What is the difference between company and business? This seemingly simple question unravels a complex web of legal structures, ownership models, operational scales, and financial realities. Understanding these distinctions is crucial for entrepreneurs, investors, and anyone navigating the world of commerce, impacting everything from liability protection to long-term strategic planning.

The terms “company” and “business” are often used interchangeably, leading to confusion. However, a closer examination reveals significant differences. A business is a broader term encompassing any activity undertaken for profit, while a company represents a specific legal structure under which a business operates. This fundamental distinction impacts various aspects, including taxation, liability, and the ease of raising capital. We’ll explore the nuances of each legal structure, the complexities of ownership and control, and the diverse operational scales involved, ultimately providing a clearer understanding of these key concepts.

Legal Structure and Formation

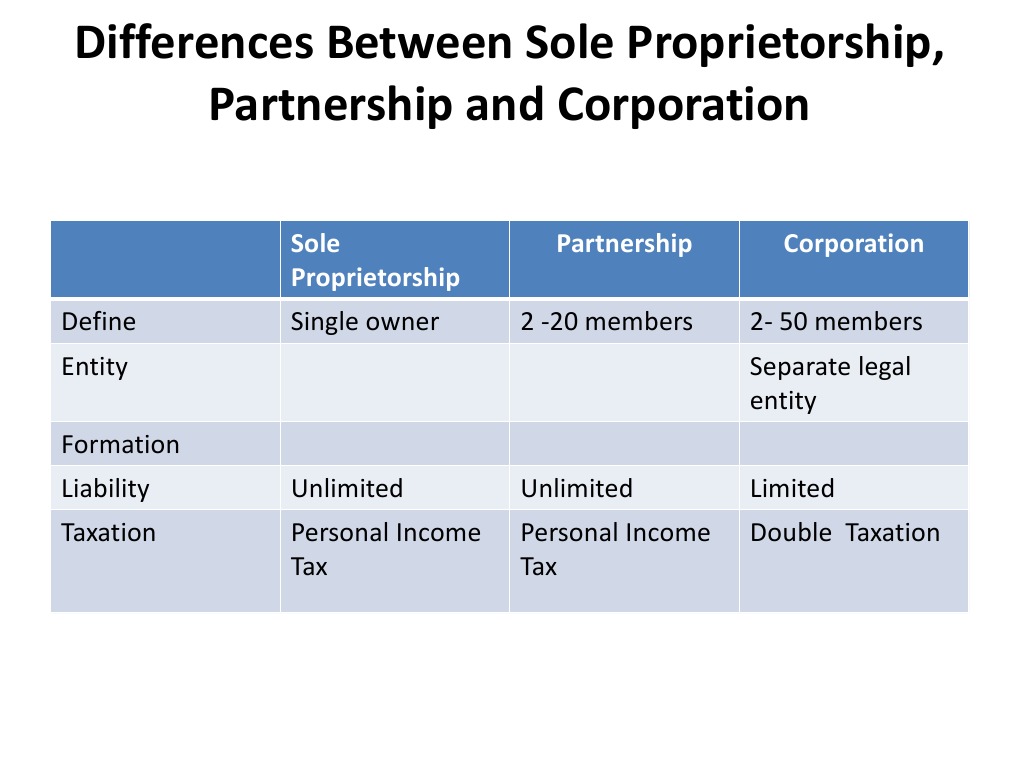

Choosing the right legal structure for your business is a crucial decision impacting liability, taxation, and administrative burden. The structure you select will significantly influence your business’s operational flexibility and long-term growth potential. Understanding the differences between various legal structures is paramount before launching any venture.

Sole Proprietorship

A sole proprietorship is the simplest form of business ownership. It’s a business owned and run by one person, and there is no legal distinction between the owner and the business. Formation is straightforward; typically, only a business license is required, depending on the location and industry. The owner directly receives all profits but is also personally liable for all business debts and obligations. This means personal assets are at risk if the business incurs debt or faces lawsuits. Many small businesses, such as freelance consultants or independent contractors, operate as sole proprietorships.

Partnership

A partnership involves two or more individuals who agree to share in the profits or losses of a business. A key element is the partnership agreement, a legally binding contract outlining each partner’s responsibilities, contributions, and share of profits and losses. Partners typically share liability for business debts, although the extent of liability can vary depending on the type of partnership (general or limited). Examples include law firms, medical practices, and accounting firms.

Limited Liability Company (LLC)

An LLC combines the benefits of a sole proprietorship/partnership with the limited liability of a corporation. Owners, known as members, enjoy limited liability, meaning their personal assets are generally protected from business debts and lawsuits. Formation involves filing articles of organization with the relevant state agency. LLCs offer flexibility in taxation; they can choose to be taxed as a sole proprietorship, partnership, S corporation, or C corporation. Many small to medium-sized businesses, such as consulting firms and retail stores, choose the LLC structure.

Corporation (C-Corp and S-Corp)

A corporation is a separate legal entity from its owners (shareholders). This separation provides significant liability protection; shareholders are generally not personally liable for business debts. Corporations are more complex to form, requiring the filing of articles of incorporation and adherence to more stringent regulatory requirements. There are two main types: C-corporations and S-corporations. C-corporations are taxed separately from their owners, while S-corporations pass their income through to their shareholders, avoiding double taxation. Large companies like Apple and Microsoft are examples of C-corporations, while smaller businesses may opt for S-corp status to manage taxation more efficiently.

Comparison of Legal Structures

| Legal Structure | Liability | Taxation | Administrative Burden |

|---|---|---|---|

| Sole Proprietorship | Unlimited personal liability | Pass-through taxation (owner’s personal income tax) | Low |

| Partnership | Generally unlimited personal liability (varies by type of partnership) | Pass-through taxation (partners’ personal income tax) | Moderate |

| LLC | Limited liability | Flexible (can choose different tax classifications) | Moderate to High |

| C-Corporation | Limited liability | Double taxation (corporate tax and shareholder tax) | High |

| S-Corporation | Limited liability | Pass-through taxation (shareholders’ personal income tax) | High |

Ownership and Control

The fundamental difference between a company and a business lies in their ownership structure and the resulting control mechanisms. While the term “business” encompasses a wide range of entities, from sole proprietorships to large corporations, the term “company” typically refers to a legally incorporated entity, often with a more complex ownership structure. This distinction significantly impacts how these entities are managed, their strategic direction, and the responsibilities of various stakeholders.

Ownership in a business, particularly a sole proprietorship or partnership, is directly tied to its management. The owner(s) have complete control over operations, decision-making, and the distribution of profits. In contrast, companies, especially corporations, often exhibit a separation of ownership and control. Shareholders own the company, but the day-to-day management is delegated to a board of directors and executive officers. This separation creates a distinct dynamic impacting stakeholder relationships and strategic direction.

Stakeholder Roles in Companies and Businesses

Stakeholders in a small business, such as a family-owned bakery, might include the owner (who is also the manager and primary employee), the family members assisting in the business, and perhaps a few local suppliers. The owner holds ultimate authority, making all key decisions. In contrast, a publicly traded company like Apple has a vastly more complex stakeholder landscape. Shareholders, who own a portion of the company, have voting rights and receive dividends, but their direct influence on day-to-day operations is limited. Other stakeholders include the board of directors, responsible for overseeing management, employees, customers, suppliers, and the broader community impacted by the company’s activities. Each group has its own set of interests and expectations.

Impact of Ownership Structures on Decision-Making, What is the difference between company and business

The ownership structure profoundly influences decision-making processes. In a sole proprietorship, the owner’s decisions are swift and autonomous, although they may lack diverse perspectives. Partnerships involve negotiation and compromise between partners. In contrast, corporations’ decision-making is more complex, involving layers of management and approval processes. The board of directors sets the overall strategic direction, while executive management implements the strategy. This layered approach can lead to slower decision-making but often incorporates more perspectives and mitigates the risks associated with single-person control.

Ownership’s Impact on Strategic Direction

A small business, perhaps a local bookstore, might focus on building a loyal customer base and providing personalized service, reflecting the owner’s values and vision. Its strategic direction is intimately tied to the owner’s personal preferences and the local market. A publicly traded company, however, must consider a broader range of factors, including shareholder expectations, market trends, and regulatory compliance. Their strategic direction is often shaped by the need to maximize shareholder value, sometimes leading to decisions that prioritize short-term gains over long-term sustainability.

Scenario: Ownership Influence Contrast

Consider a small family-owned restaurant versus a large publicly traded restaurant chain. The family-owned restaurant’s owner might decide to donate a portion of profits to a local charity, reflecting their personal values. They might also choose to maintain a smaller menu, prioritizing quality over quantity. The publicly traded chain, however, would likely focus on maximizing profitability and expanding its market share. Decisions about menu items, pricing, and marketing would be driven by market research and financial projections, with shareholder value as the primary consideration. While the family-owned restaurant’s decisions are directly influenced by the owner’s values and vision, the publicly traded chain’s decisions are largely determined by market forces and shareholder demands. This scenario highlights the stark contrast in ownership influence and its impact on strategic direction.

Size and Scope of Operations: What Is The Difference Between Company And Business

Companies and businesses differ significantly in their size and scope of operations. While the terms are often used interchangeably, understanding their operational distinctions is crucial for comprehending their respective management complexities and market approaches. This section will explore these differences, examining how scale impacts resource allocation, management strategies, and marketing efforts.

The typical size and scale of operations vary dramatically between companies and businesses. Companies, particularly large corporations, often operate on a much larger scale, encompassing numerous departments, geographical locations, and potentially even global reach. Businesses, on the other hand, frequently operate on a smaller, more localized scale, sometimes even consisting of a single proprietor or a small team.

Examples of Large Companies and Small Businesses

Illustrative examples highlight the operational disparities. Consider a multinational corporation like Walmart, with thousands of stores worldwide, employing hundreds of thousands of people, and managing a complex supply chain spanning the globe. This contrasts sharply with a local bakery, employing a handful of staff, serving a limited geographical area, and managing a relatively straightforward supply chain. Walmart’s operations require sophisticated management information systems, intricate logistics networks, and substantial capital investment, while the bakery’s operations are significantly less complex and demand fewer resources.

Impact of Size on Resource Allocation and Management Strategies

Size profoundly impacts resource allocation and management strategies. Large companies typically have dedicated departments for finance, marketing, human resources, and research and development, each with specialized personnel and budgets. They employ formal organizational structures, sophisticated planning processes, and advanced technologies to manage their operations efficiently. In contrast, small businesses often lack these specialized departments and may rely on the owner or a small team to handle multiple functions simultaneously. Their resource allocation is typically less formalized, and their management strategies tend to be more adaptable and responsive to immediate needs.

Comparison of Management Complexities

Managing a large company presents significantly greater complexities than managing a small business. Large companies face challenges related to coordination across multiple departments and geographical locations, managing diverse teams, navigating complex regulatory environments, and ensuring consistent quality and performance across a large-scale operation. Small businesses, while facing their own set of challenges, benefit from greater agility and direct owner involvement, allowing for quicker decision-making and greater adaptability to market changes. Communication and control are far more streamlined in a smaller business.

Marketing and Sales Approaches Based on Size

Marketing and sales approaches also differ significantly based on the entity’s size. Large companies typically employ sophisticated marketing strategies, including extensive advertising campaigns, market research, and brand building initiatives, leveraging substantial marketing budgets. They may utilize diverse channels, including television, print, digital, and social media. Small businesses often rely on more localized and personalized marketing efforts, such as word-of-mouth referrals, local advertising, and direct engagement with customers. Their marketing budgets are typically much smaller, requiring a more targeted and cost-effective approach.

Financial Aspects

Companies and businesses, while often used interchangeably, differ significantly in their financial structures and operations. Understanding these differences is crucial for anyone involved in managing, investing in, or analyzing these entities. This section will explore the key financial distinctions between companies (typically incorporated entities) and businesses (which can encompass a wider range of structures).

Financial Reporting Requirements

Companies, particularly those publicly traded or exceeding certain size thresholds, face significantly more stringent financial reporting requirements than most businesses. Public companies must adhere to generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS), requiring detailed and audited financial statements filed regularly with regulatory bodies. These statements typically include balance sheets, income statements, cash flow statements, and statements of changes in equity. Smaller businesses, operating as sole proprietorships or partnerships, may have simpler reporting requirements, often filing only basic tax returns. The level of detail and frequency of reporting directly correlate with the size and legal structure of the entity.

Access to Funding and Capital

Companies, especially corporations, generally have easier access to a wider range of funding sources compared to businesses. They can issue stocks and bonds to raise capital, attracting investors through public offerings or private placements. Businesses often rely on more limited options such as bank loans, lines of credit, personal savings, or angel investors. The perceived risk associated with each entity influences the availability and cost of capital. Corporations, with their established legal structures and potentially larger asset bases, tend to be seen as lower-risk investments, leading to more favorable funding terms.

Taxation

The tax implications for companies and businesses vary significantly depending on their legal structure and location. Corporations are typically subject to corporate income tax on their profits, separate from the personal income tax of their shareholders. Businesses structured as sole proprietorships or partnerships, on the other hand, typically have their profits taxed at the owner’s individual income tax rate. This can lead to different overall tax burdens, depending on the applicable tax rates and the structure chosen. Furthermore, different types of companies (e.g., S corporations, LLCs) have distinct tax treatments.

Examples of Financial Statements and Key Differences

Consider a publicly traded corporation like Apple Inc. and a small bakery operating as a sole proprietorship. Apple’s financial statements would be extensive, including detailed breakdowns of revenue streams, expenses, assets, and liabilities, audited by independent accounting firms and filed with the Securities and Exchange Commission (SEC). The bakery’s financial reporting would likely be much simpler, focusing on income and expenses for tax purposes. The level of detail, the inclusion of specific financial ratios, and the frequency of reporting would drastically differ. For instance, Apple’s statements would include items like intangible assets (brand value), while the bakery’s statements would be more straightforward, primarily focusing on tangible assets like ovens and inventory.

Hypothetical Financial Projections

Let’s project the financial performance of a small coffee shop (sole proprietorship) and a large multinational technology company (corporation) over five years.

The coffee shop’s projection might show steady, modest growth in revenue and profits, primarily funded by owner’s investment and small business loans. Key metrics would include revenue per customer, cost of goods sold, and operating expenses.

The technology company’s projection would likely illustrate significantly higher revenue and profit growth, with access to various funding sources (debt and equity). Key metrics would include market share, research and development expenditure, and return on equity. The scale of operations and complexity of the financial model would be dramatically different. For example, the technology company might project significant investments in acquisitions or new product development, which would be far beyond the scope of the coffee shop’s projections.

Objectives and Goals

Companies and businesses, while often used interchangeably, diverge significantly in their overarching objectives and goals. While both aim for success, their approaches, driven by structure and ownership, often differ substantially. Profit maximization, while a key driver for both, takes on varied nuances depending on the entity’s specific context and broader ambitions.

The typical objectives and goals of companies, particularly larger corporations, frequently encompass a broader spectrum than those of smaller businesses. This expansion often includes considerations beyond pure profit, incorporating elements of social responsibility and environmental sustainability. Conversely, smaller businesses, especially those family-owned, may prioritize short-term financial stability and growth above all else.

Profit Maximization as a Primary Objective

Profit maximization serves as a fundamental goal for both companies and businesses. However, the strategies employed and the timeframe considered differ considerably. Large companies, with their access to diverse financial resources and sophisticated planning capabilities, may adopt long-term strategies aiming for sustained, consistent profitability over several years or even decades. They might prioritize investments in research and development, brand building, and long-term market share gains, even if these actions temporarily reduce short-term profits. Smaller businesses, on the other hand, frequently focus on maximizing immediate profitability to ensure short-term financial viability and survival, potentially sacrificing long-term growth opportunities for immediate returns. This difference stems from their often-limited resources and greater vulnerability to economic fluctuations.

The Role of Social Responsibility and Environmental Sustainability

While profit remains crucial, the increasing awareness of social and environmental concerns has led many companies, particularly larger multinational corporations, to integrate these factors into their overall objectives. Corporate Social Responsibility (CSR) initiatives, ranging from ethical sourcing to charitable donations, are becoming increasingly common. Similarly, environmental sustainability, including reducing carbon footprints and adopting eco-friendly practices, is gaining traction as a key objective. These initiatives are often driven by a combination of ethical considerations, positive brand image, and growing regulatory pressures. Smaller businesses, while potentially less equipped to undertake large-scale CSR or sustainability projects, may still incorporate such considerations into their operations, albeit on a smaller scale, perhaps through local community involvement or sustainable sourcing practices within their immediate operational context.

Influence of Goals on Decision-Making

The prioritization of different goals significantly influences decision-making processes. For instance, a company prioritizing social responsibility might invest in fair trade practices, even if it increases production costs. A business primarily focused on short-term profit maximization might opt for cost-cutting measures that could negatively impact employee morale or environmental standards. A multinational corporation aiming for global market leadership might prioritize aggressive expansion strategies, potentially leading to increased competition and price wars. A family-owned business might favor slower, more controlled growth to maintain family control and a stable work environment. These contrasting approaches demonstrate how diverse objectives lead to fundamentally different decision-making frameworks.

Case Study: Contrasting Goal Setting Approaches

Consider a small family-owned bakery (Business A) and a multinational food corporation (Business B). Business A, prioritizing family legacy and community ties, might focus on maintaining high-quality, locally sourced ingredients, even if it means higher prices and lower profit margins compared to competitors using cheaper, mass-produced ingredients. Their decision-making prioritizes customer satisfaction and community engagement, aligning with their long-term goal of maintaining a reputable, locally beloved establishment. Business B, a multinational corporation, might prioritize aggressive expansion and market share maximization. They might invest heavily in marketing campaigns and efficient supply chains, potentially sacrificing some level of quality or ethical sourcing in favor of maximizing profits and global reach. Their decision-making process is driven by complex financial models and market analyses, prioritizing long-term shareholder value and global market dominance. The contrasting approaches highlight how differing organizational structures and ownership models significantly influence the setting and pursuit of goals.

Illustrative Examples

To further clarify the differences between a company and a business, let’s examine two contrasting examples: a small family-owned bakery and a large multinational technology company. These examples will highlight the variations in structure, operations, and goals characteristic of different organizational types.

Small Family-Owned Bakery

This bakery, “Sweet Surrender,” is a sole proprietorship owned and operated by the Miller family. The Millers handle all aspects of the business, from baking and decorating to customer service and accounting. Their operations are relatively simple, focusing on producing a limited range of high-quality baked goods – breads, pastries, and custom cakes – sold directly to customers in a small storefront location. Their primary goal is to provide their local community with delicious, fresh baked goods while maintaining a comfortable profit margin that allows the family to support themselves. They prioritize personal relationships with their customers and focus on consistent product quality and excellent customer service. Their organizational structure is informal, with decision-making centralized within the family. They have minimal employees, perhaps one or two part-time helpers during peak seasons. Financial management is straightforward, largely focused on tracking sales, expenses, and ensuring profitability.

Large Multinational Technology Company

In stark contrast, consider “TechGiant,” a publicly traded multinational technology company. TechGiant boasts a complex organizational structure with numerous departments, divisions, and subsidiaries operating across the globe. Its operations involve research and development, manufacturing, marketing, sales, and customer support, all highly specialized and often outsourced to various contractors and partners. Their product line is extensive, ranging from consumer electronics to enterprise software solutions. TechGiant’s goals are multifaceted, including maximizing shareholder value, expanding market share, and maintaining a leading position in technological innovation. They employ thousands of people across multiple countries, with intricate reporting structures and specialized roles. Their financial management is extremely sophisticated, involving complex accounting practices, investor relations, and strategic financial planning. Decisions are made through a hierarchical structure, with various levels of management and oversight. Their scale of operations necessitates significant investment in infrastructure, technology, and marketing.

Comparison of Examples

Sweet Surrender and TechGiant represent vastly different ends of the business spectrum. Sweet Surrender, as a small family-owned business, is characterized by simplicity, direct customer interaction, and a focus on local community engagement. Its structure is informal, and its goals are primarily centered on providing a livelihood for the owners and serving the local market. TechGiant, on the other hand, is a complex, highly structured organization with global reach and a focus on maximizing shareholder value through technological innovation and market dominance. The differences are profound, reflecting the varying scales, complexities, and objectives associated with different types of businesses and companies. The key distinctions lie in size, scope, ownership, organizational structure, and ultimate goals. Sweet Surrender’s personal touch is antithetical to TechGiant’s impersonal, market-driven approach.