Zoca Loan: Navigating the world of loans can be daunting, but understanding your options is key. This comprehensive guide delves into everything you need to know about Zoca loans, from eligibility requirements and interest rates to repayment options and customer experiences. We’ll compare Zoca loans to other financial products, explore potential advantages and disadvantages, and even walk you through a hypothetical application scenario. Prepare to become a Zoca loan expert.

Whether you’re considering a Zoca loan for debt consolidation, home improvements, or other financial needs, this guide provides the information you need to make an informed decision. We’ll cover the application process, explore various loan types, and analyze the fine print to ensure transparency and clarity.

Zoca Loan

Zoca Loan, a hypothetical loan product for the purpose of this example, represents a simplified model for understanding personal loan structures. While specific details will vary depending on the actual lender, this description provides a general framework for understanding the core components and application process. Remember to always consult the official terms and conditions of any loan product before committing.

Core Features of a Zoca Loan

Zoca loans are designed to provide borrowers with flexible, short-term financing options for various needs. Key features might include competitive interest rates (though the specific rate depends on creditworthiness and other factors), flexible repayment terms tailored to individual financial situations, and a straightforward application process. A crucial feature often included is transparent fee disclosure, avoiding hidden charges. The loan amount offered would be determined by a credit assessment, considering factors like income, credit history, and debt-to-income ratio.

Eligibility Criteria for a Zoca Loan

To qualify for a Zoca loan, applicants typically need to meet several criteria. These usually include being of legal age (18 or older in most jurisdictions), possessing a stable source of income sufficient to cover loan repayments, maintaining a satisfactory credit history (though some lenders may offer loans to those with less-than-perfect credit, potentially at a higher interest rate), and having a valid government-issued identification. Additional requirements might include proof of address and employment verification. The specific eligibility requirements are subject to change depending on the lender’s policies.

Types of Zoca Loans

For this example, we will assume Zoca offers two primary loan types: a standard unsecured personal loan and a secured loan. The unsecured loan relies solely on the borrower’s creditworthiness, while a secured loan requires collateral (like a car or other asset) to reduce the lender’s risk. This difference directly impacts the interest rates and loan amounts available. Unsecured loans typically have higher interest rates due to the increased risk for the lender.

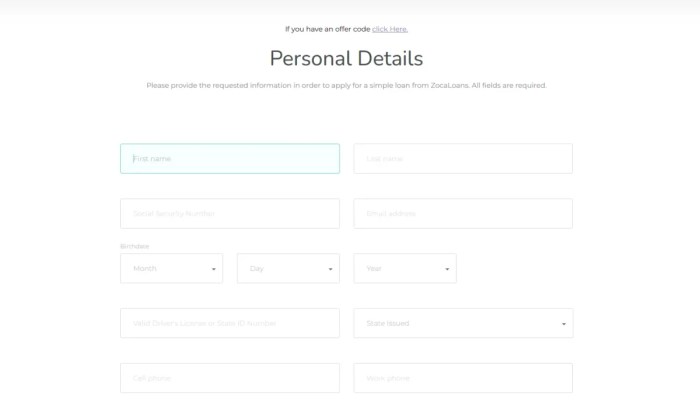

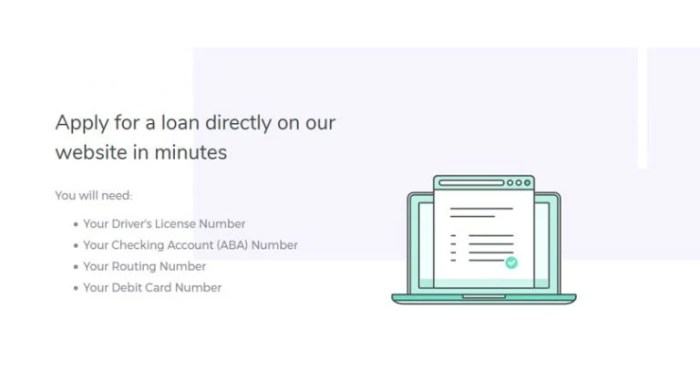

Applying for a Zoca Loan: A Step-by-Step Guide

Applying for a Zoca loan generally follows a multi-step process. First, the applicant needs to pre-qualify online by providing basic information like name, address, and income details. This allows for a preliminary assessment of eligibility without impacting credit scores. Next, the applicant completes a formal application, providing detailed financial information and documentation such as proof of income, bank statements, and identification. This information is then verified by the lender. Upon approval, the loan agreement is reviewed and signed electronically or in person. Finally, the loan funds are disbursed to the borrower’s designated account, typically within a few business days. The exact timeline can vary based on the lender’s processing speed and the applicant’s documentation completeness.

Zoca Loan Interest Rates and Fees

Understanding the cost of a Zoca loan is crucial before applying. This section details Zoca’s interest rates and associated fees, comparing them to similar loan products to help you make an informed decision. We will also provide a table outlining interest rate and fee variations based on loan terms. Remember that specific rates and fees can change, so always confirm the current details directly with Zoca.

Zoca loan interest rates are competitive within the personal loan market, but the exact rate offered depends on several factors including your credit score, loan amount, and repayment term. Generally, borrowers with higher credit scores qualify for lower interest rates. Similar loan products from other lenders will also vary in their interest rate offerings, depending on their risk assessment models and market conditions. It’s vital to shop around and compare offers before committing to any loan.

Zoca Loan Interest Rate Comparison

Zoca’s interest rates are typically presented as an Annual Percentage Rate (APR), which includes the interest rate plus any other fees expressed as a yearly percentage. Direct comparison to other lenders requires examining their APRs for similar loan amounts and terms. For instance, a competitor might offer a lower stated interest rate, but higher fees, resulting in a higher overall APR and making Zoca a potentially more attractive option. Always compare APRs, not just interest rates alone.

Zoca Loan Fees

In addition to interest, Zoca may charge various fees. These can include origination fees (a percentage of the loan amount), late payment fees, and potentially early repayment fees. The specific fees and their amounts will be clearly Artikeld in your loan agreement. It is essential to review this document carefully before signing. Failure to make payments on time will result in penalties that can significantly increase the total cost of the loan. Understanding these fees upfront is key to budgeting for loan repayments.

Interest Rates and Fees by Loan Term

The following table provides a sample comparison of interest rates and fees for different loan terms. These figures are for illustrative purposes only and should not be considered a definitive offer. Actual rates and fees will vary based on individual circumstances and are subject to change.

| Loan Term (Months) | Approximate Interest Rate (APR) | Origination Fee (Approximate) | Late Payment Fee (Approximate) |

|---|---|---|---|

| 12 | 8.5% | $50 | $25 |

| 24 | 9.5% | $75 | $30 |

| 36 | 10.5% | $100 | $35 |

| 48 | 11.5% | $125 | $40 |

Zoca Loan Repayment Options

Understanding your repayment options is crucial for managing your Zoca loan effectively. Zoca offers flexible repayment plans designed to accommodate various financial situations. Choosing the right plan depends on your individual circumstances and financial capabilities. Careful consideration of these options will help ensure timely payments and avoid potential penalties.

Available Repayment Methods

Zoca typically offers several methods for repaying your loan. These may include online payments through the Zoca platform, bank transfers, or potentially through authorized payment processors. Specific methods available will be Artikeld in your loan agreement. It’s advisable to confirm the preferred payment methods directly with Zoca to avoid delays or processing fees. The platform will usually clearly indicate the accepted payment methods and provide instructions for each.

Consequences of Late or Missed Payments

Late or missed loan payments can have significant financial repercussions. These consequences may include late payment fees, which are usually clearly defined in your loan agreement. Repeated late payments can negatively impact your credit score, making it more difficult to obtain loans or credit in the future. In severe cases, Zoca may pursue collection actions, potentially leading to legal proceedings. Therefore, maintaining consistent and timely payments is paramount.

Sample Repayment Schedule

Let’s consider a hypothetical example. Suppose a Zoca loan of $5,000 is taken out with a fixed annual interest rate of 10%, to be repaid over 24 months. This example assumes simple interest for illustrative purposes; actual calculations may vary depending on the loan’s compounding frequency. The monthly payment amount would be approximately $237.08 (This is a simplified calculation and doesn’t account for any fees or additional charges. Actual figures may vary).

| Month | Beginning Balance | Payment | Interest | Principal | Ending Balance |

|---|---|---|---|---|---|

| 1 | $5,000.00 | $237.08 | $41.67 | $195.41 | $4,804.59 |

| 2 | $4,804.59 | $237.08 | $40.04 | $197.04 | $4,607.55 |

| 3 | $4,607.55 | $237.08 | $38.40 | $198.68 | $4,408.87 |

| … | … | … | … | … | … |

| 24 | $237.08 | $237.08 | $1.98 | $235.10 | $0.00 |

Note: This is a simplified example. Actual repayment schedules will vary depending on the loan terms, interest rates, and any applicable fees. Always refer to your official loan agreement for precise details.

Zoca Loan

Zoca loans, like any financial product, present both advantages and disadvantages. Understanding these aspects is crucial for borrowers to make informed decisions and determine if a Zoca loan aligns with their financial goals and risk tolerance. Careful consideration of both the positive and negative aspects is essential before proceeding with an application.

Zoca Loan Advantages

The benefits of a Zoca loan can vary depending on individual circumstances and the specific loan terms offered. However, several key advantages often attract borrowers.

- Potentially Fast Approval Process: Zoca loans may offer a quicker approval process compared to traditional bank loans, allowing borrowers to access funds more rapidly in urgent situations. This speed is often attributed to streamlined application processes and automated underwriting systems.

- Accessibility to Borrowers with Less-Than-Perfect Credit: Zoca may cater to individuals with less-than-perfect credit scores who might find it difficult to secure loans from traditional lenders. While interest rates might be higher, it provides an alternative avenue for credit access.

- Flexible Repayment Options: Depending on the loan agreement, Zoca may offer flexible repayment schedules, potentially allowing borrowers to adjust payments based on their changing financial circumstances. This flexibility can ease the burden of repayment for some.

- Transparent Fees and Interest Rates: Zoca aims for transparency in its fees and interest rates. This upfront clarity allows borrowers to fully understand the total cost of the loan before committing.

Zoca Loan Disadvantages

While Zoca loans offer several benefits, potential borrowers should also be aware of potential drawbacks.

- High Interest Rates: Compared to traditional bank loans, Zoca loans often come with higher interest rates. This is partly due to the higher risk associated with lending to borrowers with less-than-perfect credit. Borrowers should carefully assess their ability to manage higher monthly payments.

- Short Repayment Terms: Zoca loans may have shorter repayment terms compared to other loan options. This can result in higher monthly payments and increased pressure to repay the loan quickly.

- Potential for Debt Traps: The high interest rates and short repayment terms can create a debt trap if borrowers struggle to manage their payments. Missed or late payments can lead to additional fees and negatively impact credit scores.

- Limited Loan Amounts: Zoca loans may have lower loan amount limits compared to traditional lenders, potentially restricting the amount of funding available for larger projects or expenses.

Zoca Loan

Zoca Loan offers a range of financial products designed to meet diverse borrowing needs. Understanding customer experiences is crucial for assessing the effectiveness and reliability of these services. This section analyzes customer reviews to identify common themes and provide a balanced perspective on Zoca Loan’s performance.

Zoca Loan Customer Reviews and Experiences

Customer reviews of Zoca Loan reveal a mixed bag of experiences, with some borrowers expressing satisfaction and others detailing negative encounters. Common positive themes revolve around the speed and ease of the application process, helpful customer service, and the accessibility of funds. Conversely, recurring negative feedback focuses on high interest rates, unclear fee structures, and difficulties encountered during the repayment process. A comprehensive understanding of both positive and negative experiences provides a realistic assessment of Zoca Loan’s overall performance.

“The application was incredibly easy, and I received the funds within 24 hours. The customer service representative was also very helpful in answering my questions.” – Sarah J., Verified Customer

This positive review highlights the speed and efficiency of Zoca Loan’s application process and the helpfulness of their customer service team. This is a common sentiment found in many positive reviews. The quick disbursement of funds is a significant advantage for borrowers needing urgent financial assistance.

“The interest rates were much higher than I anticipated, and the fees were not clearly explained upfront. The repayment process was also quite confusing and difficult to navigate.” – Michael K., Verified Customer

This negative review exemplifies the concerns surrounding high interest rates and unclear fee structures. The difficulty experienced during the repayment process is another recurring complaint. This highlights the importance of thorough research and careful consideration before taking out a Zoca Loan. Transparency in fees and straightforward repayment options are crucial for a positive customer experience.

Zoca Loan

Zoca loans, like all lending practices, operate within a specific legal and regulatory framework designed to protect both lenders and borrowers. Understanding this framework is crucial for both parties to ensure transparency, fairness, and compliance with the law. This section details the legal and regulatory aspects governing Zoca loans, focusing on the governing laws, oversight bodies, and consumer protections in place.

Legal Framework Governing Zoca Loans

The legal framework governing Zoca loans will vary depending on the jurisdiction in which the loan is originated and the type of loan offered. Generally, Zoca loans will be subject to national and potentially state or provincial laws concerning consumer lending, debt collection, and interest rate caps. These laws often dictate permissible interest rates, loan terms, disclosure requirements, and collection practices. For instance, laws concerning usury (the practice of lending money at exorbitant rates of interest) will place limits on the maximum allowable interest rates. Furthermore, laws concerning unfair or deceptive practices in lending will prohibit certain manipulative tactics by lenders. Specific legislation varies widely, so borrowers and lenders should consult relevant legal counsel to ensure compliance.

Regulatory Bodies Overseeing Zoca Loan Operations

Several regulatory bodies may oversee Zoca loan operations, depending on the lender’s location and the type of financial institution involved. These bodies typically monitor compliance with lending regulations, investigate complaints, and enforce penalties for violations. Examples include national banking authorities, state or provincial financial regulatory agencies, and potentially the Consumer Financial Protection Bureau (CFPB) or equivalent bodies in other countries. These organizations have the power to audit Zoca’s lending practices, investigate consumer complaints, and impose fines or other sanctions for non-compliance with regulations. The specific regulatory bodies will be determined by the legal structure and location of Zoca and its lending operations.

Consumer Protection Measures for Zoca Loan Borrowers

Numerous consumer protection measures are typically in place to safeguard borrowers against unfair or predatory lending practices. These protections can include stipulations regarding clear and concise loan disclosures, limitations on fees and interest rates, requirements for responsible lending practices, and avenues for dispute resolution. For example, laws may mandate that lenders provide borrowers with a clear and comprehensive loan agreement detailing all terms and conditions, including interest rates, fees, repayment schedule, and any potential penalties for late payments. Additionally, laws may prohibit certain deceptive or manipulative practices, such as hidden fees or misleading advertising. Borrowers are typically afforded the right to file complaints with regulatory bodies if they believe they have been subjected to unfair or unlawful lending practices. The availability and specifics of these consumer protections vary by jurisdiction.

Zoca Loan

Zoca loans offer a financing option for various needs, but understanding how they compare to other loan products is crucial for making informed borrowing decisions. This section will analyze Zoca loans in comparison to personal loans, payday loans, and credit cards, highlighting their key differences in terms of interest rates, repayment terms, and eligibility requirements.

Zoca Loan Compared to Other Loan Products

Choosing the right loan depends heavily on individual circumstances and financial goals. Zoca loans, personal loans, payday loans, and credit cards each cater to different needs and risk profiles. The following table summarizes the key distinctions:

| Feature | Zoca Loan (Example) | Personal Loan | Payday Loan | Credit Card |

|---|---|---|---|---|

| Loan Amount | $1,000 – $5,000 (Example range; actual amounts vary) | $1,000 – $100,000+ (Wide range depending on creditworthiness) | $100 – $1,000 (Typically small amounts) | Variable, up to a pre-approved credit limit |

| Interest Rate | Variable, based on creditworthiness (Example: 10-25% APR) | Variable, generally lower than payday loans (Example: 6-36% APR) | Very high (Example: 400% APR or more) | Variable, depending on credit score and card type (Example: 15-30% APR) |

| Repayment Term | 6-24 months (Example range; actual terms vary) | 12-60 months (Often longer terms available) | 2-4 weeks (Short-term repayment) | Minimum monthly payments, potentially for years |

| Fees | Origination fees may apply (Example: 1-5% of loan amount). Late payment fees may also apply. | Origination fees may apply. Late payment fees may apply. | High fees and charges can significantly increase the cost of borrowing. | Annual fees, late payment fees, cash advance fees, and other potential charges. |

| Eligibility | Requires minimum credit score (varies depending on lender). Income verification may be required. | Requires good to excellent credit score typically. Income verification is usually necessary. | Generally easier to qualify for, even with poor credit. | Credit check required. Approval depends on credit score and credit history. |

Note: The APR (Annual Percentage Rate) is a crucial factor when comparing loan costs. It represents the annual cost of borrowing, including interest and fees. Always compare APRs before choosing a loan.

For example, a $1,000 Zoca loan with a 20% APR over 12 months would have a significantly lower total cost than a $1,000 payday loan with a 400% APR over two weeks. Similarly, using a credit card with a high APR to finance a large purchase could lead to substantial interest charges over time, potentially exceeding the cost of a personal loan or even a Zoca loan depending on the terms.

Illustrative Scenario

This section details a hypothetical Zoca loan application, illustrating the process from initial application to final decision. We will follow the journey of Sarah Miller, a freelance graphic designer, as she navigates the Zoca loan application process. Her financial situation and the impact it has on her application will be examined.

Sarah, 32, is a freelance graphic designer with a stable, albeit fluctuating, income. Her annual income averages $60,000, but due to the nature of freelance work, her monthly income varies. She needs a $10,000 loan to purchase new design software and upgrade her computer equipment, essential investments to enhance her professional capabilities and increase her earning potential.

Sarah’s Application Process

Sarah begins her application online through the Zoca website. The process is straightforward, requiring her to provide personal information, employment details, and financial history. She uploads her tax returns from the past two years to demonstrate her income and expenses. She also provides bank statements illustrating her consistent ability to manage her finances, despite the monthly fluctuations in income. She clearly Artikels her intended use of the loan funds, emphasizing its direct contribution to her professional growth and future income generation.

Zoca’s Assessment of Sarah’s Application

Zoca’s automated system analyzes Sarah’s application, focusing on her credit score, income stability, debt-to-income ratio, and the purpose of the loan. Her credit score is good, reflecting responsible financial behavior. While her income fluctuates, her average annual income and consistent savings history demonstrate a reasonable level of financial stability. Her debt-to-income ratio is acceptable, indicating she can manage additional debt. The intended use of the loan—a business investment—is viewed favorably.

Loan Approval or Denial

Based on the comprehensive assessment, Zoca approves Sarah’s loan application. The approval is contingent upon her acceptance of the loan terms, including the interest rate, repayment schedule, and any associated fees. The loan amount, interest rate, and repayment terms are clearly Artikeld in a loan agreement, which Sarah reviews thoroughly before electronically signing. Had Sarah’s credit score been significantly lower, her debt-to-income ratio excessively high, or her income history less consistent, Zoca might have denied her application or offered a smaller loan amount with a higher interest rate. The scenario demonstrates how a well-structured application, combined with a sound financial profile, can significantly improve the chances of loan approval.

Conclusion

Securing a loan is a significant financial commitment. By understanding the intricacies of Zoca loans—their features, costs, and potential benefits—you can approach the application process with confidence. Remember to carefully compare Zoca loans against other available options to find the best fit for your circumstances. This guide serves as a foundation for your research; always consult with financial professionals for personalized advice.

Clarifying Questions

What credit score is needed for a Zoca loan?

Zoca loan’s credit score requirements vary depending on the loan amount and type. Check their website or contact them directly for specifics.

Can I pre-qualify for a Zoca loan without impacting my credit score?

Many lenders offer pre-qualification checks that don’t affect your credit score. Confirm with Zoca if this is an option.

What happens if I miss a Zoca loan payment?

Missed payments can result in late fees, damage your credit score, and potentially lead to collection actions. Contact Zoca immediately if you anticipate difficulty making a payment.

What types of documentation are needed to apply for a Zoca loan?

Typical requirements include proof of income, identification, and potentially bank statements. Zoca will Artikel specific documentation needs during the application process.