Why did navy federal denied my loan application – Why did Navy Federal deny my loan application? This question plagues many, highlighting the complexities of securing financing. Understanding Navy Federal’s loan application process, from required documentation to the crucial role of credit scores and debt-to-income ratios, is vital. This guide unravels the reasons behind denials, offering actionable steps to improve your chances of approval in the future, whether through improving your financial standing or exploring alternative lending options.

We’ll delve into the specific criteria Navy Federal uses to assess loan applications, examining common pitfalls such as insufficient income, high debt levels, and less-than-ideal credit scores. We’ll also provide practical strategies for reviewing your personal finances, identifying areas for improvement, and ultimately, strengthening your application for future loan requests. This comprehensive guide aims to empower you with the knowledge and tools to navigate the loan application process successfully.

Understanding Navy Federal’s Loan Application Process

Navy Federal Credit Union offers a wide range of loan products to its members. Understanding their application process, including the required documentation and timelines, is crucial for a successful application. This section details the typical steps involved, the various loan types available, and the necessary paperwork for each.

Navy Federal Loan Application Steps

The Navy Federal loan application process generally involves several key steps. First, you’ll need to pre-qualify online or visit a branch to discuss your loan needs with a representative. This involves providing basic financial information to determine your eligibility. Next, you’ll complete a formal application, providing detailed financial documentation. This application will be reviewed, and you may be asked for additional information. After approval, you’ll receive loan terms and conditions, and finally, the funds will be disbursed once all conditions are met. The exact steps and timelines may vary depending on the loan type and your individual circumstances.

Types of Loans Offered by Navy Federal

Navy Federal provides a diverse portfolio of loans catering to various financial needs. These include auto loans, mortgages (including conventional, FHA, VA, and USDA loans), personal loans, home equity loans and lines of credit, student loans, and credit cards. Each loan type has its own specific requirements and application process.

Required Documentation for Navy Federal Loans

The specific documentation required varies significantly depending on the loan type. However, some common documents include proof of income (pay stubs, tax returns), proof of residency (utility bills, driver’s license), and information on existing debts. For auto loans, you’ll need details about the vehicle you intend to purchase. Mortgage applications require extensive documentation, including property appraisals, insurance information, and details of your down payment. Personal loans may require less documentation, but proof of income and credit history are typically essential. Student loans will require information about your enrollment and educational institution.

Comparison of Navy Federal Loan Application Processes

The following table compares the application processes for several common Navy Federal loan types. Note that interest rates and processing times are subject to change and depend on individual circumstances and creditworthiness.

| Loan Type | Required Documentation | Processing Time (Estimated) | Interest Rate Range (Approximate) |

|---|---|---|---|

| Auto Loan | Proof of income, vehicle information, insurance information | 7-14 days | 3%-18% |

| Personal Loan | Proof of income, credit report | 3-7 days | 6%-24% |

| Mortgage | Proof of income, credit report, property appraisal, insurance information, down payment details | 30-60 days | 3%-7% (variable) |

| Home Equity Loan | Proof of income, credit report, home appraisal, existing mortgage information | 30-45 days | 4%-10% |

Common Reasons for Loan Application Denial

Navy Federal Credit Union, like other financial institutions, employs a rigorous loan application process to assess risk and ensure responsible lending. Denial of a loan application, while disappointing, often stems from factors within the applicant’s financial profile. Understanding these common reasons can help prospective borrowers improve their chances of approval in future applications.

Credit Score Impact on Loan Approval

A strong credit score is a cornerstone of loan approval at Navy Federal, as it reflects an applicant’s history of responsible credit management. Lenders use credit scores, such as FICO scores, to predict the likelihood of loan repayment. A higher credit score typically indicates a lower risk of default, resulting in a greater likelihood of loan approval and potentially more favorable interest rates. Conversely, a low credit score, often below 670, significantly reduces the chances of approval, as it signals a higher risk to the lender. For example, an applicant with a credit score of 550 might face denial even if they meet other eligibility criteria, while an applicant with a score of 750 would have a much higher probability of approval. The specific credit score threshold for approval can vary depending on the loan type and amount.

Debt-to-Income Ratio’s Role in Loan Approval

The debt-to-income ratio (DTI) is a crucial factor in Navy Federal’s loan assessment. DTI represents the percentage of your gross monthly income that goes towards debt payments (including mortgages, car loans, credit cards, student loans, etc.). A high DTI indicates a larger portion of your income is already committed to debt servicing, leaving less available for loan repayment. Navy Federal typically prefers applicants with a lower DTI, as this demonstrates a greater capacity to manage additional debt. For instance, an applicant with a DTI of 40% might be approved for a smaller loan, while an applicant with a DTI of 55% might face denial, especially for larger loan amounts. The acceptable DTI range varies depending on the type and size of the loan.

Insufficient Income Leading to Loan Denial

Insufficient income is a frequent reason for loan application denial. Navy Federal needs to ensure applicants have enough disposable income to comfortably repay the loan without undue financial strain. Several scenarios can lead to insufficient income being flagged: a low income relative to the loan amount requested, significant recent income reduction (e.g., job loss or pay cut), inconsistent income history (e.g., self-employment with fluctuating earnings), or substantial existing debt obligations that significantly impact disposable income. For example, an applicant seeking a large mortgage with a low annual salary might face denial because the lender deems their income insufficient to cover the monthly mortgage payments. Similarly, an applicant who recently experienced a job loss, even if temporarily, may not meet the income requirements for loan approval.

Loan Application Decision-Making Process

The following flowchart illustrates the simplified decision-making process for Navy Federal loan applications:

[Descriptive Flowchart]

Imagine a flowchart with boxes and arrows. The first box is “Loan Application Received.” An arrow points to a box labeled “Credit Score Check.” Another arrow branches from this box to “DTI Calculation.” Both arrows converge into a box labeled “Income Verification.” From this box, one arrow leads to “Loan Approved” and another to “Loan Denied.” From the “Loan Denied” box, an arrow points to “Notification to Applicant,” explaining the reason for denial (e.g., low credit score, high DTI, insufficient income). This visual representation simplifies the complex process, highlighting the key factors considered.

Reviewing Your Personal Financial Situation

Understanding your personal finances is crucial for securing loan approval. A thorough review of your credit report, debt-to-income ratio, and overall financial health can significantly increase your chances of success in future loan applications. This process involves proactive steps to improve your credit score and manage your debt effectively.

Credit Report Review

A clean and accurate credit report is fundamental to obtaining favorable loan terms. To effectively review your report, follow these steps:

- Obtain your credit reports: You are entitled to a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) annually through AnnualCreditReport.com. Avoid sites that charge a fee, as they are not affiliated with the official source.

- Review for accuracy: Carefully examine each report for errors, such as incorrect addresses, late payments that weren’t yours, or accounts you don’t recognize. Dispute any inaccuracies immediately with the respective credit bureau.

- Analyze credit utilization: Pay close attention to your credit utilization ratio—the percentage of your available credit you’re using. A lower ratio (ideally below 30%) is generally better for your credit score.

- Identify negative marks: Note any late payments, collections, bankruptcies, or other negative items that could be impacting your score. Understanding these will help you address them proactively.

Debt-to-Income Ratio Calculation

Your debt-to-income ratio (DTI) is a key factor lenders consider. It shows the percentage of your monthly gross income that goes towards debt payments. A lower DTI generally indicates lower financial risk.

DTI = (Total Monthly Debt Payments) / (Gross Monthly Income) * 100%

For example, if your total monthly debt payments are $2,000 and your gross monthly income is $6,000, your DTI is 33.33%. Lenders often prefer a DTI below 43%, though this can vary depending on the loan type and lender.

Credit Score Improvement Strategies

Improving your credit score takes time and consistent effort. Here are several effective strategies:

- Pay bills on time: On-time payments are the most significant factor influencing your credit score. Set up automatic payments or reminders to avoid late payments.

- Reduce credit utilization: Keep your credit utilization low by paying down existing balances. Aim for less than 30% of your available credit.

- Maintain a diverse credit mix: A mix of credit accounts (credit cards, installment loans) can positively impact your score, but avoid opening too many new accounts in a short period.

- Monitor your credit reports regularly: Regularly check your credit reports for errors and identify areas for improvement.

- Consider credit counseling: If you’re struggling with debt, a credit counseling agency can provide guidance and develop a debt management plan.

Debt Reduction Strategies

Effectively managing and reducing debt is vital for improving your financial health. Consider these strategies:

- Debt snowball method: Pay off your smallest debts first, building momentum and motivation. This can improve your credit score faster than other methods.

- Debt avalanche method: Focus on paying off the debts with the highest interest rates first to save money in the long run.

- Balance transfers: Transfer high-interest debt to a lower-interest credit card, but be mindful of balance transfer fees and interest rate increases after the introductory period.

- Negotiate with creditors: Contact your creditors to explore options like lower interest rates or payment plans if you’re facing financial hardship.

Actions After Loan Denial

Following a loan denial, take these steps:

- Review the denial letter carefully: Understand the specific reasons for the denial. This information will guide your next steps.

- Check your credit report: Verify the accuracy of the information used in the loan application process.

- Address any negative items on your credit report: Work on improving your credit score by addressing issues like late payments or high credit utilization.

- Re-apply after improvement: Once you’ve made significant progress in improving your financial situation, re-apply for the loan.

- Consider alternative lenders: Explore other lenders who may have less stringent requirements.

Exploring Alternative Options

A Navy Federal loan denial doesn’t necessarily mean you’re shut out from borrowing. Many other financial institutions offer a range of loan products, each with its own set of advantages and disadvantages. Understanding these alternatives is crucial to securing the funding you need. Carefully weighing your options and understanding your financial situation will increase your chances of approval.

Exploring alternative loan options involves comparing interest rates, fees, repayment terms, and eligibility requirements across different lenders. This process requires diligent research and a clear understanding of your creditworthiness and financial capacity. Government-backed loan programs can also provide additional avenues for securing financing.

Comparison of Loan Options from Other Financial Institutions

Several financial institutions offer personal loans, auto loans, and mortgages. Credit unions, like Navy Federal, often provide competitive rates and personalized service, but membership requirements may apply. Banks generally offer a wider range of products but may have stricter eligibility criteria and potentially higher interest rates. Online lenders often boast streamlined application processes and quicker approvals but may charge higher fees or have less transparent terms. For example, a credit union might offer a personal loan with a 7% APR, while a large bank might offer a similar loan at 9%, and an online lender might offer 12% but with faster processing. The best option depends on individual circumstances and priorities.

Advantages and Disadvantages of Alternative Loan Options

Choosing the right lender requires careful consideration of several factors. For instance, while online lenders offer convenience and speed, they might have higher interest rates and less flexible repayment options compared to traditional banks or credit unions. Banks, known for their established reputation and wide range of services, might have more stringent eligibility requirements and longer processing times. Credit unions, prioritizing member service, often provide competitive rates and personalized support, but membership limitations may restrict access.

Government-Backed Loan Programs, Why did navy federal denied my loan application

The government offers various loan programs designed to support specific needs and populations. The Small Business Administration (SBA) provides loans to small businesses, while the Federal Housing Administration (FHA) insures mortgages for individuals with lower credit scores. The Department of Veterans Affairs (VA) offers home loans to eligible veterans. These programs often come with lower interest rates and more lenient eligibility requirements than conventional loans, but they also have specific application processes and eligibility criteria. For example, an FHA loan might require a lower down payment than a conventional mortgage, making homeownership more accessible to some borrowers. However, FHA loans often involve mortgage insurance premiums.

Implications of Seeking a Co-Signer for a Loan

A co-signer agrees to repay the loan if the primary borrower defaults. This significantly improves the chances of loan approval, especially for individuals with limited credit history or low credit scores. However, it also binds the co-signer to the repayment responsibility, potentially impacting their credit score if the primary borrower fails to make payments. Choosing a co-signer requires careful consideration of the financial relationship and trust between the parties involved. It’s crucial that both parties fully understand the implications before entering into such an agreement.

Creating a Budget to Manage Finances Effectively

Effective budgeting is essential for managing finances and improving loan application prospects. A budget Artikels planned income and expenses, helping individuals track spending habits and identify areas for savings. The 50/30/20 rule is a common budgeting guideline: 50% of income for needs, 30% for wants, and 20% for savings and debt repayment. For example, someone earning $5,000 a month might allocate $2,500 for needs (housing, food, transportation), $1,500 for wants (entertainment, dining out), and $1,000 for savings and debt repayment. This approach provides a clear financial picture, enabling better financial planning and increasing the likelihood of successful loan applications in the future.

Understanding Your Rights as a Borrower

Being denied a loan can be frustrating, but it’s crucial to understand your rights as a borrower. Knowing the process for disputing a denial and the legal protections available can empower you to navigate this challenging situation effectively. This section Artikels the steps you can take if you believe your loan application was unfairly denied.

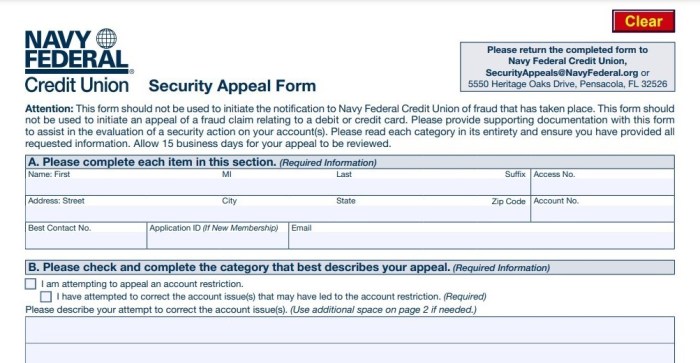

Disputing a Loan Application Denial

If you believe Navy Federal’s decision was incorrect, you have the right to request a review of their decision. Begin by carefully reviewing the denial letter, noting the specific reasons provided. This letter often includes contact information for appealing the decision. Contact Navy Federal directly via phone or written correspondence, clearly stating your intention to dispute the denial and providing any supporting documentation that contradicts the reasons given. Keep records of all communication with Navy Federal. If the initial appeal is unsuccessful, you may have further recourse depending on the specifics of the denial and applicable laws.

Addressing Unfair or Discriminatory Denials

The Equal Credit Opportunity Act (ECOA) prohibits lenders from discriminating against applicants based on factors such as race, color, religion, national origin, sex, marital status, age, or because you receive public assistance. If you suspect discrimination played a role in your denial, gather evidence to support your claim. This could include documentation showing similar applicants with different characteristics were approved, or evidence of biased treatment during the application process. You can file a complaint with the Consumer Financial Protection Bureau (CFPB) if you believe Navy Federal violated the ECOA or other consumer protection laws. The CFPB investigates complaints and can take action against lenders who engage in discriminatory practices.

Relevant Consumer Protection Laws

Several laws protect consumers in the lending process. The Fair Credit Reporting Act (FCRA) grants you the right to access your credit report and dispute any inaccurate information. The Truth in Lending Act (TILA) requires lenders to disclose all loan terms and fees clearly. Understanding these laws empowers you to identify potential violations and take appropriate action. If you believe Navy Federal violated any of these laws, you can file a complaint with the appropriate regulatory agency. Thorough documentation is essential throughout this process.

Seeking Financial Counseling

Navigating loan denials can be stressful, and seeking guidance from a financial counselor can be beneficial. Non-profit credit counseling agencies offer free or low-cost services, providing personalized advice and support. They can help you understand your financial situation, develop a budget, and create a plan to improve your creditworthiness. The National Foundation for Credit Counseling (NFCC) is a reputable organization that can connect you with certified credit counselors in your area. They can offer strategies for improving your financial standing and increasing your chances of loan approval in the future.

Obtaining Your Credit Report and Score

Your credit report and score are crucial elements in the loan application process. You are entitled to a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) annually through AnnualCreditReport.com. Reviewing your report helps identify any errors or inaccuracies that could negatively impact your credit score. You can dispute inaccurate information directly with the credit bureaus. While your credit score isn’t free, many financial institutions and credit card companies offer free credit score monitoring services, providing you with regular updates on your creditworthiness.

Improving Your Chances of Future Loan Approval

A Navy Federal loan denial doesn’t have to be a permanent setback. By proactively addressing the underlying issues and demonstrating improved financial responsibility, you can significantly increase your chances of approval in the future. This involves a multifaceted approach encompassing credit repair, responsible financial management, and effective communication with lenders.

Creating a Plan to Improve Financial Standing

Improving your financial standing requires a structured plan. This involves carefully analyzing your current financial situation, identifying areas for improvement, and setting realistic goals. Begin by creating a detailed budget, tracking all income and expenses. Identify areas where you can reduce spending, such as unnecessary subscriptions or entertainment costs. Prioritize paying down high-interest debt, such as credit card balances, to lower your debt-to-income ratio (DTI). This ratio, a key factor in loan approvals, compares your monthly debt payments to your gross monthly income. A lower DTI generally improves your chances of loan approval. For example, reducing your credit card debt by $500 per month will demonstrably improve your DTI and strengthen your loan application.

Strategies for Building a Stronger Credit History

A strong credit history is crucial for loan approval. Consistent on-time payments are the cornerstone of a good credit score. Pay all your bills, including credit cards, loans, and utilities, on time, every time. Keep your credit utilization ratio low; this is the percentage of your available credit that you’re using. Aim to keep it below 30%. For instance, if you have a credit card with a $1000 limit, try to keep your balance below $300. Consider obtaining a secured credit card if you have limited credit history. This type of card requires a security deposit, which serves as your credit limit, helping you build credit responsibly. Regularly review your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) to identify and dispute any errors.

Responsible Financial Management

Responsible financial management is not just about paying bills on time; it’s about making informed financial decisions. This includes creating a realistic budget, tracking your spending, and saving regularly. Avoid taking on more debt than you can comfortably manage. Before applying for any loan, carefully consider the terms and conditions, including interest rates and repayment schedules. Building an emergency fund is also crucial; this provides a safety net for unexpected expenses, preventing you from taking on additional debt during unforeseen circumstances. For example, having three to six months’ worth of living expenses saved can prevent you from needing a loan for unexpected repairs or medical bills.

Resources for Financial Education

Numerous resources are available to help you improve your financial literacy. The National Foundation for Credit Counseling (NFCC) offers free and low-cost credit counseling services. The Consumer Financial Protection Bureau (CFPB) provides valuable information on various financial topics, including debt management and credit repair. Many reputable financial websites and books offer practical advice on budgeting, saving, and investing. Local libraries and community colleges often provide free financial literacy workshops.

Effective Communication with Lenders

After a loan denial, contacting the lender directly can be beneficial. Request a detailed explanation of the denial, focusing on the specific reasons for the rejection. This information allows you to address the underlying issues. Express your commitment to improving your financial situation and provide evidence of your progress, such as reduced debt or improved credit scores. A well-articulated and respectful communication demonstrates your seriousness and can positively influence future loan applications. It is important to maintain a professional and polite tone throughout the communication.

Final Thoughts

Securing a loan can be challenging, but understanding the reasons behind a Navy Federal loan application denial is the first step towards success. By carefully reviewing your financial situation, addressing any weaknesses, and exploring alternative options if necessary, you can significantly improve your chances of future approval. Remember, responsible financial management is key, and proactive steps to improve your credit score and debt-to-income ratio will greatly benefit your future loan applications. Don’t let a denial discourage you; use it as an opportunity for growth and financial empowerment.

Answers to Common Questions: Why Did Navy Federal Denied My Loan Application

What happens if I disagree with Navy Federal’s loan denial?

Review the denial letter carefully. Contact Navy Federal directly to understand the specific reasons for the denial. You may be able to provide additional information or address concerns. If you believe the denial is unfair or discriminatory, explore your options for dispute resolution, potentially involving consumer protection agencies.

Can I reapply for a loan after a denial?

Yes, but only after addressing the reasons for the previous denial. Improve your credit score, reduce your debt-to-income ratio, and ensure you meet all the requirements before reapplying. Waiting a few months may also be beneficial.

How long does it take to hear back from Navy Federal after applying for a loan?

Processing times vary depending on the loan type and the completeness of your application. Check your application status online or contact Navy Federal directly for an update.