What is a business formation document? It’s the crucial legal paperwork that brings your business idea to life, officially establishing its existence and defining its structure. Understanding these documents is paramount, whether you’re launching a sole proprietorship, partnership, LLC, or corporation. Each business structure requires specific documentation, outlining ownership, responsibilities, and operational guidelines. This guide will demystify the process, providing clarity on the types of documents, their key elements, and the legal implications of each.

From articles of incorporation to operating agreements and partnership agreements, we’ll explore the nuances of each document type, highlighting essential components like liability clauses, ownership percentages, and governance structures. We’ll also delve into the step-by-step formation process, outlining the documents required at each stage and the role of legal professionals in ensuring compliance. Ultimately, mastering business formation documents is key to building a legally sound and sustainable enterprise.

Defining Business Formation Documents

Business formation documents are the foundational legal paperwork that establishes a business entity’s existence and Artikels its operational structure. These documents are crucial for defining the relationship between the business and its owners, setting out the rules of operation, and determining liability and taxation. Understanding these documents is essential for any entrepreneur seeking to launch and legally operate a business.

Business formation documents are the legal instruments used to create and formally register a business entity with the relevant governmental authorities. They define the legal structure of the business, the rights and responsibilities of its owners, and the rules governing its operations. These documents serve as the blueprint for the business, dictating how it will function and interact with the outside world.

Types of Business Formation Documents

The specific documents required vary significantly depending on the chosen business structure. Each structure necessitates a unique set of paperwork to ensure compliance with relevant laws and regulations. Failure to properly file these documents can lead to legal complications and potential liabilities.

Business Formation Documents by Structure

The differences in formation documents are directly related to the legal implications of each business structure. A sole proprietorship, for instance, has significantly simpler requirements than a corporation. This complexity stems from the increased legal protections and operational structures inherent in more complex business models.

- Sole Proprietorship: Typically requires minimal documentation. The business owner may simply need to obtain the necessary licenses and permits to operate legally. No formal formation document is usually required, though registration with the relevant tax authorities is essential.

- Partnership: Requires a partnership agreement, which Artikels the responsibilities, contributions, and profit-sharing arrangements between partners. This agreement, while not always legally mandated, is strongly recommended to avoid future disputes.

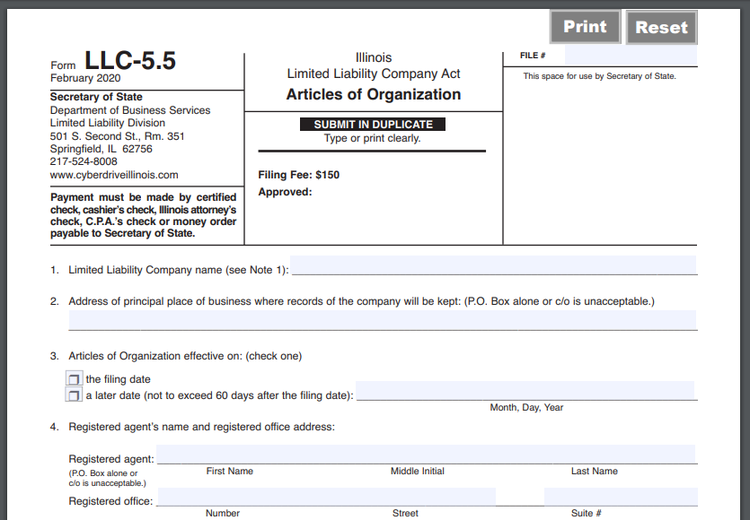

- Limited Liability Company (LLC): Requires filing articles of organization with the relevant state agency. These articles typically include the LLC’s name, registered agent, and purpose. Many states also require an operating agreement, which details the internal management structure and operational guidelines.

- Corporation (S Corp or C Corp): Requires filing articles of incorporation with the state. This document contains details about the corporation’s name, purpose, registered agent, and initial directors. Corporations also typically have bylaws that Artikel the rules for internal governance and shareholder meetings.

Key Elements of Business Formation Documents

Business formation documents are the cornerstone of any legal entity. These documents define the structure, ownership, and operational parameters of a business, shaping its legal standing and influencing its future trajectory. Understanding their key components is crucial for both entrepreneurs establishing new ventures and existing businesses undergoing restructuring.

The specific elements included vary depending on the chosen business structure (sole proprietorship, partnership, LLC, corporation, etc.), but certain core components are almost universally present. These elements not only establish the legal framework but also significantly impact liability, taxation, and operational flexibility.

Articles of Incorporation/Organization

Articles of Incorporation (for corporations) and Articles of Organization (for LLCs) are foundational documents. They Artikel the basic details of the business, including its name, registered address, purpose, and the names and addresses of its initial directors or members. The legal significance lies in their formal establishment of the entity as a separate legal person, distinct from its owners. This separation limits the personal liability of owners for business debts, a crucial element for risk mitigation. For instance, a corporation’s articles of incorporation will specify the number of authorized shares, while an LLC’s articles of organization will detail its management structure (member-managed or manager-managed).

Operating Agreement (for LLCs)

Unlike corporations, LLCs typically have an operating agreement. This internal document governs the day-to-day operations of the business, outlining the members’ rights and responsibilities, profit and loss allocation, decision-making processes, and procedures for admitting or removing members. Its legal significance lies in providing a framework for internal governance and conflict resolution, often preventing disputes and providing a roadmap for the LLC’s activities. A well-drafted operating agreement can significantly impact the LLC’s longevity and stability. For example, it might stipulate voting rights based on capital contributions or operational roles.

Bylaws (for Corporations)

Corporations rely on bylaws to define internal rules and procedures. These documents Artikel the responsibilities of the board of directors, shareholder meetings, election of officers, and other internal governance matters. Their legal significance is similar to that of an operating agreement, providing a framework for internal order and resolving potential conflicts. The bylaws ensure consistency and transparency in corporate governance, protecting the interests of shareholders and the corporation itself. For example, bylaws might Artikel the process for amending the corporation’s articles of incorporation.

Shareholder Agreements (for Corporations)

Shareholder agreements are private contracts among shareholders, establishing their respective rights and obligations regarding ownership, voting, dividends, and other matters not explicitly covered in the articles of incorporation or bylaws. These agreements often provide additional protection for minority shareholders, ensuring their interests are adequately represented in the corporation’s governance. The legal significance lies in their ability to tailor the relationship between shareholders beyond the basic corporate framework, providing flexibility and clarity regarding shareholder relationships. For instance, a shareholder agreement could define a buy-sell agreement outlining procedures for transferring shares upon a shareholder’s death or departure.

| Element Name | Description | Legal Significance | Example |

|---|---|---|---|

| Articles of Incorporation/Organization | Foundational document establishing the entity. | Creates a separate legal entity, limiting personal liability. | Specifies the corporation’s authorized shares or LLC’s management structure. |

| Operating Agreement (LLCs) | Governs internal operations, member rights, and responsibilities. | Provides a framework for internal governance and conflict resolution. | Artikels profit and loss sharing, decision-making processes, and member admission/removal. |

| Bylaws (Corporations) | Defines internal rules and procedures for corporate governance. | Ensures consistent and transparent corporate governance. | Specifies the responsibilities of the board of directors and procedures for shareholder meetings. |

| Shareholder Agreements (Corporations) | Contract among shareholders defining their rights and obligations. | Provides additional protection for minority shareholders and flexibility beyond basic corporate structure. | Defines buy-sell agreements or voting rights. |

The Formation Process

Forming a business involves a series of crucial steps, each requiring specific documentation. The complexity of these steps and the associated documents varies significantly depending on the chosen business structure (sole proprietorship, partnership, LLC, corporation, etc.). Understanding this process is vital for ensuring legal compliance and setting a strong foundation for your business.

The formation process typically involves several key stages, each with its own set of necessary documents. Navigating this process efficiently requires careful planning and, often, the assistance of legal professionals. The following sections detail the steps involved, the relevant documents, and the role of legal expertise.

Steps in Business Formation

The steps involved in forming a business are sequential and interconnected. Failure to complete one step correctly can impact subsequent stages and potentially lead to legal complications. Therefore, a methodical approach is crucial.

- Business Plan Development: Before formal registration, a comprehensive business plan outlining the business’s goals, strategies, market analysis, and financial projections is essential. This document isn’t a legal requirement for registration but is crucial for securing funding and guiding the business’s trajectory.

- Choosing a Business Structure: Selecting the appropriate legal structure (sole proprietorship, partnership, LLC, S-corp, C-corp) is a foundational step. This choice significantly impacts liability, taxation, and administrative requirements. Consider consulting with a legal or tax professional to determine the optimal structure for your circumstances.

- Name Registration and Availability Check: The chosen business name must be checked for availability and then registered with the relevant authorities (state or federal, depending on the structure and scope of operations). This often involves filing a “Statement of Intent” or similar document.

- Registering the Business: This step involves filing the necessary formation documents with the relevant state agency. For example, LLCs require filing Articles of Organization, while corporations require filing Articles of Incorporation. This process varies significantly depending on the chosen business structure and the state’s regulations.

- Obtaining Necessary Licenses and Permits: Depending on the industry and location, businesses may need various licenses and permits to operate legally. These can range from general business licenses to industry-specific permits (e.g., food handling permits, contractor licenses).

- Opening a Business Bank Account: Separating personal and business finances is crucial for liability protection and financial clarity. Opening a dedicated business bank account is a standard practice.

Illustrative Flowchart of the Business Formation Process

A visual representation can clarify the sequential nature of business formation. The flowchart below illustrates the typical progression, though specific steps and documents might vary based on the business structure and location.

Imagine a flowchart starting with “Business Idea” at the top. This flows down to “Develop Business Plan,” then branches to “Choose Business Structure” leading to parallel paths for each structure (Sole Proprietorship, Partnership, LLC, Corporation). Each path then leads to “Register Business Name,” followed by “Register Business” (with specific documents listed under each structure path, like “Articles of Organization” for LLCs and “Articles of Incorporation” for corporations). Next, all paths converge to “Obtain Licenses and Permits,” followed by “Open Business Bank Account,” and finally ending with “Begin Operations.”

The Role of Legal Professionals

Legal professionals, such as attorneys specializing in business law, play a vital role in the business formation process. Their expertise ensures compliance with all relevant laws and regulations, minimizing the risk of legal issues.

Legal professionals assist in choosing the optimal business structure, drafting and filing the necessary documents, securing the necessary licenses and permits, and addressing any legal complexities that may arise during the formation process. Their involvement reduces the risk of costly mistakes and ensures a smooth and legally sound start for the business.

Impact of Business Structure on Documents and Procedures

The chosen business structure significantly influences the required documents and procedures. Each structure has unique legal and regulatory requirements.

- Sole Proprietorship: Relatively simple to form, requiring minimal documentation. Often only necessitates obtaining the necessary business licenses and permits.

- Partnership: Requires a partnership agreement outlining the responsibilities, contributions, and profit-sharing arrangements between partners. This agreement is crucial for managing internal relationships and avoiding future disputes. Partnerships may also need to register with the state, depending on local regulations.

- Limited Liability Company (LLC): Requires filing Articles of Organization with the state. An operating agreement is recommended, though not always legally mandated, to define the management structure and member responsibilities.

- Corporation (S-Corp or C-Corp): Involves more complex procedures, including filing Articles of Incorporation, bylaws, and potentially other documents depending on the state. Corporations have more stringent regulatory requirements.

Different Business Structures and Their Formation Documents: What Is A Business Formation Document

Choosing the right business structure significantly impacts legal and financial obligations. Understanding the formation documents required for each structure is crucial for compliance and operational efficiency. This section Artikels the key documents needed for various business structures, emphasizing the variations in complexity and requirements.

Sole Proprietorships and Their Formation Documents, What is a business formation document

Sole proprietorships, the simplest form of business, are generally not required to file extensive formation documents with the state. The business is considered a direct extension of the owner. However, certain documents are essential for operational and legal purposes.

The importance of maintaining accurate records cannot be overstated, as these serve as proof of business transactions and ownership. Furthermore, these documents are crucial in case of legal disputes or tax audits.

- Business License: Obtained from local and/or state government, depending on the business activity and location.

- Employer Identification Number (EIN) (Optional): While not always mandatory, an EIN from the IRS is recommended for tax purposes, particularly if hiring employees or operating as a sole proprietor with a separate business bank account.

- Business Bank Account Records: Separating personal and business finances is crucial for liability protection and simplified accounting.

- Contracts and Agreements: These documents formalize business relationships with clients and suppliers.

Partnerships and Their Formation Documents

Partnerships involve two or more individuals who agree to share in the profits or losses of a business. While the specific requirements vary by state, a well-defined partnership agreement is paramount. This agreement Artikels the responsibilities, profit-sharing arrangements, and dispute resolution mechanisms among partners. Failure to establish a clear agreement can lead to significant conflicts and legal issues.

The formalization of the partnership agreement protects all involved parties by clarifying roles and responsibilities, avoiding potential disputes over ownership and profit distribution.

- Partnership Agreement: A legally binding contract outlining the terms of the partnership, including responsibilities, profit/loss sharing, and dispute resolution.

- Business License: Required depending on the business activity and location.

- Employer Identification Number (EIN): Required by the IRS for tax purposes if the partnership employs individuals.

- Bank Account Records: Essential for tracking business finances and separating them from personal funds.

Limited Liability Companies (LLCs) and Their Formation Documents

LLCs offer a blend of partnership simplicity and corporate liability protection. Forming an LLC typically involves filing articles of organization with the state. These articles provide basic information about the LLC, including its name and registered agent. Additional documents are often necessary for internal governance and operations.

The process of filing articles of organization establishes the LLC’s legal existence and provides a framework for its operations. The operating agreement further defines internal structures and operational guidelines.

- Articles of Organization: Filed with the state to officially establish the LLC.

- Operating Agreement: An internal document outlining the management structure, member responsibilities, profit/loss sharing, and other operational details.

- Business License: Required depending on the business activity and location.

- Employer Identification Number (EIN): Generally required by the IRS for tax purposes.

Corporations (S-Corps and C-Corps) and Their Formation Documents

Corporations, both S-Corps and C-Corps, are considered separate legal entities from their owners, offering the strongest liability protection. The formation process is more complex than for other structures and typically involves more extensive documentation. Key distinctions exist between S-Corps and C-Corps, primarily related to taxation.

The process of incorporation establishes the corporation as a separate legal entity, shielding the owners from personal liability for business debts and obligations. The corporate charter is a fundamental document in this process.

- Articles of Incorporation: Filed with the state to officially establish the corporation.

- Bylaws: Internal rules governing the corporation’s operations and internal management.

- Corporate Charter: A document outlining the corporation’s purpose, structure, and powers.

- Business License: Required depending on the business activity and location.

- Employer Identification Number (EIN): Required by the IRS for tax purposes.

Post-Formation Compliance and Ongoing Requirements

Maintaining compliance after forming a business is crucial for its longevity and legal standing. Failure to meet ongoing requirements can lead to significant penalties, including fines, legal action, and even business dissolution. Understanding and adhering to these requirements is vital for responsible business operation.

Post-formation compliance varies significantly depending on the chosen business structure. Each structure has specific legal and regulatory obligations that must be met consistently. These obligations often involve regular filings, tax payments, and adherence to specific industry regulations. Ignoring these requirements can result in severe consequences, impacting the business’s credibility, financial stability, and overall success.

Ongoing Compliance Requirements for Different Business Structures

The ongoing compliance requirements differ greatly across various business structures. Sole proprietorships, for example, typically have simpler compliance needs compared to corporations or LLCs. Sole proprietorships primarily focus on individual tax filings and adhering to relevant industry regulations. Partnerships require filing partnership tax returns and maintaining accurate records of the partnership agreement. LLCs often have more complex requirements, including annual report filings, compliance with state regulations, and potentially maintaining a registered agent. Corporations face the most stringent requirements, including holding annual shareholder meetings, filing annual reports, maintaining corporate minutes, and adhering to complex corporate governance regulations. Failure to meet these requirements can lead to penalties and legal repercussions.

Examples of Post-Formation Documents Needed for Ongoing Compliance

Several post-formation documents are essential for maintaining ongoing compliance. These documents vary depending on the business structure but generally include:

For example, corporations typically require maintaining meticulous records of board meetings (minutes), shareholder meetings, and stock issuances. LLCs often need to file annual reports with the state, updating information on registered agents and members. All business structures require maintaining accurate financial records, including income statements, balance sheets, and tax returns. These documents serve as evidence of compliance and are often required during audits or legal proceedings. Furthermore, depending on the industry, businesses may need to maintain specific licenses, permits, or certifications, all requiring documentation.

Potential Consequences of Non-Compliance

Non-compliance with post-formation requirements can have serious consequences. These can range from relatively minor penalties, such as late filing fees, to more severe repercussions, including:

- Fines and Penalties: Governments impose fines for late or missed filings, failure to pay taxes, or non-compliance with specific regulations.

- Legal Action: Severe non-compliance can lead to lawsuits, potentially resulting in significant financial losses and damage to reputation.

- Loss of Licenses and Permits: Failure to maintain required licenses or permits can result in their revocation, halting business operations.

- Business Dissolution: In extreme cases, persistent non-compliance can lead to the forced dissolution of the business.

- Reputational Damage: Non-compliance can severely damage a business’s reputation, making it difficult to attract investors, customers, and partners.

For instance, a corporation failing to file its annual report might face substantial fines and could even face legal challenges from shareholders. A small business neglecting to pay its employment taxes could face severe penalties from the relevant tax authorities. The consequences of non-compliance can be significant and far-reaching, highlighting the importance of proactive compliance measures.

Best Practices for Maintaining Accurate and Up-to-Date Business Formation Documents

Maintaining accurate and up-to-date business formation documents is crucial for avoiding compliance issues. Best practices include:

Implementing a robust document management system is vital. This could involve using specialized software or simply maintaining a well-organized physical and digital filing system. Regularly reviewing and updating documents, such as the operating agreement or bylaws, ensures accuracy and reflects any changes in the business structure or operations. Seeking professional advice from legal and accounting professionals is also strongly recommended to ensure compliance with all relevant regulations. Proactive compliance is significantly more cost-effective than reactive measures taken after non-compliance has already occurred.

Illustrative Examples of Business Formation Documents

Understanding the structure and key elements of business formation documents is crucial for establishing a legally sound and operationally efficient business. The following examples illustrate the core components of common documents used for different business structures. While specific requirements vary by jurisdiction, these examples highlight common themes and crucial considerations.

Sample Articles of Incorporation for a Corporation

Articles of Incorporation are the foundational document for a corporation, outlining its essential details and establishing its legal existence. A sample might include the following key sections:

- Corporate Name: This section states the chosen name for the corporation, ensuring it complies with state regulations and isn’t already in use.

- Registered Agent and Registered Office: This designates the individual or entity authorized to receive legal and official documents on behalf of the corporation, and the physical address where these documents will be received.

- Purpose: A statement defining the corporation’s business activities. This can be broad (e.g., “to engage in any lawful business”) or specific (e.g., “to manufacture and sell widgets”).

- Capital Stock: This Artikels the authorized number of shares, their par value (if any), and the classes of stock (e.g., common stock, preferred stock) the corporation is authorized to issue. This section is vital for understanding the corporation’s ownership structure.

- Directors: The initial board of directors is named, responsible for overseeing the corporation’s affairs.

The purpose of each section is to clearly define the corporation’s legal identity, structure, and operational scope, providing a framework for its future actions and compliance with state regulations.

Sample Operating Agreement for an LLC

An Operating Agreement governs the internal affairs of a Limited Liability Company (LLC). It’s a flexible document that allows members to tailor the agreement to their specific needs and relationships. A sample might include:

- Management Structure: This section specifies whether the LLC will be member-managed (members directly manage the business) or manager-managed (a designated manager or managers handle the business operations).

- Capital Contributions: This details the financial contributions of each member, outlining their initial investment and any subsequent capital contributions.

- Profit and Loss Allocation: This specifies how profits and losses will be distributed among the members, which may be equal, proportional to capital contributions, or based on a pre-agreed formula.

- Member Responsibilities: This section defines the roles and responsibilities of each member in the operation of the LLC.

- Dispute Resolution: This Artikels the process for resolving conflicts among members, often including mediation or arbitration clauses to avoid costly litigation.

- Withdrawal or Dissolution: This addresses the procedures for a member’s withdrawal from the LLC and the process for dissolving the LLC.

These clauses are critical because they define the members’ rights and obligations, avoiding future disputes and providing a clear framework for the LLC’s operation.

Sample Partnership Agreement

A Partnership Agreement Artikels the terms and conditions governing a partnership. Key provisions for liability and ownership include:

- Liability: This section clarifies the liability of each partner for the partnership’s debts and obligations. It might specify whether partners are jointly and severally liable (each partner is fully liable for all partnership debts) or have limited liability (their liability is limited to their capital contribution).

- Ownership and Profit/Loss Sharing: This section defines each partner’s ownership percentage in the partnership and how profits and losses will be shared. This often mirrors the capital contributions, but can be adjusted based on individual partner contributions or agreements.

- Management and Decision-Making: This Artikels how the partnership will be managed and decisions made. It might specify voting rights, the authority of individual partners, and processes for resolving disputes.

- Dissolution: This section describes the procedures for dissolving the partnership, including circumstances that trigger dissolution and the process for distributing assets.

The Partnership Agreement safeguards the partners’ interests by defining their roles, responsibilities, and the division of assets and liabilities. A clearly defined agreement is essential to minimize future conflicts.

Comparison of Articles of Incorporation and Operating Agreement

A visual comparison could be presented as a table:

| Feature | Articles of Incorporation (Corporation) | Operating Agreement (LLC) |

|---|---|---|

| Purpose | Establishes the corporation’s legal existence and defines its basic structure. | Governs the internal operations and relationships among LLC members. |

| Filing Requirement | Must be filed with the Secretary of State or equivalent agency. | Generally not filed with the state, but recommended for internal governance. |

| Flexibility | Less flexible; changes often require amendments filed with the state. | Highly flexible; can be customized to suit the specific needs of the members. |

| Liability | Shareholders have limited liability; the corporation is a separate legal entity. | Members typically have limited liability; the LLC is a separate legal entity. |

| Management | Typically managed by a board of directors. | Can be member-managed or manager-managed, as defined in the agreement. |

This table effectively summarizes the key differences between these two foundational documents, highlighting their distinct purposes and functionalities.