What is modified business tax in Nevada? Understanding Nevada’s Modified Business Tax (MBT) is crucial for businesses operating within the state. This tax, unlike a simple percentage of profits, utilizes a complex formula considering various factors to determine the tax liability. This guide delves into the intricacies of MBT, clarifying its calculation, filing procedures, and implications for different business structures. We’ll also compare it to other Nevada business taxes and explore its broader economic impact.

This comprehensive overview will equip you with the knowledge necessary to navigate the complexities of MBT compliance, ensuring you understand your obligations and can effectively manage your tax responsibilities. We’ll cover everything from determining your tax base and calculating your liability to understanding filing deadlines and penalties for non-compliance. By the end, you’ll have a clear grasp of how MBT affects Nevada businesses and how to best manage it within your operations.

Definition of Modified Business Tax in Nevada

Nevada’s Modified Business Tax (MBT) is a gross receipts tax levied on businesses operating within the state. Unlike a net income tax, which taxes profits after expenses, the MBT taxes a company’s gross revenue, providing a simpler, more straightforward tax calculation for the state. This system aims to broaden the tax base and ensure a more consistent revenue stream for Nevada’s government, regardless of individual business profitability.

Businesses Subject to MBT are broadly categorized based on their annual gross receipts. The specific thresholds and classifications can change, so consulting the Nevada Department of Taxation’s official resources is crucial for the most up-to-date information. Generally, however, businesses exceeding a certain gross receipts threshold are subject to the tax. The tax applies to a wide range of industries and business structures, including corporations, partnerships, and limited liability companies (LLCs).

MBT Tax Base

The tax base for MBT calculations is the business’s gross receipts from sales and services performed within Nevada. This includes all revenue generated from business activities, irrespective of deductions for expenses, costs of goods sold, or other business expenditures. The calculation excludes certain specifically defined items, such as sales subject to other state taxes (like sales tax) to avoid double taxation. Accurate record-keeping of all business revenue is vital for proper MBT calculation and compliance.

Businesses Exempt from MBT

Several types of businesses are exempt from the MBT. These exemptions often aim to support specific sectors or prevent undue burdens on smaller entities. For instance, businesses with gross receipts below a certain threshold are typically exempt. Additionally, certain non-profit organizations and government entities may also qualify for exemption. Precise details on exemptions require careful review of the Nevada Department of Taxation guidelines and regulations as these can be subject to change. Specific examples of potentially exempt businesses include small businesses operating under a certain revenue limit, qualifying non-profits, and government agencies. It is important to note that eligibility for exemption depends on meeting specific criteria defined by the Nevada Department of Taxation.

Calculation of Modified Business Tax

Calculating Nevada’s Modified Business Tax (MBT) involves several steps and depends on the business structure and income level. The process is designed to levy a tax on the net profits of businesses operating within the state. Understanding these calculations is crucial for accurate tax filing and compliance.

MBT Calculation Process

The MBT calculation begins with determining the business’s net income. This is generally calculated by subtracting allowable deductions from gross receipts. These deductions can include cost of goods sold, salaries, rent, and other legitimate business expenses. The resulting net income is then subject to the MBT tax rate, which varies depending on the income bracket. Finally, the calculated MBT is the amount due to the Nevada Department of Taxation. It’s important to consult the official Nevada Department of Taxation guidelines for the most up-to-date and accurate information on allowable deductions.

MBT Calculation Examples for Different Business Structures

The MBT calculation remains largely the same regardless of the business structure (sole proprietorship, LLC, corporation). The key difference lies in how the net income is reported. For sole proprietorships and single-member LLCs, net income is reported on the individual’s personal income tax return (Form NV-1120). For partnerships and multi-member LLCs, the net income is reported on the partnership return (Form NV-1065). Corporations report their net income on the corporate income tax return (Form NV-1120-CORP). The MBT is calculated on the net income reported on the relevant return.

For example, consider a sole proprietorship with $100,000 in gross receipts and $40,000 in allowable deductions. The net income is $60,000. If this falls within a tax bracket with a 1.5% MBT rate, the tax liability would be $900 ($60,000 x 0.015). An LLC with the same net income would calculate its MBT in the same manner. A corporation, while filing a separate return, would also use the same basic formula to determine its MBT liability.

MBT Tax Rates by Income Bracket

Nevada’s MBT is a graduated tax, meaning the tax rate increases as net income increases. The specific rates can change, so it’s crucial to refer to the Nevada Department of Taxation’s website for the most current information. However, a simplified example might show brackets like this: Net income up to $100,000 might be taxed at 1.2%, income between $100,000 and $250,000 at 1.5%, and income above $250,000 at 1.8%. These rates are illustrative and may not reflect current law.

MBT Calculation Table

The following table provides an example of how MBT is calculated for different income levels based on hypothetical tax rates. Remember, these rates are for illustrative purposes only and may not reflect the current tax law. Always consult the official Nevada Department of Taxation resources for the most accurate and current tax rates.

| Net Income | Tax Rate (%) | MBT Calculation | MBT Amount |

|---|---|---|---|

| $50,000 | 1.2 | $50,000 x 0.012 | $600 |

| $150,000 | 1.5 | $150,000 x 0.015 | $2,250 |

| $300,000 | 1.8 | $300,000 x 0.018 | $5,400 |

| $500,000 | 1.8 | $500,000 x 0.018 | $9,000 |

Filing Requirements for Modified Business Tax

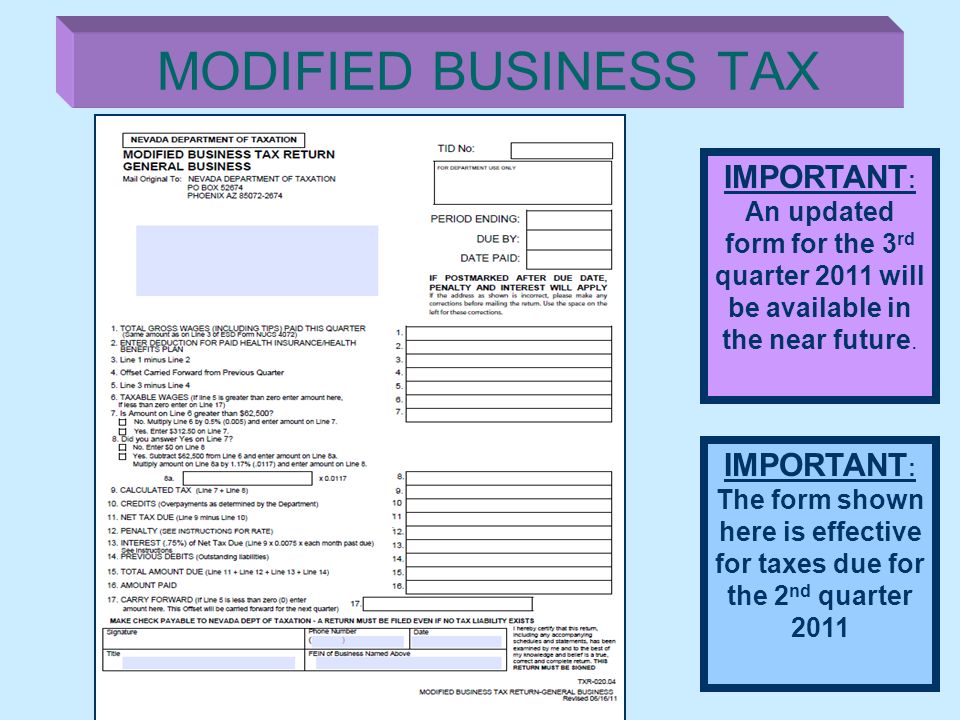

Filing the Nevada Modified Business Tax (MBT) return requires adherence to specific deadlines and procedures. Understanding these requirements ensures compliance and avoids potential penalties. This section details the necessary steps for accurate and timely filing.

MBT Return Filing Deadlines

The Nevada Department of Taxation establishes deadlines for MBT filings. These deadlines typically fall on the 15th day of the fourth month following the end of the tax period. For example, the deadline for a calendar-year filer (January 1 to December 31) is April 15th of the following year. However, it’s crucial to consult the official Nevada Department of Taxation website for the most up-to-date and accurate filing deadlines, as these dates can be subject to change, particularly if the 15th falls on a weekend or holiday. Always verify the deadline to prevent late filing penalties.

Methods for Filing MBT Returns

Nevada offers several convenient methods for filing MBT returns. Taxpayers can choose to file electronically through the Nevada Department of Taxation’s online portal, which provides a user-friendly interface and allows for immediate submission. Alternatively, taxpayers can file their MBT returns via mail, using the designated address provided by the Nevada Department of Taxation. The mailing address should be clearly indicated on the tax forms. While both options are acceptable, electronic filing is generally recommended for its speed and efficiency.

Required Documents for MBT Filing

Accurate and complete documentation is essential for successful MBT filing. Taxpayers must submit the completed MBT return form, along with supporting documentation that substantiates the reported income and expenses. This typically includes but is not limited to financial statements such as profit and loss statements, balance sheets, and supporting schedules detailing the calculation of the MBT liability. Any relevant business licenses or registrations may also be required. Failure to provide sufficient supporting documentation may result in delays in processing or requests for further information.

Correcting Errors on Filed MBT Returns

Errors on filed MBT returns can be corrected by filing an amended return. The Nevada Department of Taxation provides specific forms and instructions for amending tax returns. The amended return should clearly identify the errors made on the original return and provide the necessary corrections with supporting documentation. It’s essential to file the amended return as soon as possible after discovering the error to minimize any potential penalties or interest charges. The Department’s website provides detailed guidance on the process of filing amended returns.

Penalties and Interest for Non-Compliance: What Is Modified Business Tax In Nevada

Non-compliance with Nevada’s Modified Business Tax (MBT) regulations can result in significant financial penalties and interest charges. Understanding these consequences is crucial for businesses to ensure timely and accurate filing and payment of their MBT liabilities. Failure to do so can lead to substantial additional costs beyond the original tax owed.

Late Filing Penalties for MBT Returns

The Nevada Department of Taxation imposes penalties for late filing of MBT returns. The penalty amount depends on the length of the delay. Generally, a penalty is applied as a percentage of the unpaid tax. For example, a late filing penalty might be 10% of the unpaid tax for a return filed within 30 days of the due date, increasing to a higher percentage for greater delays. Specific penalty percentages and calculation methods should be verified directly with the Nevada Department of Taxation, as these are subject to change. It’s essential to consult the most up-to-date official guidelines to ensure accurate understanding.

Interest Charges for Unpaid MBT Taxes, What is modified business tax in nevada

In addition to penalties for late filing, interest accrues on unpaid MBT taxes. This interest is calculated daily from the original due date until the tax is fully paid. The interest rate is typically set by the state and is usually higher than typical commercial interest rates. The total interest charge can quickly accumulate, significantly increasing the overall cost of non-compliance. Similar to the late filing penalties, precise interest rates and calculation methods are subject to change and should be confirmed on the Nevada Department of Taxation website or through direct contact with the department.

Appealing an MBT Assessment

Businesses disagreeing with an MBT assessment have the right to appeal. The appeal process typically involves filing a formal protest with the Nevada Department of Taxation within a specified timeframe. This protest should clearly state the grounds for the appeal, including supporting documentation. The Department will review the protest and may offer a resolution. If the appeal is not resolved at this level, further appeal options may be available, potentially including administrative hearings or judicial review. Detailed information regarding the appeal process, including deadlines and required documentation, is available on the Nevada Department of Taxation website.

MBT Audit Process Flowchart

The following flowchart illustrates the steps involved in an MBT audit:

[Descriptive Flowchart]

Imagine a flowchart with boxes and arrows. The first box would be “Notification of Audit.” An arrow would point to the next box, “Request for Documentation.” Another arrow would lead to “Department Review of Documents.” Then an arrow to “Assessment of Tax Liability.” This box would branch to two boxes: one saying “Agreed Assessment” (with an arrow to “Payment of Tax”) and another saying “Disputed Assessment” (with an arrow leading to “Appeal Process” as described in the previous section). The entire flowchart represents a clear and organized path through the audit process. Each step represents a distinct phase in the audit process, guiding taxpayers through the necessary actions. Clear communication and timely response are crucial at each stage.

Comparison with Other Nevada Business Taxes

Understanding the Modified Business Tax (MBT) requires comparing it to other Nevada business taxes to fully grasp its implications. This comparison will highlight the key differences in tax rates, filing requirements, and applicability, ultimately helping businesses choose the most appropriate tax structure.

Nevada employs several business taxes, each with its own unique characteristics. A direct comparison between the MBT and other prominent taxes like sales tax and gross receipts tax reveals significant distinctions in their scope, calculation, and administrative burden.

MBT, Sales Tax, and Gross Receipts Tax: Key Differences

The following points detail the crucial differences between the Modified Business Tax (MBT), Nevada Sales Tax, and Nevada Gross Receipts Tax. This analysis focuses on the tax base, rate structure, and filing procedures, providing a clear understanding of each tax’s advantages and disadvantages.

- Modified Business Tax (MBT): This tax is levied on the net profits of businesses operating in Nevada, excluding certain deductions allowed under the tax code. The tax rate is a flat percentage, and filing requirements are generally more complex than sales tax. It is advantageous for businesses with lower net profits relative to gross receipts, but can be disadvantageous for businesses with high net profits.

- Nevada Sales Tax: This tax is levied on the sale of tangible personal property and certain services. The tax rate varies by locality, and filing requirements are generally straightforward. It is advantageous for businesses with high gross receipts but low net profits, and can be disadvantageous for businesses that sell primarily exempt items.

- Nevada Gross Receipts Tax: This tax is levied on the gross receipts of businesses operating in Nevada, regardless of profitability. The tax rate is a flat percentage, and filing requirements are relatively simple. It is advantageous for businesses with high gross receipts and low operating expenses, but can be disadvantageous for businesses with low profit margins.

Comparative Analysis of Nevada Business Taxes

The table below provides a concise comparison of the MBT, sales tax, and gross receipts tax in Nevada, focusing on key aspects relevant to business owners.

| Tax Type | Tax Base | Tax Rate | Filing Frequency |

|---|---|---|---|

| Modified Business Tax (MBT) | Net Profits (after allowable deductions) | Variable (check Nevada Department of Taxation for current rates) | Quarterly or Annually (depending on business revenue) |

| Sales Tax | Sales of tangible personal property and certain services | Variable by locality (check Nevada Department of Taxation for current rates) | Monthly or Quarterly (depending on business revenue) |

| Gross Receipts Tax | Gross Receipts | Variable by industry (check Nevada Department of Taxation for current rates) | Monthly or Quarterly (depending on business revenue) |

Resources and Further Information

Navigating the complexities of Nevada’s Modified Business Tax (MBT) can be challenging. Fortunately, several resources are available to provide assistance and clarification. Understanding where to find this information is crucial for ensuring compliance and avoiding potential penalties. This section details the key resources and contact information businesses need to effectively manage their MBT obligations.

The Nevada Department of Taxation offers a comprehensive range of support materials and contact options for taxpayers. These resources are designed to help businesses understand their MBT responsibilities, complete their filings accurately, and resolve any questions or concerns they may have.

Relevant Government Websites and Publications

The Nevada Department of Taxation’s website is the primary source for all MBT-related information. It contains the complete MBT statutes, regulations, forms, instructions, and frequently asked questions (FAQs). Additionally, the department regularly publishes newsletters and updates on its website, providing timely information on changes to the MBT and other tax-related matters. These publications offer valuable insights into recent developments and clarifications, ensuring businesses stay current with the latest regulations. Searching the Nevada Department of Taxation website using s like “Modified Business Tax,” “MBT,” or specific aspects of the tax will yield relevant results.

Contact Information for the Nevada Department of Taxation

The Nevada Department of Taxation provides multiple channels for contacting their support team. Businesses can reach them via phone, mail, or email. Their website usually provides a comprehensive list of contact numbers, categorized by the type of inquiry. The website also typically features a contact form for submitting questions online. It is recommended to check the official website for the most up-to-date contact information, as contact details may change periodically.

Resources for Businesses Seeking Assistance with MBT Compliance

The Nevada Department of Taxation offers various resources to assist businesses with MBT compliance. These resources may include online tutorials, webinars, and downloadable guides that explain the MBT system in detail. Furthermore, the department may offer in-person assistance at their offices or through scheduled appointments. Tax professionals, such as Certified Public Accountants (CPAs) and Enrolled Agents (EAs), also provide specialized services to help businesses navigate the complexities of MBT compliance. These professionals can offer guidance on filing, calculations, and potential tax planning strategies.

Process for Obtaining Clarification on Specific Aspects of MBT Regulations

Businesses seeking clarification on specific aspects of MBT regulations can contact the Nevada Department of Taxation directly through the channels mentioned previously. When contacting the department, it is essential to provide as much detail as possible regarding the specific regulation or aspect of the MBT that requires clarification. This includes referencing the specific section of the statute or regulation, if known. The department typically responds to inquiries within a reasonable timeframe, providing written clarification or directing the business to relevant resources. For complex issues, it might be advisable to seek professional tax advice.

Impact of MBT on Nevada Businesses

The Modified Business Tax (MBT) in Nevada, while designed to broaden the tax base and generate revenue, has had a multifaceted impact on the state’s businesses. Understanding this impact requires analyzing its effects on profitability, investment decisions, and the varying experiences of different industries. The overall economic consequences are complex and depend heavily on individual business models and market conditions.

MBT’s Effect on Business Profitability and Investment Decisions

The MBT directly impacts business profitability by adding an additional tax burden. For businesses with higher gross receipts, the tax can significantly reduce net income. This reduction can, in turn, influence investment decisions. Businesses may postpone expansion plans, reduce hiring, or delay the adoption of new technologies due to the increased tax liability. The extent of this impact varies depending on a business’s ability to absorb the added cost, its profit margins, and the overall economic climate. For example, a small business with thin profit margins might experience a more pronounced impact than a large corporation with substantial revenue streams. Conversely, a business experiencing rapid growth might find the tax less burdensome as the increased revenue can offset the added expense.

MBT’s Impact Across Different Nevada Industries

The MBT’s influence varies across Nevada’s diverse industries. Industries with high gross receipts, such as tourism and hospitality, might feel a more substantial impact than those with lower gross receipts. For instance, large casino resorts will pay considerably more in MBT than a small local bakery. Similarly, industries heavily reliant on tourism, which can be sensitive to economic fluctuations, may experience greater vulnerability to the MBT’s effects during economic downturns. Conversely, industries less dependent on consumer spending or with stronger pricing power might absorb the tax more easily. The construction industry, for example, may be less affected if demand remains strong and it can pass the increased costs onto clients.

Examples of Business Adaptation to MBT Regulations

Nevada businesses have adopted various strategies to adapt to the MBT. Some businesses have implemented cost-cutting measures to offset the increased tax liability, such as streamlining operations or negotiating better deals with suppliers. Others have adjusted their pricing strategies to incorporate the added tax, though this can impact competitiveness. Large corporations with sophisticated financial planning departments may have built the MBT into their long-term financial models, adjusting investment strategies accordingly. Smaller businesses, on the other hand, might rely on more reactive adjustments, such as seeking out government assistance programs or exploring alternative business models. The specific adaptations employed depend on the size, resources, and industry of the business.

Illustrative Example: Silver State Coffee Roasters

Silver State Coffee Roasters is a small, independent coffee roaster operating in Reno, Nevada. They source green coffee beans from various regions globally, roast them in-house, and sell their roasted beans, ground coffee, and brewed coffee directly to consumers through their retail store and online sales. This example will illustrate how the Modified Business Tax (MBT) applies to their operations for a hypothetical tax year.

Business Income and Deductions

Silver State Coffee Roasters’ gross revenue for the tax year was $250,000. This includes sales from their retail store, online orders, and wholesale accounts. Their total allowable deductions, including cost of goods sold (COGS), rent, utilities, salaries, marketing expenses, and depreciation, amounted to $180,000. The COGS represents the cost of the green coffee beans, packaging, and other direct costs associated with producing their coffee products.

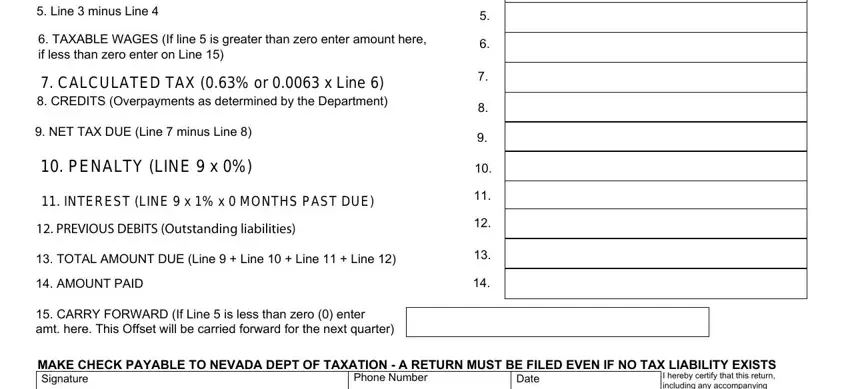

Modified Business Tax Calculation

Nevada’s MBT is calculated on the business’s net income, which is the difference between gross revenue and allowable deductions. In Silver State Coffee Roasters’ case, their net income is $250,000 (Gross Revenue) – $180,000 (Deductions) = $70,000. Assuming a simplified MBT rate of 1.376% (note: the actual rate can vary depending on the tax year and the business’s specific circumstances), the MBT owed would be $70,000 * 0.01376 = $963.20.

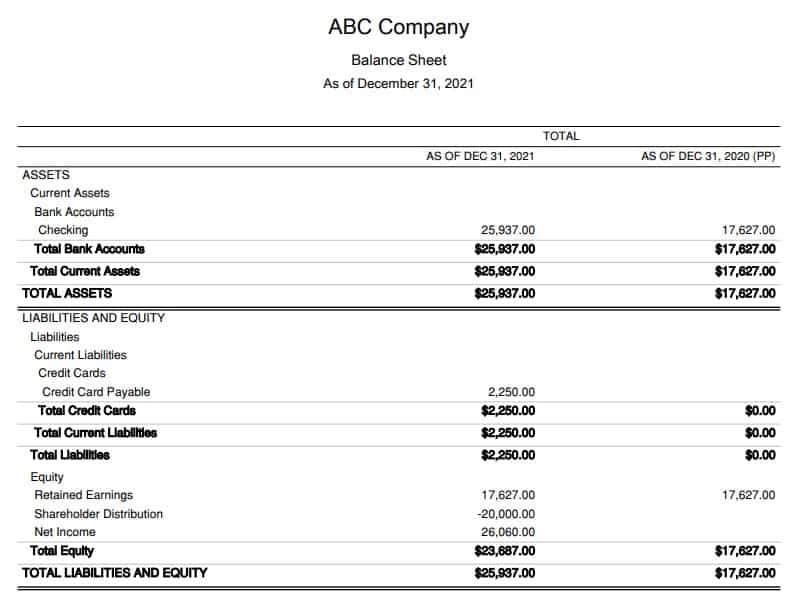

Impact on Financial Statements

The $963.20 MBT expense will be recorded on Silver State Coffee Roasters’ income statement as an operating expense, reducing their net profit. This will, in turn, affect their balance sheet by reducing their retained earnings. The tax liability will also be reflected on their tax returns. The business’s overall profitability is affected but in this case, the impact is relatively small given their overall revenue and profitability.

MBT Compliance Experience

Silver State Coffee Roasters engaged a tax professional to assist with their MBT filing. This professional helped them accurately determine their allowable deductions and ensured their return was filed accurately and on time. The business found the MBT filing process relatively straightforward, although the need for professional assistance added to their overall tax preparation costs. The business maintains meticulous records of all their financial transactions to facilitate the annual tax preparation. They have developed a system of tracking income and expenses which greatly simplifies the compliance process.