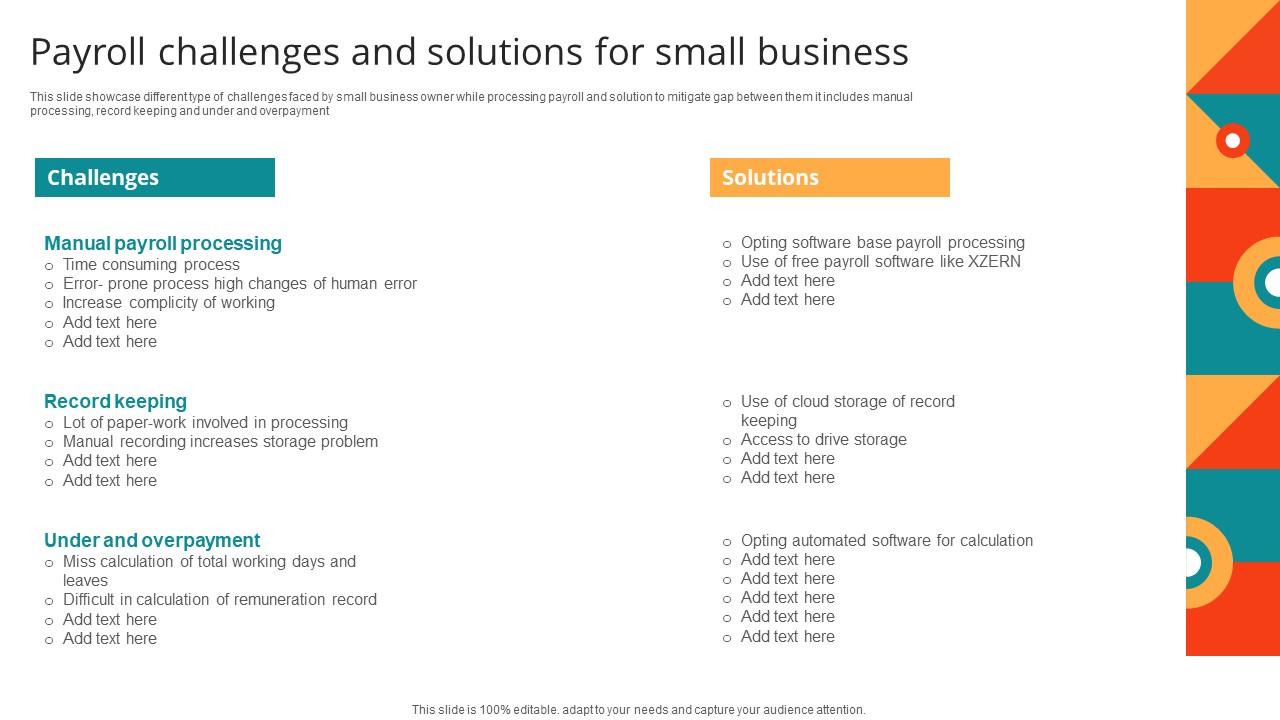

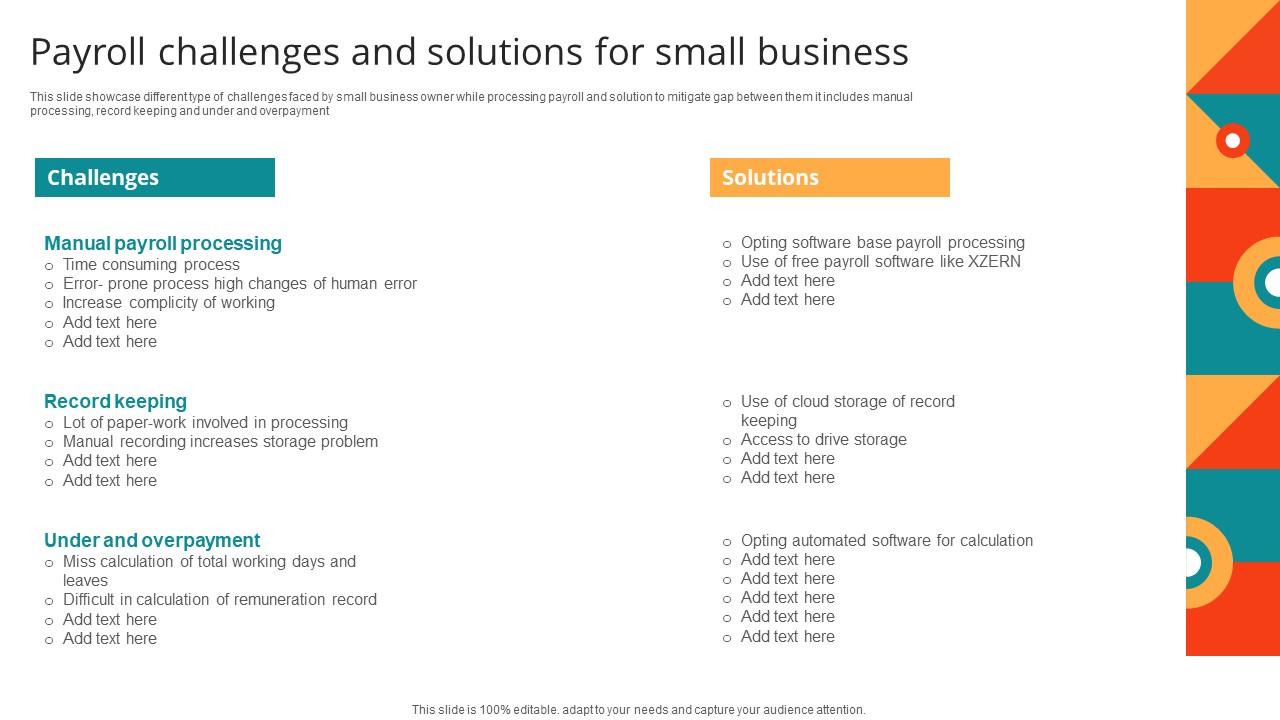

What is the most significant payroll challenge for small businesses? For many small business owners, navigating the complexities of payroll looms large. It’s not just about cutting checks; it’s a multifaceted process encompassing cost management, legal compliance, accurate time tracking, and effective employee communication. Failure in any of these areas can lead to significant financial losses, legal penalties, and damaged employee morale. This article delves into the key challenges, offering practical strategies and solutions to help small businesses overcome these hurdles and thrive.

The sheer volume of regulations, from federal and state tax laws to wage and hour requirements, can be overwhelming. Inaccurate payroll calculations, even minor ones, can snowball into significant financial liabilities. Furthermore, inefficient time tracking systems can lead to time theft and inaccurate compensation. These issues, coupled with the need for robust payroll software and effective employee communication, paint a complex picture for small business owners. Understanding these challenges is the first step towards developing effective strategies for successful payroll management.

Cost Management and Budgeting

Payroll is a significant expense for any business, but especially for small businesses operating on tight margins. Effective cost management and budgeting around payroll are crucial for survival and growth. Failing to do so can lead to serious financial difficulties, even insolvency. This section details the impact of payroll costs and provides strategies for effective management.

Payroll Processing Fees and Profitability

Payroll processing fees, while seemingly small individually, can significantly impact a small business’s profitability over time. These fees vary depending on the chosen payroll service (manual, outsourced, or software-based) and the number of employees. For instance, a small business with 5 employees using a low-cost software might pay $50-$100 per month, but a larger business or one using a more comprehensive service could pay several hundred dollars monthly. These recurring costs directly reduce net profit, especially for businesses with low profit margins. Careful consideration of the total cost of payroll processing, including software fees, potential penalties for errors, and time spent on payroll administration, is vital for maintaining profitability.

Impact of Inaccurate Payroll Calculations

Inaccurate payroll calculations can result in substantial financial losses for small businesses. Underpayment of employees can lead to legal issues, including fines and lawsuits, while overpayment eats directly into profits. Errors in calculating taxes and deductions can also lead to penalties from tax authorities. For example, a consistent $100 monthly overpayment to 5 employees equates to $6000 annually – a significant amount for a small business. Implementing robust payroll processes, including regular audits and the use of reliable payroll software, is crucial to minimizing these risks.

Budgeting System for Payroll Expenses

A simple yet effective payroll budgeting system for small businesses involves projecting payroll expenses for a given period (e.g., monthly or quarterly). This involves estimating total salaries, benefits (health insurance, retirement contributions), payroll taxes (Social Security, Medicare, unemployment), and processing fees. This projected figure should then be integrated into the overall business budget, ensuring sufficient funds are allocated to cover payroll obligations. Regular monitoring of actual payroll expenses against the budget is essential to identify and address any discrepancies promptly. For example, a business can allocate a specific percentage of its projected revenue to payroll expenses, allowing for adjustments based on revenue fluctuations.

Cost-Saving Strategies for Small Business Payroll

Several strategies can help small businesses reduce their payroll costs. These include:

- Negotiating with payroll providers: Explore different payroll software options and negotiate for lower fees, especially with longer-term contracts.

- Automating payroll processes: Automating tasks like time tracking and tax calculations reduces manual effort and minimizes errors, thus saving time and money.

- Optimizing employee benefits: Carefully evaluating employee benefits packages and selecting cost-effective options can reduce overall payroll costs without significantly impacting employee morale.

- Outsourcing payroll: Outsourcing payroll to a specialized firm can reduce the administrative burden and potentially lower costs if the internal cost of managing payroll exceeds the outsourcing fees.

- Implementing robust internal controls: Strong internal controls minimize errors and prevent fraud, saving money in the long run.

Comparison of Payroll Software Costs

The cost of payroll software varies significantly depending on features, the number of employees, and the provider. The following table provides a simplified comparison:

| Software | Monthly Fee (approx.) | Features | Number of Employees Supported |

|---|---|---|---|

| Software A | $50 – $150 | Basic payroll, tax calculations, direct deposit | 1-50 |

| Software B | $100 – $300 | Advanced features, time tracking, reporting, HR tools | 50+ |

| Software C | $20 – $75 | Basic payroll, limited features | 1-25 |

| Manual Processing | Variable (time cost) | High risk of errors, time-consuming | Low |

Compliance and Legal Requirements

Navigating the complex web of payroll regulations is a significant challenge for small businesses. Failure to comply can lead to substantial financial penalties and reputational damage. Understanding federal, state, and local tax laws, as well as other employment regulations, is crucial for smooth operations and legal compliance.

Payroll compliance involves much more than just calculating wages and issuing paychecks. It encompasses a broad range of legal and administrative responsibilities, each with its own set of complexities and potential pitfalls. The intricacies of these regulations often necessitate specialized knowledge or the engagement of external payroll professionals.

Federal, State, and Local Payroll Tax Regulations

The United States boasts a complex system of overlapping payroll tax regulations. Federal laws mandate taxes like Social Security and Medicare taxes (FICA), federal income tax withholding, and unemployment insurance contributions. However, these are just the starting point. Each state has its own unique set of payroll taxes, including state income tax withholding, state unemployment insurance taxes, and potentially other levies. Furthermore, some localities impose additional taxes, further complicating the payroll process. This patchwork of regulations requires businesses to stay abreast of constantly evolving rules and adapt their payroll processes accordingly, potentially necessitating different procedures for employees in different states or localities. The sheer volume of legislation and its frequent updates can be overwhelming for small business owners who may lack the dedicated HR or payroll expertise to handle this burden effectively.

Common Payroll Compliance Mistakes

Small businesses often make mistakes that can lead to significant penalties. Misclassifying employees as independent contractors to avoid payroll taxes is a common error, resulting in substantial back taxes and potential legal action from regulatory bodies like the IRS. Incorrectly withholding taxes, failing to file payroll tax returns on time, or neglecting to pay state and local taxes are other frequent missteps. Failing to keep accurate payroll records, which are essential for audits, is another common issue. These errors, often stemming from a lack of understanding or resources, can expose businesses to financial risks and legal challenges. For example, miscalculating overtime pay or failing to pay minimum wage can lead to lawsuits and significant financial penalties.

Potential Penalties for Non-Compliance

The penalties for payroll non-compliance can be severe. These penalties can include significant back taxes, interest charges, and even legal fees associated with defending against lawsuits. The IRS and state agencies may impose penalties for late filing, inaccurate reporting, or intentional non-compliance. In severe cases, businesses may face criminal charges. The financial burden of these penalties can be crippling for small businesses, potentially leading to business closure. The penalties are not only monetary; reputational damage can also negatively impact future business prospects.

Resources for Ensuring Payroll Compliance

Several resources can help small businesses maintain payroll compliance. The IRS website offers comprehensive information on federal payroll taxes and regulations. State government websites provide details on state-specific payroll requirements. Professional Employer Organizations (PEOs) can handle payroll processing and compliance for businesses. Payroll software can automate many aspects of payroll and help ensure accuracy. Consulting with a tax professional or payroll specialist is highly recommended to ensure compliance with all applicable regulations.

Payroll Compliance Checklist

Maintaining accurate records is paramount for payroll compliance. A checklist can help ensure all necessary steps are followed consistently. This includes regularly reviewing and updating employee information, accurately calculating wages and deductions, correctly withholding and remitting taxes, filing all required tax returns on time, and maintaining comprehensive payroll records. Regularly reviewing these steps, perhaps quarterly, and consulting with experts when needed can help mitigate risks and ensure compliance. Using payroll software and maintaining detailed documentation are vital for minimizing errors and streamlining the process.

Time and Attendance Tracking

Accurate time and attendance tracking is crucial for small businesses, impacting payroll accuracy, labor cost control, and overall operational efficiency. Inaccurate tracking can lead to significant financial losses, legal issues, and employee dissatisfaction. The challenge lies in balancing the need for precise record-keeping with the limited resources and often informal work environments common in smaller organizations.

Challenges of Accurate Employee Hour Tracking in Small Businesses

Small businesses often lack the dedicated HR personnel and sophisticated systems found in larger corporations. This can make accurate time tracking difficult. Common challenges include reliance on manual processes prone to errors, difficulty managing employees working across multiple locations or flexible schedules, and the potential for time theft or buddy punching. The absence of robust oversight can also lead to inconsistencies in recording breaks, overtime, and other paid time off. Furthermore, integrating time tracking with existing payroll systems can be a significant hurdle, adding complexity and increasing the risk of errors.

Methods for Time and Attendance Tracking

Several methods exist for tracking employee hours. Timesheets remain a common, low-cost option, requiring employees to manually record their start and end times. Time clocks, either physical or digital, offer a more automated approach, recording employee punches electronically. However, the most comprehensive and efficient solutions are provided by time and attendance tracking software. These software packages offer features such as automated calculations, integration with payroll systems, and advanced reporting capabilities, often including GPS tracking for field-based employees.

Comparison of Time Tracking Methods

The choice of method depends on the specific needs and resources of the small business. Timesheets are simple and inexpensive but prone to errors and require significant manual effort. Time clocks offer greater accuracy and automation but may involve upfront investment in hardware and software. Time and attendance tracking software provides the highest level of accuracy, efficiency, and reporting capabilities, but typically represents the highest cost.

| Method | Advantages | Disadvantages |

|---|---|---|

| Timesheets | Low cost, simple to implement | Prone to errors, time-consuming, requires manual data entry |

| Time Clocks | More accurate than timesheets, automated recording | Upfront investment in hardware, potential for technical issues |

| Time and Attendance Software | Highly accurate, automated calculations, integration with payroll, advanced reporting | Higher cost, requires training and setup |

Strategies for Minimizing Time Theft

Time theft, where employees claim payment for hours not worked, can significantly impact a small business’s bottom line. Implementing clear policies on timekeeping, regular audits of time records, and using time tracking systems with features like GPS tracking or biometric authentication can help minimize this risk. Furthermore, fostering a culture of trust and accountability, along with regular communication with employees about timekeeping expectations, can significantly reduce the likelihood of time theft. Disciplinary procedures should also be clearly defined and consistently enforced.

Implementing a Reliable Time Tracking System

Implementing a reliable time tracking system involves several steps.

- Assess Needs: Determine the specific requirements of the business, considering factors such as the number of employees, work schedules, and the need for advanced features.

- Choose a Method: Select the most appropriate time tracking method based on the assessment, considering cost, ease of use, and accuracy.

- Implement the System: Set up the chosen system, ensuring all employees are trained on its proper use.

- Establish Clear Policies: Develop and communicate clear policies on timekeeping, breaks, overtime, and other related issues.

- Monitor and Audit: Regularly monitor time records for accuracy and conduct periodic audits to detect and address any discrepancies.

- Integrate with Payroll: Integrate the time tracking system with the payroll system to streamline the payroll process and minimize errors.

Employee Onboarding and Offboarding

Efficient employee onboarding and offboarding processes are crucial for small businesses to maintain accurate payroll records, ensure compliance, and minimize administrative burdens. These processes, often overlooked, significantly impact payroll accuracy and overall operational efficiency. Streamlining these procedures can save time, reduce errors, and improve employee satisfaction.

Setting Up New Employee Payroll Information

Establishing a new employee’s payroll information requires a systematic approach to ensure accuracy and compliance. This typically involves collecting necessary data, verifying information, and inputting it into the payroll system. The steps involved often include obtaining the employee’s tax information (W-4, I-9), direct deposit details, emergency contact information, and details about their compensation (salary, hourly rate, pay frequency). Verification of this information, through documentation checks and employee confirmation, is crucial to prevent errors. This initial data entry is the foundation for accurate payroll processing throughout the employee’s tenure. Inaccurate information at this stage can lead to significant problems down the line, including incorrect tax withholdings, delayed payments, and potential legal issues.

Importance of Accurate Data Entry During Onboarding

Accurate data entry during onboarding is paramount for smooth payroll processing. Errors introduced at this stage can propagate through the entire payroll cycle, leading to various complications. For instance, incorrect Social Security numbers can result in tax reporting errors and penalties. Incorrect bank account information can lead to payment delays or even payments going to the wrong account. Inaccurate hourly rates or salary information can result in underpayment or overpayment of employees, affecting both employee morale and the company’s financial stability. Moreover, inconsistent or incomplete data makes it difficult to generate accurate reports for tax purposes or for internal analysis of labor costs. Therefore, a robust system of data verification and validation is essential to minimize errors and ensure compliance.

Managing Employee Offboarding and Final Payroll Calculations

Employee offboarding involves a series of steps to ensure a smooth transition and accurate final payroll calculations. This includes confirming the employee’s last day of employment, calculating any accrued vacation or sick time, and ensuring all final payments, including wages, bonuses, and outstanding reimbursements, are processed accurately and timely. Important documentation, such as the final pay stub, separation paperwork, and any relevant tax forms, should be provided to the employee. Additionally, it’s crucial to manage the termination of benefits, such as health insurance and retirement contributions, according to company policy and legal requirements. Failure to accurately manage offboarding can lead to disputes, legal challenges, and negative impacts on employee relations. Accurate record-keeping throughout the employee’s tenure simplifies this process significantly.

Potential Problems Associated with Inefficient Onboarding and Offboarding Processes

Inefficient onboarding and offboarding processes can result in a cascade of problems for small businesses. These include increased administrative burden, higher payroll processing costs, compliance issues, and negative impacts on employee morale. Delayed payments due to inaccurate information can damage employee relations. Errors in tax reporting can result in penalties and fines. Lack of clear procedures can lead to inconsistencies and confusion. Furthermore, inefficient processes consume valuable time and resources that could be better allocated to core business activities. A well-defined and streamlined process, on the other hand, contributes to a more efficient and compliant payroll system.

Payroll Procedures for New Hires and Departing Employees

The following flowchart illustrates the key steps involved in payroll processing for new hires and departing employees. The flowchart would visually depict two separate, but parallel, paths.

New Hire Path: This path would start with the job offer, followed by the collection of necessary payroll information (W-4, direct deposit details, etc.), data entry and verification, and finally, the first payroll run.

Departing Employee Path: This path would begin with the employee’s resignation or termination, followed by the calculation of final pay (including accrued time off), the processing of final payments, and the completion of necessary separation paperwork. Both paths would converge at the point of maintaining accurate payroll records. The flowchart would use clear visual elements, such as boxes and arrows, to show the sequence of steps and decision points. This visual representation provides a clear and concise overview of the payroll procedures, aiding in the understanding and implementation of best practices.

Technology and Software

For small businesses, payroll processing can be a significant administrative burden. The choice between manual payroll and payroll software significantly impacts efficiency, accuracy, and compliance. Understanding the benefits and drawbacks of each approach, along with the features and security considerations of various software options, is crucial for successful payroll management.

Payroll software offers numerous advantages over manual processing, streamlining operations and minimizing the risk of errors. Manual payroll, on the other hand, is often more prone to mistakes, requires significant time investment, and lacks the advanced features offered by modern software solutions.

Payroll Software versus Manual Payroll Processing, What is the most significant payroll challenge for small businesses

Manual payroll processing relies heavily on spreadsheets, calculators, and potentially physical record-keeping. This method is time-consuming, susceptible to human error (leading to miscalculations of wages, deductions, and taxes), and lacks the automation capabilities of software solutions. It also increases the risk of non-compliance with ever-changing tax regulations. In contrast, payroll software automates many of these tasks, reducing processing time and the likelihood of errors. Features such as automatic tax calculations, direct deposit, and reporting capabilities significantly improve efficiency and accuracy. The cost savings from reduced labor hours and decreased risk of penalties often outweigh the initial investment in software.

Payroll Software Options: Features, Cost, and Ease of Use

The market offers a wide array of payroll software solutions, catering to businesses of various sizes and complexities. Options range from simple, affordable programs suitable for very small businesses to comprehensive, enterprise-level systems with advanced features. Factors to consider include the number of employees, the complexity of payroll calculations (e.g., multiple pay rates, bonuses, commissions), and integration with other business software (e.g., accounting software, HR systems). Cost varies significantly, with some offering subscription-based models while others charge per employee or transaction. Ease of use is also a critical factor, with intuitive interfaces and user-friendly features reducing the learning curve and ensuring efficient adoption by employees. For example, Gusto is known for its user-friendly interface and comprehensive features, while ADP offers a broader range of solutions for larger businesses with more complex needs. Smaller businesses might find solutions like QuickBooks Payroll or Paychex Flex more suitable, depending on their specific needs and budget.

Improving Efficiency and Accuracy with Payroll Software

Payroll software streamlines several aspects of payroll processing, leading to significant improvements in efficiency and accuracy. Automatic tax calculations eliminate the risk of manual errors in tax withholding and reporting. Direct deposit functionality reduces processing time and eliminates the need for manual check writing and distribution. Automated reporting features generate various reports (e.g., payroll summaries, tax forms, employee earnings statements) quickly and accurately, simplifying compliance requirements. For instance, a small business using payroll software might reduce its payroll processing time from several hours per pay period to just a few minutes, freeing up valuable time for other tasks. The accuracy of calculations also reduces the risk of costly errors and potential penalties for non-compliance.

Security Considerations When Choosing and Using Payroll Software

Protecting sensitive employee data is paramount. When selecting payroll software, prioritize vendors with robust security measures, including encryption, data backups, and multi-factor authentication. Regular software updates are crucial to patch security vulnerabilities. Compliance with data privacy regulations (e.g., GDPR, CCPA) should also be a key consideration. The software should adhere to strict security protocols to prevent unauthorized access and data breaches. Businesses should also establish internal security policies, such as limiting access to payroll data to authorized personnel and regularly reviewing employee access permissions.

Essential Features of Payroll Software for Small Businesses

Choosing the right payroll software depends on the specific needs of your small business. However, several features are essential for most.

- Automated Tax Calculations: Ensures accurate withholding and reporting of federal, state, and local taxes.

- Direct Deposit: Streamlines payment distribution and reduces processing time.

- Employee Self-Service Portal: Allows employees to access pay stubs, W-2s, and other information online.

- Time and Attendance Tracking Integration: Simplifies timekeeping and payroll calculation.

- Reporting and Analytics: Provides valuable insights into payroll costs and trends.

- Compliance Features: Ensures adherence to all relevant labor laws and tax regulations.

- Secure Data Storage and Encryption: Protects sensitive employee data.

- Customer Support: Provides assistance when needed.

Employee Relations and Communication

Payroll processes significantly impact employee morale and overall productivity within a small business. Inaccurate or delayed payments can lead to decreased job satisfaction, increased stress, and ultimately, a decline in work performance. Conversely, a transparent and efficient payroll system fosters trust and improves employee relations.

Payroll issues directly affect employee morale and productivity. Late or incorrect payments erode trust, causing stress and impacting employee focus and efficiency. Conversely, a well-managed payroll system boosts morale and productivity by demonstrating the company’s commitment to its employees’ well-being and financial security. This positive impact can translate to increased retention rates and improved overall business performance.

Communicating Payroll Information Effectively

Clear and consistent communication is crucial for maintaining positive employee relations regarding payroll. This involves providing employees with easily understandable pay stubs, regular updates on payroll changes, and readily accessible channels for addressing questions or concerns. A well-defined communication strategy should include multiple methods, such as email, company intranet, and potentially even in-person meetings, to ensure all employees receive the necessary information. For example, a small business could use a combination of email pay stubs and a dedicated section on their internal communication platform to explain payroll policies and answer frequently asked questions. This multi-faceted approach ensures that information reaches everyone, regardless of their preferred communication style or technological proficiency.

Addressing Employee Payroll-Related Questions and Concerns

Establishing a clear and accessible process for handling employee payroll inquiries is vital. This could involve designating a specific individual or department to address payroll-related questions, setting up a dedicated email address or phone line, or utilizing a frequently asked questions (FAQ) section on the company intranet. Prompt and accurate responses are key to maintaining employee trust and preventing minor issues from escalating into larger problems. For instance, a quick response to a query about a missing payment can prevent an employee from feeling neglected or undervalued. Ignoring or delaying responses, however, can foster negativity and distrust.

Potential Conflicts Arising from Payroll Errors or Discrepancies

Payroll errors or discrepancies can lead to various conflicts, including decreased morale, damaged trust, and even legal issues. Late payments can cause financial hardship for employees, while incorrect deductions or calculations can result in disputes and potentially legal action. Transparency and a proactive approach to error resolution are crucial for mitigating these risks. For example, a company might establish a clear process for investigating and rectifying payroll errors, including a timeline for resolving issues and a communication plan to keep employees informed. This proactive approach demonstrates a commitment to fairness and accuracy, minimizing potential conflicts.

Communication Plan for Payroll Changes and Updates

A comprehensive communication plan is essential for keeping employees informed about any changes or updates to payroll policies or processes. This plan should Artikel the methods of communication (e.g., email, intranet announcements, meetings), the frequency of updates, and the individuals responsible for disseminating information. The plan should also address how employees can provide feedback or raise concerns. For instance, a company might announce upcoming changes to its payroll system through an email to all employees, followed by a company-wide meeting to answer questions and address concerns. Regular updates and open communication channels ensure employees stay informed and can adapt to any changes smoothly.

Scalability and Growth: What Is The Most Significant Payroll Challenge For Small Businesses

Scaling payroll processes presents unique challenges for small businesses experiencing rapid growth. As the employee count increases, so do the complexities of payroll administration, demanding a more robust and adaptable system to maintain accuracy, efficiency, and compliance. Failure to proactively address these challenges can lead to costly errors, legal issues, and decreased employee satisfaction.

The transition from a simple, manual payroll system to a sophisticated, automated solution is crucial for managing the increasing workload associated with a larger workforce. This transition requires careful planning, considering factors such as budget, existing infrastructure, and the specific needs of the growing business. Ignoring the scalability issue can lead to bottlenecks and inefficiencies, ultimately hindering the company’s growth trajectory.

Adapting Payroll Systems to Accommodate Increasing Employee Numbers

Adapting payroll systems requires a strategic approach that prioritizes automation and integration. Manually processing payroll for a large workforce is impractical and error-prone. Small businesses should investigate cloud-based payroll solutions offering scalability features. These systems can automatically handle increasing employee data, tax calculations, and reporting requirements without significant manual intervention. A phased approach might involve starting with a basic system and upgrading to a more comprehensive solution as the company expands, ensuring that the system can easily handle additional employees and data without requiring a complete system overhaul. For example, a small business using a spreadsheet initially could transition to a software-as-a-service (SaaS) payroll solution like Gusto or ADP, which can accommodate a larger number of employees and offer advanced features such as time tracking and benefits administration.

Maintaining Payroll Accuracy and Compliance During Rapid Growth

Maintaining accuracy and compliance during rapid growth necessitates robust internal controls and regular audits. Implementing a clear process for data entry, verification, and approval is essential. This might involve assigning specific roles and responsibilities for different aspects of payroll processing, such as data input, approval, and reconciliation. Regular audits, either internal or external, help identify and rectify any errors before they escalate into significant problems. Staying abreast of changing tax laws and regulations is also crucial, requiring businesses to invest in training or consulting services to ensure compliance. For instance, a business expanding into a new state must ensure its payroll system accurately calculates and withholds the appropriate state taxes. Failure to do so can result in significant penalties.

Streamlining Payroll Processes During Expansion with Technology

Technology plays a pivotal role in streamlining payroll during expansion. Cloud-based payroll software automates many manual tasks, reducing the risk of errors and freeing up HR personnel to focus on strategic initiatives. Features such as automated tax calculations, direct deposit, and reporting capabilities significantly improve efficiency. Integration with other HR systems, such as time and attendance tracking software, eliminates data duplication and ensures data consistency. For example, integrating a time tracking system with the payroll software automatically updates employee hours worked, reducing the likelihood of manual errors and discrepancies. This integration can also improve accuracy in calculating overtime pay and other compensation elements.

Transitioning from a Simple to a More Complex Payroll System

Transitioning from a simple to a more complex payroll system requires careful planning and execution. This involves assessing the current payroll process, identifying areas for improvement, and selecting a new system that meets the business’s evolving needs. The transition should be phased to minimize disruption and ensure a smooth transfer of data. Training employees on the new system is crucial to ensure its effective use. This includes providing comprehensive documentation and hands-on training sessions to familiarize employees with the new system’s functionalities. Regular monitoring and evaluation of the new system are also essential to identify any challenges or areas for further improvement. A well-defined timeline and communication plan can mitigate risks and ensure a successful transition. For example, a small business might start by migrating employee data to the new system in stages, ensuring accuracy at each step before completing the full transition.