What is business appraisal? It’s more than just assigning a dollar figure to a company; it’s a deep dive into a business’s financial health, market position, and future potential. Understanding the value of a business is crucial for a multitude of reasons, from securing loans and attracting investors to navigating complex legal situations like mergers, acquisitions, or divorce settlements. This guide unravels the intricacies of business appraisal, explaining its purpose, methodologies, and the crucial factors influencing the final valuation.

We’ll explore various appraisal methods, including the income approach, market approach, and asset-based approach, highlighting their strengths and weaknesses. We’ll also delve into the key factors that can significantly impact a business’s value, both positively and negatively, such as intangible assets, market conditions, and financial performance. Finally, we’ll walk you through the appraisal process itself, from initial data gathering to the final report, empowering you to understand and interpret the results effectively.

Defining Business Appraisal: What Is Business Appraisal

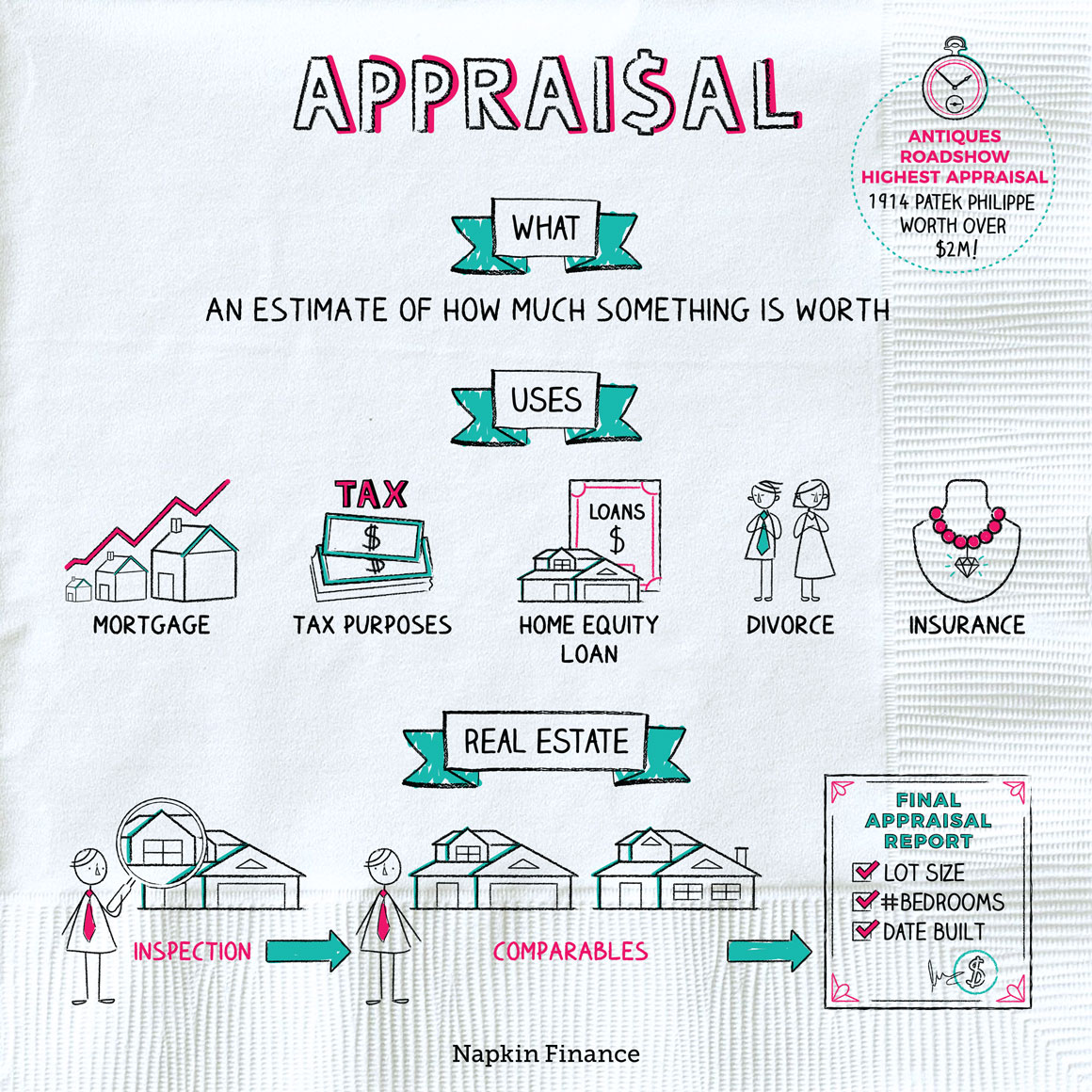

Business appraisal is the process of determining the monetary worth of a company. It’s a crucial step in many business transactions, providing a clear and objective assessment of a company’s value. Understanding this value is vital for informed decision-making.

Business appraisal involves a detailed examination of various factors that contribute to a company’s worth, going beyond simply looking at its assets and liabilities. It takes into account factors like profitability, market position, and future growth potential. The result is a comprehensive report that serves as a reliable guide for various business purposes.

Types of Businesses Requiring Appraisal

Several situations necessitate a professional business appraisal. The complexity of the appraisal process can vary greatly depending on the size and type of business. Knowing when to seek professional appraisal services is essential for making sound financial decisions.

- Mergers and Acquisitions: When two companies merge or one acquires another, an accurate appraisal ensures a fair price is negotiated. For example, a large tech company acquiring a smaller startup will need an appraisal to determine the fair market value of the startup.

- Sale of a Business: Selling a business requires a precise valuation to attract potential buyers and secure a favorable sale price. Consider a family-owned restaurant deciding to sell after decades of operation; a professional appraisal will be crucial in setting a realistic asking price.

- Estate Planning: Incorporating a business into estate planning requires determining its value for tax purposes and equitable distribution among heirs. This is particularly relevant for large family businesses passed down through generations.

- Bank Financing: Securing loans or other financing often necessitates a business appraisal to demonstrate the company’s worth as collateral. A small business seeking a loan to expand its operations might need an appraisal to demonstrate its creditworthiness.

- Dissolution of Partnerships: When partners decide to separate, an appraisal helps fairly divide the assets and liabilities of the business. This can prevent disputes and ensure a smooth transition for all parties involved.

Business Valuation vs. Business Appraisal

While the terms “business valuation” and “business appraisal” are often used interchangeably, there are key distinctions. While both aim to determine a business’s worth, their scope and purpose differ significantly. Understanding these differences is vital for choosing the right approach for a specific situation.

Business valuation is a broader term encompassing various methods to estimate a company’s worth. It can be done for various purposes, including internal planning, strategic decision-making, and investor relations. Business appraisal, on the other hand, is a more formal process, often required for legal or financial purposes. Appraisals usually follow specific guidelines and standards, resulting in a more legally defensible valuation. For instance, a business valuation might be conducted for internal use to inform a company’s strategic planning, while a business appraisal would be necessary when selling the company to a third party. The appraisal would need to adhere to specific standards and be suitable for use in legal or financial proceedings.

Purposes of a Business Appraisal

Business appraisals serve a multitude of critical purposes, providing crucial financial insights for various stakeholders. The value determined through a professional appraisal can significantly influence decision-making in a range of situations, from estate planning to legal disputes. Understanding the various applications of business appraisals is essential for both business owners and those involved in transactions involving businesses.

A business appraisal provides a detailed, objective assessment of a company’s worth, factoring in its assets, liabilities, profitability, and market position. This valuation is often vital for informed decision-making, and its accuracy can have significant financial implications. The process itself involves a thorough analysis of the company’s financial records, operational efficiency, and market dynamics.

Reasons for Requiring a Business Appraisal

Several situations necessitate a formal business appraisal. These situations span personal financial planning, legal requirements, and complex business transactions. The common thread is the need for an independent, objective assessment of a company’s value.

For example, a business owner considering selling their company will need an appraisal to determine a fair asking price. Similarly, a company seeking funding from investors will use an appraisal to demonstrate its value and potential for return. In situations involving estate taxes, the valuation provided by a qualified appraiser can significantly impact the amount of tax owed.

Legally Mandated Business Appraisals

In certain circumstances, a business appraisal is not merely advisable, but legally required. These situations typically involve legal proceedings where a fair and accurate valuation is crucial for equitable outcomes.

For instance, in probate proceedings following the death of a business owner, a court may mandate a business appraisal to determine the fair market value of the business for distribution among heirs. Similarly, in divorce settlements involving a business as a marital asset, a court-ordered appraisal is often necessary to ensure a fair division of property. Bankruptcy proceedings may also necessitate business appraisals to determine the value of assets for creditors.

Business Appraisals in Mergers and Acquisitions

Business appraisals play a pivotal role in mergers and acquisitions (M&A). They provide essential information to both buyers and sellers, helping to determine a fair purchase price and facilitating successful transactions.

Before a merger or acquisition, both parties often commission independent appraisals to establish a realistic valuation range. This helps to ensure that the transaction is mutually beneficial and avoids disputes later on. The appraisal considers various factors, including the target company’s financial performance, market share, competitive landscape, and intangible assets such as brand reputation and intellectual property. A discrepancy between the buyer’s and seller’s valuations can lead to protracted negotiations or even the failure of the deal.

Business Appraisals in Estate Planning and Divorce Settlements

While both estate planning and divorce settlements utilize business appraisals to determine value, their purposes and contexts differ significantly. In estate planning, the appraisal ensures fair distribution of assets among heirs, minimizing potential conflicts. In divorce, the appraisal aims to provide an equitable division of marital assets.

In estate planning, a business appraisal helps to determine the fair market value of the business for estate tax purposes and for distribution to beneficiaries. This prevents disputes among family members after the owner’s death. In divorce settlements, the appraisal establishes the value of the business as a marital asset, allowing for a fair division between the divorcing spouses. The specific methodology used in the appraisal may vary depending on the jurisdiction and the specifics of the case. For example, a discount for lack of marketability might be applied in estate planning but not necessarily in a divorce settlement.

Methods Used in Business Appraisal

Business valuation employs various methods, each with its strengths and weaknesses depending on the specific circumstances of the business being appraised. The choice of method often depends on factors such as the nature of the business, the availability of data, and the purpose of the appraisal. Understanding these methods is crucial for accurate and reliable valuation.

Business Valuation Methods Comparison

The selection of an appropriate valuation method is critical for obtaining a reliable estimate of a business’s worth. Different methods offer diverse perspectives, and a comprehensive appraisal often involves employing multiple approaches to arrive at a well-supported conclusion. The following table summarizes four common methods:

| Method Name | Description | Advantages | Disadvantages |

|---|---|---|---|

| Income Approach | Estimates value based on the present value of future cash flows. | Reflects the earning potential of the business; widely accepted in many industries. | Requires accurate financial projections; sensitive to discount rate assumptions; may not be suitable for businesses with unstable earnings. |

| Market Approach | Compares the subject business to similar businesses that have recently been sold. | Relatively simple and straightforward; uses real-market data. | Finding truly comparable businesses can be challenging; market data may be limited or unreliable; doesn’t account for unique business characteristics. |

| Asset-Based Approach | Values the business based on the net asset value of its assets. | Simple to understand and apply; particularly suitable for asset-heavy businesses. | Ignores intangible assets and future earning potential; may undervalue businesses with significant growth prospects. |

| Discounted Cash Flow (DCF) Analysis | A specific type of income approach that projects future cash flows and discounts them to their present value. | Provides a detailed and comprehensive valuation; considers the time value of money. | Requires detailed financial forecasting; sensitive to discount rate assumptions and growth rate projections; can be complex and time-consuming. |

Income Approach to Business Valuation

The income approach focuses on the present value of a business’s future earnings. This method assumes that a business’s value is directly related to its ability to generate cash flow. The most common technique within this approach is discounted cash flow (DCF) analysis. This involves projecting future cash flows, selecting an appropriate discount rate reflecting the risk associated with the business, and then discounting those future cash flows back to their present value.

For example, imagine a bakery projecting annual net cash flows of $100,000 for the next five years. Using a discount rate of 10%, the present value of these cash flows can be calculated. A higher discount rate would reflect a higher perceived risk and result in a lower valuation. Another example could involve a software company projecting significantly higher growth in future years, impacting the present value calculation accordingly. The complexity lies in accurately predicting future cash flows and selecting an appropriate discount rate.

Market Approach to Business Valuation

The market approach uses comparable company data to estimate a business’s value. This involves identifying similar businesses that have recently been sold and adjusting their sale prices to reflect differences between the subject business and the comparable businesses. These adjustments might include differences in size, profitability, and market position.

For example, a valuation of a small regional restaurant might compare it to similar restaurants in the same area that have recently changed hands. Adjustments would be made for factors like seating capacity, menu pricing, and customer base. However, finding truly comparable businesses can be difficult, especially for unique or specialized businesses. This limitation arises from the inherent difficulty in finding perfect matches in terms of size, industry, profitability, and growth prospects. The lack of perfectly comparable data is a significant constraint of this method.

Asset-Based Approach to Business Valuation

The asset-based approach values a business based on the net asset value (NAV) of its assets. NAV is calculated by subtracting liabilities from the fair market value of assets. This method is particularly suitable for businesses with predominantly tangible assets, such as manufacturing companies or real estate businesses. However, it often undervalues businesses with significant intangible assets, such as brand recognition, intellectual property, or strong customer relationships.

For instance, a trucking company with a large fleet of trucks and trailers would be well-suited for an asset-based approach. The value of its assets (trucks, trailers, land, etc.) would be assessed, and liabilities would be subtracted to arrive at a net asset value. Conversely, a technology startup with minimal tangible assets but significant intellectual property would be poorly valued using this approach, as the value of its patents or software would be largely ignored. This approach is therefore most useful when tangible assets represent a significant portion of the business’s overall value.

Factors Affecting Business Value

A business’s value is a complex interplay of numerous factors, both tangible and intangible. Understanding these influences is crucial for accurate appraisal and informed decision-making, whether for mergers and acquisitions, financing, or estate planning. This section will delve into the key elements that significantly impact a business’s valuation.

Tangible and Intangible Assets

Tangible assets, those with physical form, directly contribute to a business’s value. These include real estate, equipment, inventory, and cash. Their value is often determined by market prices or appraisal reports. However, intangible assets, lacking physical form, are equally, if not more, important in many cases. These encompass brand reputation, intellectual property (patents, trademarks, copyrights), customer relationships, and established market presence. The value of these intangible assets is often harder to quantify but can significantly outweigh the value of tangible assets, especially for businesses with strong brands or unique technologies. For example, a tech startup with a revolutionary patented technology might have limited tangible assets but a very high valuation due to the immense potential of its intellectual property.

Market Conditions and Their Impact on Valuation

Market conditions exert a powerful influence on business valuations. A robust economy with high consumer confidence typically leads to higher valuations, as businesses enjoy increased sales and profitability. Conversely, economic downturns, recessions, or industry-specific challenges can significantly depress valuations. For instance, during the 2008 financial crisis, the valuations of many real estate companies plummeted due to the sharp decline in property values and reduced demand. The current interest rate environment also plays a critical role; higher interest rates increase the cost of borrowing, potentially reducing a business’s profitability and hence its valuation. Industry-specific trends and regulations also play a significant role; a sudden shift in consumer preferences or the introduction of stringent environmental regulations can impact a business’s future prospects and, consequently, its value.

Financial Performance Metrics and Business Appraisal

Financial performance metrics provide the bedrock of any business valuation. Key indicators like revenue growth, profitability (net income, EBITDA), cash flow, and return on investment (ROI) are meticulously analyzed to project future earnings and determine the business’s value. A history of consistent revenue growth and strong profitability signals a healthy and valuable business. Conversely, declining revenue, consistent losses, or poor cash flow can significantly reduce the appraised value. The methods used in business appraisal, such as discounted cash flow (DCF) analysis, heavily rely on these financial metrics to project future earnings and discount them back to their present value. For example, a business with a high and stable EBITDA margin is generally considered more valuable than a business with fluctuating and low margins.

Factors Negatively Impacting Appraised Value

Several factors can negatively impact a business’s appraised value. Understanding these risks is crucial for mitigating their effects and improving a business’s overall valuation.

- High levels of debt: Excessive debt burdens can significantly reduce a business’s profitability and its perceived value to potential buyers or investors.

- Dependence on a single customer or product: This lack of diversification increases vulnerability to market fluctuations and reduces overall value.

- Outdated technology or infrastructure: Failure to invest in modern technology and infrastructure can negatively impact efficiency and competitiveness.

- Poor management team: A weak or inexperienced management team poses a risk to future profitability and business sustainability.

- Legal and regulatory issues: Pending or unresolved lawsuits, regulatory violations, or non-compliance can significantly decrease a business’s value.

- High employee turnover: High employee turnover indicates potential issues with workplace culture, compensation, or management, leading to lower valuation.

- Lack of succession planning: The absence of a clear succession plan for key personnel increases uncertainty and reduces the business’s perceived long-term value.

The Appraisal Process

A business appraisal isn’t a single event but a methodical process involving several crucial steps. The thoroughness and accuracy of each stage directly impact the reliability and validity of the final valuation. A well-executed appraisal process ensures a robust and defensible estimate of a business’s worth.

Steps Involved in a Business Appraisal, What is business appraisal

The business appraisal process can be visualized as a sequential flow, each stage building upon the previous one. A typical process would include the following steps, which can vary slightly depending on the complexity of the business and the purpose of the appraisal. A simplified flowchart would illustrate this progression clearly.

+-----------------+

| Client Inquiry |

+--------+--------+

|

V

+-----------------+

| Engagement Letter|

+--------+--------+

|

V

+-----------------+

| Data Collection |

+--------+--------+

|

V

+-----------------+

| Analysis & Valuation |

+--------+--------+

|

V

+-----------------+

| Report Writing |

+--------+--------+

|

V

+-----------------+

| Report Review & Delivery|

+-----------------+

The Appraiser’s Role in Information Gathering and Analysis

The appraiser acts as a detective, meticulously gathering and analyzing information relevant to the business being appraised. This involves reviewing financial statements, conducting interviews with management and key personnel, analyzing industry trends, and assessing the company’s competitive landscape. The appraiser must critically evaluate the data collected, identifying inconsistencies and potential biases to ensure the accuracy of the final valuation. For example, an appraiser might reconcile discrepancies between reported revenue and actual cash flow to arrive at a more realistic picture of the business’s profitability. This analytical process often requires significant expertise in accounting, finance, and the specific industry in which the business operates.

The Importance of Due Diligence in the Appraisal Process

Due diligence is paramount in ensuring the accuracy and reliability of the appraisal. This involves a thorough investigation of all aspects of the business, including its financial health, legal compliance, operational efficiency, and management quality. Neglecting due diligence can lead to significant errors in the valuation, potentially resulting in costly mistakes for the client. For instance, the discovery of undisclosed liabilities during the due diligence phase could significantly impact the final valuation. A comprehensive due diligence process helps mitigate these risks by providing a complete and accurate picture of the business’s condition.

Preparing and Presenting the Final Appraisal Report

The final appraisal report summarizes the appraiser’s findings and presents the final valuation. It should be a clear, concise, and well-organized document that details the methodology used, the data analyzed, and the rationale behind the valuation. The report should also include any assumptions made and limitations of the appraisal. The presentation of the report should be tailored to the audience, whether it’s a potential buyer, seller, lender, or court of law. For example, a report intended for a potential buyer might focus more on the business’s future earning potential, while a report for a lender might emphasize the business’s asset base and collateral value. Clarity and transparency are key to ensuring the report is understood and accepted by all stakeholders.

Interpreting the Appraisal Report

Understanding a business appraisal report requires careful consideration of its various components. The report should not be viewed as a single number representing value, but rather a comprehensive document outlining the methodology, assumptions, and conclusions leading to the valuation. A thorough understanding of the report is crucial for all stakeholders involved in the transaction or decision-making process.

Sample Business Appraisal Report Excerpt

Executive Summary: The estimated market value of ABC Company, as of December 31, 2023, is $1,500,000. This valuation is based on a discounted cash flow analysis (DCF) and a market approach utilizing comparable company transactions. Key assumptions include a discount rate of 10% and a projected annual growth rate of 5% for the next five years. Significant limitations include the availability of comparable company data and the inherent uncertainty associated with future cash flows.

Methodology: This appraisal employed three primary valuation methods: Discounted Cash Flow (DCF), Market Approach, and Asset-Based Approach. The DCF method projected future cash flows based on historical financial data and management projections. The Market Approach involved comparing ABC Company to publicly traded and privately held comparable companies. The Asset-Based Approach determined the net asset value of ABC Company.

Financial Projections: [Table showing projected revenue, expenses, and cash flows for the next five years].

Valuation Conclusions: Based on the three valuation methods employed, the most probable range of value for ABC Company is between $1,400,000 and $1,600,000. The final valuation of $1,500,000 represents a weighted average of the three approaches, with greater weight given to the DCF analysis due to its consideration of future growth potential.

Interpreting Key Findings and Conclusions

The key findings and conclusions section of the report summarizes the appraiser’s determination of the business’s value. In the sample excerpt, the estimated market value is clearly stated, along with the methods used to arrive at that figure. The range of values provides a margin of error, reflecting the inherent uncertainties in business valuation. Understanding the weighting given to each valuation method is crucial; this highlights the appraiser’s judgment on which method provides the most reliable estimate in the specific circumstances. A thorough review of the assumptions and limitations (discussed below) is also vital for a complete understanding.

Uses of Appraisal Report Findings by Stakeholders

Appraisal reports serve various purposes for different stakeholders. For example:

* Buyers: Use the report to determine a fair purchase price, negotiating leverage, and securing financing. A buyer might use the valuation to support their offer price, ensuring they aren’t overpaying.

* Sellers: Use the report to justify their asking price, ensuring they receive fair market value for their business. They may use it to support negotiations with potential buyers.

* Investors: Use the report to assess the investment potential of a business, determining whether the potential return justifies the investment risk. This might inform decisions on whether to invest, and how much to invest.

* Lenders: Use the report to assess the collateral value of a business for loan applications. The valuation helps determine the loan amount and repayment terms.

* Legal Proceedings: Appraisal reports can be used in legal disputes involving business ownership, divorce settlements, or estate planning. They provide an objective assessment of value for legal proceedings.

Understanding Limitations and Assumptions

All business appraisals involve assumptions and limitations. The sample excerpt highlights the limitations of comparable company data and the uncertainty of future cash flows. Understanding these limitations is critical. For example, if the market approach relied on limited comparable companies, the valuation’s reliability may be reduced. Similarly, if the financial projections are overly optimistic, the DCF valuation might overstate the business’s value. The appraiser’s explanation of these assumptions and limitations should be carefully reviewed to assess the overall credibility and reliability of the valuation. It’s important to note that these limitations do not necessarily invalidate the appraisal, but they should be considered when interpreting the results.

Illustrative Examples of Business Appraisals

Business valuations are not theoretical exercises; they are crucial in a wide range of real-world situations. The following examples illustrate the diverse applications and methodologies employed in different contexts. Each scenario highlights the importance of a well-executed appraisal in achieving specific business objectives.

Small Business Loan Application

A hypothetical scenario involves Sarah, the owner of a thriving bakery, “Sweet Surrender.” She seeks a $50,000 loan to expand her operations, purchasing new ovens and renovating her storefront. The lender requires a business appraisal to assess the viability of the loan and the bakery’s capacity to repay. The appraiser would use methods like discounted cash flow (DCF) analysis, considering Sweet Surrender’s historical financial performance, projected future earnings, and the bakery’s asset value (equipment, inventory, and real estate). The appraisal report would detail the bakery’s value, its profitability, and the associated risks, providing the lender with a comprehensive picture to inform their lending decision. A successful appraisal demonstrating strong financial health and growth potential significantly increases the likelihood of loan approval.

Large Company Merger and Acquisition

Imagine a scenario involving “TechGiant,” a publicly traded technology company, acquiring “InnovateSolutions,” a smaller, privately held software firm. The valuation of InnovateSolutions is paramount. TechGiant’s acquisition strategy hinges on a precise appraisal. Multiple valuation methods are employed, including market-based approaches (comparing InnovateSolutions to similar publicly traded companies), asset-based approaches (assessing the fair market value of InnovateSolutions’ assets), and income-based approaches (projecting InnovateSolutions’ future earnings and discounting them to present value). The final valuation, a consensus figure derived from various methodologies, informs the acquisition price, ensuring a fair deal for both parties. This process involves extensive due diligence, reviewing financial statements, and projecting future synergies. The appraisal report becomes a critical document in the legal and financial aspects of the merger.

Family-Owned Business Transfer

Consider the “Miller Family Farms,” a multi-generational agricultural business. The current owner, John Miller, plans to transfer ownership to his son, Robert. A business appraisal is essential to determine the fair market value of the farm, ensuring equitable transfer of ownership and minimizing potential family disputes. The appraisal considers the farm’s land value, equipment, livestock, and future earning potential, accounting for factors like market conditions and agricultural trends. The appraisal report helps establish a fair market value that forms the basis for tax calculations and estate planning, ensuring a smooth transition and maintaining family harmony. The process involves careful documentation of assets and liabilities, as well as consideration of any intangible assets, such as brand reputation and customer relationships.

Business Appraisal in a Legal Dispute

In a shareholder dispute involving “GlobalCorp,” two major shareholders disagree on the company’s value. One shareholder seeks to buy out the other, leading to a legal battle over the appropriate valuation. An independent business appraisal becomes crucial evidence in the legal proceedings. The appraiser meticulously examines GlobalCorp’s financial records, operational efficiency, market position, and future prospects, using various valuation techniques to reach a conclusion. The appraisal report, presented as expert testimony, influences the court’s decision regarding the fair market value of the company’s shares, and ultimately, the settlement of the dispute. The appraisal process must strictly adhere to legal and ethical standards, ensuring the report’s credibility and admissibility in court.