What is pre business – What is pre-business? It’s the crucial, often overlooked, phase before your business officially launches. This period involves laying the groundwork for success, from meticulous market research and crafting a robust business plan to securing funding and navigating legal complexities. Think of it as building a strong foundation before constructing the skyscraper of your entrepreneurial dreams – a phase that determines the stability and longevity of your venture.

Understanding the pre-business phase is vital for aspiring entrepreneurs. It encompasses a series of strategic steps designed to minimize risk and maximize the chances of a successful launch. This involves tasks such as defining your target market, developing a comprehensive business plan, securing necessary funding, and addressing crucial legal and regulatory considerations. By meticulously planning during this phase, you set the stage for a smoother, more successful business journey.

Defining “Pre-Business” Activities

The pre-business phase represents the crucial groundwork laid before the official launch of any venture. It’s a period of intense planning, research, and preparation, determining the viability and future success of the business. This phase is distinct from the operational phase, which focuses on day-to-day running and expansion. Understanding the intricacies of pre-business activities is paramount for entrepreneurs seeking to minimize risks and maximize their chances of success.

Pre-business activities encompass all the tasks undertaken before a company officially begins operations. This differs significantly from the operational phase, which involves the actual running of the business, including sales, production, and customer service. The pre-business phase is characterized by strategic planning and resource acquisition, while the operational phase is about execution and scaling. Neglecting the pre-business phase can lead to poorly defined strategies, inadequate resources, and ultimately, business failure.

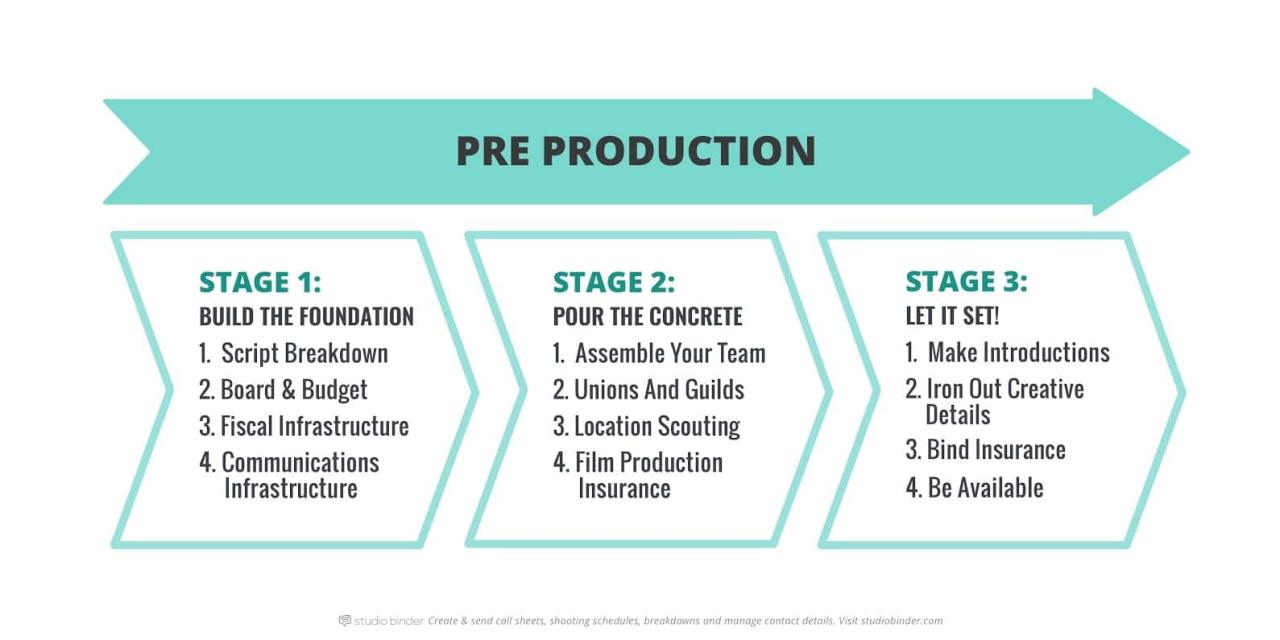

Stages of the Pre-Business Phase

The pre-business phase typically involves several interconnected stages. These stages often overlap and iterate, requiring continuous evaluation and adjustment. A clear understanding of these stages allows for a more systematic and efficient approach to business development.

Key Differences Between Pre-Business and Operational Phases

The fundamental difference lies in the focus: pre-business concentrates on planning and preparation, while the operational phase centers on execution and growth. Pre-business activities are largely proactive, involving market analysis, resource securing, and strategy development. The operational phase is reactive, adapting to market demands and customer feedback. Pre-business is about laying the foundation; operations are about building the structure. One example highlighting this difference is the contrast between developing a comprehensive marketing plan (pre-business) and actually implementing marketing campaigns (operational).

Examples of Common Pre-Business Tasks

Several key tasks characterize the pre-business phase. These tasks are interconnected and should be addressed concurrently, rather than sequentially, to ensure a holistic approach to business development. Thorough completion of these tasks significantly improves the chances of long-term business success.

| Task | Description | Timeline | Resources Needed |

|---|---|---|---|

| Market Research | Analyzing target markets, identifying competitors, and assessing market demand for the product or service. | 3-6 months | Market research reports, surveys, competitor analysis tools, industry experts |

| Business Plan Development | Creating a comprehensive document outlining the business’s goals, strategies, and financial projections. | 2-4 months | Financial modeling software, industry data, business plan templates |

| Securing Funding | Obtaining necessary capital through loans, investments, or bootstrapping. | 1-6 months (depending on funding source) | Business plan, financial projections, investor network |

| Legal Structure Setup | Establishing the legal framework for the business, such as registering the company and obtaining necessary licenses and permits. | 1-3 months | Legal counsel, government resources, registration fees |

Market Research and Analysis in the Pre-Business Phase

Thorough market research is crucial before launching any business. It mitigates risk, informs strategic decisions, and significantly increases the chances of success. Without understanding your market, your product or service, however innovative, might fail to find its audience. This pre-business phase research lays the foundation for a robust business plan and a sustainable enterprise.

Market research involves systematically gathering and analyzing information about your potential customers, competitors, and the overall market landscape. This process helps you identify opportunities, refine your business model, and ultimately, make informed choices about everything from product development to marketing strategies. The goal is to gain a clear, data-driven understanding of the market before investing significant resources.

Methods for Conducting Effective Market Research

Effective market research utilizes a variety of methods to gain a comprehensive understanding. These methods should be tailored to your specific business idea and resources. A multi-faceted approach typically yields the most valuable insights.

- Surveys: Online surveys, using platforms like SurveyMonkey or Google Forms, are cost-effective and allow you to reach a large audience quickly. Well-designed surveys with clear, concise questions can gather quantitative data (e.g., demographics, purchasing habits) and qualitative data (e.g., opinions, feedback). For example, a survey could ask about preferred features in a new software application or the willingness to pay for a particular service.

- Competitor Analysis: Analyzing your competitors’ strengths, weaknesses, pricing strategies, and marketing efforts provides valuable insights. This involves researching their websites, social media presence, and customer reviews to understand their market positioning and identify potential gaps or opportunities. For instance, analyzing a competitor’s pricing strategy might reveal an underserved market segment with a willingness to pay a premium for specific features.

- Focus Groups: Focus groups involve bringing together a small group of potential customers to discuss your product or service. This qualitative research method provides rich, nuanced insights into customer needs and preferences. For example, a focus group could be used to test different marketing messages or gather feedback on a prototype.

- Secondary Research: This involves gathering information from existing sources, such as market reports, industry publications, and government data. This can provide a broader understanding of the market trends and demographics relevant to your business idea. For example, industry reports can provide data on market size, growth rates, and consumer behavior.

Identifying Target Audiences and Their Needs

Defining your target audience is paramount. This involves segmenting the market into groups based on shared characteristics (demographics, psychographics, behavior) and identifying the specific needs and pain points of each segment. Understanding your target audience allows you to tailor your product, marketing, and sales strategies to resonate with them effectively.

For example, a company selling organic baby food might target parents concerned about their children’s health and willing to pay a premium for high-quality ingredients. Understanding this target audience’s values and priorities allows the company to craft marketing messages that emphasize health and sustainability.

Sample Market Research Questionnaire

A well-structured questionnaire is crucial for gathering meaningful data. The following example focuses on a hypothetical coffee shop:

| Question Type | Question | Answer Options/Type |

|---|---|---|

| Demographic | What is your age range? | 18-24, 25-34, 35-44, 45-54, 55+ |

| Behavioral | How often do you visit coffee shops? | Daily, Several times a week, Once a week, Less than once a week |

| Attitudinal | How important is the atmosphere of a coffee shop to you? | Very Important, Somewhat Important, Not Important |

| Open-ended | What are your favorite things about coffee shops? | Text box for free response |

| Rating Scale | How would you rate the importance of free Wi-Fi? | 1 (Not at all important) to 5 (Extremely important) |

This sample questionnaire demonstrates the different question types that can be used to gather comprehensive data. Remember to keep the questionnaire concise and easy to understand to maximize response rates.

Developing a Business Plan

A comprehensive business plan is crucial for securing funding, guiding operations, and achieving long-term success. It serves as a roadmap, outlining your business goals, strategies, and financial projections. A well-structured plan demonstrates your understanding of the market, your competitive advantage, and your ability to manage the business effectively. This section details the process of creating a robust business plan.

Step-by-Step Guide to Business Plan Creation

Creating a business plan is an iterative process, often requiring refinement as your understanding of the market and your business evolves. The following steps provide a structured approach:

- Executive Summary: Write this last. It concisely summarizes the entire plan, highlighting key aspects such as the business opportunity, target market, financial projections, and management team.

- Company Description: Detail your business’s mission, vision, legal structure, and ownership. Include information about your products or services and your unique selling proposition (USP).

- Market Analysis: This section thoroughly analyzes your target market, including market size, trends, demographics, and competition. It should identify your ideal customer profile and demonstrate the market opportunity for your business.

- Organization and Management: Describe your business structure, organizational chart, and key personnel. Highlight the experience and expertise of your management team.

- Service or Product Line: Detail your offerings, including features, benefits, pricing, and production process. Explain your intellectual property (if any) and any competitive advantages.

- Marketing and Sales Strategy: Artikel your marketing plan, including target audience, marketing channels, and sales strategies. Detail your customer acquisition cost (CAC) and customer lifetime value (CLTV) estimations.

- Funding Request (if applicable): If seeking funding, clearly state the amount needed, its intended use, and your proposed return on investment (ROI).

- Financial Projections: Include detailed financial forecasts, including income statements, balance sheets, and cash flow statements. These projections should be realistic and supported by market research and assumptions.

- Appendix (optional): Include supporting documents such as market research data, resumes of key personnel, and permits or licenses.

Key Sections of a Business Plan

A well-structured business plan typically includes the following key sections:

- Executive Summary

- Company Description

- Market Analysis

- Organization and Management

- Service or Product Line

- Marketing and Sales Strategy

- Funding Request (if applicable)

- Financial Projections

- Appendix (optional)

Importance of Financial Projections and Forecasting

Financial projections are critical for assessing the viability and potential profitability of your business. They provide a realistic picture of your expected revenue, expenses, and cash flow over a specific period. Accurate forecasting helps secure funding, make informed decisions, and track progress against targets. Investors and lenders rely heavily on these projections to assess risk and potential returns.

Creating Realistic Financial Projections

Let’s illustrate creating realistic financial projections with a hypothetical example. Imagine a small bakery launching in a town with a population of 10,000.

| Year | Revenue | Cost of Goods Sold | Gross Profit | Operating Expenses | Net Profit |

|---|---|---|---|---|---|

| Year 1 | $50,000 | $25,000 | $25,000 | $15,000 | $10,000 |

| Year 2 | $75,000 | $37,500 | $37,500 | $20,000 | $17,500 |

| Year 3 | $100,000 | $50,000 | $50,000 | $25,000 | $25,000 |

These figures are hypothetical. Realistic projections require detailed market research, pricing strategies, and cost analysis. For instance, the revenue projections are based on estimated sales volume and average transaction value. Cost of Goods Sold (COGS) includes raw materials and direct labor costs. Operating expenses encompass rent, utilities, salaries, and marketing costs. This example demonstrates a gradual increase in revenue and profit, reflecting business growth and market penetration. However, it’s crucial to consider potential risks and challenges that could impact these projections, such as competition, economic downturns, or unexpected expenses. Sensitivity analysis should be conducted to test the robustness of these projections under different scenarios.

Securing Funding and Resources

Securing sufficient funding is crucial for a pre-business venture to transition into a fully operational enterprise. The choice of funding source significantly impacts the trajectory of the business, influencing its growth, operational flexibility, and long-term sustainability. Understanding the various options and their associated implications is paramount for entrepreneurs navigating the pre-business phase.

Funding options for startups are diverse, each with its own set of advantages and disadvantages. Careful consideration of these factors is essential for aligning the funding strategy with the business’s specific needs and risk tolerance. The selection process often involves a thorough evaluation of the business plan, the management team’s capabilities, and the market opportunity.

Funding Options for Startups

Startups typically explore several avenues for securing funding. Bootstrapping, angel investors, and venture capital represent three distinct approaches, each offering unique characteristics.

Bootstrapping

Bootstrapping involves funding a business using personal savings, revenue generated from operations, and loans from friends and family. This approach minimizes reliance on external investors, offering greater control and avoiding equity dilution. However, bootstrapping can limit growth potential due to constrained capital and may require a longer time horizon to achieve scale. Successful bootstrapping often requires meticulous financial management and a strong understanding of lean business principles. For example, a software developer might use their personal savings to develop a minimum viable product (MVP), then reinvest early revenue to enhance the product and expand marketing efforts.

Angel Investors

Angel investors are high-net-worth individuals who invest their personal capital in early-stage companies in exchange for equity. They provide not only financial resources but also mentorship and industry connections. Angel investment offers a quicker path to capital compared to bootstrapping, but it involves surrendering a portion of equity. The selection process for angel investors is competitive, requiring a compelling business plan and a strong team. A successful example is the early investment by Ron Conway in Google, which yielded substantial returns for both the investor and the company.

Venture Capital

Venture capital firms invest in high-growth potential startups, typically at a later stage than angel investors. They provide significant capital injections in exchange for a substantial equity stake and influence over the company’s direction. Venture capital offers rapid growth opportunities but demands a high return on investment, often requiring significant revenue projections and a scalable business model. Venture capital funding comes with stringent reporting requirements and a loss of operational autonomy. For instance, many technology unicorns, such as Uber and Airbnb, initially secured substantial funding from venture capital firms.

Factors Investors Consider

Investors evaluate business proposals based on several key factors. These include the size and potential of the target market, the strength of the management team, the competitive landscape, the financial projections, and the overall business model’s viability. A strong value proposition, clear revenue streams, and a well-defined exit strategy are also crucial for securing investment. Investors often conduct due diligence to assess the risks and potential returns before committing funds.

Comparison of Funding Options

| Funding Option | Capital Amount | Equity Dilution | Control | Mentorship | Risk |

|---|---|---|---|---|---|

| Bootstrapping | Limited | None | High | None | High |

| Angel Investors | Moderate | Moderate | Moderate | High | Moderate |

| Venture Capital | High | High | Low | Moderate | Moderate |

Legal and Regulatory Considerations

Navigating the legal landscape is crucial for any aspiring entrepreneur. Failure to comply with relevant regulations can lead to significant financial penalties, legal battles, and even business closure. Understanding and adhering to legal requirements from the outset minimizes risk and sets the stage for a successful venture.

Business Registration and Licensing, What is pre business

Registering your business name and obtaining the necessary licenses and permits are fundamental legal steps. The specific requirements vary significantly depending on your business structure (sole proprietorship, partnership, LLC, corporation), industry, and location. For example, a food truck will require different permits than a software development company. A sole proprietorship might only need a business license from the local municipality, while a corporation may face more complex registration processes at both the state and federal levels. Failure to obtain the correct licenses can result in hefty fines and potential legal action. The process typically involves filing paperwork with relevant government agencies, paying fees, and potentially undergoing inspections to ensure compliance with safety and operational standards.

Intellectual Property Rights

Protecting intellectual property (IP) is paramount, particularly for businesses built around innovative products, services, or brands. This encompasses patents (for inventions), trademarks (for brand names and logos), and copyrights (for creative works). Understanding which type of IP protection is relevant to your business and proactively securing those rights is essential to prevent infringement and protect your competitive advantage. For instance, a tech startup developing a novel algorithm should consider patent protection, while a clothing brand should register its logo as a trademark. Neglecting IP protection can leave your business vulnerable to competitors copying your ideas and undermining your market position.

Common Legal Pitfalls

Several common legal pitfalls can hinder a business’s success during the pre-business phase. One frequent mistake is operating without the necessary licenses and permits, as discussed above. Another is failing to secure adequate insurance coverage, leaving the business exposed to significant financial losses in case of accidents, lawsuits, or other unforeseen events. Poorly drafted contracts with suppliers, customers, or employees can also create significant legal headaches down the line. Finally, neglecting to establish clear ownership structures and agreements among business partners can lead to disputes and costly legal battles.

Pre-Launch Legal Checklist

Before launching your business, it’s vital to complete a thorough legal checklist. This checklist should include:

- Choosing a business structure and registering it with the relevant authorities.

- Obtaining all necessary licenses and permits at the local, state, and federal levels.

- Securing appropriate insurance coverage (general liability, professional liability, etc.).

- Registering trademarks and/or patents, as applicable.

- Developing and reviewing contracts with suppliers, customers, and employees.

- Establishing clear ownership structures and agreements among business partners.

- Consulting with a legal professional to ensure compliance with all relevant laws and regulations.

Building a Team and Establishing Partnerships: What Is Pre Business

Building a strong team and forging strategic partnerships are critical for pre-business success. A well-structured team with complementary skills mitigates risk and accelerates progress, while strategic partnerships provide access to resources and expertise otherwise unavailable to a fledgling venture. These two elements are intertwined; a strong team can better leverage partnerships, and successful partnerships can strengthen the team.

A strong team possesses a diverse skillset, ensuring all facets of the business are adequately addressed. This goes beyond simply having people with different job titles; it’s about complementary strengths and weaknesses, a shared vision, and a collaborative work ethic. A lack of such synergy can lead to internal conflicts, stalled progress, and ultimately, failure.

Key Roles and Responsibilities in a Startup Team

The specific roles within a startup team will vary depending on the nature of the business, but some common positions include a CEO responsible for overall strategy and leadership, a CTO focusing on technology and product development, a CFO managing finances, and a marketing and sales lead driving customer acquisition. Each role demands distinct expertise and responsibilities. For example, the CEO needs strong leadership and strategic thinking, the CTO requires deep technical understanding, the CFO needs financial acumen, and the marketing and sales lead must possess a strong understanding of the target market and effective sales strategies. The absence of any of these core functions can severely hinder progress. Effective delegation and clear lines of responsibility are crucial for team efficiency.

Benefits of Establishing Strategic Partnerships

Strategic partnerships offer numerous advantages to pre-business ventures. Access to capital, technology, distribution channels, and market expertise are all significant benefits. For instance, a partnership with an established company might provide access to a ready-made customer base or a robust supply chain, significantly reducing the time and resources needed to reach market viability. Furthermore, partnerships can enhance credibility and brand recognition, attracting investors and customers more readily. A collaboration with a reputable organization can lend legitimacy to a new venture, mitigating the risks associated with an unknown entity. Finally, partnerships can foster innovation through the exchange of ideas and expertise.

Examples of Effective Team Structures

The ideal team structure depends on the business model. A technology startup might benefit from a flatter, more agile structure, emphasizing collaboration and rapid iteration. Conversely, a more traditional business might prefer a hierarchical structure with clearly defined roles and reporting lines. For instance, a SaaS (Software as a Service) startup might benefit from a team structure centered around engineering, product development, and marketing, with a strong emphasis on rapid prototyping and customer feedback loops. Meanwhile, a consulting firm might require a more structured approach with project managers, consultants, and administrative support staff, prioritizing clear communication and project management capabilities. Scalability should also be a consideration when choosing a structure; the team needs to be able to adapt and grow as the business expands.

Developing a Marketing Strategy

A robust marketing strategy is crucial for pre-business activities, laying the groundwork for a successful product or service launch. It involves identifying your target audience, crafting compelling messaging, selecting appropriate channels, and meticulously tracking your progress. A well-defined strategy ensures you reach the right people with the right message at the right time, maximizing your impact and minimizing wasted resources before you even officially launch.

Sample Marketing Plan

This sample marketing plan Artikels key components for a hypothetical fitness app targeting young professionals aged 25-35 in urban areas.

Target Audience: Young professionals (25-35 years old) living in major cities, health-conscious, tech-savvy, busy lifestyles, seeking convenient and effective workout solutions. They are active on social media, particularly Instagram and TikTok.

Messaging: The app offers personalized workout plans, guided sessions, and progress tracking, all designed to fit into busy schedules. The messaging emphasizes convenience, effectiveness, and community. Key phrases include: “Fitness on your terms,” “Achieve your goals, anytime, anywhere,” and “Join our supportive community.”

Channels: Social media marketing (Instagram, TikTok, Facebook ads), influencer collaborations, content marketing (blog posts, fitness tips), email marketing, pre-launch waiting list building.

Pre-Launch Marketing Strategies

Several strategies are particularly effective during the pre-launch phase. These strategies focus on building anticipation and generating leads before the official launch.

Content Marketing: Creating valuable and engaging content related to your product or service establishes your brand as an authority and generates interest. For the fitness app, this could involve blog posts on workout tips, healthy recipes, and interviews with fitness experts.

Influencer Marketing: Partnering with relevant influencers can significantly boost brand awareness and reach a wider audience. The fitness app could collaborate with fitness influencers on Instagram and TikTok to showcase the app’s features and benefits.

Email Marketing: Building an email list before launch allows you to directly communicate with potential customers and keep them updated on progress. Offering incentives, like early bird discounts or exclusive content, can encourage sign-ups.

Public Relations: Securing media coverage through press releases and media outreach can generate buzz and credibility.

Building Brand Awareness Before Launch

Building brand awareness before a launch requires a multifaceted approach.

Social Media Engagement: Actively engaging with your target audience on social media platforms builds anticipation and fosters a sense of community. This could include running contests, polls, and Q&A sessions.

Website Development: A well-designed website provides valuable information about your product or service and allows potential customers to learn more. Including a countdown timer to the launch date can build excitement.

Strategic Partnerships: Collaborating with complementary businesses can expand your reach and introduce your brand to a new audience. For the fitness app, this could involve partnering with a nutrition company or a yoga studio.

Measuring Pre-Launch Marketing Effectiveness

Tracking key metrics provides valuable insights into the success of pre-launch marketing efforts.

Website Analytics: Monitoring website traffic, bounce rate, and time spent on site provides insights into user engagement.

Social Media Analytics: Tracking metrics such as likes, shares, comments, and reach helps assess the effectiveness of social media campaigns.

Email Marketing Metrics: Analyzing open rates, click-through rates, and conversion rates helps measure the effectiveness of email marketing efforts.

Lead Generation: Tracking the number of leads generated through various channels provides insights into the effectiveness of lead generation strategies. For example, monitoring sign-ups for the pre-launch waiting list.