, and artistic works. Registration of a copyright provides legal evidence of ownership and the date of creation. For example, a software company registering its source code protects its intellectual property from unauthorized copying and distribution. The copyright registration certificate and any associated documentation demonstrate ownership. Failure to register a copyright does not negate the existence of copyright protection (copyright protection exists automatically upon creation), but it significantly weakens the ability to enforce those rights in court and can impact the potential for damages awarded in infringement cases. The lack of formal registration makes proving ownership and damages considerably more challenging.

Bank and Financial Institution Records

Bank and financial institution records offer compelling evidence of business ownership by demonstrating financial control and activity associated with the business. These records provide a verifiable audit trail of transactions, lending credence to claims of ownership and management. The consistent use of business accounts for all financial dealings further strengthens the link between the individual and the business.

Bank statements, loan agreements, and other financial documents act as a crucial piece of the ownership puzzle, especially when combined with other forms of evidence. By meticulously tracking financial transactions related to the business, these records paint a clear picture of the individual’s or entity’s financial involvement and control over the business’s assets. This level of financial engagement is a strong indicator of ownership, particularly when coupled with other legal and registration documents.

Financial Records Demonstrating Business Ownership

A range of financial records can solidify claims of business ownership. These records provide a detailed history of financial activity, lending credibility to the asserted ownership. The consistency and comprehensiveness of these records are vital in establishing a strong case for ownership.

- Bank Statements: Regular bank statements showing consistent deposits and withdrawals related to business operations, clearly linked to the business’s name and tax identification number, are strong evidence of financial control. For example, statements demonstrating regular payments to suppliers, employees, and receipts from customers directly into a business account.

- Loan Agreements: Loan agreements secured against business assets, with the business owner listed as the borrower, unequivocally establish a connection between the individual and the business’s financial well-being. The agreement details the terms of the loan, the collateral used, and the borrower’s responsibility for repayment, all of which point to ownership.

- Credit Card Statements: Business credit card statements showing purchases and payments directly related to business operations can serve as supplementary evidence of financial involvement. This is particularly helpful when coupled with other documentation, such as invoices or receipts.

- Investment Records: Documentation of investments made into the business, such as capital contributions or equity investments, directly link the investor to the business’s ownership structure. This could include capital contribution agreements or equity investment agreements.

- Payroll Records: Payroll records demonstrating the payment of employee salaries and wages from the business account directly link the owner to the operational aspects of the business. These records also reflect the owner’s responsibility for compliance with employment laws.

Tax Documents and Returns: What Documents Prove Ownership Of A Business

Tax documents, specifically tax returns, serve as compelling evidence of business ownership and financial control. Their detailed nature provides a verifiable record of the business’s financial activities, directly linking individuals or entities to the business’s operations and profits. This information is crucial in establishing ownership claims, particularly in disputes or legal proceedings.

Tax returns, whether corporate, partnership, or individual, reflect the financial performance of the business and the distribution of profits. This information can corroborate ownership claims by demonstrating the financial stake held by individuals or entities. The consistency and accuracy of the information presented across various tax years strengthen the validity of the ownership claim.

Corporate Tax Return Information Indicative of Ownership

Corporate tax returns (Form 1120 in the US, for example) contain crucial information that validates business ownership. The return identifies the corporation’s name and address, its tax identification number (EIN), and the names and addresses of its officers and directors. The ownership structure is often reflected in the shareholder information, indicating the percentage of ownership held by each individual or entity. Furthermore, the profit and loss statement within the return shows the financial performance of the business, providing evidence of the financial benefits accruing to the claimed owners. Discrepancies between the stated ownership on the return and external claims of ownership could indicate fraud or inaccurate reporting. For instance, if a tax return lists only one shareholder, but a separate document claims multiple owners with significant equity, this discrepancy would require further investigation.

Partnership Tax Return Information and Ownership Verification, What documents prove ownership of a business

Partnership tax returns (Form 1065 in the US) similarly offer evidence of ownership. These returns clearly identify the partners, their respective addresses, and their allocated share of the partnership’s income, losses, and credits. The allocation of profits and losses directly reflects the ownership structure and provides verifiable evidence of each partner’s financial stake. Any significant deviation between the profit allocation Artikeld in the tax return and the ownership claims presented externally would raise serious questions about the accuracy of the ownership claims. For example, if a partner claims a 50% ownership stake but the tax return allocates them only 20% of the profits, this discrepancy would need to be resolved to confirm the true ownership structure.

Implications of Discrepancies Between Tax Documents and Ownership Claims

Discrepancies between the information presented in tax documents and claims of business ownership can have serious implications. Such discrepancies may lead to legal challenges, questioning the legitimacy of ownership claims. This could result in legal disputes, tax audits, and even criminal investigations, depending on the nature and severity of the discrepancies. In the case of a business sale, for example, discrepancies could invalidate the sale agreement, leading to significant financial and legal ramifications for all parties involved. In cases of fraud or misrepresentation, penalties could include substantial fines and even imprisonment. Therefore, maintaining consistency and accuracy in all ownership documentation, including tax returns, is paramount.