What is a business broker? They’re the unsung heroes of the business world, facilitating the often-complex transactions that see companies change hands. These skilled professionals act as intermediaries, guiding both buyers and sellers through the intricate process of business acquisition and divestiture, ensuring a smooth and profitable outcome. Their expertise encompasses far more than simply connecting parties; it involves meticulous valuation, strategic marketing, and shrewd negotiation, all while navigating the legal and regulatory landscape.

Business brokers handle everything from identifying potential buyers and sellers to conducting due diligence and overseeing the final closing. Their deep understanding of market trends, financial analysis, and legal requirements allows them to effectively manage the numerous complexities involved in selling or buying a business, minimizing risk and maximizing returns for their clients. They often specialize in specific industries or business sizes, providing a tailored approach that caters to unique needs.

Defining a Business Broker

Business brokers act as intermediaries, facilitating the sale or acquisition of businesses. They possess a deep understanding of business valuation, marketing strategies, and negotiation tactics, enabling them to navigate the complexities of business transactions efficiently and effectively. Their role extends beyond simply connecting buyers and sellers; they provide crucial support throughout the entire process, ensuring a smooth and successful transfer of ownership.

A business broker’s core function is to streamline the sale or purchase of a business. This involves a multifaceted approach encompassing various crucial services. They begin by conducting a thorough valuation of the business, taking into account factors such as revenue, assets, liabilities, and market conditions. This valuation serves as the foundation for pricing the business and attracting potential buyers. Subsequently, they develop and implement a comprehensive marketing strategy to reach a targeted pool of potential buyers, often utilizing both online and offline channels. Finally, they expertly manage negotiations between the buyer and seller, ensuring a fair and mutually beneficial outcome. Their expertise helps to avoid common pitfalls and delays, ultimately leading to a successful transaction.

Services Offered by Business Brokers

Business brokers offer a comprehensive suite of services designed to support all stages of a business transaction. These services typically include a detailed business valuation, which determines the fair market value of the business based on various financial and operational factors. They then create a compelling marketing package showcasing the business’s strengths and potential, often including professionally produced brochures, virtual tours, and online listings. Beyond marketing, brokers manage all aspects of the negotiation process, advocating for their clients’ best interests and ensuring a smooth and efficient transaction. They also provide guidance on legal and financial matters, often coordinating with lawyers, accountants, and other professionals to ensure a seamless transition of ownership. Finally, they assist with the due diligence process, facilitating the review of financial records and other relevant documentation by both the buyer and the seller.

Comparison with Other Professionals

While business brokers share some similarities with other professionals involved in business sales, their roles are distinct. Real estate agents, for example, focus primarily on the sale of physical properties, while business brokers handle the sale of entire businesses, including intangible assets like goodwill, intellectual property, and client lists. Investment bankers, on the other hand, typically deal with larger transactions, often involving mergers and acquisitions of publicly traded companies. Business brokers cater to a broader range of businesses, from small, privately held firms to larger enterprises. Their focus is on the operational aspects of the business and the seamless transfer of ownership, unlike investment bankers who are often more concerned with financial engineering and strategic positioning.

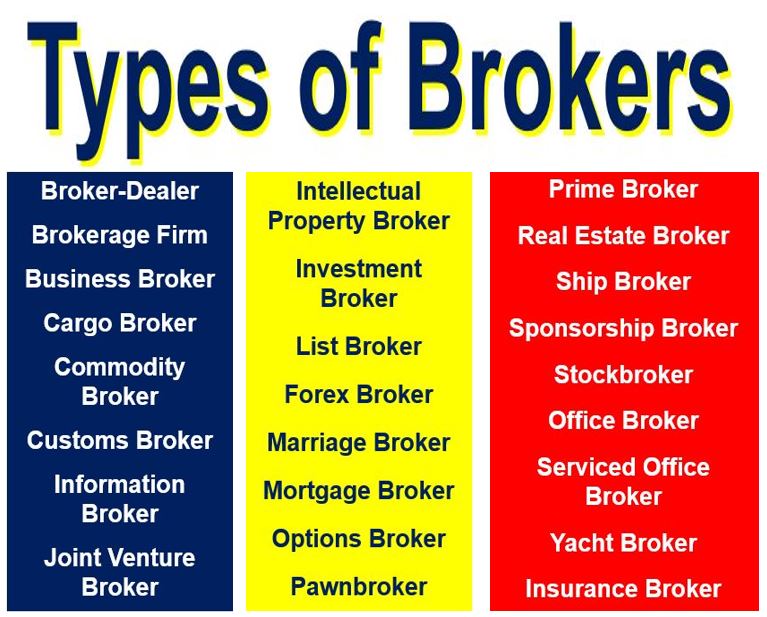

Types of Business Brokers

The following table illustrates the diverse specializations within the business brokerage industry. Brokers may focus on specific industries, business sizes, or transaction types, offering tailored expertise to their clients.

| Broker Type | Specialization | Typical Business Size | Transaction Focus |

|---|---|---|---|

| Restaurant Broker | Restaurants, cafes, bars | Small to medium-sized | Asset sales, franchise transfers |

| Manufacturing Broker | Manufacturing companies | Medium to large-sized | Asset sales, mergers and acquisitions |

| Retail Broker | Retail businesses | Small to large-sized | Asset sales, franchise transfers, leasehold sales |

| Franchise Broker | Franchise businesses | Small to medium-sized | Franchise resales, franchise development |

The Business Brokerage Process: What Is A Business Broker

Selling a business is a complex undertaking, requiring specialized knowledge and expertise. A business broker acts as an intermediary, guiding both the seller and buyer through the intricate process, ensuring a smooth and successful transaction. This section details the typical steps involved in the business brokerage process.

The business brokerage process is a multifaceted journey, typically involving several distinct stages. Each stage requires careful planning, meticulous execution, and effective communication between the broker, seller, and potential buyers. The ultimate goal is to maximize the sale price while minimizing the time and effort required by the seller.

Initial Consultation and Business Valuation

This initial phase involves a thorough assessment of the business. The broker meets with the seller to understand their goals, gather financial information, analyze market conditions, and perform a comprehensive business valuation. This valuation considers factors such as revenue, profitability, assets, liabilities, and market comparables. Discrepancies in valuation expectations between the seller and the broker are addressed at this early stage through transparent communication and realistic goal setting. For instance, if the seller’s expectations are overly optimistic compared to market data, the broker will present a detailed comparative market analysis (CMA) showcasing similar businesses sold recently to establish a reasonable asking price.

Marketing and Advertising the Business

Once the valuation is complete and the asking price is agreed upon, the broker develops a comprehensive marketing strategy to attract potential buyers. This may involve creating a detailed confidential business profile, listing the business on online marketplaces, networking with potential investors, and utilizing targeted advertising campaigns. A crucial aspect is presenting the business in the most attractive light, highlighting its strengths and addressing any weaknesses proactively and honestly. For example, a struggling aspect of the business might be reframed as an opportunity for improvement with the right investment and management.

Buyer Qualification and Due Diligence

The broker screens potential buyers, verifying their financial capabilities and seriousness of intent. Once suitable buyers are identified, the broker facilitates the due diligence process. This involves providing buyers with access to financial records, legal documents, and other relevant information about the business. Challenges might arise if buyers request information deemed confidential by the seller; in such cases, the broker mediates, ensuring transparency while protecting sensitive data. A common challenge is buyers requesting extensions to the due diligence period; the broker negotiates an acceptable timeframe, balancing the buyer’s needs with the seller’s desire for a timely closing.

Negotiation and Offer Management

The broker manages all negotiations between the buyer and seller, ensuring a fair and equitable outcome for both parties. This includes handling offers, counteroffers, and addressing any disagreements. A skilled broker navigates complex negotiations, ensuring that all terms and conditions are clearly defined and documented. For instance, if a buyer makes a lowball offer, the broker will leverage market data and the business’s strengths to justify a higher price, ultimately aiming for a mutually acceptable agreement.

Closing the Deal

Once the terms of the sale are agreed upon, the broker facilitates the closing process. This involves coordinating with lawyers, accountants, and other professionals to ensure a smooth and legal transaction. Common challenges during closing include unforeseen issues discovered during final inspections or last-minute changes to the agreement. The broker’s experience and expertise are vital in resolving such issues quickly and efficiently, ensuring a successful closing. For example, a last-minute discrepancy in inventory count might necessitate a price adjustment or a renegotiation of the terms; the broker would navigate this situation to protect the interests of both parties.

Flowchart of the Business Brokerage Process

A simplified flowchart would depict the process as follows:

[Imagine a flowchart here. The boxes would be: 1. Initial Consultation & Valuation; 2. Marketing & Advertising; 3. Buyer Qualification & Due Diligence; 4. Negotiation & Offer Management; 5. Closing the Deal. Arrows would connect each box, indicating the sequential nature of the process.]

Business Valuation Methods

Accurately determining a business’s worth is crucial for successful transactions. Business valuation isn’t an exact science; it’s an art informed by various methods, each with its strengths and weaknesses. The chosen approach depends heavily on the specific business, its industry, and the purpose of the valuation (e.g., sale, merger, financing). Several key factors influence the final valuation, requiring a nuanced understanding of the business’s financial health and market position.

Several methods exist for valuing a business, each offering a unique perspective on its worth. These methods often provide different valuations, highlighting the importance of considering multiple approaches to arrive at a comprehensive and defensible figure. The selection of appropriate methods depends significantly on the type of business, the availability of financial data, and the overall goals of the valuation process.

Asset-Based Valuation

Asset-based valuation focuses on the net asset value of a business. This method sums the fair market value of a company’s assets (tangible and intangible) and subtracts its liabilities. Tangible assets include things like real estate, equipment, and inventory, while intangible assets encompass brand recognition, intellectual property, and customer relationships. This approach is particularly useful for asset-heavy businesses, such as manufacturing companies or real estate firms, where the value is largely tied to the physical assets. However, it often undervalues businesses with significant intangible assets or strong future earning potential. For instance, a tech startup with minimal physical assets but high growth potential might be significantly undervalued using this method.

Income-Based Valuation

Income-based valuation methods focus on the future earnings potential of the business. The most common approach is Discounted Cash Flow (DCF) analysis, which estimates the present value of future cash flows, discounted to account for the time value of money. Other income-based methods include capitalization of earnings, where a multiple of the business’s average earnings is used to estimate its value. This method is suitable for established businesses with a stable earnings history. However, it requires careful forecasting of future earnings, which can be challenging, particularly for businesses operating in volatile markets. A successful restaurant chain, for example, would be well-suited for income-based valuation due to its predictable cash flows.

Market-Based Valuation

Market-based valuation compares the subject business to similar businesses that have recently been sold. This involves identifying comparable companies, analyzing their transactions, and applying relevant multiples (such as price-to-earnings or price-to-sales ratios) to estimate the value of the subject business. This approach relies on the availability of comparable transactions and the accuracy of the market data. It’s particularly useful for businesses in established industries with readily available market data. However, finding truly comparable businesses can be difficult, and the chosen multiples can significantly impact the valuation. For example, a small bakery might be valued using comparable sales of similar bakeries in the same region.

Factors Influencing Business Valuation

Profitability, asset value, and market conditions are key factors. Profitability, reflected in metrics like net income and cash flow, directly impacts the value of a business. Higher profitability generally leads to higher valuations. The value of a business’s assets, both tangible and intangible, also plays a significant role. Finally, prevailing market conditions, including economic growth, interest rates, and industry trends, can significantly influence the value of a business. A business in a booming industry will generally command a higher valuation than one in a declining industry.

| Valuation Method | Description | Strengths | Weaknesses |

|---|---|---|---|

| Asset-Based | Net asset value (assets – liabilities) | Objective, straightforward for asset-heavy businesses | Ignores future earnings potential, undervalues intangible assets |

| Income-Based (DCF) | Present value of future cash flows | Considers future earnings potential | Relies on forecasting, sensitive to discount rate assumptions |

| Income-Based (Capitalization of Earnings) | Multiple of average earnings | Simple, uses readily available data | Relies on historical data, ignores future growth |

| Market-Based | Comparison to similar transactions | Reflects market realities | Finding comparable businesses can be challenging, sensitive to market fluctuations |

Legal and Regulatory Aspects

Business brokerage, while seemingly straightforward, operates within a complex legal and regulatory framework. Understanding and adhering to these regulations is crucial for both the broker and the clients involved, ensuring smooth transactions and avoiding potential legal disputes. Non-compliance can lead to significant financial penalties, reputational damage, and even criminal charges.

The business brokerage process involves numerous legal considerations, impacting various stages from initial valuation to final sale. Brokers must be knowledgeable about relevant laws and regulations to protect themselves and their clients. This includes understanding contract law, property law, securities law, and tax law, as these all intersect in business sales. Furthermore, brokers often act as intermediaries, requiring a deep understanding of agency law and fiduciary responsibilities.

Applicable Laws and Regulations

A wide range of laws and regulations govern business brokerage activities, varying by jurisdiction. These often include licensing requirements for brokers, regulations concerning disclosures and representations in sales materials, and specific rules regarding the handling of confidential information. For example, in some jurisdictions, brokers must be licensed real estate agents if they’re dealing with the sale of commercial real estate alongside the business. Failure to comply with these regulations can result in significant fines and the suspension or revocation of a broker’s license. Brokers need to stay updated on changes in these regulations to maintain compliance.

The Role of Legal Professionals

Legal professionals play a vital role in business transactions facilitated by brokers. Attorneys provide critical legal advice to both buyers and sellers, reviewing contracts, ensuring compliance with relevant laws, and addressing any potential legal issues. They can help negotiate favorable terms, identify and mitigate risks, and represent clients in legal disputes if necessary. The broker’s role is to facilitate the transaction, while the lawyer ensures the transaction is legally sound and protects their client’s interests. This division of labor is crucial for a successful and legally compliant business sale.

Common Legal Issues in Business Sales

Several common legal issues can arise during the business sale process. These include disputes over the accuracy of financial statements, disagreements regarding the valuation of assets, breaches of contract, and intellectual property rights issues. For instance, a buyer might discover undisclosed liabilities after the sale is completed, leading to legal action against the seller and potentially the broker. Similarly, disputes over the ownership or licensing of key intellectual property assets are common and can significantly delay or derail a transaction. Proactive legal counsel and thorough due diligence are essential to minimize these risks.

Finding and Working with a Business Broker

Finding the right business broker is crucial for a smooth and successful business sale or acquisition. A skilled broker possesses the expertise to navigate the complexities of the transaction, maximizing your return while minimizing potential risks. Choosing wisely can significantly impact the outcome of your deal.

Selecting a business broker requires careful consideration of several key factors. The process involves more than simply finding someone who advertises their services; it necessitates a thorough evaluation to ensure a good fit and alignment of interests.

Broker Qualifications and Experience, What is a business broker

A reputable business broker will possess extensive experience in the specific industry sector relevant to your business. This experience translates to a deeper understanding of market dynamics, valuation methodologies, and potential buyer profiles. Look for brokers with a proven track record of successful transactions, ideally within your industry niche. Years of experience alone aren’t sufficient; demonstrated success is key. A broker’s specialization can significantly affect the outcome, especially in complex industries with unique regulatory environments. For instance, a broker specializing in technology businesses will possess a different skillset than one focused on restaurants.

Broker Reputation and References

Thorough due diligence is essential. Check online reviews and testimonials from previous clients to gauge the broker’s reputation. Contacting previous clients directly to discuss their experiences can provide invaluable insights. Look for consistent positive feedback regarding communication, negotiation skills, and overall professionalism. A broker with a strong reputation will have a network of contacts within the industry, facilitating a wider reach to potential buyers. Negative reviews, particularly regarding ethical conduct or lack of responsiveness, should raise significant concerns.

Broker Fees and Compensation Structure

Understanding the broker’s fee structure is critical. Fees typically range from a percentage of the final sale price, often dependent on the complexity of the transaction and the broker’s involvement. Clarify all fees upfront, including any additional charges for marketing, due diligence, or legal support. Transparency regarding compensation is crucial to avoid unexpected costs later in the process. Compare fee structures from different brokers to ensure you are receiving competitive pricing for the services offered. Negotiating fees is possible, particularly when working with multiple brokers.

Negotiating a Brokerage Contract

The brokerage contract Artikels the terms and conditions of the agreement, including fees, responsibilities, and timelines. Carefully review all clauses before signing. Ensure the contract clearly defines the broker’s responsibilities, the scope of services, and the payment schedule. Negotiate favorable terms, such as specific deadlines or clauses protecting your interests. Seek legal counsel to review the contract before signing to ensure your rights and interests are protected. A well-negotiated contract can prevent future disputes and protect your interests throughout the transaction.

Questions to Ask Potential Business Brokers

Before engaging a business broker, a comprehensive list of questions should be prepared to assess their suitability and experience. This proactive approach ensures a smooth and efficient process.

- How many years of experience do you have in my industry sector?

- Can you provide references from past clients?

- What is your fee structure, and are there any additional charges?

- What is your marketing strategy for selling my business?

- What is your process for identifying and qualifying potential buyers?

- What is your experience with similar business valuations?

- What legal and regulatory aspects are you familiar with in this type of transaction?

- What is your contingency plan if the sale falls through?

- How will you maintain confidentiality throughout the process?

- What is your estimated timeline for completing the sale?

Illustrative Examples of Successful Business Brokerage

Business brokers play a crucial role in facilitating smooth and profitable business transactions. Their expertise in valuation, negotiation, and legal compliance significantly impacts the success of sales and acquisitions. The following examples highlight how a skilled broker can navigate complex situations and achieve favorable outcomes for both buyers and sellers.

Successful Navigation of a Complex Transaction: The Case of “Green Thumb Gardens”

Green Thumb Gardens, a thriving organic vegetable farm, faced a unique challenge during its sale. The farm’s value was significantly tied to its long-term lease agreement on the land, which was set to expire within five years. Furthermore, the seller, a retiring couple, desired a structured payment plan to minimize their immediate tax burden. A skilled business broker recognized these complexities and developed a multi-faceted strategy. First, they conducted a thorough valuation that considered the lease’s remaining term and the potential for renewal or relocation. Second, they negotiated an agreement with the buyer, a larger agricultural conglomerate, that included a contingency plan for lease renewal or land acquisition. Finally, they structured the payment plan to accommodate the seller’s tax concerns, involving a combination of upfront payment and deferred installments secured by the farm’s assets. The broker’s ability to address both the financial and legal aspects of the transaction resulted in a successful sale that satisfied both parties. The challenges were significant—the uncertain lease and the seller’s tax situation—but the broker’s expertise provided solutions that secured a positive outcome.

Hypothetical Business Sale: “Tech Solutions Inc.”

Tech Solutions Inc., a small software development company specializing in mobile applications, was put up for sale by its founder, Sarah Miller, who wished to retire. The company had a strong client base and a proven track record of profitability. The buyer was “GlobalTech,” a larger technology firm looking to expand its mobile app development capabilities. The business broker involved in the transaction first conducted a comprehensive valuation of Tech Solutions Inc., considering its revenue, profitability, assets, and intellectual property. They then prepared a detailed marketing package highlighting the company’s strengths and growth potential. The broker facilitated negotiations between Sarah Miller and GlobalTech, ensuring fair market value was achieved and all legal and financial aspects were addressed, including due diligence, contract drafting, and closing procedures. The broker also assisted with the transition of clients and employees, ensuring a smooth handover. The successful sale resulted in a mutually beneficial agreement, with Sarah receiving a fair price for her business and GlobalTech acquiring a valuable asset. The broker’s expertise in valuation, negotiation, and transition management was instrumental in the deal’s success. The impact of the broker’s skills ensured a transparent and efficient process, minimizing potential risks and maximizing the outcome for both parties.

Impact of Broker Expertise on Transaction Success

The successful completion of business sales relies heavily on the expertise of a qualified business broker. Their skills in valuation, negotiation, marketing, and legal compliance significantly reduce risks and increase the likelihood of a smooth and profitable transaction. In both the “Green Thumb Gardens” and “Tech Solutions Inc.” examples, the broker’s ability to anticipate and address potential challenges, structure the deal to meet the specific needs of both buyer and seller, and navigate complex legal and financial aspects proved crucial. A skilled broker’s contribution extends beyond simply finding a buyer; they act as a trusted advisor, guiding clients through every step of the process and ensuring a positive outcome.