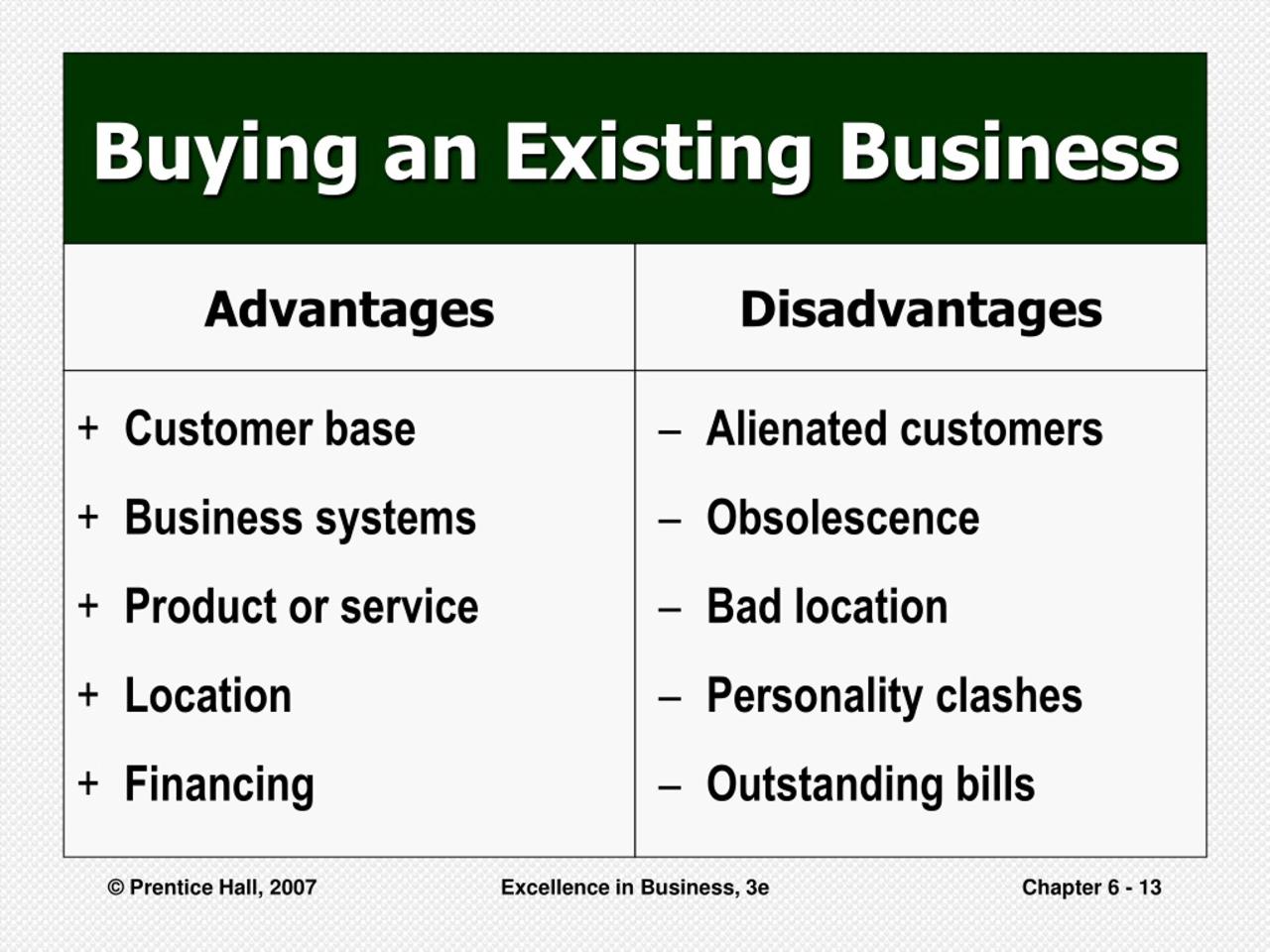

When buying an existing business it is important to understand that success hinges on meticulous preparation and a comprehensive understanding of the target. Acquiring a business isn’t just about the financials; it’s a multifaceted process demanding thorough due diligence, legal navigation, market analysis, operational assessment, and a robust risk mitigation strategy. Ignoring any of these critical areas can lead to significant setbacks, even failure. This guide Artikels the essential steps to navigate this complex landscape successfully.

From scrutinizing financial statements and legal documents to analyzing the customer base and operational efficiency, each step is crucial in determining the true value and potential of the business. A successful acquisition requires a clear understanding of the market, the competitive landscape, and a realistic assessment of potential risks and rewards. By following a structured approach, you can significantly increase your chances of a profitable and sustainable acquisition.

Due Diligence and Financial Analysis

Acquiring an existing business requires meticulous preparation, and a crucial element of this preparation is a comprehensive due diligence process, focusing heavily on the financial aspects of the target company. This involves a deep dive into the business’s financial records to assess its health, stability, and overall value. Ignoring this step can lead to costly mistakes and ultimately, business failure.

Thorough Due Diligence Process

A thorough due diligence process goes beyond simply reviewing financial statements. It’s a multi-faceted investigation designed to uncover any potential risks or liabilities associated with the acquisition. This process typically involves verifying the accuracy of the seller’s representations, investigating the business’s legal compliance, and assessing its operational efficiency. Key aspects include reviewing contracts, licenses, permits, and intellectual property rights to ensure legal compliance and ownership. A detailed review of customer contracts and supplier agreements helps understand the business’s reliance on key relationships. Furthermore, an assessment of the business’s physical assets, including equipment and inventory, is critical to verifying their condition and value. Finally, a market analysis should be conducted to understand the competitive landscape and the business’s position within it.

Key Financial Statements Examination

Several key financial statements provide a comprehensive picture of a business’s financial health. The Income Statement shows revenue, expenses, and profit over a specific period. Examine trends in revenue growth, profitability margins, and the consistency of expense management. A declining revenue trend or consistently high operating expenses should raise concerns. The Balance Sheet provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. Analyze the ratio of current assets to current liabilities (liquidity) to gauge the business’s ability to meet short-term obligations. A high debt-to-equity ratio may indicate significant financial risk. The Cash Flow Statement tracks the movement of cash both into and out of the business. Focus on operating cash flow, as this reflects the cash generated from the core business operations. Consistent positive operating cash flow is a strong indicator of financial stability. Finally, reviewing several years’ worth of these statements reveals trends and patterns that might not be apparent in a single year’s data.

Financial Health and Stability Evaluation Checklist

A structured checklist helps ensure no critical aspect is overlooked during the due diligence process. This checklist should cover various areas, including:

- Revenue Analysis: Review revenue trends, seasonality, and customer concentration.

- Expense Analysis: Examine cost of goods sold, operating expenses, and identify areas for potential cost savings.

- Profitability Analysis: Assess gross profit margin, operating profit margin, and net profit margin over time.

- Liquidity Analysis: Calculate current ratio, quick ratio, and cash flow ratios to evaluate short-term solvency.

- Solvency Analysis: Analyze debt-to-equity ratio, debt service coverage ratio, and times interest earned to assess long-term solvency.

- Efficiency Analysis: Examine inventory turnover, accounts receivable turnover, and accounts payable turnover to assess operational efficiency.

- Valuation Analysis: Compare different valuation methods to determine a fair purchase price.

Business Valuation Methods Comparison

Several methods exist for valuing a business, each with its own strengths and weaknesses. The Asset-Based Approach values the business based on the net asset value of its assets. This method is suitable for businesses with significant tangible assets. The Income Approach values the business based on its future earnings potential, often using discounted cash flow (DCF) analysis. This is a common method for profitable businesses. The Market Approach values the business by comparing it to similar businesses that have recently been sold. This requires finding comparable transactions, which can be challenging. The chosen method depends on the specific circumstances of the business and the availability of relevant data. For example, a tech startup with significant intangible assets might be best valued using the income approach, while a manufacturing company with substantial physical assets might be better suited for an asset-based approach. Choosing the most appropriate method requires careful consideration and potentially professional valuation expertise.

Legal and Regulatory Compliance: When Buying An Existing Business It Is Important To

Acquiring an existing business involves more than just financial transactions; a thorough understanding and adherence to legal and regulatory frameworks are paramount to a successful acquisition and the ongoing operation of the business. Ignoring this crucial aspect can lead to significant financial penalties, operational disruptions, and even legal challenges that threaten the viability of the acquired entity. This section focuses on the critical legal and regulatory due diligence required before finalizing a business acquisition.

Legal and regulatory compliance encompasses a wide range of considerations, impacting every facet of the business. From ensuring all licenses and permits are current and compliant with relevant legislation to understanding and mitigating potential liabilities, this process demands meticulous attention to detail and, ideally, the expertise of legal counsel specializing in business acquisitions.

Review of Legal Documents and Permits

A comprehensive review of all legal documents and permits associated with the target business is essential. This includes examining contracts with suppliers, customers, and employees; reviewing lease agreements for property and equipment; and verifying the validity and current status of all licenses, permits, and registrations required for the business’s operation. Failure to identify and address any discrepancies or breaches can lead to significant legal and financial repercussions after the acquisition is complete. For example, an expired business license could result in immediate operational shutdown, incurring significant financial losses.

Potential Legal Issues and Mitigation Strategies

Several potential legal issues require careful consideration during the due diligence process. These include outstanding lawsuits or litigation against the business, potential environmental liabilities (such as contamination of land or water), intellectual property rights infringements, and outstanding tax obligations. Mitigation strategies involve conducting thorough background checks, engaging legal counsel to review all relevant documentation, and obtaining appropriate insurance coverage to address potential liabilities. For instance, environmental site assessments can identify potential contamination issues, allowing for proactive remediation and cost estimation before the acquisition is finalized. Similarly, thorough review of tax records will reveal any outstanding liabilities, allowing for negotiation or adjustment during the acquisition process.

Industry-Specific Regulatory Hurdles and Compliance Requirements

The regulatory landscape varies significantly across industries. Businesses operating in heavily regulated sectors, such as healthcare, finance, or pharmaceuticals, face considerably more stringent compliance requirements. For example, a healthcare provider must adhere to HIPAA regulations regarding patient privacy and data security. A financial institution must comply with banking regulations and anti-money laundering laws. Understanding and addressing these industry-specific requirements is crucial for ensuring the smooth operation of the acquired business and avoiding costly penalties. Ignoring these can result in significant fines, legal action, and reputational damage.

Step-by-Step Guide to Navigating the Legal Aspects of Acquiring an Existing Business, When buying an existing business it is important to

- Engage Legal Counsel: Secure the services of an attorney specializing in business acquisitions early in the process. Their expertise is invaluable throughout the due diligence and negotiation phases.

- Review All Legal Documents: Conduct a thorough review of all contracts, licenses, permits, and other legal documents associated with the business.

- Conduct Due Diligence Investigations: Perform comprehensive background checks on the business, including financial records, legal history, and regulatory compliance records.

- Identify and Assess Potential Liabilities: Identify potential legal and financial liabilities and develop strategies for mitigation.

- Negotiate and Structure the Acquisition Agreement: Negotiate the terms of the acquisition agreement, ensuring that all legal and regulatory requirements are addressed.

- Post-Acquisition Compliance: Establish systems and procedures to ensure ongoing compliance with all relevant laws and regulations.

Customer Base and Market Analysis

Acquiring an existing business requires a thorough understanding of its customer base and the broader market landscape. This analysis is crucial for identifying growth opportunities and mitigating potential risks. A robust assessment will inform your pricing strategies, marketing efforts, and overall business plan. Neglecting this stage can lead to costly mistakes and hinder your chances of success.

Assessing the strength and loyalty of the existing customer base involves more than just looking at sales figures. A comprehensive analysis requires a multi-faceted approach, combining quantitative and qualitative data.

Customer Base Assessment Methods

Understanding the existing customer base requires a blend of quantitative and qualitative data analysis. Quantitative data, such as customer lifetime value (CLTV), churn rate, and average purchase value, provides a numerical overview of customer behavior and profitability. Qualitative data, gathered through surveys, interviews, and reviews, offers insights into customer satisfaction, brand perception, and loyalty drivers. Combining these perspectives provides a complete picture. For example, a high CLTV coupled with low churn rate suggests a loyal and profitable customer base. Conversely, a high churn rate despite high average purchase value indicates potential issues with customer retention.

Target Market and Competitive Landscape Analysis

Analyzing the target market and competitive landscape involves identifying the business’s ideal customer profile (ICP) and understanding its position within the market. This involves market segmentation to identify distinct groups of customers with shared characteristics. Competitive analysis should identify direct and indirect competitors, analyzing their strengths, weaknesses, pricing strategies, and market share. Porter’s Five Forces framework—analyzing the threat of new entrants, the bargaining power of suppliers and buyers, the threat of substitutes, and competitive rivalry—provides a structured approach to evaluating industry attractiveness and competitive intensity. For example, a business operating in a highly fragmented market with low barriers to entry might face intense competition, requiring a strong differentiation strategy.

Growth and Expansion Opportunities

Identifying growth opportunities requires a comprehensive understanding of the existing market and the potential for expansion. This includes evaluating opportunities for market penetration (increasing market share within the existing market), market development (expanding into new geographic markets or customer segments), product development (introducing new products or services), and diversification (entering new, unrelated markets). Analyzing market trends, technological advancements, and evolving customer needs can reveal untapped potential. For example, a local bakery might identify growth opportunities by expanding its delivery radius, introducing online ordering, or offering catering services.

Current vs. Ideal Customer Profile

The following table compares the current customer base demographics with the ideal customer profile, highlighting areas for potential improvement and targeted marketing efforts.

| Demographic | Current Customer Base | Ideal Customer Profile | Gap Analysis & Actionable Insights |

|---|---|---|---|

| Age | 35-55 years | 25-65 years | Expand marketing to reach younger and older demographics. Consider age-specific messaging and promotions. |

| Income | $50,000 – $100,000 | $40,000 – $150,000 | Target higher-income individuals with premium offerings and targeted advertising. Explore more affordable options to attract lower-income customers. |

| Location | Within 10-mile radius | Within 20-mile radius & online | Expand delivery radius and invest in online marketing and e-commerce capabilities. |

| Interests | Family-oriented, health-conscious | Family-oriented, health-conscious, environmentally conscious | Highlight eco-friendly practices and sustainable sourcing to attract environmentally conscious consumers. |

Operations and Management

Acquiring an existing business requires a thorough understanding of its operational capabilities and management structure. A successful acquisition hinges not just on financial viability but also on the smooth integration and optimization of the acquired company’s operations. Neglecting this crucial aspect can lead to unforeseen challenges and hinder the overall success of the acquisition.

Operational efficiency and processes are paramount to a business’s profitability and sustainability. A comprehensive review assesses the effectiveness of current systems, identifies bottlenecks, and reveals areas ripe for improvement. This evaluation lays the groundwork for informed decision-making and strategic planning post-acquisition.

Operational Efficiency and Process Review

This involves a detailed examination of the business’s day-to-day operations, including production processes, supply chain management, inventory control, and customer service. Analyzing key performance indicators (KPIs) such as production output, defect rates, lead times, and customer satisfaction scores provides quantifiable data to identify areas needing improvement. For example, a restaurant might analyze customer wait times and table turnover rates to optimize service flow. A manufacturing company might analyze production line efficiency and waste to identify areas for cost reduction and increased output. Benchmarking against industry best practices helps to set realistic targets for improvement.

Potential Areas for Improvement and Cost Reduction

Identifying areas for improvement often involves streamlining processes, automating tasks, negotiating better supplier contracts, and optimizing resource allocation. For instance, transitioning from manual inventory tracking to a computerized system can reduce errors and labor costs. Negotiating volume discounts with suppliers can lower the cost of goods sold. Similarly, optimizing staffing levels based on peak demand can reduce payroll expenses without compromising service quality. A detailed cost-benefit analysis for each potential improvement is crucial to ensure the financial viability of the changes.

Integration Plan for Acquired Business

If the acquired business is integrated into an existing operation, a detailed integration plan is crucial. This plan should address all aspects of the integration, including IT systems, personnel, branding, and customer communication. A phased approach, starting with the most critical aspects and gradually integrating other areas, is often the most effective strategy. For example, integrating customer databases might be prioritized to ensure seamless customer service, followed by the integration of accounting and inventory management systems. A clear timeline and communication plan will help minimize disruption and ensure a smooth transition.

Key Personnel and Their Roles

Understanding the strengths and weaknesses of key personnel is vital for successful integration. A comprehensive assessment of each individual’s skills, experience, and contribution to the business provides valuable insight for managing the transition and identifying potential leadership gaps. This assessment should include detailed job descriptions, performance reviews, and interviews with employees. This information informs decisions about retaining, re-assigning, or replacing personnel post-acquisition. For example, a highly skilled sales manager might be retained while a less effective marketing manager might be replaced. A clear organizational chart outlining reporting structures and responsibilities will aid in smooth operations.

Risk Assessment and Mitigation

Acquiring an existing business presents a multifaceted landscape of potential risks. Thorough risk assessment and the development of robust mitigation strategies are crucial for a successful acquisition. Failing to adequately address these risks can lead to significant financial losses, operational disruptions, and even the complete failure of the venture. This section details potential risks, mitigation strategies, common pitfalls, and the construction of a comprehensive risk assessment matrix.

Potential risks associated with acquiring an existing business span financial, operational, and legal domains. Financial risks include inaccurate financial statements, hidden liabilities, and insufficient cash flow. Operational risks encompass unforeseen challenges in integrating systems, managing personnel, and adapting to existing processes. Legal risks involve compliance issues, potential lawsuits, and contract disputes. Proactive risk management is not merely prudent; it’s essential for survival.

Financial Risks and Mitigation

Financial risks are arguably the most significant concerns in any business acquisition. These include the possibility of undisclosed debts, inflated asset values, and underestimated operational expenses. To mitigate these risks, independent verification of financial statements by a qualified accountant is paramount. Due diligence should extend beyond the provided financials, including thorough examination of tax returns, bank statements, and accounts receivable and payable records. Furthermore, a comprehensive cash flow projection, incorporating realistic assumptions about revenue and expenses, should be developed to assess the acquisition’s financial viability. Contingency plans, such as securing additional financing or negotiating a lower purchase price, should be in place to address potential shortfalls.

Operational Risks and Mitigation

Operational risks involve the integration of the acquired business into the buyer’s existing operations or the establishment of new operational structures. This includes potential challenges in integrating different systems, managing employees, and adapting to existing business processes. A detailed operational assessment should be conducted to identify potential bottlenecks and areas requiring improvement. This assessment should include interviews with key employees to understand the existing operational processes and challenges. Mitigation strategies involve developing a comprehensive integration plan, including timelines, responsibilities, and resource allocation. Contingency plans should address potential disruptions, such as employee attrition or system failures. For example, a phased integration approach, starting with critical systems and processes, can minimize disruption.

Legal and Regulatory Risks and Mitigation

Legal and regulatory compliance is critical. Acquiring a business might involve inheriting existing legal liabilities, non-compliance with regulations, or facing future regulatory changes. A thorough legal review of contracts, permits, licenses, and compliance records is necessary. This review should identify potential legal issues and assess the associated risks. Mitigation strategies include obtaining legal counsel specialized in business acquisitions, conducting a comprehensive environmental audit (if applicable), and developing a compliance plan to address any identified deficiencies. Contingency plans should address potential legal challenges, such as lawsuits or regulatory investigations.

Common Pitfalls to Avoid

Several common pitfalls can derail an acquisition. Overlooking hidden liabilities, failing to adequately assess the customer base, neglecting cultural integration, and underestimating the time and resources required for integration are common mistakes. Insufficient due diligence, inadequate financing, and a lack of a well-defined integration plan also contribute to acquisition failures. For example, relying solely on the seller’s financial statements without independent verification is a significant oversight. Similarly, neglecting to assess the cultural fit between the acquiring and acquired companies can lead to integration challenges and employee attrition.

Building a Risk Assessment Matrix

A risk assessment matrix provides a structured approach to identifying, analyzing, and prioritizing risks. This matrix typically includes columns for risk description, likelihood (e.g., low, medium, high), impact (e.g., low, medium, high), and mitigation strategies. Each identified risk is evaluated based on its likelihood and potential impact. The matrix then prioritizes risks based on a risk score (e.g., likelihood x impact), allowing for focused mitigation efforts on the highest-risk items. For example, a high-likelihood, high-impact risk, such as significant undisclosed liabilities, would require immediate attention and a comprehensive mitigation strategy. A simple example of a risk assessment matrix could use a 1-5 scale for both likelihood and impact, with 1 being low and 5 being high, resulting in a risk score from 1 to 25.

Negotiation and Purchase Agreement

Acquiring an existing business is a complex process, and even with thorough due diligence, the negotiation and finalization of the purchase agreement are critical stages demanding careful planning and execution. A well-structured negotiation strategy and a legally sound purchase agreement are essential to protect your interests and ensure a smooth transition. This section will Artikel key elements of successful business acquisition negotiations and provide best practices for structuring the purchase agreement.

Negotiation is a multifaceted process involving strategic maneuvering, compromise, and a deep understanding of the seller’s motivations and your own objectives. A robust strategy allows you to navigate these complexities effectively, achieving a deal that aligns with your financial goals and risk tolerance.

Key Elements of a Successful Negotiation Strategy

A successful negotiation strategy hinges on preparation, clear communication, and a flexible yet firm approach. Thorough due diligence provides the foundation for informed decision-making. Understanding the seller’s motivations—financial constraints, retirement plans, or desire to pursue other ventures—can significantly influence the negotiation process. Developing a clear understanding of your own walk-away point is crucial; knowing your limits prevents emotional decisions. Finally, maintaining open communication, even when disagreements arise, fosters a collaborative environment that can lead to a mutually beneficial outcome. This involves active listening and clearly articulating your proposals and concerns.

Structuring a Fair and Legally Sound Purchase Agreement

The purchase agreement is the legally binding contract that Artikels the terms and conditions of the business acquisition. It should be comprehensive, covering all aspects of the transaction to prevent future disputes. Key components include the purchase price, payment terms, asset transfer, liabilities assumed, representations and warranties (statements made by the seller about the business), indemnification (protecting the buyer from certain losses), and closing conditions. Seeking legal counsel specializing in business acquisitions is crucial to ensure the agreement protects your interests and complies with all relevant laws and regulations. A poorly drafted agreement can lead to significant financial and legal repercussions.

Common Negotiation Tactics and Effective Responses

Negotiations often involve various tactics, some of which may be attempts to gain an unfair advantage. For example, sellers may initially present an inflated asking price to allow for negotiation, or they might try to delay the process to leverage other offers. Buyers, conversely, may attempt to minimize the purchase price by highlighting potential liabilities or undervaluing assets. Effective responses involve maintaining a professional demeanor, presenting counter-offers supported by solid evidence, and being prepared to walk away if the terms are unacceptable. Understanding common tactics and developing counter-strategies ensures a fair and equitable outcome.

Sample Checklist of Items to Include in the Purchase Agreement

Before finalizing any business acquisition, it is essential to ensure the purchase agreement encompasses all relevant aspects. The following checklist provides a starting point, although the specific requirements may vary based on the circumstances of the acquisition.

- Parties Involved: Clearly identify the buyer and seller.

- Purchase Price: Specify the total purchase price and payment schedule.

- Assets Included: Detail all assets being transferred (real estate, equipment, inventory, intellectual property).

- Liabilities Assumed: Clearly state which liabilities the buyer will assume.

- Representations and Warranties: Include statements by the seller regarding the business’s financial condition, legal compliance, and operational aspects.

- Indemnification: Artikel the seller’s responsibility for losses incurred by the buyer due to breaches of representations and warranties.

- Covenants: Include restrictions on the seller’s actions after the sale (e.g., non-compete agreements).

- Closing Conditions: Specify conditions that must be met before the transaction is finalized (e.g., financing, regulatory approvals).

- Governing Law: State the jurisdiction whose laws will govern the agreement.

- Dispute Resolution: Artikel the process for resolving any disagreements.

This checklist serves as a foundation. Each item should be thoroughly reviewed and customized to reflect the specifics of the acquisition. Remember, seeking legal counsel is crucial to ensure a comprehensive and legally sound agreement.

Post-Acquisition Integration

Successfully integrating an acquired business requires meticulous planning and execution. A smooth transition minimizes disruption, retains valuable employees, and preserves positive customer and supplier relationships, ultimately maximizing the return on investment. Failure to properly integrate can lead to significant losses, impacting profitability and potentially jeopardizing the entire venture.

Post-acquisition integration is a complex process involving numerous interconnected steps. Effective management necessitates a clear strategy, dedicated resources, and a commitment to open communication throughout the process. This section Artikels the critical steps involved in a successful integration.

Integration Planning and Team Formation

A dedicated integration team should be formed immediately following the acquisition. This team, composed of members from both the acquiring and acquired companies, will be responsible for developing and executing the integration plan. The plan should Artikel specific goals, timelines, and responsibilities for each team member. For example, a large retail chain acquiring a smaller competitor might assign separate teams to handle inventory systems, customer relationship management (CRM) integration, and employee onboarding. Clear communication channels and regular progress meetings are essential to ensure everyone is aligned and working towards common objectives.

Employee Retention and Onboarding

Retaining key employees from the acquired business is crucial for preserving institutional knowledge and ensuring operational continuity. A well-structured retention plan, offering competitive compensation and benefits packages, is essential. This plan might include retention bonuses, equity participation, or opportunities for career advancement within the acquiring company. Furthermore, a thorough onboarding process for all employees from the acquired business should be established to ensure a smooth transition and integration into the new company culture. This could involve training programs, mentorship opportunities, and clear communication regarding company policies and procedures.

Customer and Supplier Relationship Management

Maintaining positive relationships with customers and suppliers is vital for long-term success. A communication plan should be developed to inform customers and suppliers about the acquisition and any changes they can expect. Transparency and consistent communication are key to mitigating any concerns or uncertainties. For example, a software company acquiring a smaller competitor might reassure customers about continued service and support, emphasizing any improvements or enhancements resulting from the merger. Similar communication should be established with suppliers to ensure a seamless transition of supply chains and procurement processes.

Timeline for Key Post-Acquisition Activities

| Activity | Timeline (Weeks) | Responsible Party | Key Milestones |

|---|---|---|---|

| Integration Team Formation | 1-2 | CEO, Integration Manager | Team assembled, charter defined |

| Assessment of Acquired Business | 2-4 | Integration Team | Financial review, operational audit, customer analysis completed |

| Employee Retention Strategy Implementation | 3-6 | HR, Integration Team | Retention offers made, key employees retained |

| System Integration | 6-12 | IT, Operations Team | Data migration complete, systems fully integrated |

| Customer Communication Plan Implementation | 2-4 | Marketing, Sales Team | Initial customer communication completed, feedback collected |

| Supplier Relationship Management | 2-4 | Procurement Team | Supplier contracts reviewed and updated |

| Post-Acquisition Audit | 10-12 | Finance Team, External Auditors | Financial statements reviewed, compliance verified |