What is a business partner number in Florida? This seemingly simple question unveils a surprisingly complex reality within Florida’s business regulatory landscape. Unlike some states with clearly defined partner identification numbers, Florida doesn’t have a single, universally recognized “business partner number.” Instead, understanding partner identification hinges on the specific business structure, registration requirements, and the context in which the information is needed. This exploration will clarify the various identification methods used for business partners in Florida, addressing the potential confusion surrounding this term.

Florida businesses utilize several identification numbers depending on their structure and interactions with the state. These include Employer Identification Numbers (EINs) from the IRS, state tax IDs, and registration numbers specific to different business types like LLCs or partnerships. We will dissect these identifiers, comparing and contrasting them with the elusive “business partner number” concept. We’ll also explore the implications of using—or misusing—partner identification information in various business scenarios, from contracts to tax filings. The primary source for official business registration information in Florida is the Florida Department of State, Division of Corporations.

Defining “Business Partner Number” in Florida: What Is A Business Partner Number In Florida

The term “business partner number” in Florida lacks a standardized, officially recognized definition. This ambiguity leads to confusion and varying interpretations depending on the context within Florida’s complex business regulatory framework. Understanding the nuances of this term requires careful consideration of the specific situation where it arises.

There is no single, state-issued “business partner number” analogous to an employer identification number (EIN) or a business license number. Instead, the phrase likely refers to an identifier associated with a specific business entity’s partners, depending on the context. This could be a social security number (SSN) if the business is a partnership or a limited liability company (LLC) with individual members, or it might refer to an EIN if the business partners themselves are entities like corporations. The context of its use is critical for proper interpretation.

Interpretations of “Business Partner Number”

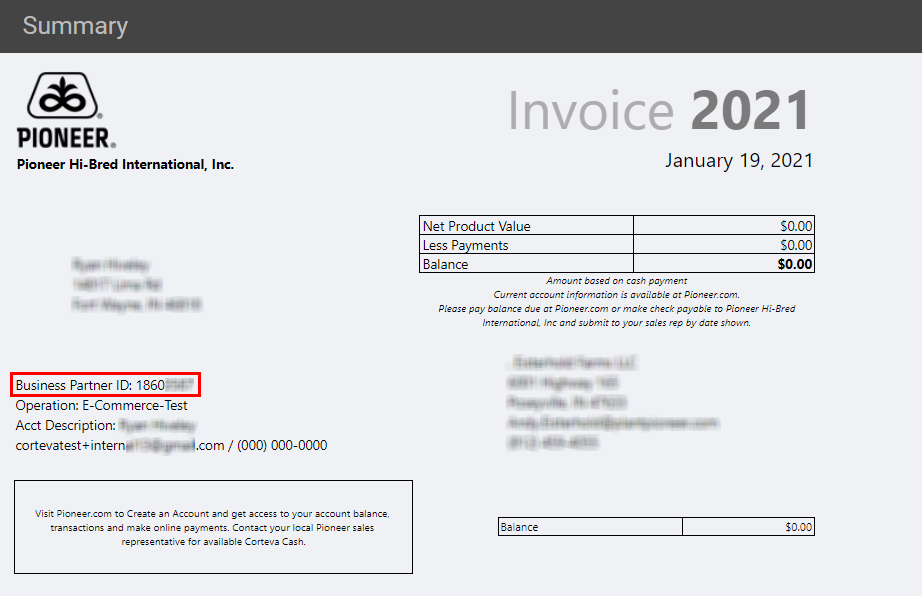

The meaning of “business partner number” hinges heavily on the specific context. For example, a state agency requesting a “business partner number” might be seeking the SSNs of individual partners in a small business partnership for tax reporting purposes or the EIN of a corporate partner in a joint venture. A private company might use the term internally to track its own business relationships, assigning unique numbers for identification. The lack of a formal definition allows for this variability, which unfortunately also contributes to the potential for miscommunication and errors.

Examples of “Business Partner Number” Usage

Imagine a scenario where a Florida-based construction company, a partnership, is bidding on a state contract. The state agency’s application might ask for the “business partner numbers” of the company’s owners. In this instance, the request likely refers to the SSNs of the partners. Conversely, if the construction company partnered with a larger corporation on a project, the relevant “business partner number” might be the corporation’s EIN. Another example could involve an internal database used by a private company to manage its various business collaborations, where each partnership is assigned a unique numerical identifier for tracking purposes. This internal identifier, while serving a similar function, is not a formally recognized state or federal designation.

Potential for Confusion and Lack of Standardization

The absence of a standardized definition for “business partner number” creates significant potential for misunderstanding. Businesses might struggle to comply with requests for this information if the request is unclear. State agencies and private companies might use the term inconsistently, leading to confusion and delays. This ambiguity highlights the need for clearer communication and possibly a more precise, standardized terminology within Florida’s business regulations to avoid future complications and misinterpretations. The lack of a consistent definition creates inefficiencies and potentially increases the risk of errors in record-keeping and reporting.

Florida Business Registration and Identification Numbers

Florida businesses require various registration and identification numbers depending on their structure, activities, and tax obligations. Understanding these numbers is crucial for compliance and smooth operation. While the term “business partner number” isn’t an officially recognized designation in Florida, several official numbers serve related purposes, often concerning the individuals involved in a business entity. This section clarifies the key distinctions.

Several distinct identification numbers are used by businesses operating in Florida. These numbers are issued by different government agencies and serve different purposes, from federal tax obligations to state-level compliance. Confusing these numbers can lead to penalties and operational difficulties.

Employer Identification Number (EIN)

The Employer Identification Number (EIN), also known as a Federal Tax Identification Number, is a nine-digit number issued by the Internal Revenue Service (IRS). It’s required for various federal tax purposes, including filing corporate income tax returns, paying employment taxes, and opening a corporate bank account. Sole proprietors and partnerships may or may not require an EIN depending on their specific circumstances (e.g., employing others, operating as a corporation or LLC). The EIN is a federal identifier and is distinct from any state-level registration numbers. It’s not a “business partner number” but rather a crucial identifier for the business entity itself.

Florida Department of Revenue Tax ID Number, What is a business partner number in florida

The Florida Department of Revenue (DOR) issues tax identification numbers for businesses operating within the state. These numbers are essential for various state tax purposes, including sales tax, use tax, and corporate income tax. The specific type of tax ID number a business receives from the DOR depends on its structure and the types of taxes it’s obligated to collect and remit. This number is crucial for state-level compliance, separate from the federal EIN. Again, it doesn’t represent a “business partner number,” but rather the business’s unique identifier within Florida’s tax system.

Comparison with the Concept of a “Business Partner Number”

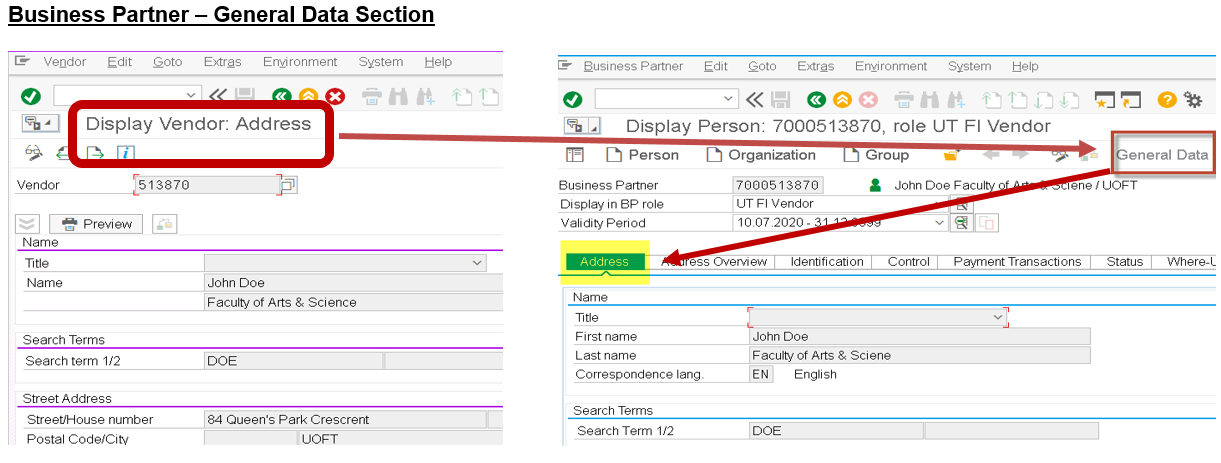

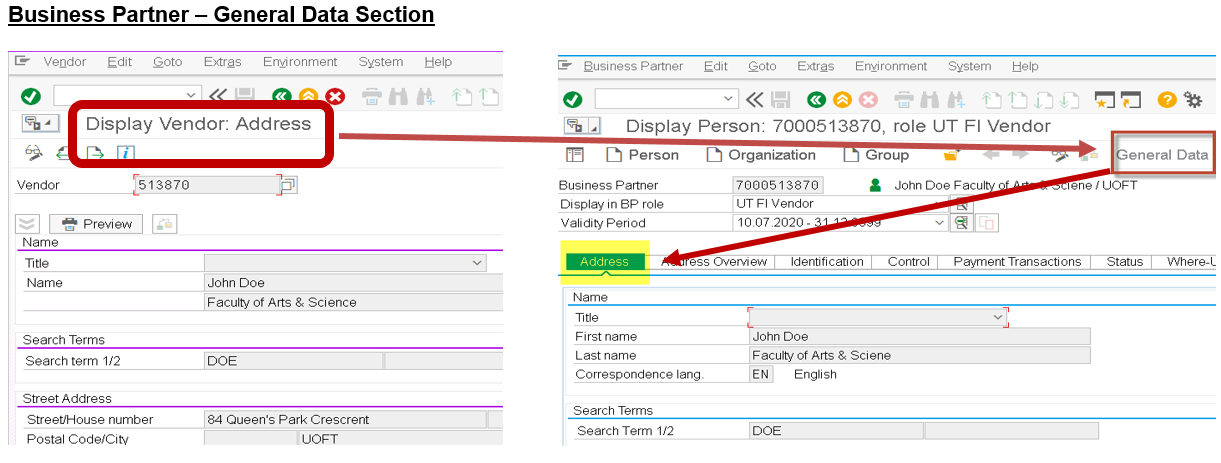

The term “business partner number” is not an official designation used by Florida state agencies. Information related to business partners is typically found within the business’s registration documents filed with the Florida Department of State, Division of Corporations. These documents would detail the names and potentially other identifying information of the business partners, but no specific “partner number” is assigned. The EIN and DOR tax ID numbers identify the business entity itself, not individual partners. Information about partners is held separately, typically within the registration documents reflecting the business structure (e.g., partnership agreement, articles of incorporation).

Primary Source of Information on Business Registration

The primary source of information regarding business registration in Florida is the Florida Department of State, Division of Corporations. This agency handles the registration of various business entities, providing information on requirements, forms, and filings. The Florida Department of Revenue (DOR) is another crucial agency, responsible for issuing state tax identification numbers and overseeing tax compliance for businesses. Both agencies offer online resources and assistance to businesses navigating registration and compliance processes.

Partnership Structures in Florida

Florida offers several partnership structures for businesses, each with its own legal implications and registration requirements. Choosing the right structure depends on factors such as liability protection, tax implications, and management control. Understanding these differences is crucial for entrepreneurs starting a business in the Sunshine State.

Types of Florida Business Partnerships

Florida recognizes several types of business partnerships, each offering varying degrees of liability protection and operational control. The choice of structure significantly impacts the business’s legal and financial responsibilities.

| Partnership Type | Registration Number Type | Issuing Agency | Key Features |

|---|---|---|---|

| General Partnership | None (typically not required for registration, but may need a fictitious name registration if the business name differs from the partners’ names) | Florida Department of State, Division of Corporations | All partners share in the business’s profits and losses; all partners have unlimited personal liability for business debts; relatively simple to form. |

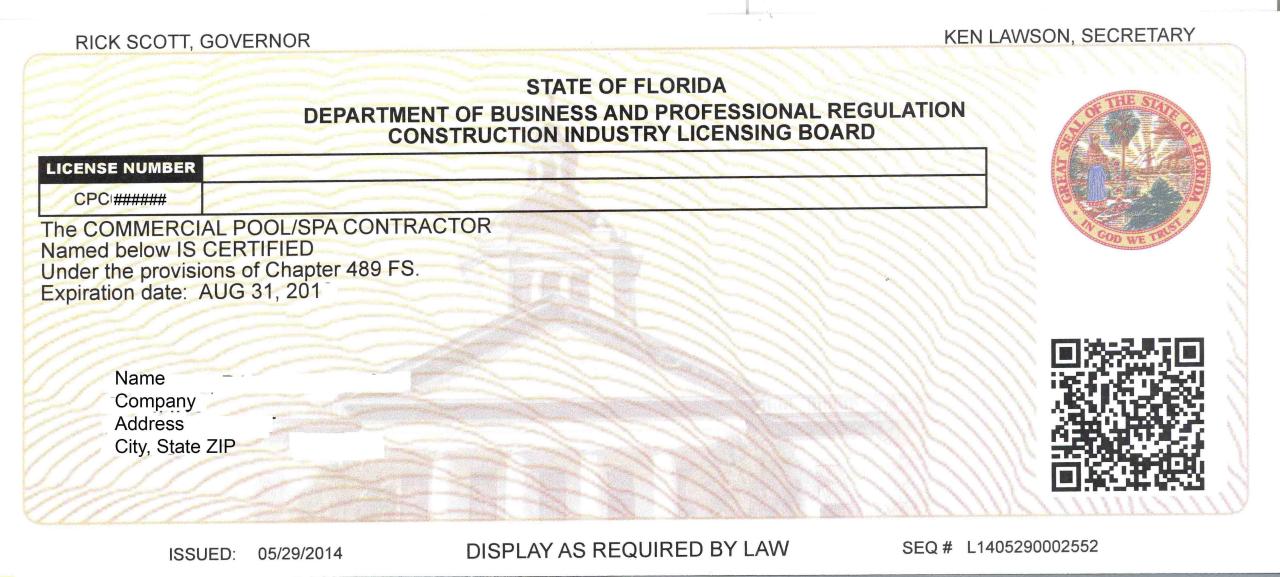

| Limited Partnership (LP) | Limited Partnership Registration Number | Florida Department of State, Division of Corporations | Combines general and limited partners; general partners manage the business and have unlimited liability; limited partners contribute capital but have limited liability and limited involvement in management. Requires filing a certificate of limited partnership with the state. |

| Limited Liability Company (LLC) | LLC Registration Number | Florida Department of State, Division of Corporations | Offers limited liability to all members; flexible management structure (member-managed or manager-managed); provides pass-through taxation (profits and losses are passed through to the members’ personal income tax returns), unless electing to be taxed as a corporation. Requires filing Articles of Organization with the state. |

| Limited Liability Partnership (LLP) | LLP Registration Number | Florida Department of State, Division of Corporations | Provides limited liability protection to partners for the actions of other partners; often used by professionals such as lawyers and accountants; requires registration with the state and adherence to specific requirements. |

Legal and Regulatory Context

Understanding the legal framework surrounding business partnerships in Florida is crucial for navigating potential disputes and ensuring compliance. While Florida doesn’t issue a specific “business partner number,” the legal requirements for registering and operating a partnership are clearly defined within state statutes and regulations. These regulations dictate how partnerships are formed, their operational requirements, and the responsibilities of individual partners.

Florida’s legal framework for business partnerships primarily stems from the Florida Revised Statutes, particularly Chapter 620, which addresses limited liability companies (LLCs), and Chapter 622, which addresses general partnerships. While the term “business partner number” isn’t explicitly used, the registration process and subsequent identification of the business entity are governed by these statutes. These statutes Artikel requirements for registration, tax obligations, and the legal responsibilities of partners. Failure to comply with these regulations can lead to significant legal repercussions.

Relevant Florida Statutes and Regulations

Florida’s business registration process relies heavily on the Department of State’s Division of Corporations. While there’s no dedicated “business partner number,” the registration process for LLCs and general partnerships assigns unique identification numbers. For LLCs, this is usually a registration number issued upon filing the articles of organization. General partnerships, while not required to register with the state, might still obtain an EIN (Employer Identification Number) from the IRS for tax purposes. This EIN acts as a crucial identifier for the partnership. The specific statutes governing registration vary depending on the chosen partnership structure. For instance, Chapter 620, Florida Statutes, details the requirements for forming and registering LLCs, while Chapter 622 addresses the formation of general partnerships.

Hypothetical Dispute and Legal Ramifications

Imagine a scenario where two partners in a Florida-based construction firm, “Sunshine Builds,” have a dispute. One partner, Alex, claims that a significant business decision – securing a large contract – was made without his consent. He argues this decision violates the partnership agreement and seeks to dissolve the partnership. The other partner, Ben, counters that the decision was within the scope of the partnership’s operations and that Alex was duly informed. The lack of a formally registered “business partner number” does not absolve either partner from legal accountability. The dispute would be resolved through the courts, relying on evidence such as the partnership agreement, communication records, and witness testimonies. The outcome would depend on the specific terms of the partnership agreement and the interpretation of Florida partnership law. Potential legal ramifications could include financial penalties, dissolution of the partnership, and potential legal action for breach of contract or fiduciary duty. Alex might seek legal remedies based on claims of breach of contract or fiduciary duty, while Ben would defend his actions based on the partnership agreement and his interpretation of the partner’s responsibilities.

Florida Business Partnership Registration Process

The following flowchart illustrates the general process for registering a business partnership in Florida, specifically focusing on the most common structures: LLCs and general partnerships. Note that this is a simplified representation and may not cover all specific scenarios or exceptions.

[Diagram Description: A flowchart would be included here. The flowchart would begin with a decision point: “Is the partnership an LLC or a General Partnership?” If LLC, the flow would proceed to “File Articles of Organization with the Florida Department of State,” then to “Obtain Registration Number,” and finally to “Obtain EIN (if needed).” If General Partnership, the flow would proceed to “Obtain EIN (from IRS),” and then to “Establish a Partnership Agreement.” Both paths would then converge at “Begin Business Operations.”]

Practical Applications and Examples

In Florida, there isn’t a single, overarching “business partner number” assigned to individuals within a partnership. Instead, various identification numbers and methods are used depending on the context, primarily focusing on the legal structure of the business itself (sole proprietorship, partnership, LLC, etc.) and the specific interaction (tax filings, banking, contracts). Understanding these distinctions is crucial for accurate record-keeping and compliance.

The identification methods used will vary based on the type of business entity. For instance, a general partnership might use the Social Security Numbers (SSNs) of the partners for tax purposes, while a Limited Liability Company (LLC) would use its own Employer Identification Number (EIN) obtained from the IRS. The use of individual partner information versus the business entity’s information is a key difference that impacts how business transactions are conducted.

Identifying Partners in Business Contracts

Business contracts often require the identification of all partners involved. This typically involves providing the legal names and addresses of each partner, along with their respective ownership percentages or roles within the partnership. For example, a contract for the lease of commercial property might list each partner’s name and address, clarifying their shared responsibility for the lease agreement. Failure to accurately identify all partners could lead to disputes over liability and contract enforcement. This detailed identification helps to clarify who is responsible for obligations under the contract. Incorrectly identifying a partner, or omitting a partner entirely, can severely impact the enforceability of the contract and potentially lead to legal disputes.

Partner Identification in Banking Transactions

When a partnership opens a business bank account, the bank will require identification information for each partner. This often includes SSNs, driver’s licenses, or passports, depending on the bank’s policies and the type of partnership. This information is used for verification purposes and to comply with anti-money laundering (AML) regulations. For example, a bank might require a copy of each partner’s driver’s license and proof of address. Providing inaccurate information or omitting a partner could lead to account delays, account freezing, or even legal repercussions for non-compliance with banking regulations. The consequences can range from minor delays to severe financial penalties.

Partner Information in Tax Filings

The IRS requires specific information about partners when filing partnership tax returns (Form 1065). This includes each partner’s name, address, and their share of the partnership’s income or loss. This information is used to determine each partner’s individual tax liability. Incorrectly reporting partner information on tax filings can result in significant penalties, including back taxes, interest, and potential legal action. Accurate and complete reporting of partner information is paramount for tax compliance. The penalties for incorrect information can be substantial and impact the partners’ individual tax liabilities.

Alternative Identification Methods

Florida lacks a centralized, dedicated “business partner number” for identifying individuals involved in business partnerships. Therefore, alternative methods are necessary to establish the identities of partners for legal and administrative purposes. These methods carry varying degrees of effectiveness and legal weight, depending on the context.

Identifying business partners in Florida without a dedicated business partner number relies on established documentation and legal frameworks. The reliability and legal standing of these methods depend heavily on the accuracy and completeness of the records used. Choosing the appropriate method depends on the specific need – be it tax filings, contract enforcement, or regulatory compliance. Misidentification can lead to significant legal and financial repercussions.

Methods for Identifying Business Partners

The following methods offer alternative means of identifying business partners in Florida, each with its own strengths and weaknesses. Careful consideration of these factors is crucial for selecting the most appropriate method for a given situation.

- Partnership Agreement: This legally binding document Artikels the partners’ identities, contributions, and responsibilities.

- Advantages: Provides definitive proof of partnership and partner identities. Serves as a primary legal reference.

- Disadvantages: May not be readily accessible in all situations. Relies on the accuracy and completeness of the initial documentation. If not properly executed, its legal standing may be challenged.

- Florida Department of State Division of Corporations Records: For registered partnerships, this provides access to official registration documents, including the names and addresses of the partners.

- Advantages: Provides publicly accessible and legally verifiable information on registered partnerships.

- Disadvantages: Only applicable to formally registered partnerships. Does not cover unregistered partnerships or informal business arrangements.

- Tax Returns (e.g., Partnership Return of Income, Form 1065): Federal and state tax filings often list the names and tax identification numbers of the partners.

- Advantages: Provides a reliable record of partner identities for tax purposes. May be required for various financial and legal processes.

- Disadvantages: Access may be restricted due to privacy concerns. Information may be incomplete or outdated if returns haven’t been recently filed.

- Bank Records: Business bank accounts often list the names of the partners as authorized signatories.

- Advantages: Provides evidence of partner involvement in financial transactions.

- Disadvantages: Access is limited to authorized individuals. May not reflect all partners, especially in complex ownership structures.